Introduction

Do you think the stock market doesn’t make sense most of the time?

In fact, you are not alone. Most people will think and feel that way towards the stock market, especially in times when the economy is bad, but yet the stock market is still capable of making new highs.

In this article, we will share with you why the stock market is what it is, and why, after learning what we share with you for FREE, it will make you a better investor!

So read on to find out more.

What does Market Return mean?

Let’s start by going through what market return is.

Generally speaking, when investors and market participants refer to the market benchmark, or market portfolio, most will define that as the S&P 500, which stands for the Standard & Poor 500.

Therefore market return is defined by how well the S&P 500 performs at any moment in time.

What the S&P 500 really is

Let’s start by going through what it really means to be part of the S&P 500 market portfolio.

First off, do you know there are approximately 4266 public listed companies in the US exchanges?

Furthermore, there are over 10,000 Over the Top (OTC) companies listed in the American financial markets that provide liquidity to companies.

Next, according to the US Business Register there are over 160,000 multi-establishment companies that are privately owned and not publicly listed. Obviously this does not include single establishment companies and sole proprietorships which go into the millions.

Most importantly, this is the eligibility criteria to be included into the S&P 500:

“To be eligible for S&P 500 index inclusion, a company should be a U.S. company, have a market capitalization of at least USD 11.8 billion, be highly liquid, have a public float of at least 10% of its shares outstanding, and its most recent quarter’s earnings and the sum of its trailing four consecutive quarters’ earnings must be positive.”

Key Takeaway:

The S&P 500 seeks to represent the leading companies in leading industries.

This means the S&P 500 represents the Crème de la crème of all US companies.

It is therefore also implied that on a relativity basis, these S&P 500 companies should outperform the average US companies in terms of business performance at any given time!

Here’s why the Stock Market is making new highs

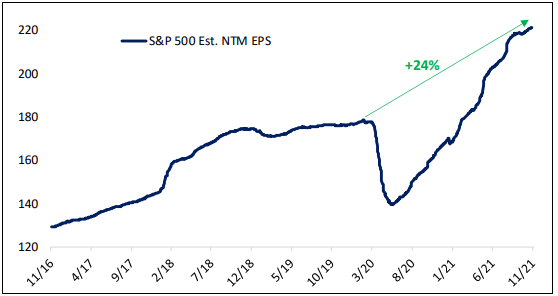

The chart below provides the estimated earnings per share (EPS) over the next 12 months for these S&P 500 companies.

What may surprise many is the fact that this S&P 500 earnings metric is 24% higher today than it was pre Covid!

In simple terms, the best US companies are expected to earn more in today’s Covid stricken environment, compared to Pre-Covid days.

It is also for this reason that the stock prices of these 500 companies have exceeded pre-Covid levels!

In Closing..

It is clear, from the above, that the stock market, in particular the S&P 500, is not representative of the US general economy.

Therefore, anyone thinking that the S&P 500 should crash, is overvalued, or due for correction purely based on what they see and feel over the broad US economy, should reassess this based on how they see these premium companies will perform going forward.

Can’t emphasize this enough..the stock market benchmark represents the best of the US economy!