Introduction

2021 was truly a year of great rotational confusion. The way money flowed across various themes and sectors in 2021, would have sent the most flexible minded trader and investor into a tailspin headache!

While the S&P 500 advanced 26.9% in 2021, all was not fine under the hood.

Above the seemingly calm and non volatile sea, it felt mostly like good weather for the sailors out in the ocean in 2021.

However, beneath the ocean surface, the undercurrents were seemingly chaotic, erratic and highly volatile.

Many stocks that did very well in 2020, were severely punished in 2021, losing more than -50% from their all time highs!

We have prepared an article summarising all the cross current rotational plays that occurred in 2021 via infographic chart style.

Let’s find out what were the thematic plays that occurred in 2021!

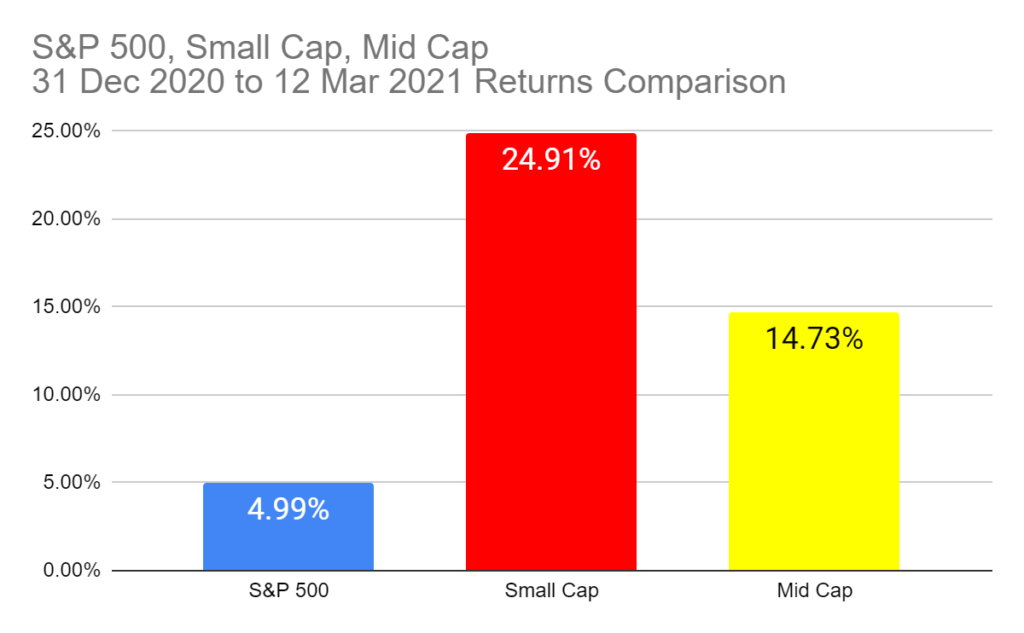

Big took over from the Small in latter 2021

The first 3 months of 2021 was highly favourable to small cap stocks. The Russell 2000 did very well, and gained almost 25% by riding the speculative meme stock craze.

Mid caps rode on the tailcoat and gained 15%.

Gains in the S&P 500 were muted (only 5%) and lagged behind.

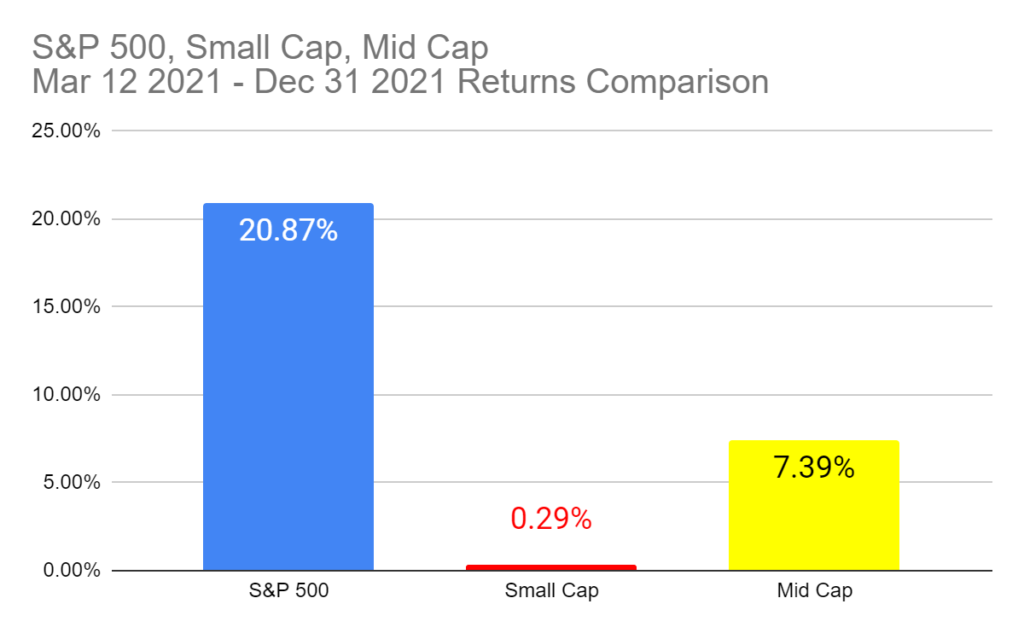

The roles reversed significantly in the next 9 months.

S&P 500 tacked an additional gain of 21% from serious institutional and professional fund money.

Similarly, Mid caps rode on the tailcoat and gained an additional 15%.

However, the meme craze quickly fizzled out for speculative small stocks, and small caps literally went nowhere subsequent 9 months.

Value and Growth Yoyo-ing

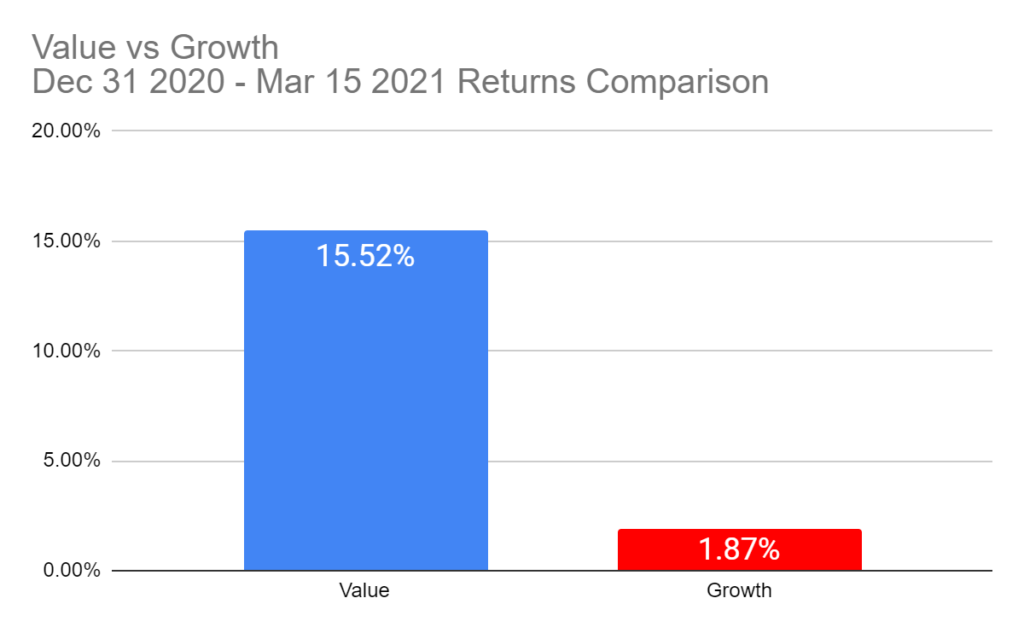

The Value thematic play caught on during the first 3 months of 2021, rising 15.5%.

After rallying super hard in 2020, Growth took a breather and only gained 1.87%.

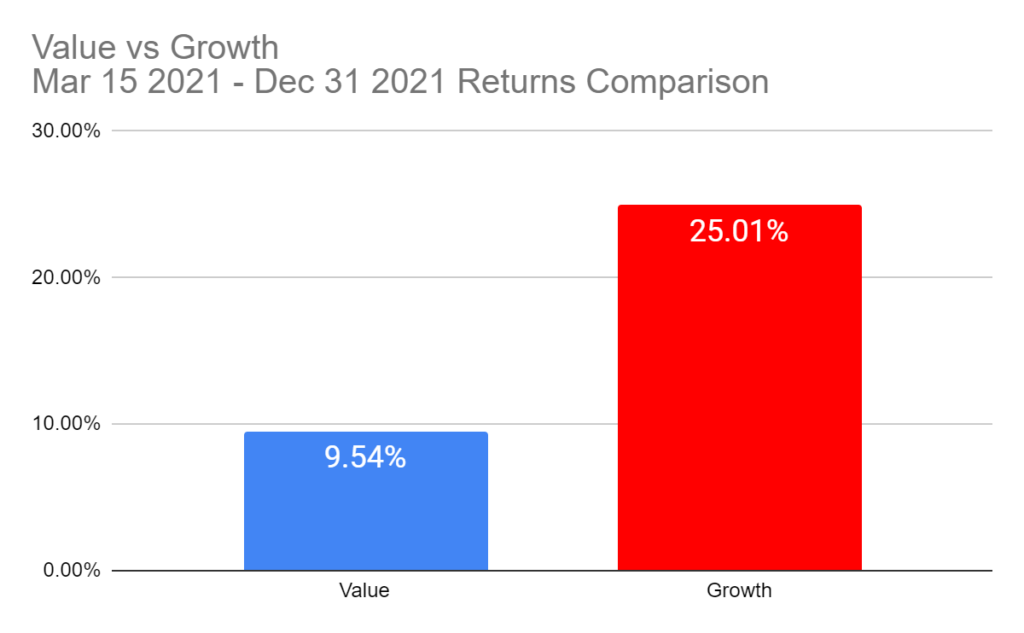

Then the ever fickle Greek god Auxo (goddess of Growth), gave her blessing back to Growth stocks and nudged an additional 25% in the remaining 9 months!

That said, Value stocks did not too badly as well, although they paled in comparison to Growth by only achieving 9.5%.

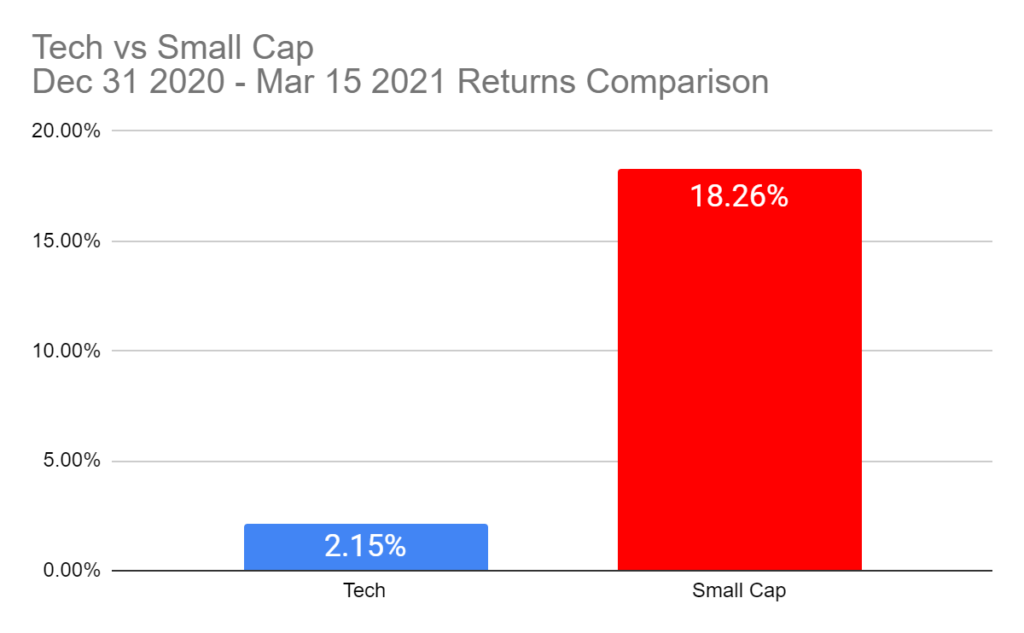

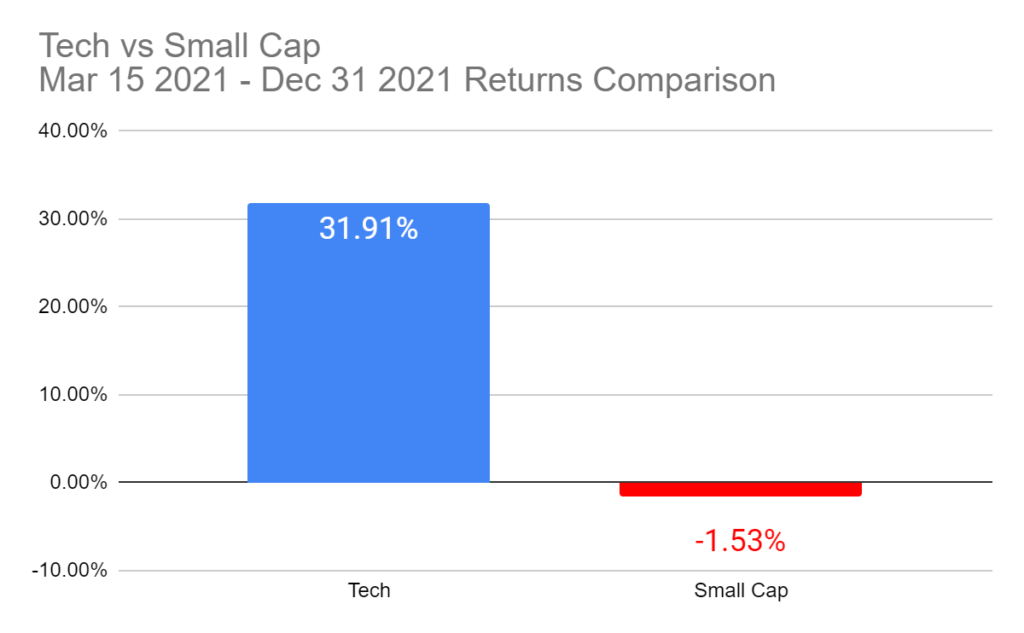

Tech ate Small Cap’s lunch

Similarly, small cap was the star in the first 3 months 2021 gaining 18.26% versus the generally popular Tech play.

Then tech completely ate Small cap’s lunch in the subsequent 9 months, gaining almost 32% while small cap lost -1.53%!

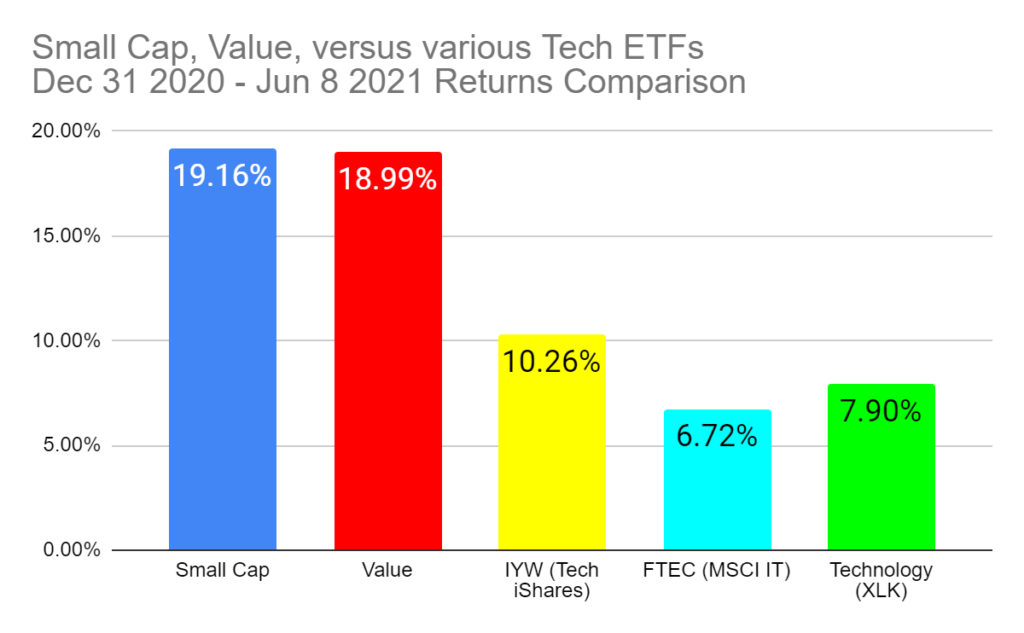

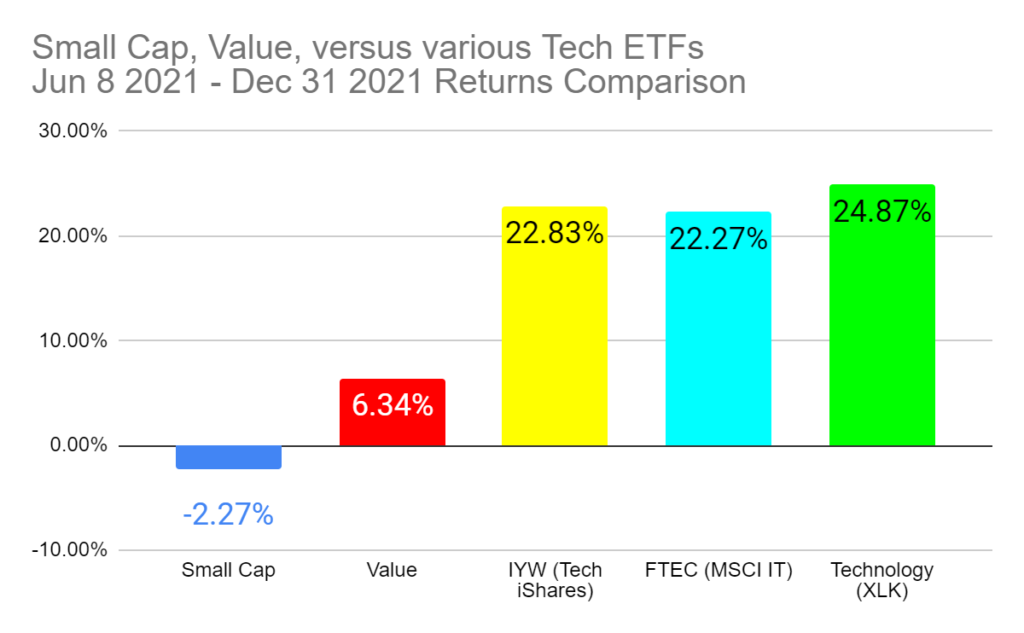

Same Charts - all together

Here’s the infographic comparing Tech, Value and small cap. The time periods are different and show the rotational play in effect for the first six months and subsequent six months of 2021.

What about various S&P 500 Sectors?

There are 11 sectors making up the S&P 500 stock portfolio.

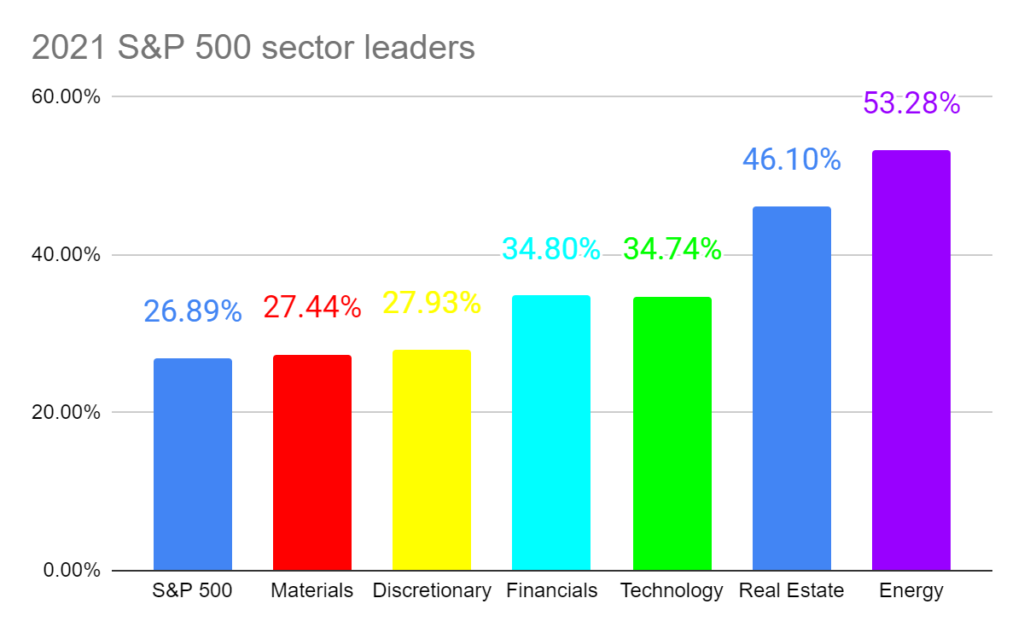

These are the 6 sectors that outperformed the S&P 500 in 2021.

Most notably, Energy was the surprising sector that significantly outperformed the S&P 500 gaining 53% on a relative basis!

Real Estate was near 2nd place gaining 46%!

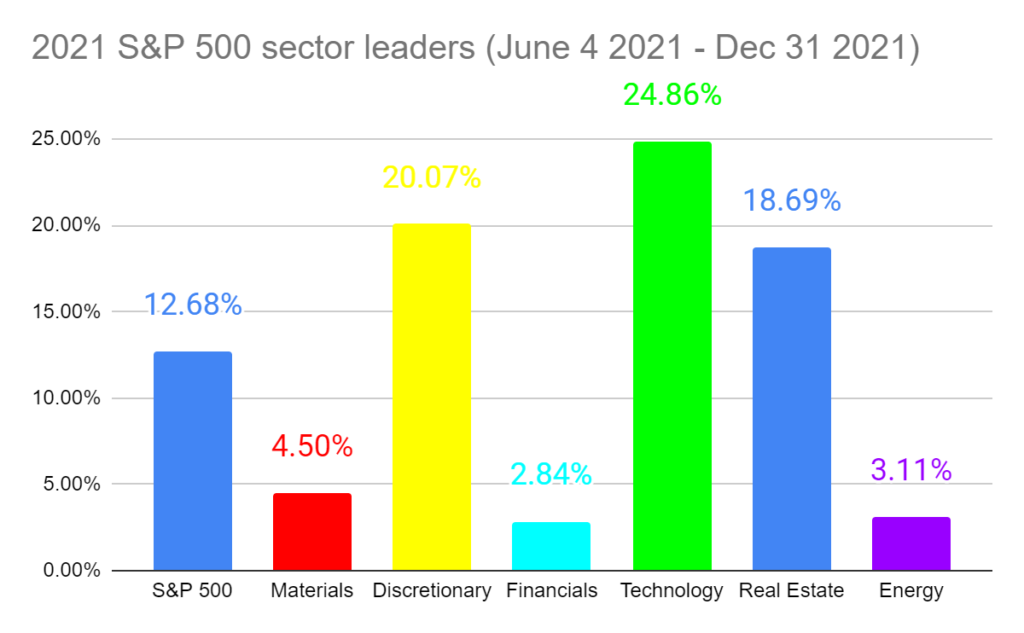

However, do kindly take note that Energy’s sizzle likely fizzled out in the latter 6 months of 2021 as well as Financials and Materials. This means that their relative outperformance to the S&P 500 occurred in the first 6 months of 2021!

Conclusion

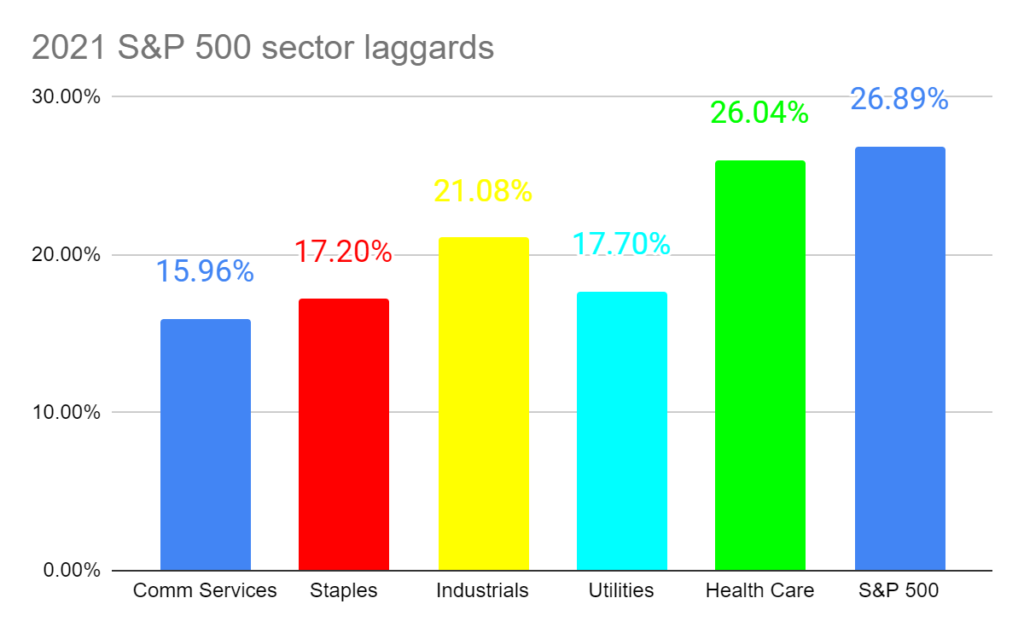

Are you interested to know the remaining 5 sector laggards of the S&P 500?

They might be interesting because if the trend of continued fund rotation were to persist into 2022, these underperformers in 2021 might finally see the light of day in 2022!

The caveat is, if the pattern of rotation continues to play out in 2022.

In summary, the five sectors to look out for are ‘Health Care’, ‘Utilities’, ‘Industrials’, ‘Staples’ and ‘Communication Services’!

Disclaimer: Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

If you find trading extremely difficult or are worried and not confident you can achieve portfolio profitability in 2022 – please rest assured you are not alone in feeling that way.

In fact, many professional traders, analysts and stock investors are getting ready for a tough 2022! The reason is because the stock market has run up a lot since the Covid lows, and the stock market is overpriced with high valuations. Coupled with the Fed making financial less accommodative than we had seen in the past 2 years, the only natural thing is for the stock market to take a break.

Therefore, the US stock market is expected to either trade sideways or in the worst case, experience a correction in 2022.

Do you know that when markets trade sideways or enter into correction territory. AlgoMerchant’s fully automated AI trading strategies are designed to exploit such market conditions?

Please contact us at hello@algomerchant.com if you wish to learn more about our AI trading solutions!