Introduction

On 14-15th December 2021, the US Federal Reserve (Fed) will be conducting their regular scheduled Fed Open Market Committee (FOMC) meeting .

This meeting matters a lot to everyone in the world and especially the USA, as it is where decisions regarding the nation’s money supply are made and communicated to the public.

The abundance of money supply provided by the Fed has been the primary driver for the stock market run up since the Covid low. So any changes in the future money supply will be keenly watched by Traders and Investors!

We have prepared this summary article for our community readers regarding the 4 most important takeaways regarding this FOMC meeting!

1. Ending the Quantitative Easing (QE) Programme

It is already old news, which is baked in the current stock market price that the Fed is going to end its highly accommodative QE programme. Therefore, for the benefit of our community readers it is important to not over-react to news headlines regarding the end of QE.

The last FOMC meeting in November resulted in the Fed announcing it will no longer increase its $120 billion per month bond buying QE programme, and further announced they will reduce the asset purchase by $15B in November and December respectively.

Hence, what is currently priced by the market, is for the QE programme to end by May 2022, assuming a $15B reduction per month rate.

What is rumoured: Now, what is currently rumoured, and therefore might already be partially priced into the stock market, is for the Fed to increase the reduction rate from $15B to $30B per month. Note this is just rumoured and is by no means confirmed. What could therefore happen, is that if the Fed does increase the reduction to $30B it might cause a temporary selldown, rather than a full blown correction.

What will catch the market off guard? Now, if the Fed were to announce a reduction rate greater than $30B per month, that would be totally unexpected and might trigger a Nov-Dec 2018 like correction which saw the market correct by -20%!

2. Fed’s inflation forecast

Jerome Powell, the current Fed chair, has already suggested that the previously ‘transitory’ inflation term should be ‘retired’, which also means that the Fed is already expecting higher upside surprises for future inflation. Frankly, this does not bode well for the stock market, and if the Fed does use stronger language in this Dec FOMC meeting to describe their expectations of inflation, it might trigger further downside for the stock market.

What might catch the market off guard? However, if the Fed does communicate, similar to the Biden’s administration inflation expectation (check out our previous article) that peak inflation is probably already in, then this might be a welcomed surprise for the stock market.

If this scenario occurs, we might see a continuation of the bull market!

3. Raising Interest Rates

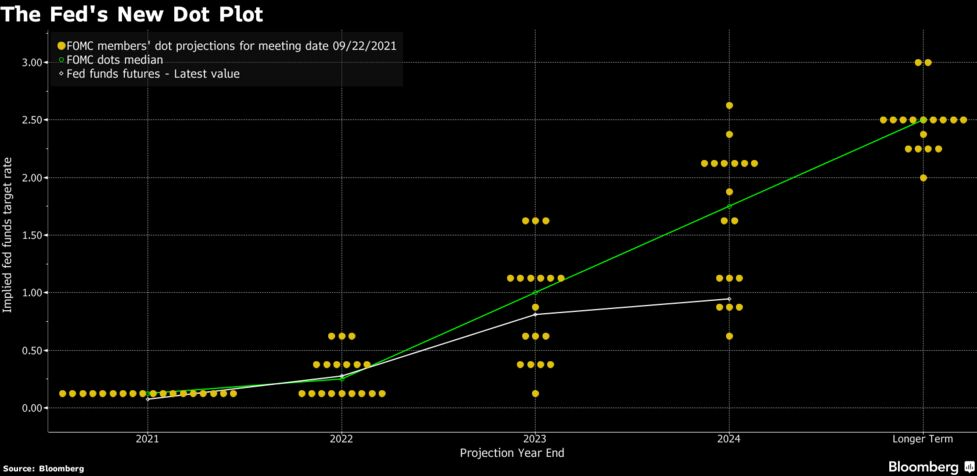

The chart below summarises what is currently priced into the stock market – which is a 50% chance interest rates will start to rise in 2022!

What is rumoured? It is currently rumoured that the Fed might perform 2 rate hikes in 2022 which assumes that when the QE programme ends in May, shortly after 2 interest rate hikes will occur in conjunction.

What might catch the market off guard? If 3 rate hikes were to be projected by the Fed, this will be unexpected for the financial markets and might trigger a stock market correction.

Correspondingly, a bullish outcome might occur if the Fed says that due to the Omicron threat the financial market still needs support, thereby announcing only 1 rate hike.

4. Reducing Fed’s involvement in Repo Markets

This factor is perhaps the most complicated of the 4 must know(s). However, it is very important as the Repo market drives short term money liquidity for major financial institutions, so we will do our best to simplify this.

In summary, the QE programme initiated by the Fed (US Central Bank), directly purchases the US treasury bonds issued by the US federal government, and as an exchange for the treasuries and bills, provides the US federal government with cash. That cash is used to pay government employees’ salaries, and other government related spending which then drives the economy.

The Repo market, on the other hand, originally affected banks and other private financial institutions who also hold US treasury bonds that might exchange them with cash from other private parties. For example, a big private bank that has a lot of undeployed short term cash, may choose to buy US treasury bonds through the Repo market from another private third party only for a short duration, with the promise of getting paid short term interest.

Now what our community readers need to know is that in 2019, the Fed started to meddle in the Repo market, which was always private until that point. The Fed, in their bid to lubricate the short term financing market, started to support the Repo market by agreeing to buy US treasury bonds from the open market (short term), and then selling them back. This action provided much needed short term cash liquidity to financial institutions and the Repo market.

What might catch the market off guard? Currently, the stock market is not pricing in any changes in the Fed’s existing involvement with the Repo market. Any Fed statements that might suggest a reduced level of support to the Repo market, is likely to send negative shockwaves to the stock market as short term liquidity will be impacted.

Conclusion

Basically, everything that has been explained above are what-ifs, which may or may not occur, and therefore at the point of writing this article, these scenarios are not facts.

However, what is safe to say, and is a fact, is that the stock market today, is definitely less accommodative than it was in early 2021 because the Fed is already less accommodative since November 2021.

Therefore, many professional traders, analysts and stock investors are getting ready for a tough 2022! The reason is because the stock market has run up a lot since the Covid lows, and the stock market is overpriced with high valuations. Coupled with the Fed making financial less accommodative than we had seen in the past 2 years, the only natural thing is for the stock market to take a break.

Hence, the US stock market is expected to either trade sideways or in the worst case, experience a correction in 2022.

Do you know that when markets trade sideways or enter into correction territory, AlgoMerchant’s fully automated AI trading strategies are designed to exploit such market conditions?

If you are keen to explore alternative ways to profit from a tough market next year, we have an upcoming VIKI seminar. Click the link below to register for the event to learn how VIKI can profit when the market cannot!

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.