Let’s assume you’ve already done your basic research on what stock trading is, and you’re now looking for tips on how to delve into investing or trading. Unfortunately, our experience has shown that there are many beginner traders who have invested without a strategy or an end goal in mind.

For example, we know of many traders who buy popular stocks based off friends’ recommendations or what they read online. However, we find that they do not necessarily know when to exit the trades, and whether the outcomes ultimately meet their investment objectives!

Did you know that research has shown that most retail traders actually lose money? The journey of Investing and trading can be daunting and long, therefore, it is very important to have a plan. Below is a simple process which we have come up with to kick-start your investment journey, and it involves 5 basic factors to consider and explore.

TAKEAWAY

- It is important to have a target return objective before starting your trading journey.

- A simple process of financial projection will help investors assess whether their investment objectives are realistic.

- 3 out of 5 factors (investment horizon, initial capital, and regular top ups) are easier for individuals to control.

- The remaining 2 factors (investment growth rate and portfolio risks) are externally driven by market conditions and harder to control. However, it is still possible to make reasonable assumptions on what they are in your financial projections.

1. Investment Horizon

The first most important advice is actually for you to identify your investment horizon, which represents the amount of time you expect to have investment exposure. For example, if you’re a young professional, you may define your horizon starting from your first pay check to retirement, since your objective is to have money for retirement. In general, the longer the investment horizon the better, as time is an essential ingredient for your wealth to grow.

2. Initial Capital

Next, you need to understand that the starting capital is crucial in generating wealth although starting capital varies across individuals depending on their circumstances. In fact most experienced traders always recommend allocating only a percentage of your savings that you intend to use for trading. It is preferred for your trading capital to remain untouched during the investment horizon, in order to leverage on time compounding effects for wealth to beget more wealth!

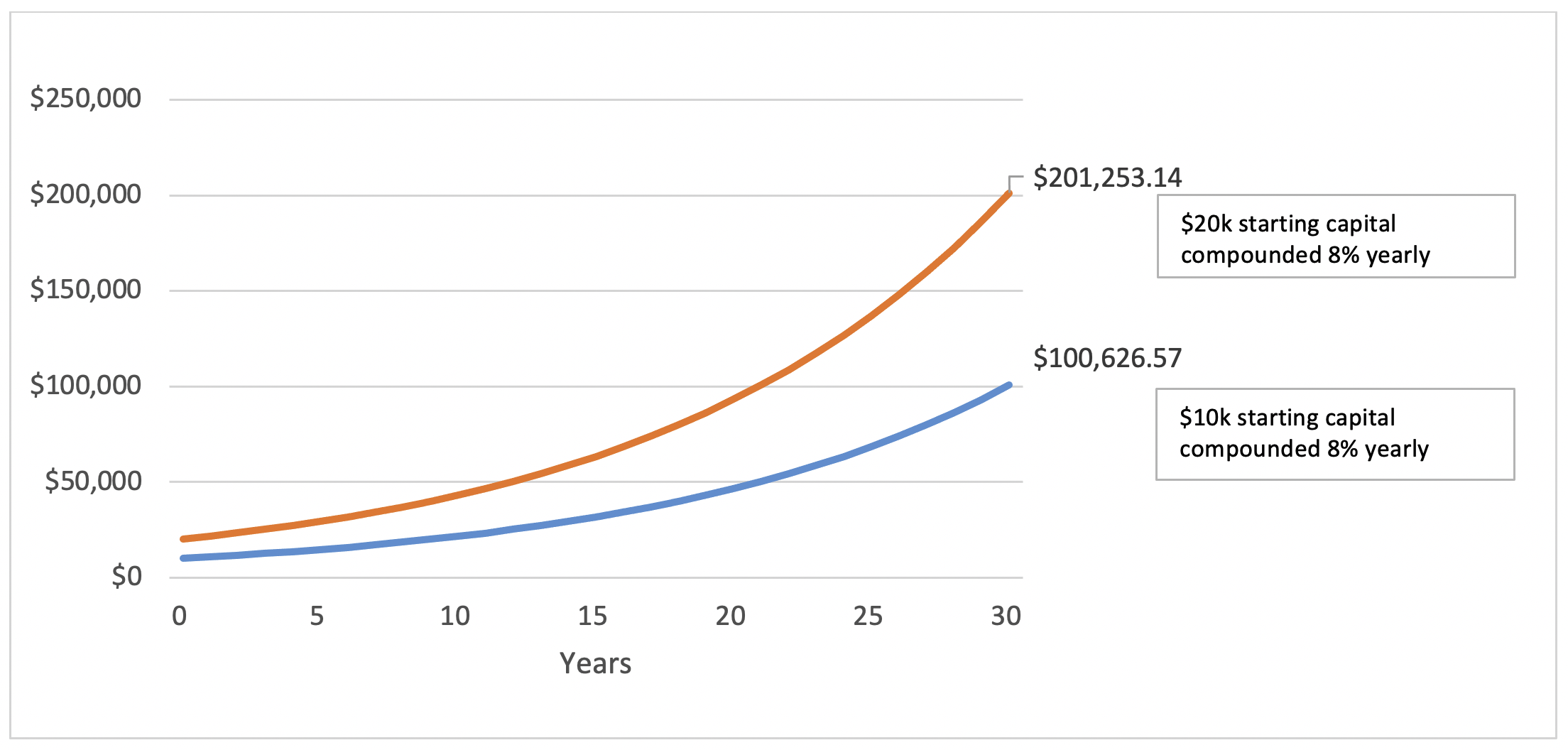

For example, Figure 1 shows that a $20,000 initial capital assumed to grow at 8% annually for 30 years will beat the scenario with a $10,000 initial capital by a magnitude of 100%!

3. Regular Top ups

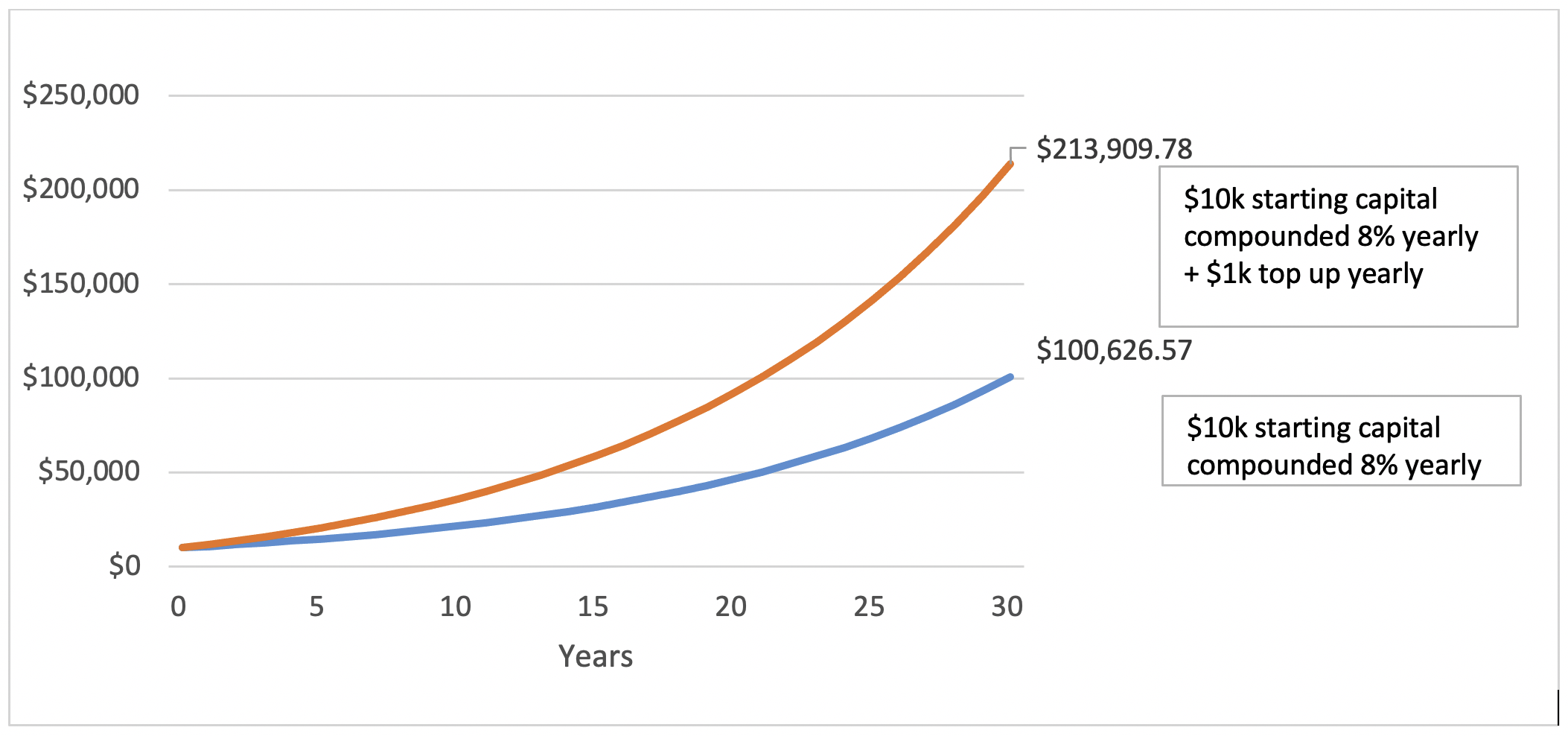

Performing top ups throughout your investment horizon is beneficial in generating more investment wealth. As illustrated in Figure 2 below, a $10,000 initial capital is assumed to grow at 8% annually for 30 years; the scenario with a $1,000 yearly top up beats the one without the yearly top up by a magnitude of 112%!

4 & 5. Assumed Annual Growth Rates & Investment Risks

In the examples above, a simple 8% annual growth rate is assumed for illustrative purposes only. However, from our experience, it is most likely the case that a consistent fixed and positive annual growth rate is not realistic throughout the investment horizon, since stocks are known to be volatile.

Yearly growth rate and investment risk factors are externally driven by market conditions, and harder to control and determine. However, it is still important to make reasonable assumptions on these 2 factors to ensure that your financial projections are realistic, something that a lot of retail traders do not actually do. In general, there is a trade-off between risk and returns. If you are expecting very high returns, you must also be mindful of the fact that there will be periods whereby your investments experience negative growths and drawdowns.

There are multiple ways to assume annual growth rates and investment risks (years of negative growth rates). One way is to look back on history, to understand how the investment product or portfolio has performed historically across time.

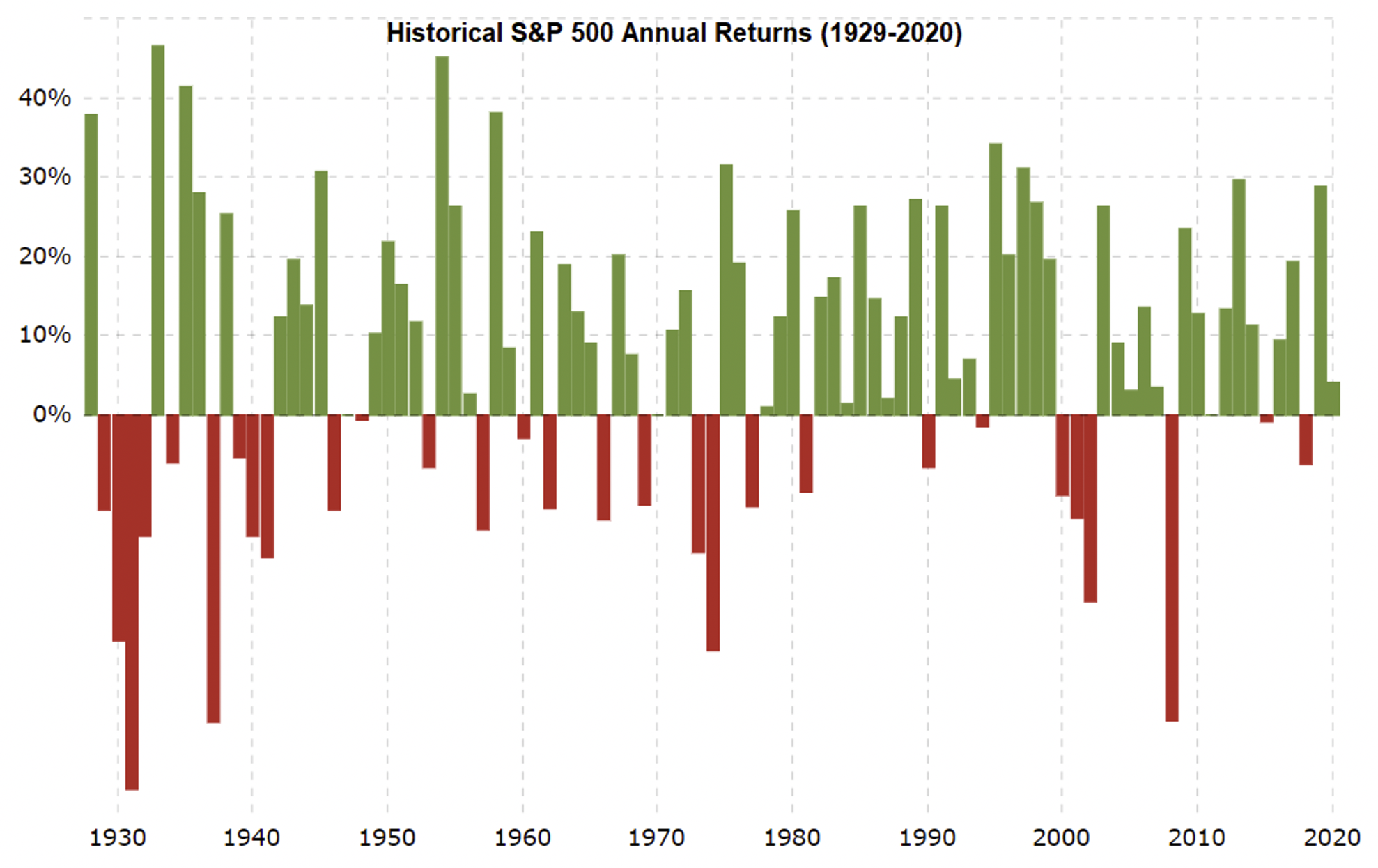

For example, an investor that invests in a portfolio of the top 500 US stocks (S&P 500) can apply his annual growth rates and investment risks from the chart below, which has a combination of positive and negative yearly returns.

Just to highlight the concept of high returns going hand-in-hand with volatility, the S&P 500 below has returned a historical annualised average return of around 10% since 1929 to 2019. However, during this 90-years period, there were 29 years where S&P 500 had negative returns! The maximum yearly drawdown could be as high as -47%!

The Final Piece – Meeting your investment objectives

We find that most successful investors base their investment objectives on achieving a particular target return at the end of their investment horizon. In this article, we have explained how a simple process with 5 factors to keep in mind can help traders and investors navigate towards an end goal.

The 3 easiest factors to iterate are investment horizon, initial capital and regular tops up, which are all within the control of individuals. It is also equally important to make reasonable assumptions on annual growth rates and investment risks, so that your financial projections are realistic and you can decide whether your target returns can be met or not.