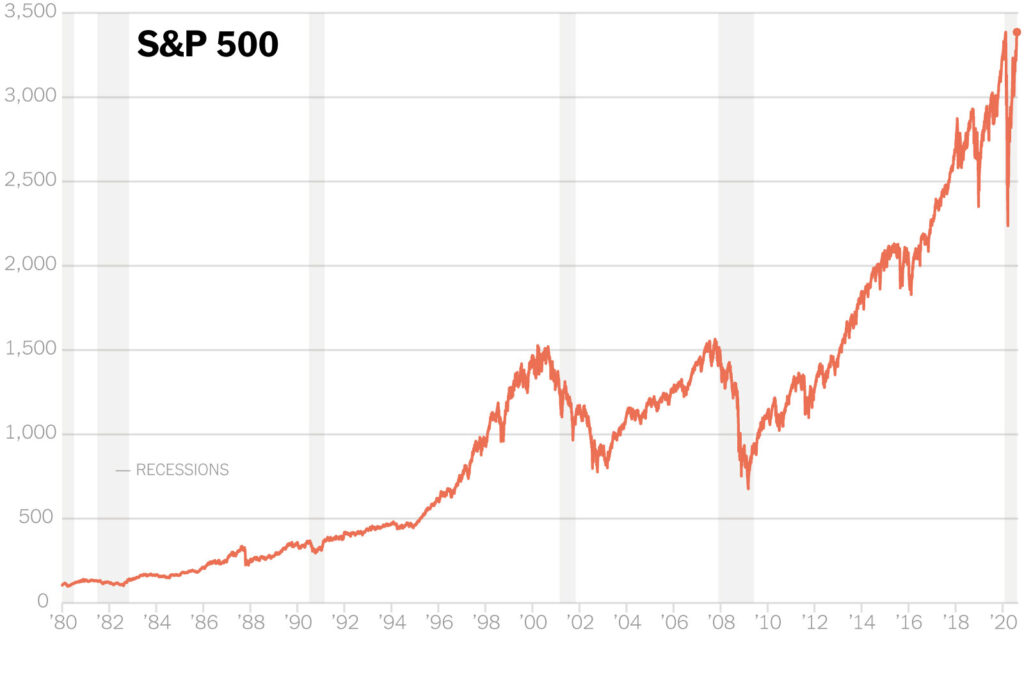

Stocks rallied for the second consecutive session on Wednesday, with markets reaching new records as the S&P 500 and Dow Jones Industrial Average closed at record highs, driven by strong gains in technology stocks as investors appeared to shrug off geopolitical concerns. The S&P 500 reached a new all-time high of 5,792.04, while the Nasdaq Composite finished at 18,291.62. The Dow followed suit, closing at a record 42,512.00, marking another significant gain.

Despite this strong market performance, the broader U.S. economy continues to send mixed signals as it contends with inflation pressures, Federal Reserve policy adjustments, and global uncertainties. The latest Federal Reserve minutes reveal a divide among policymakers over the extent of recent interest rate cuts, highlighting the challenge of balancing inflation control with economic growth. While inflation is nearing the Fed’s 2% target, a cooling labor market and robust job numbers have sparked debate over the appropriate pace for easing monetary policy.

Source: Forbes

With the upcoming Consumer Price Index (CPI) data set to be released, any unexpected uptick could shift the Fed’s current trajectory, underscoring the uncertainty despite the market’s recent strength.

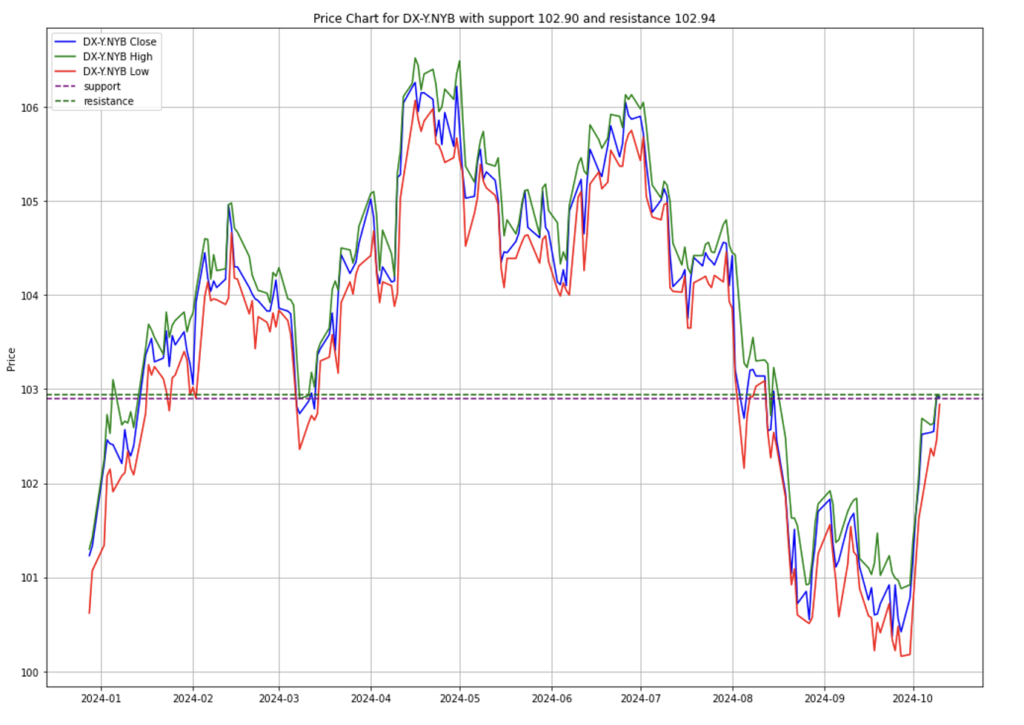

U.S. Dollar Strength Signals Confidence in Economy

The strength of the U.S. dollar, coinciding with markets reaching new records, particularly against major global currencies, highlights confidence in the U.S. economy relative to its international counterparts. Investors anticipate a measured approach from the Federal Reserve regarding interest rate adjustments. However, while the dollar remains steady, increased inflation risks could pose challenges for U.S. exporters and impact corporate earnings.

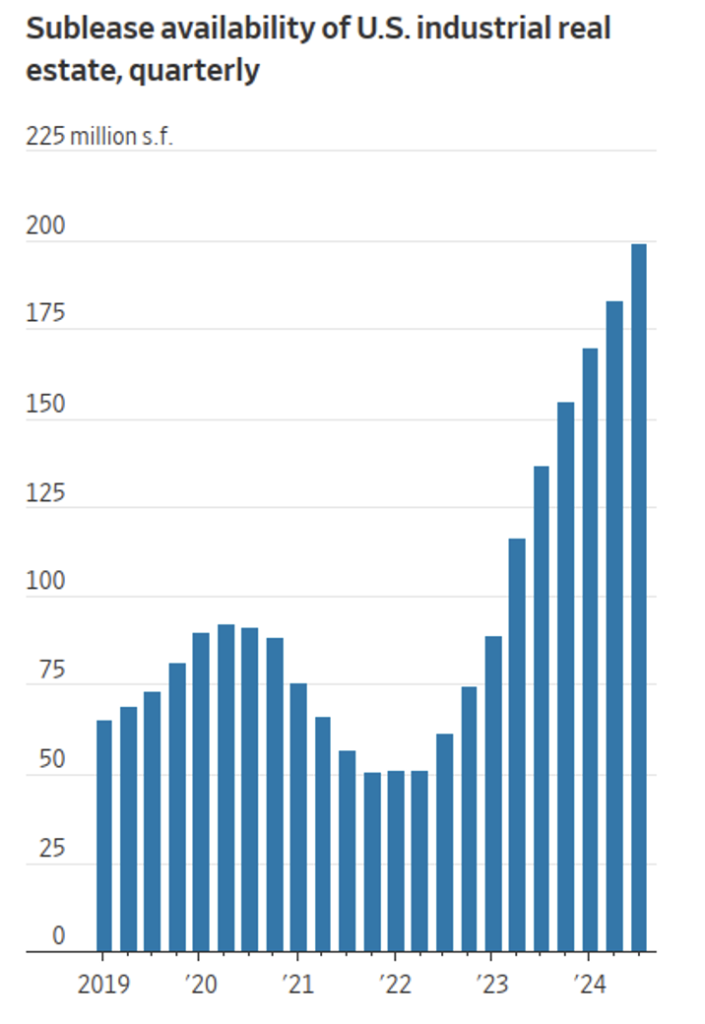

Declining Consumer Demand for Home Improvement and Industrial Real Estate

The economic environment is also impacted by supply-chain dynamics, as companies like Home Depot adjust their strategies post-pandemic. Home Depot has begun subleasing large warehouse spaces previously acquired to meet surging demand during the pandemic, signalling weaker consumer demand for home improvement projects.

MARKET CONCERNS

International Inflation Trend

Inflation trends, especially in emerging markets like India, have overshot central bank targets. In India, September inflation likely exceeded the Reserve Bank’s 4% target due to rising food prices and a challenging statistical base. Such inflationary pressures in international markets could impact global supply chains and trade dynamics, with repercussions for U.S. inflation and consumer prices.

As global economies grapple with inflation, shifting monetary policies, and climate risks, the U.S. economy remains resilient, though not immune to these broader issues. Investors and businesses alike must navigate this complex landscape, balancing optimism with caution amid these uncertainties.

International Dynamics

Germany’s economic slowdown, exacerbated by high energy costs and reduced demand from China, could influence trade relations and the broader eurozone economy. Germany’s ongoing economic struggles contrast sharply with the relative strength of the U.S. economy, highlighting the unique challenges faced by different global markets.

WATCHOUT

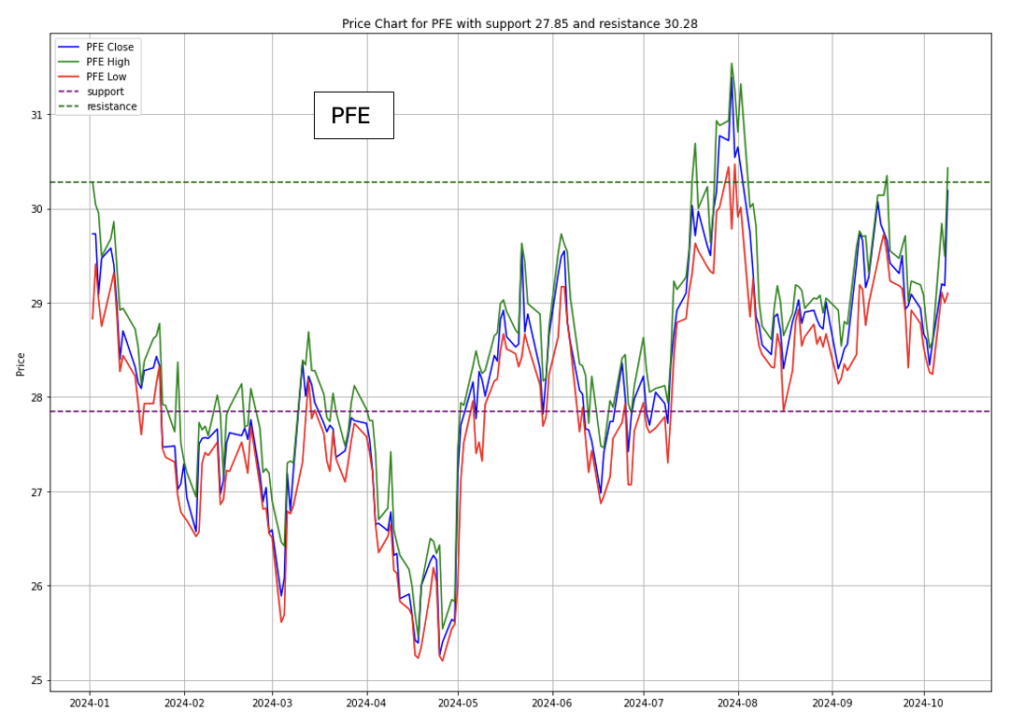

Pfizer Faces Investor Scrutiny

Pfizer faces pressure from activist investors to improve its performance after its pandemic-driven growth has subsided. The company’s recent challenges include limited near-term catalysts and high debt, which prevent large acquisitions. However, Pfizer is expected to focus on smaller deals and potential divestitures to regain investor confidence.

Hurricane Milton's Impact on Insurance Stocks

Hurricane Milton, expected to cause up to $100 billion in insured losses, is set to shake the insurance and reinsurance markets. Companies like Munich Re, Swiss Re, and Lloyd’s of London syndicates could see higher reinsurance rates, benefiting their long-term profitability despite short-term losses.

Investment Opportunity & Risk

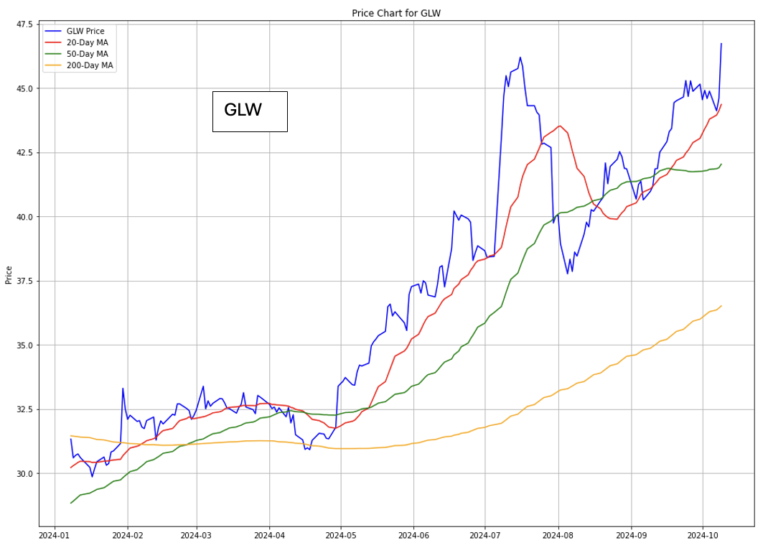

Corning Inc. (GLW)

- Corning Inc. has experienced significant call options activity, with bullish investors showing optimism regarding the company’s value. GLW is currently trading at $46.73, up 23.8% since August. The company’s products, particularly in optical AI connectivity, are expected to drive sales growth in the near future. Analysts have raised their price targets, with some seeing the stock potentially reaching $55.

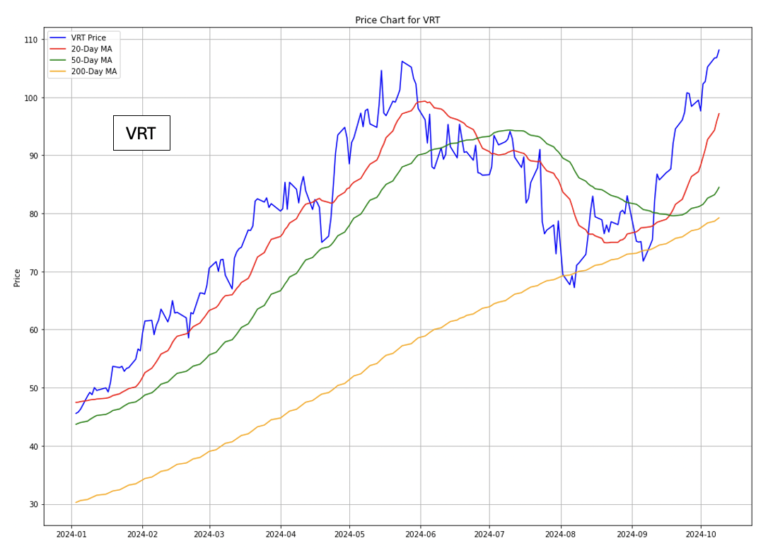

Vertiv Holdings (VRT)

- Vertiv, a data center infrastructure provider, has seen substantial growth this year, with its stock up 125% year-to-date. The company reported strong Q2 earnings and raised its full-year guidance, driven by increased demand for AI-related infrastructure. Analysts remain bullish on VRT, with price targets as high as $125, reflecting its leadership in data center cooling and power management systems.

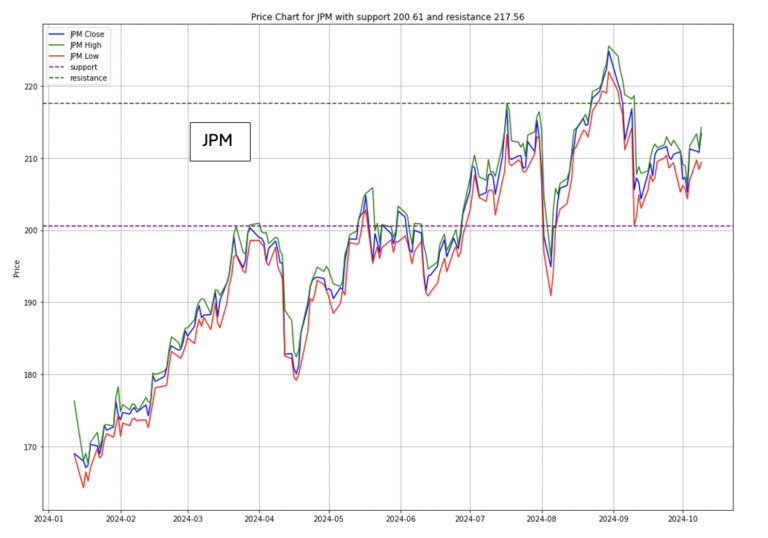

JPMorgan Chase & Co. (JPM)

- JP Morgan, one of the largest global banks, is set to report strong Q3 earnings, supported by rising interest rates and robust performance in its trading and lending divisions. The bank has outperformed the broader market over the last two decades, providing substantial returns to shareholders.

CONCLUSION

- The U.S. economy navigates a complex landscape shaped by domestic policy shifts and international challenges.

- The Federal Reserve manages inflation and labor market adjustments.

- The strength of the U.S. dollar and steady economic performance create cautious optimism.

- External factors, such as Germany’s economic slowdown and rising costs from natural disasters like Hurricane Milton, present significant uncertainties.

- Amid uncertainties, markets are reaching new records.

- Companies like Corning Inc., Vertiv Holdings, and JPMorgan Chase show resilience and growth potential, supported by strong earnings and investor confidence in sectors like data centers, AI infrastructure, and financial services.

- In contrast, Pfizer faces activist pressure to address challenges from post-pandemic transitions and debt burdens.

- The broader market also contends with global inflationary pressures, especially from emerging markets like India.

- Ultimately, while the U.S. stock market offers growth opportunities, it also demands prudent decision-making in an increasingly interconnected and unpredictable global economy.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.