The US stock market continues to demonstrate market resilience, driven by positive earnings and easing inflationary pressures. Key indices such as the S&P 500 and Dow Jones Industrial Average have reached new highs despite lingering concerns about inflation and interest rates. However, the Nasdaq has lagged due to a rotation out of technology stocks.

Despite the Federal Reserve’s recent rate cuts, inflation remains a challenge. September saw a year-on-year inflation increase of 2.4%, down slightly from August’s 2.5%. Core inflation, which excludes food and energy, remains sticky at 3.3%, signalling persistent price pressures. This data arrives as the Fed attempts to balance inflation control with economic growth, a delicate act that will shape market sentiment heading into 2025.

GLOBAL OUTLOOK

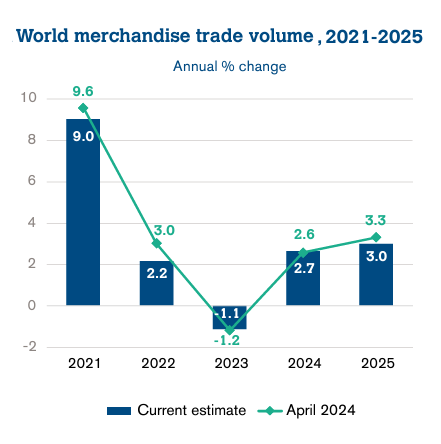

WTO Sees A Modest Global Trade Growth

The World Trade Organization (WTO) has revised its forecast for trade growth, predicting a 2.7% increase in goods traded for 2024, slightly higher than the 2.6% forecasted earlier. This revision reflects a recovery in demand as inflation eases and central banks around the world lower interest rates. However, global trade remains vulnerable to geopolitical tensions, fluctuating oil supplies, and tariff risks.

Source: WTO

Rising Global Demand for Copper

Copper, often referred to as “Dr. Copper” due to its historical ability to signal global economic health, is set for a significant increase in demand. This market resilience is not only evident in the US but also globally, driven by rising initiatives for renewable energy infrastructure and the shift to electric vehicles (EVs), which enhance copper’s critical role in electrical wiring and energy systems. Prices for copper have already surged 13% year-to-date, with December futures gaining 8.5% in the last month alone.

As global demand for copper grows, companies involved in copper production and related industries are positioned to benefit. Notable companies to watch include Freeport-McMoRan Inc. (FCX), a major player in copper mining, and Southern Copper Corporation (SCCO), one of the largest copper producers globally. Both of these stocks are likely to experience positive momentum as demand for copper rises.

Additionally, companies in the renewable energy and electric vehicle sectors, such as Tesla (TSLA) and General Motors (GM), will indirectly be impacted by the rising cost and availability of copper, which is essential for their products’ production.

WATCHOUT

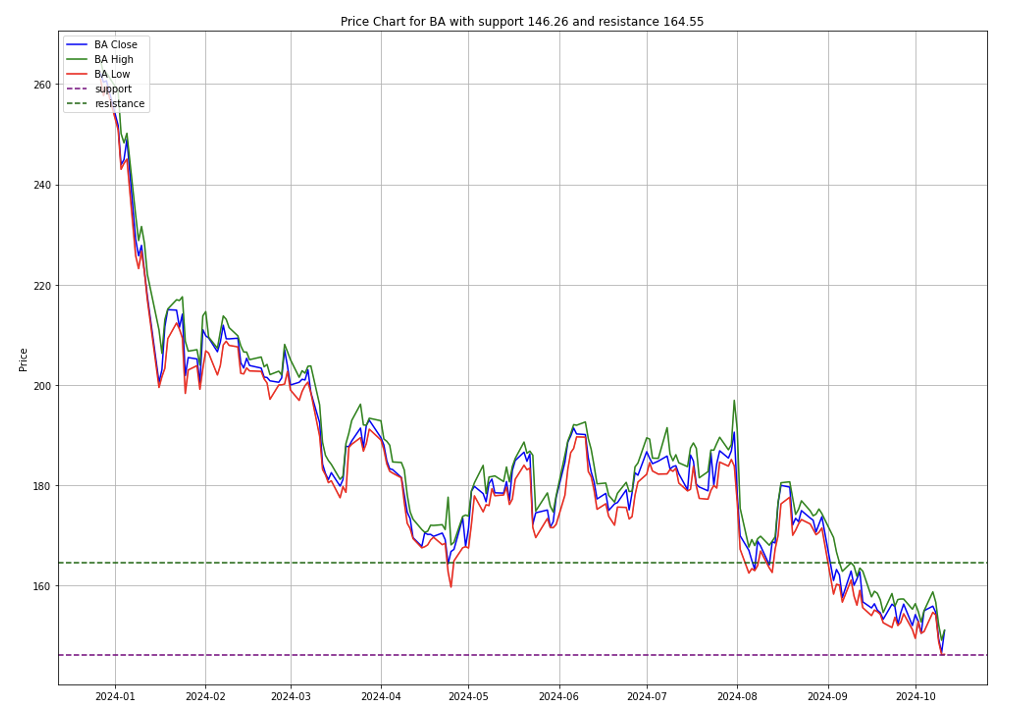

Boeing Faces Challenges with Workforce Cuts and Production Delays

Boeing is facing significant operational challenges as it cuts 10% of its workforce, or 17,000 jobs, due to a machinist strike and delays in its 777X aircraft production. The company is set to book $5 billion in charges related to troubled programs, leading to a potential quarterly loss of $6 billion. Boeing’s struggles have been compounded by production issues that have burned through its cash reserves, further exacerbating its challenges in the competitive aerospace industry.

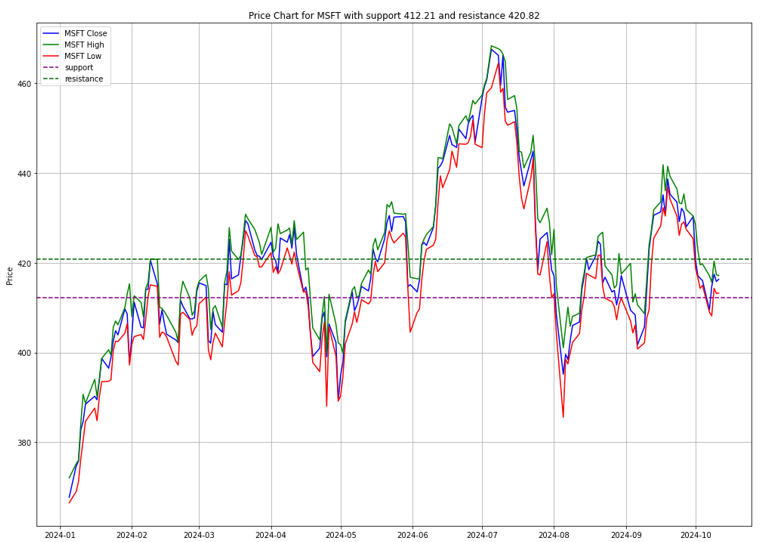

Microsoft Underperforms in 2024 Amid AI Monetization Concerns

Microsoft has underperformed in 2024, gaining just over 10% YTD, significantly lagging behind other tech peers. Concerns over its ability to monetize artificial intelligence (AI) investments, including its partnership with OpenAI, have weighed on investor sentiment. Despite recent analyst downgrades, Microsoft maintains a “strong buy” consensus, with a potential upside of 21%. However, its future performance will depend heavily on how well it can convert AI-driven initiatives into profitable ventures.

Investment Opportunity & Risk

In light of the market resilience, investors might consider some stock opportunities:

Domino’s Pizza (DPZ)

- Domino’s Pizza, reported significant free cash flow (FCF) margin expansion despite flat sales in Q3 2024. The company’s strong FCF of $376.1 million and its ability to squeeze higher cash from operations make its stock notably undervalued. Currently, analysts project the stock is worth at least 25% more than its current value, around $537 per share. Domino’s consistent ability to generate free cash, combined with expectations of higher future sales, positions it as a solid investment opportunity.

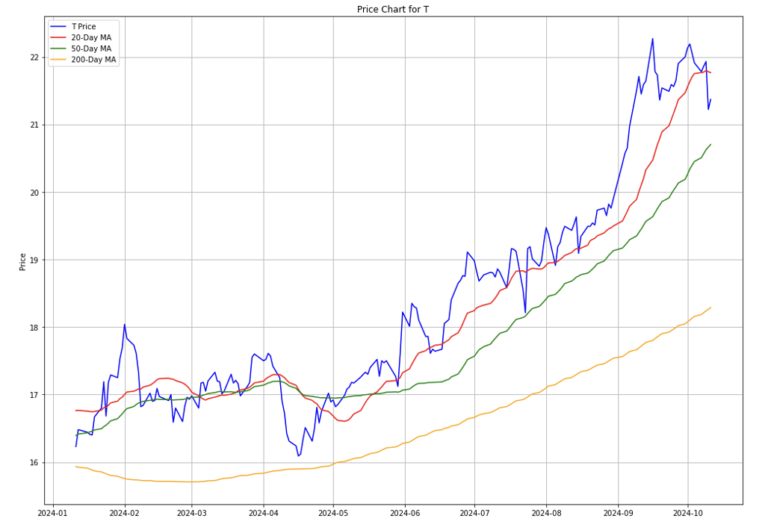

AT&T (T)

- AT&T, no longer a “dividend aristocrat” after cutting its dividend in 2022, has refocused on its core telecom businessThe stock has rebounded by 13% in recent months as the company exited non-core ventures like WarnerMedia. While AT&T is not expected to deliver high growth, its solid dividend yield of 5.2% makes it an attractive option for income-seeking investors, especially with falling interest rates increasing the appeal of dividend-paying stocks.

CONCLUSION

- The US economy is facing a mixed landscape as inflation remains a challenge, but market resilience is strong, especially in sectors like finance and energy.

- Trade is expected to rebound as inflation eases and interest rates fall globally

- For investors, key opportunities exist in sectors like technology (Microsoft), consumer goods (Domino’s Pizza), and industrials (Boeing).

- Additionally, commodities like copper offer promising long-term investment potential as global demand for infrastructure-related metals surges.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.