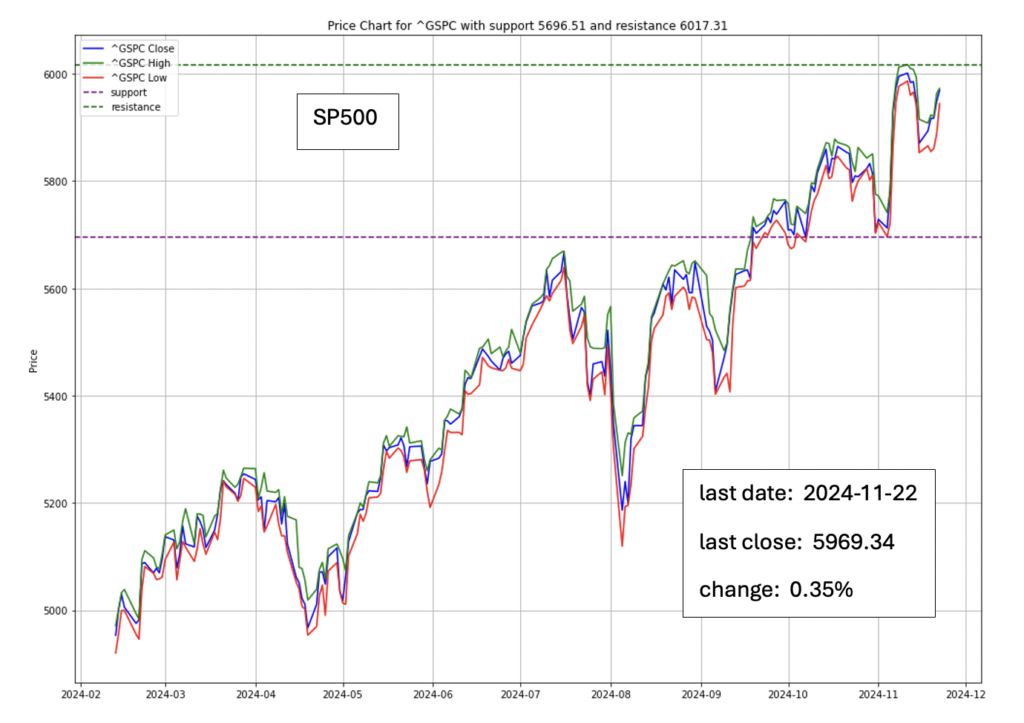

Dow Hits Record High as S&P 500 and Nasdaq Climb Last Friday. The U.S. economy continues to reflect resilience and complexity as it navigates various domestic and international influences. Key developments include inflation trends, the retail landscape, the ongoing impact of geopolitical events, and the roles of emerging industries like artificial intelligence.

Inflation Report to Shape Fed Decisions

The U.S. is poised to release the Personal Consumption Expenditures (PCE) Price Index, a critical inflation gauge preferred by the Federal Reserve. Economists anticipate a 2.3% annual rise for October, with this report being the final one before the Fed’s December meeting. Persistent inflationary pressures have kept the central bank cautious about further rate cuts, creating a divide in market expectations about whether to proceed with a 25-basis-point cut or pause.

Source: Bloomberg

MARKET CONCERN

Retail Mixed Signals as Black Friday Begins

As Black Friday ushers in the holiday shopping season, the retail sector provides mixed signals about consumer strength amidst higher costs. Walmart has raised its annual sales forecast, citing robust momentum from back-to-school and Halloween sales. Meanwhile, Target has tempered its outlook due to weaker-than-expected holiday-quarter projections. Upcoming earnings from Best Buy, Macy’s, Nordstrom, and Urban Outfitters will offer further clarity.

Trump's Return Alters Markets and Trade Patterns

Source: VanityFair

The re-emergence of the Trump administration brings renewed attention to the “Trump trade,” with cryptocurrency and the U.S. dollar experiencing significant gains. Meanwhile, clean energy stocks and foreign currencies like the Mexican peso face headwinds. Additionally, Trump’s tariffs on China have fundamentally shifted U.S. trade patterns, favouring manufacturing hubs like Mexico and Vietnam over China. However, many products still rely on Chinese components, underscoring the interconnectedness of global supply chains.

GLOBAL CONCERN

Oil Prices Rise as Eurozone Struggles

Oil prices surged on geopolitical tensions stemming from the Ukraine conflict, reflecting the global interconnectedness of energy markets. Meanwhile, the Eurozone struggles with stagnating business activity despite recent rate cuts, highlighting divergent recovery paths between major economies

Source: Reuters

WATCHOUT

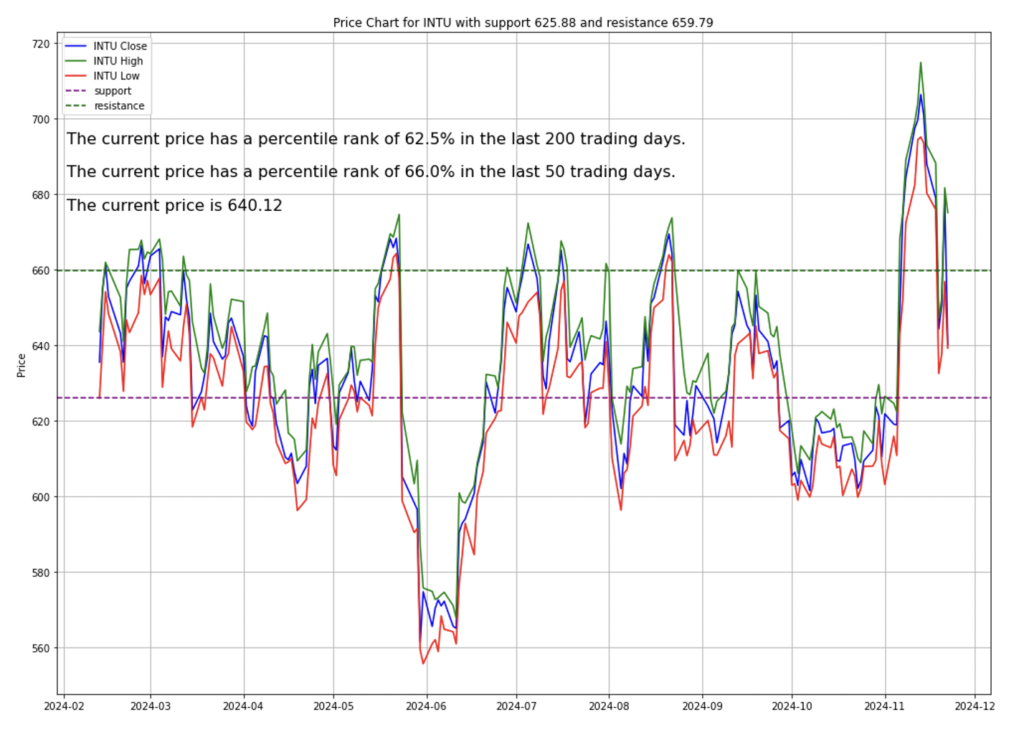

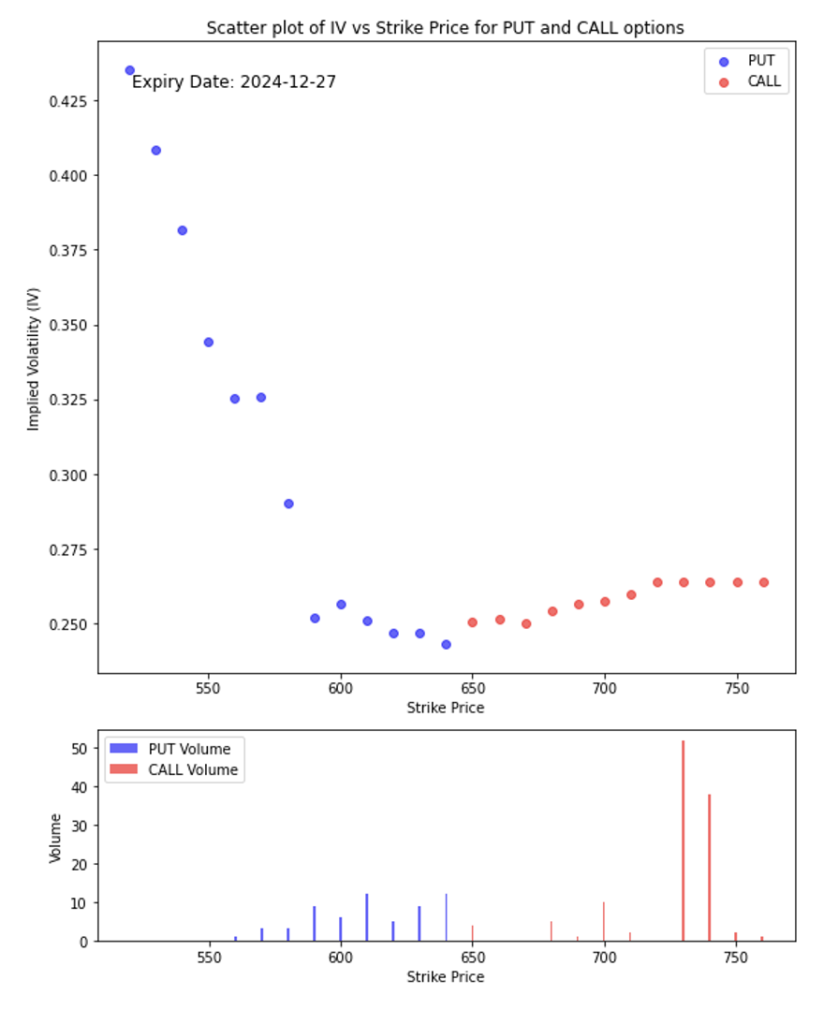

Tax Software Firm -Intuit- Faces Doubts on Guidance

Intuit (INTU) maintained full-year guidance but faced investor scepticism due to a weak second-quarter forecast. The company cited shifting revenue timelines driven by promotional campaigns.

Going Forward Movement:

Bullish Bias:

The higher volume in CALL options at 700–750 suggests traders expect upward price movement. The slight increase in IV for CALLs supports this, as higher IV often accompanies expectations of price increases.

Downside Support:

PUT activity around 550–600 suggests this range might act as a psychological or technical support level, as traders are not heavily betting on a significant decline below this level.

Range Expectations:

If the current price is near 650, the stock could remain range-bound in the short term, with potential to test the 700–750 levels on the upside or pull back to 600.

Investment Opportunity & Risk

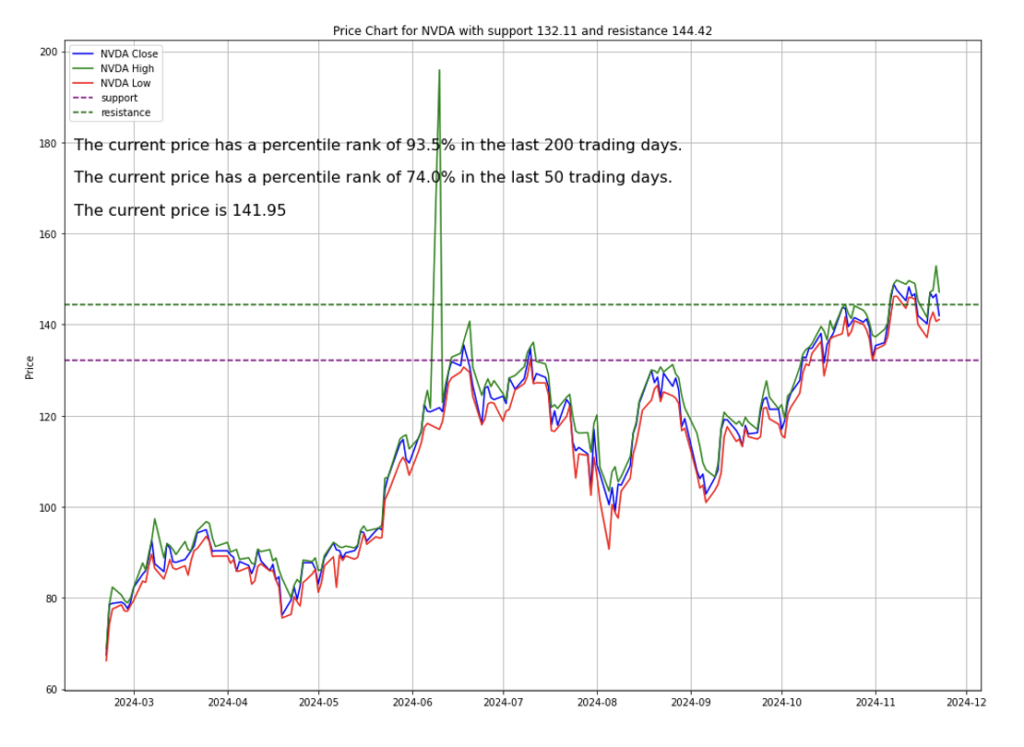

Cyclical stocks have outperformed technology, reflecting a shift toward economic growth sectors. The Dow Hits Record High as the Dow Jones Industrial Average reached new peaks, driven by gains in heavy industry, retail, and auto manufacturers. Meanwhile, tech giants like Nvidia and Amazon lagged, weighed down by profit-taking and export restrictions.

Nvidia (NVDA)

Despite strong free cash flow margins and optimistic long-term prospects, Nvidia has experienced recent volatility. Analysts anticipate continued demand for its AI-centric products, including the upcoming Blackwell chips, which promise robust gross margins.

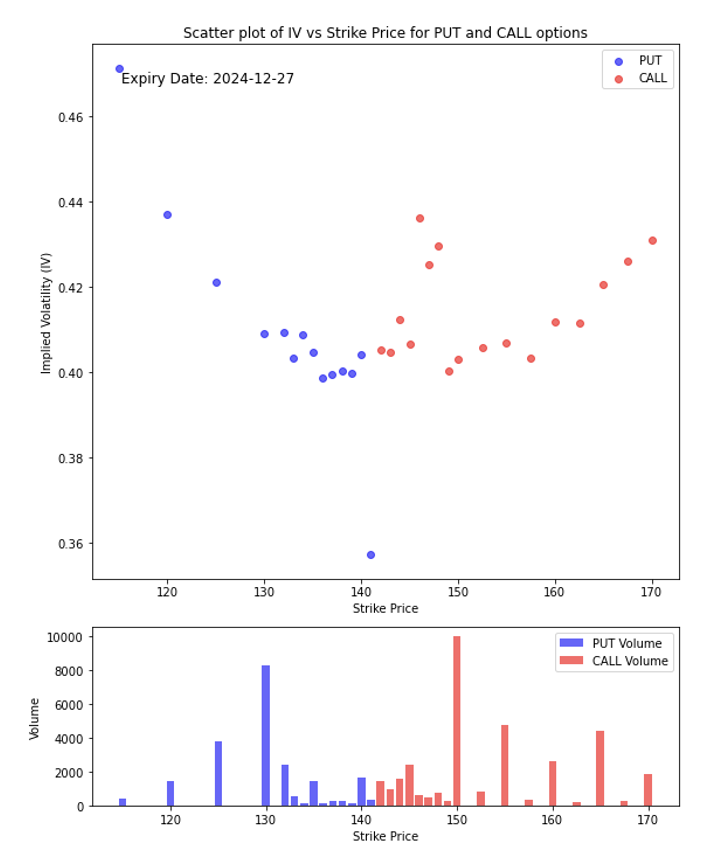

It looks like the market is leaning slightly bullish based on this chart. The big cluster of CALL options around the 150 strike suggests that traders are optimistic and positioning for the stock to move higher. On the other hand, the noticeable PUT volume near the 130 strike means there are still some traders hedging against a potential drop, so the sentiment isn’t entirely one-sided.

If the stock is currently trading somewhere around 140 to 145, it seems like the market expects it to stay in that range for now, but there’s potential to test the 150 level on the upside. At the same time, there’s a chance it could dip toward 130 if the overall market or company-specific news takes a turn.

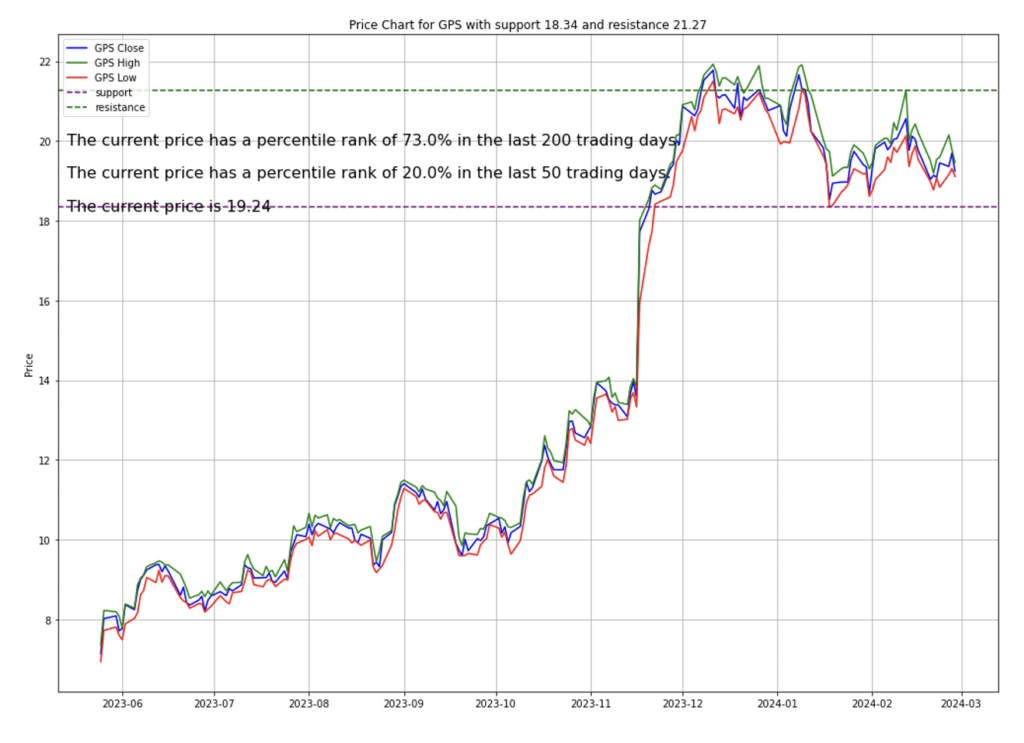

Gap (GPS)

Gap has raised its full-year sales outlook following strong third-quarter results and a promising start to the holiday season. The retailer now expects annual sales to grow between 1.5% and 2%, compared to its earlier projection of slight growth. Shares surged 8.3% in after-hours trading as the company showcased positive momentum.

In the third quarter ending November 2, Gap reported profits of $274 million, or 72 cents per share, up from $218 million, or 58 cents per share, a year earlier. Sales increased by 2% to $3.83 billion, exceeding analysts’ estimates of $3.81 billion. Comparable sales rose 1%, with a notable 7% growth in online sales.

CEO Richard Dickson credited the company’s strategic focus and brand revitalization efforts for the improvement. Appointed last year, Dickson has aimed to modernize marketing and reignite Gap’s creative culture, including hiring designer Zac Posen as creative director. Under his leadership, Athleta saw a 5% rise in comparable sales, while the namesake Gap brand grew by 3%. Banana Republic, however, experienced a 1% decline, and Old Navy’s comparable sales remained flat.

The company continues to focus on leadership restructuring, particularly for Banana Republic, and revitalizing Athleta to strengthen its position in the market.

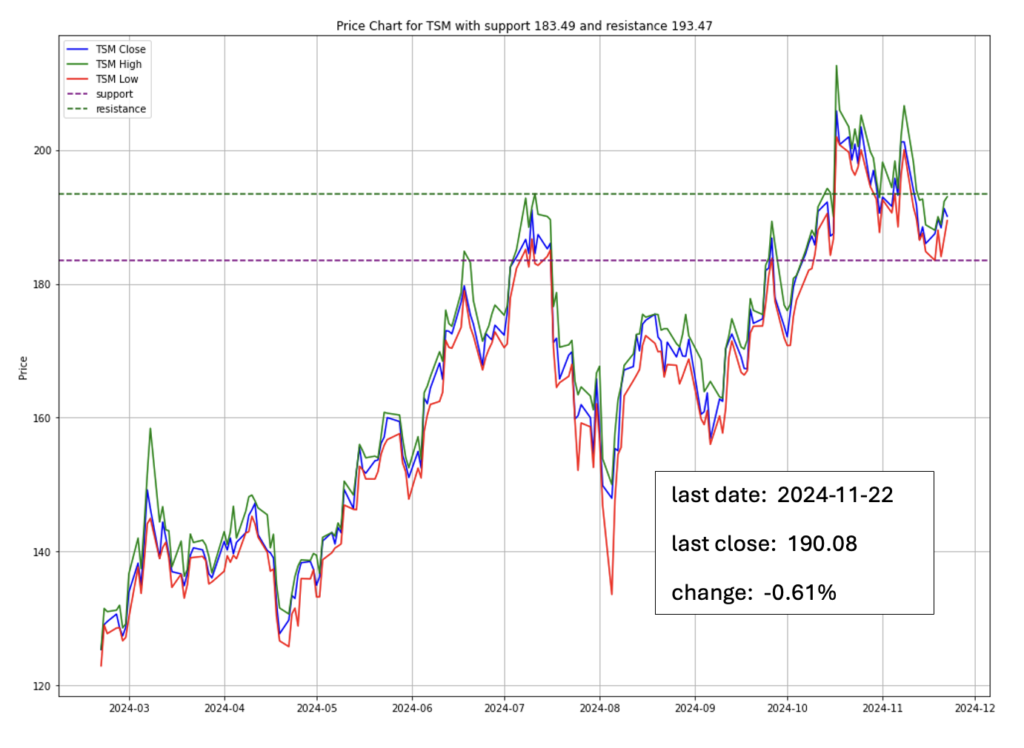

TSMC (TSM)

TSMC continues to dominate the global semiconductor market as the world’s largest contract chipmaker. It’s leading the way with advanced technology like its 3nm process, which is now in production with Apple as a key customer. Looking ahead, TSMC is already developing 2nm chips, keeping it ahead of rivals like Samsung and Intel.

The company is also expanding globally, building plants in Arizona and Japan to diversify operations and reduce geopolitical risks tied to Taiwan. That said, Taiwan remains its core hub for innovation and manufacturing.

Despite some challenges like geopolitical tensions and increased competition, TSMC’s position is strong. Demand for chips in high-performance computing, automotive, and AI continues to grow, giving TSMC a solid runway for future growth.

For investors, it’s a promising story—steady profits, cutting-edge tech, and a leading role in the industry. But, of course, keeping an eye on global tensions is key.

CONCLUSION

- Dow Hits Record High as S&P 500 and Nasdaq Climb, showcasing the U.S. economy’s resilience amid diverse influences.

- Major trends influencing the U.S. economy and stock market, driven by the interaction of macroeconomic forces, sector dynamics, and individual stock performance.

- It also incorporates the influence of international developments, which continue to play a critical role in shaping investor sentiment and market trajectories.

- From evolving monetary policies and geopolitical shifts to emerging industry opportunities, these factors collectively define the current investment landscape.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.