As the US economy closes 2024, it is experiencing promising signs of growth. Real GDP is expected to expand by 2.7% in 2024, underpinned by strong consumer spending and productivity improvements. While recession fears have eased, inflation remains a critical concern, and inflationary pressures have resurged slightly in recent months.

Source: Fibre2Fashion

The labour market has maintained a positive trajectory, with unemployment at 4.2% and wage growth outpacing inflation. However, inflation still sits at approximately 2.7%, a level the Federal Reserve aims to reduce to 2%. This persistent inflationary pressure is compounded by rising costs in essential categories like housing, medical care, and utilities.

US Growth Faces Inflation and Trade Risks in 2025

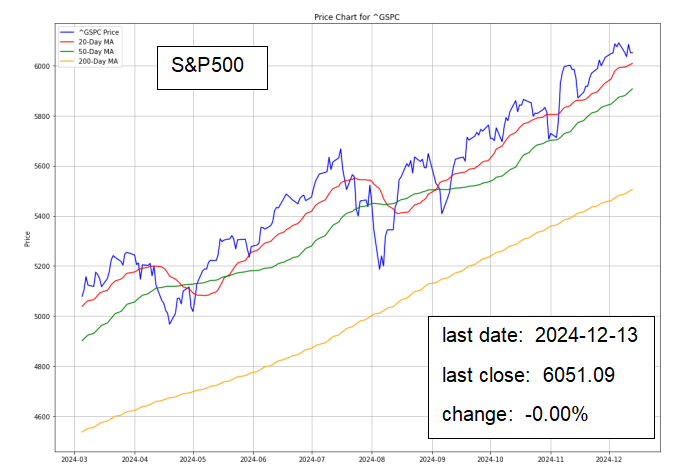

The US stock market has been buoyed by record inflows in recent months, particularly into technology stocks, leading to the anticipated ‘Santa rally‘. This rally is expected to drive further stock price increases, especially in megacap technology stocks like those in the “Magnificent Seven,” which now represent 33% of the S&P 500’s market capitalization.The labour market has maintained a positive trajectory, with unemployment at 4.2% and wage growth outpacing inflation. However, inflation still sits at approximately 2.7%, a level the Federal Reserve aims to reduce to 2%. This persistent inflationary pressure is compounded by rising costs in essential categories like housing, medical care, and utilities.

On the global front, trade policies and geopolitical tensions, such as tariffs imposed by the Trump administration, could have significant implications. Increased tariffs on imports from countries like China, Mexico, and Canada could spur inflation and disrupt global supply chains, affecting both consumer prices and corporate profits.

GLOBAL IMPACT

Investment Opportunity & Risk

Nike (NKE)

Nike has faced challenges in 2024, with its stock underperforming the broader market by 27% year-to-date. Despite this, analysts are optimistic about Nike’s long-term potential, with the stock seen as undervalued. The company’s new CEO, Elliott Hill, is expected to provide strategic updates that may steer Nike back to growth. The sportswear giant is navigating a decline in revenue and changes in its leadership, including key appointments such as the EVP of HR. Additionally, Nike’s extension of its partnership with the NFL could help bolster future growth.

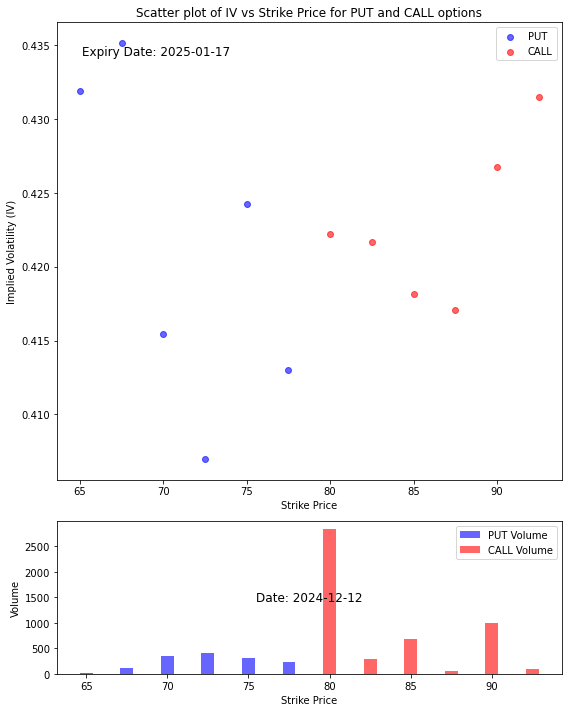

- The significant spike in CALL volume near the 80 strike price, combined with higher implied volatility at these levels, suggests that the market expects upward movement toward or beyond the 80–90 range.

- With high IV and volume at these higher strike prices, it is likely that traders are anticipating a rise in the stock price, at least in the near term.

Given the data from the IV, volume, and the expiration date of January 17, 2025, it appears that the stock is likely to experience upward movement in the near future, particularly toward the 80–90 strike price range. The heightened CALL option activity supports this expectation, with traders positioning for potential gains at these levels. Therefore, a bullish outlook seems probable, with possible price movement toward the 80-90 strike price range in the near term.

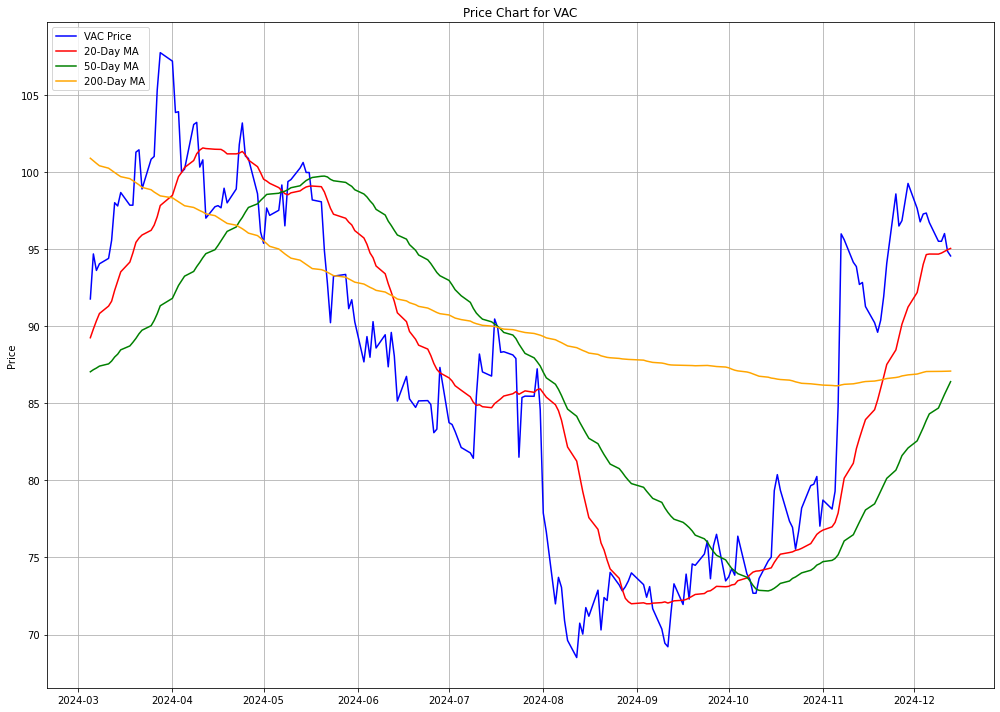

Marriott Vacations (VAC)

Marriott Vacations has seen mixed performance, underperforming its peers like Hilton and Travel + Leisure since 2019. However, analysts are optimistic about a rebound in 2025, citing growth in high-net-worth consumer segments and new resort openings in destinations like Waikiki and Bali. The company has also been resilient in the face of challenges such as the Maui wildfires, and its stock remains undervalued relative to peers.

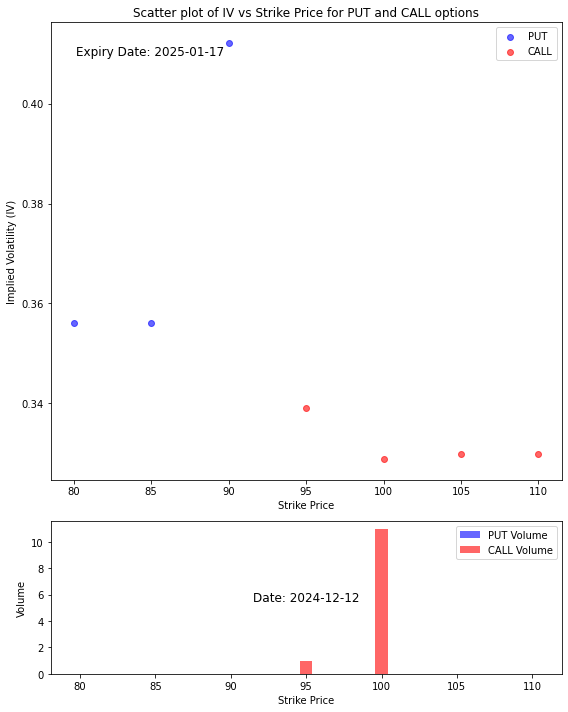

- The high IV and spike in CALL volume at the 100 strike price indicate that traders are positioning for potential upward movement in the stock price toward or above this strike price.

- The lower PUT volume supports the notion that there isn’t significant expectation for a downward move.

- Given the significant spike in CALL volume and higher implied volatility at the 100 strike price, it’s likely that the stock could see upward movement toward the 100 strike price, potentially testing or breaking this level. The market sentiment is leaning bullish, and traders appear to be betting on the stock moving higher in the near term.

- As such, a bullish outlook seems appropriate, with the stock possibly targeting or surpassing the 100 strike price in the near future, especially considering the high volume and implied volatility at these levels.

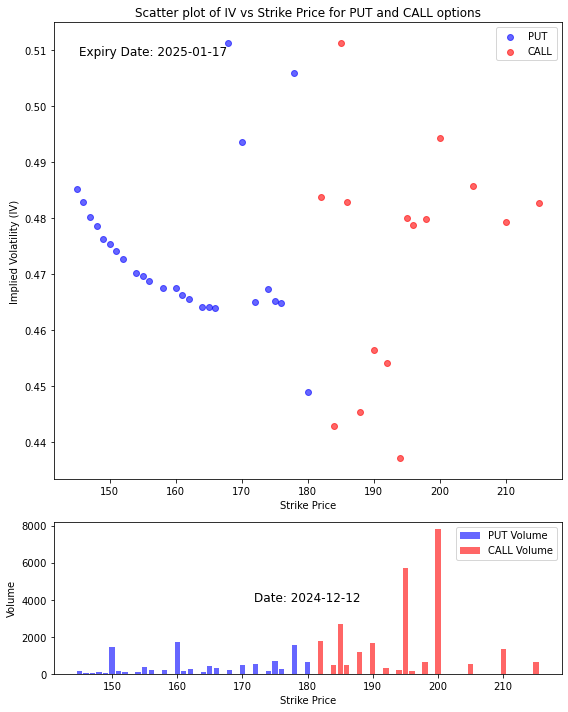

Broadcom (AVGO)

Broadcom‘s stock surged 24.43% in a single day, driven by strong growth prospects in AI. The company’s AI-related opportunities, especially its role in developing semiconductor technologies for AI applications, could lead to significant revenue growth, possibly reaching $60B-$90B by 2027. Despite some short-term concerns over specific product delays, Broadcom’s long-term growth potential remains strong.

- Given the strong CALL option volume, particularly around the 200 strike price, and the increasing IV at higher strike prices, the stock is likely to experience upward movement in the near term. The market sentiment appears bullish, and traders are positioning for a potential rise towards or above the 200 strike price.

- Thus, the stock could move higher in the short term, with a focus on potential resistance or targets around the 190–200 strike price range, given the high volume and implied volatility there.

Under Armour (UA)

Under Armour is pivoting to a more premium market segment, which is expected to enhance profitability and brand recognition. Analysts remain bullish on the company’s stock, with BMO Capital maintaining an Outperform rating and a price target of $12. Under Armour’s shift towards higher-end products and operational efficiency improvements could result in meaningful earnings growth.

CONCLUSION

- The US economy is on track for growth, but faces challenges from inflationary pressures, geopolitical tensions, and fiscal policy changes.

- Despite strong tech performances and record inflows, the stock market could face volatility if inflation isn’t controlled.

- Companies like Nike, Marriott Vacations, and Under Armour are addressing their own challenges while planning for long-term growth.

- Investors need to stay alert to both domestic economic signals and international developments, particularly around trade policies and inflation.

- Trade policies and inflation will play a critical role in shaping market trends in 2025.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.