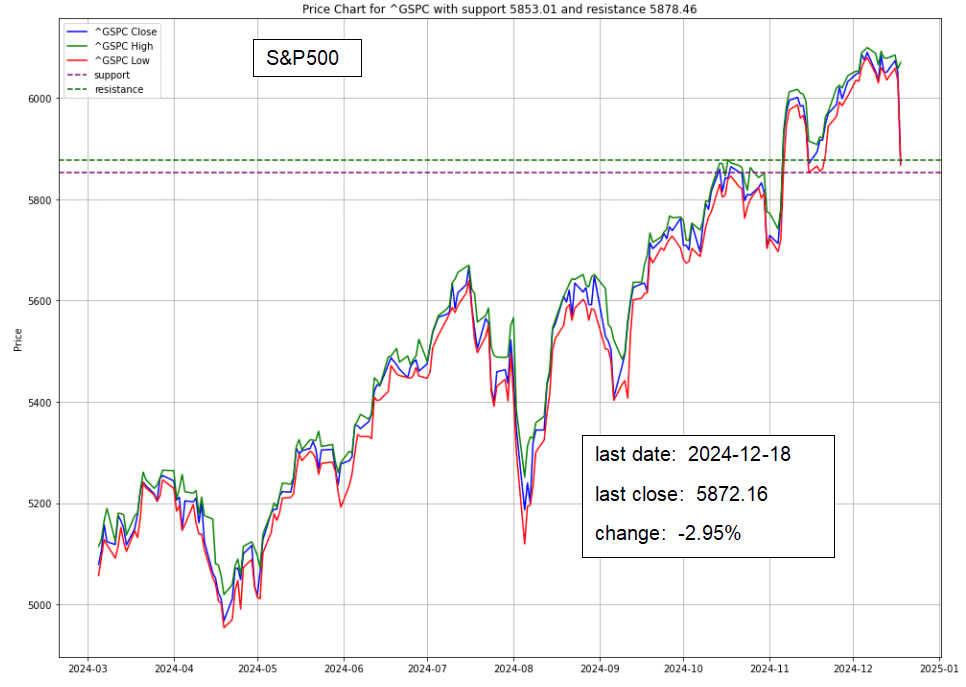

The US stock market has encountered significant turbulence in recent weeks, driven primarily by the Federal Reserve’s latest policy decisions and economic outlook for 2025. On December 18, 2024, the Fed made its third rate cut of the year, reducing its key interest rate by 0.25 percentage points. However, the accompanying forecast for the upcoming year dampened investor sentiment. Fed officials indicated that they expect only two more rate cuts in 2025, down from earlier predictions of a series of reductions. This hawkish outlook sent shockwaves through financial markets, causing a sharp selloff in both stocks and bonds. The Dow Jones Industrial Average plummeted by 1,123 points, marking its worst drop in nearly two years.

As the Fed moves away from its aggressive rate-cutting stance, concerns about inflation resurfaced, particularly as consumer spending and wage growth remain robust. The potential for higher inflationary pressures has led to fears that the Fed could be less accommodating than previously anticipated, creating a tightening environment for financial markets.

Interest Rate Uncertainty Is Shaking Up Key Market Sectors

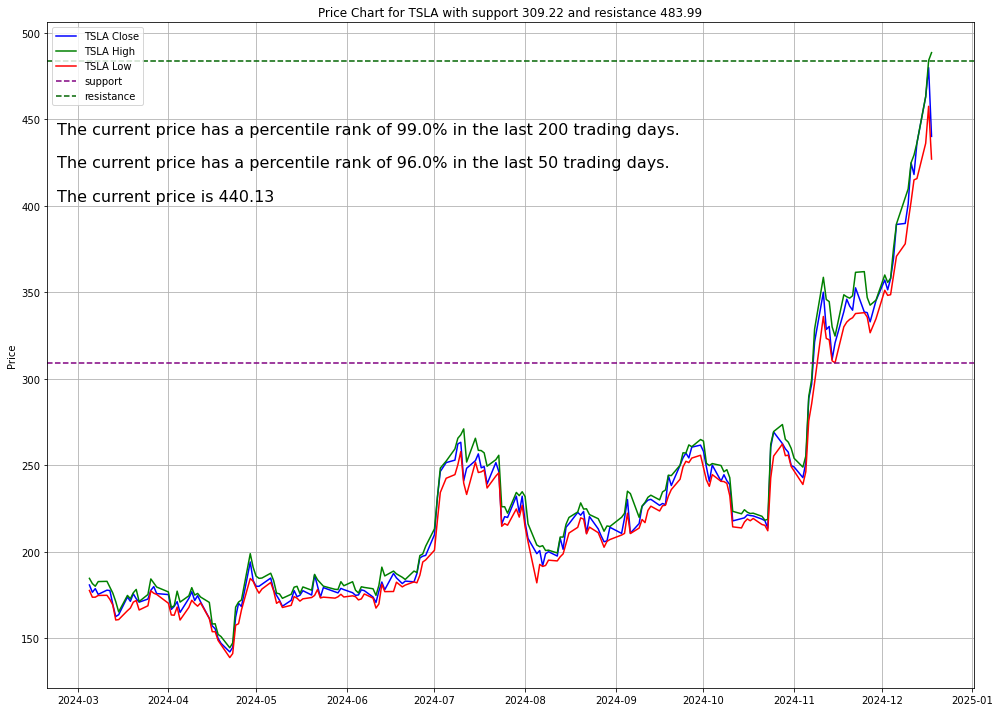

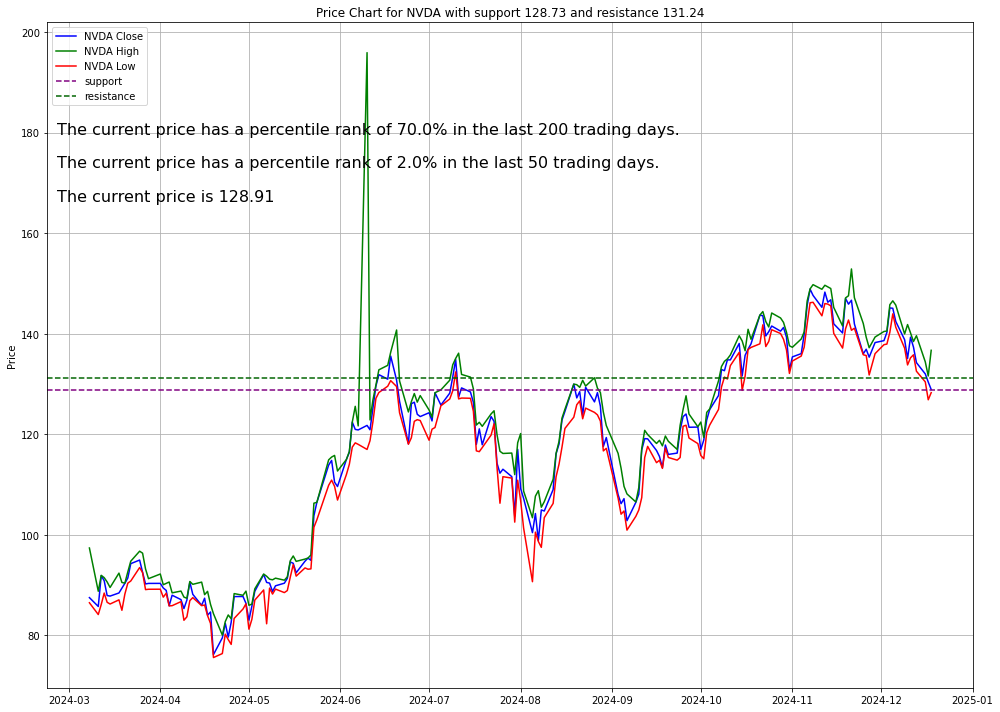

This uncertainty about interest rates has already impacted key sectors. High-momentum stocks, particularly in technology, have faced sell-offs. Notably, Tesla saw a dramatic 8.3% drop, despite a year-to-date rally of 93%. The decline in Tesla’s stock was partly attributed to the Fed’s policy announcement, which dampened expectations for continued low interest rates. Nvidia, another technology giant, also suffered a correction. Although its long-term growth prospects remain strong, especially in AI chips, recent price weakness has triggered concerns about short-term momentum.

GLOBAL IMPACT

Trump’s Trade Policies Fuel Inflation Fears

On the international stage, ongoing trade and geopolitical uncertainties are adding pressure on the stock market. President-elect Donald Trump’s policies on tariffs and trade could exacerbate inflationary pressures and disrupt global supply chains, contributing to the worst drop in market sentiment. This has created another layer of uncertainty for both U.S. and international markets. Moreover, the broader economic implications of these policies could further complicate the Fed’s strategy of managing inflation while supporting growth.

WATCHOUT

General Mills Struggles with Profit Outlook and Consumer Sensitivity

Source: Investopedia

General Mills, a prominent player in the consumer staples sector, has felt the impact of the Fed’s decisions. Despite reporting better-than-expected second-quarter earnings, the company revised its full-year profit forecast downward, citing increased promotional spending and heightened price sensitivity among consumers. This adjustment led to a 3.1% drop in its stock price and analysts revising their price targets. General Mills’ strategy to invest more heavily in its brands aims to drive growth but has also projected a decline in operating profits. While the company maintains an attractive dividend record with 54 years of consistent payouts, balancing price increases with consumer demand remains a critical challenge for investors.

Investment Opportunity & Risk

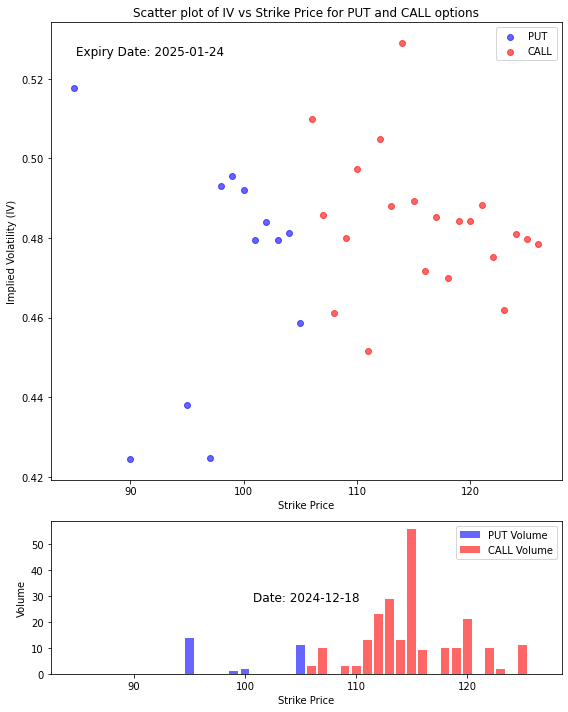

Tesla (TSLA)

Tesla, which has seen remarkable gains this year, encountered a sharp decline following the Federal Reserve’s policy announcement. Despite a rally of 93% year-to-date and 91% since the November election, Tesla’s stock fell 8.3% on December 18, 2024. The Fed’s signals about slower rate cuts than expected have raised concerns among investors, especially those who had bid up Tesla shares in anticipation of continued easy monetary policy. However, analysts remain optimistic about Tesla’s long-term prospects, particularly with upcoming product launches, including a new lower-priced model in early 2025 and the potential for a self-driving robotaxi service by late 2025.

- Clearly the sentiment on the stock is secondary to the market direction dictated by the Fed’s narrative.

- The option indicators point to a massive uncertainty over the stock price behaviour going forward.

- If there is no major after effect of the Fed’s led sentiment, the shown data shows that the sentiment over TSLA is still fairly tilted towards bullishness.

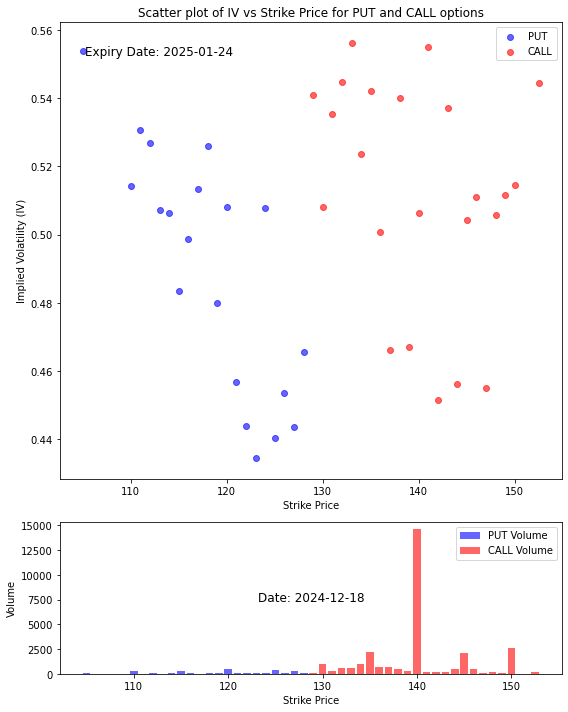

Nvidia (NVDA)

Nvidia’s stock has been on an extraordinary growth trajectory, rising nearly 14-fold since late 2022. However, after hitting a record high in November 2024, Nvidia shares have faced a pullback, dropping 15% from their peak. The company remains a leader in the AI chip market, with its products powering critical advancements in artificial intelligence and data centers. Despite recent technical weakness, Nvidia’s long-term outlook remains strong, with substantial growth anticipated in the AI sector. Analysts are eyeing key support levels around $115, where Nvidia’s stock could stabilize before resuming its upward momentum.

- Given the more moderate drop (1%), the stock may experience some price consolidation or slight fluctuations within a range. If the price approaches the 140 level, watch for potential price action in the options market to see if there is a breakout or reversal from this point.

- This stock is likely to show some stabilization or mild fluctuations, with the 140 level serving as a key point for both upward and downward price movement in the short term.

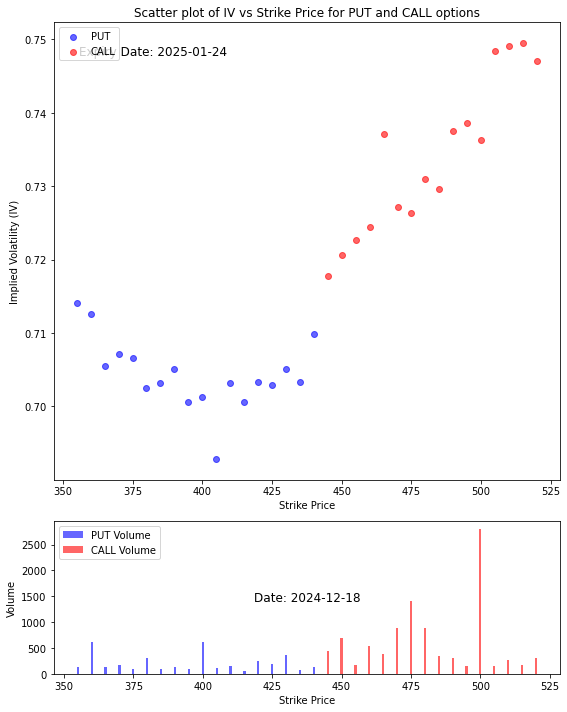

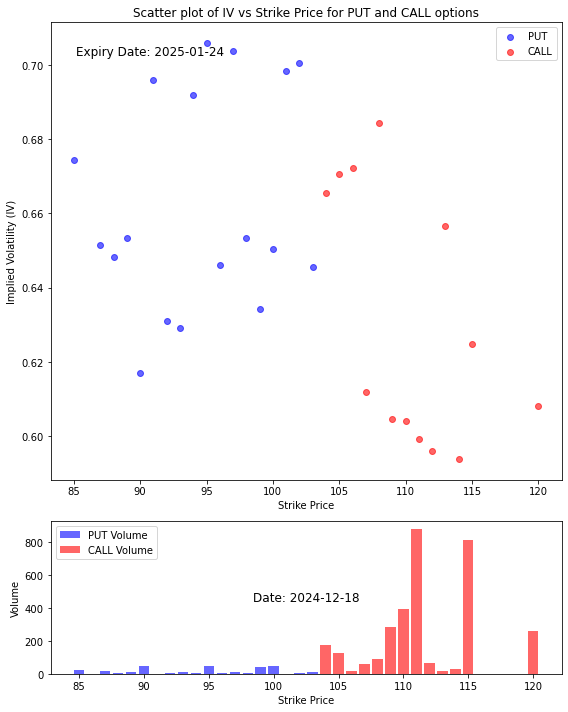

Micron Technology (MU)

Micron Technology reported an 84% increase in total revenue, with a notable 46% jump in its data-center business, which now accounts for more than half of its sales. Despite this, the company issued a cautious outlook for the upcoming quarter, citing weaker-than-expected performance in consumer-oriented markets such as PCs and automotive sales. This led to a 13% drop in Micron’s stock after hours, underscoring the challenges faced by semiconductor companies due to cyclical slowdowns in some markets. However, Micron remains well-positioned for growth, particularly driven by AI and data-center demand.

- The chart shows that market players are still hoping for the price to move up as shown by the spikes in call volume at the further-out prices where the call option prices are cheap and worth speculating. However the aggregate implied volatilities of the call option is considerably lower than the aggregate implied volatilities of the put option.

- There is not much conviction for bullish moves.

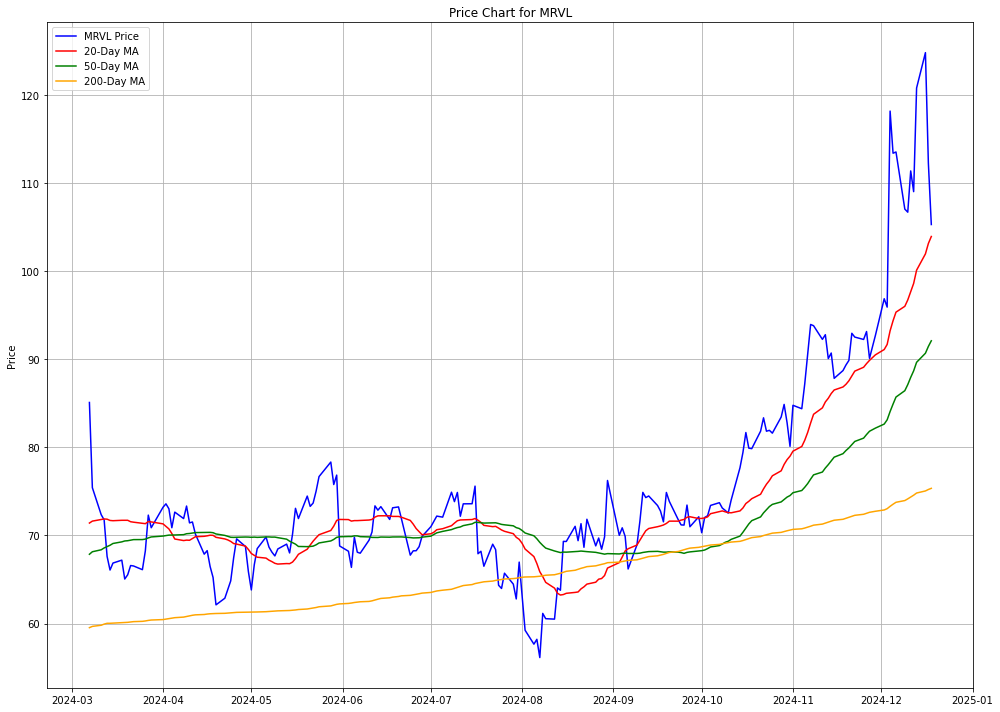

Marvell Technology (MRVL)

Marvell has seen its stock price target raised to $130 by CFRA, reflecting strong growth prospects, particularly in the semiconductor sector. The company is expected to benefit from the expanding market for custom silicon chips, driven by AI and data-center growth. Marvell’s total addressable market is projected to grow at a compound annual growth rate of 29% through 2028, presenting significant upside potential for the company. Marvell’s strong financial health, combined with its strategic position in the semiconductor space, makes it a promising stock for 2025.

- Despite the negative impact of the Fed’s narrative, the volatility smile chart of this stock indicates a strong underlying sentiment favoring bullishness.

- The aggregate implied volatilities of the call option is higher than that of the put option and the volume of the call option clearly indicates the belief that there is a strong chance that the stock price with climb higher.

CONCLUSION

- The U.S. stock market has recently faced turbulence, with the worst drop triggered by the Federal Reserve’s policy decisions, including a December 2024 rate cut and limited cuts projected for 2025, raising inflation concerns and dampening sentiment.

- This hawkish stance sparked a sharp selloff, compounded by broader uncertainties such as trade policies and geopolitical tensions.

- Despite these challenges, sectors like technology and semiconductors, including companies like Tesla, Nvidia, and Marvell, show strong growth potential, driven by trends in AI and data centers.

- Meanwhile, consumer staples like General Mills are struggling with inflation and shifting demand. Investors should remain vigilant as economic uncertainties persist into 2025.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.