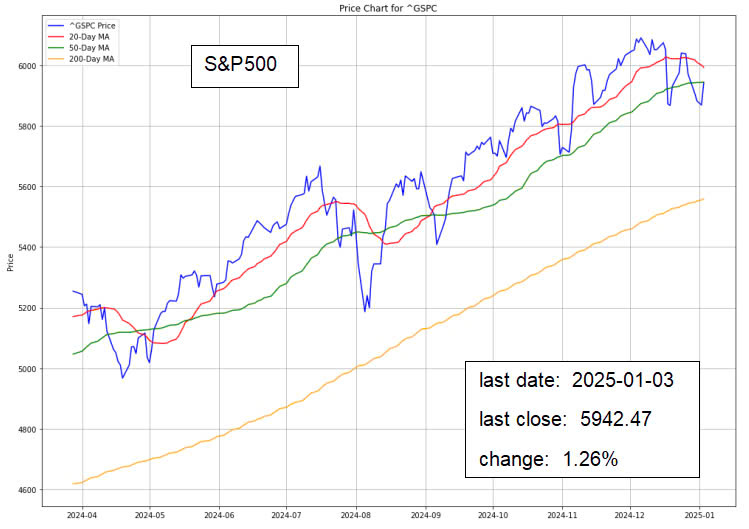

The stock market kicked off the new year with a strong rally, driven by gains in megacap technology stocks and chip makers. On Friday, the S&P 500 Index closed up 1.26%, the Dow Jones Industrial Average rose 0.80%, and the Nasdaq 100 Index surged 1.67%. The rally was fueled by dovish comments from Richmond Fed President Thomas Barkin, who suggested that while inflation is not yet back to target, the Federal Reserve may not need to maintain its previous level of restrictiveness. Additionally, the reelection of Louisiana Republican Mike Johnson as Speaker of the House of Representatives boosted market sentiment, as it could pave the way for President-elect Donald Trump’s business-friendly deregulatory agenda.

Despite a stronger-than-expected U.S. ISM manufacturing report and rising Treasury yields, stocks held onto their gains. The ISM manufacturing index for December rose to 49.3, up from 48.4 in November, indicating a slower pace of contraction in the manufacturing sector. However, the index remained below the 50 mark, signaling contraction for the ninth consecutive month, with weakness in employment and backlogs of orders continuing to weigh on the sector.

U.S. Economic Data & Fed Minutes Shape 2025 Outlook

As 2025 gets underway, investors are closely monitoring key U.S. economic indicators and Federal Reserve meeting minutes to assess the health of the economy and the outlook for interest rates. The December nonfarm payrolls data, due on Friday, will provide the latest snapshot of employment levels. Meanwhile, the Federal Reserve’s December meeting minutes, set for release on Wednesday, will offer insights into how policymakers view the potential impact of President-elect Trump’s planned policies on the economy and interest rates.

Recent strong U.S. economic data has led investors to scale back expectations for interest rate cuts in 2025. U.S. money markets are now pricing in just over 40 basis points of rate cuts by December, a significant reduction from the 150 basis points anticipated at the start of 2024. Further robust data could further trim these expectations, especially as Trump’s anticipated policies, including trade tariffs and tax cuts, are expected to boost the economy and potentially stoke inflation after his inauguration on January 20.

Source: Forbes

The dollar recently hit a two-year high against a basket of currencies, and strong economic data could push it even higher, while U.S. Treasury yields may also rise. The Fed reduced interest rates in December but lowered its forecasts for future rate cuts, now anticipating just two cuts in 2025.

Source: Investment News

Other key data releases include the JOLTS job openings figures for November on Tuesday, the ADP private payrolls data for December on Wednesday, and the latest weekly jobless claims numbers on Thursday. The ISM nonmanufacturing index for December, due on Tuesday, and the University of Michigan’s preliminary consumer confidence survey for January, due on Friday, will also be closely watched.

Source: WSJ

INTERNATIONAL ISSUES

Eurozone Inflation Key as ECB Eyes 2025 Rate Cuts

In the Eurozone, flash estimate inflation data for December will be a key focus, with investors expecting further interest rate cuts by the European Central Bank due to a faltering economy and slowing inflation. Eurozone money markets are pricing in just over 100 basis points of further rate reductions in 2025.

Source: France 24

Bank of Japan Meeting to Weigh Wage Growth & Rate Hike

Japan’s Bank of Japan branch managers’ meeting on Thursday will be closely watched for insights into wage trends and regional economic conditions. Stronger wage growth could bolster the case for a rate hike later in January. Japan will also release household spending figures for November on Friday, which could provide evidence of growing consumer confidence.

Source: NHK World Japan

China's Inflation Data to Gauge Economic Health

China’s consumer and producer price inflation figures for December, due on Thursday, will be critical for assessing the health of the world’s second-largest economy. Recent data has shown mixed signals, with factory activity expanding at a slower pace while construction and services activities rebounded sharply.

Source: WSJ

Investment Opportunity & Risk

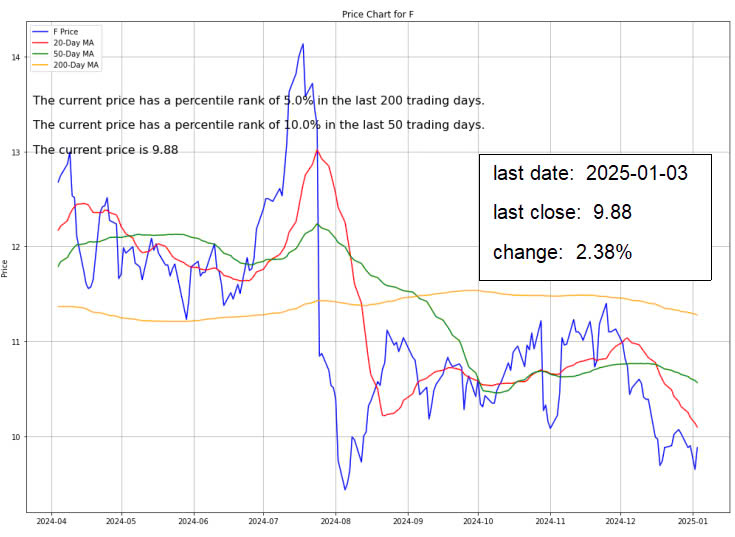

Ford (NYSE: F)

On Friday, CFRA analyst Garrett Nelson revised Ford‘s (NYSE:F ) 12-month price target to 11.00, while maintaining a Hold rating, citing a warranted discount with a 2025 P/E ratio of 5.6x compared to the current 11.13x. Despite Ford’s strong Q4 2024 U.S. sales of 530,660 units, an 8.8% year-over-year increase driven by growth in hybrid (up 26%) and EV (up 16%) segments, Nelson anticipates challenges in 2025, including high inventory, weakened consumer demand, and potential EV tax credit phase-outs. Ford’s trailing revenue of 9.49, with InvestingPro Fair Value metrics suggesting slight overvaluation.

Recent developments include a new head of quality appointment to address recalls and warranty costs, a Jefferies downgrade over inventory and strategic concerns, and a record-breaking Nürburgring lap by the Mustang GTD. However, potential risks loom, such as the incoming Trump administration’s possible cancellation of the USPS electric mail truck contract.

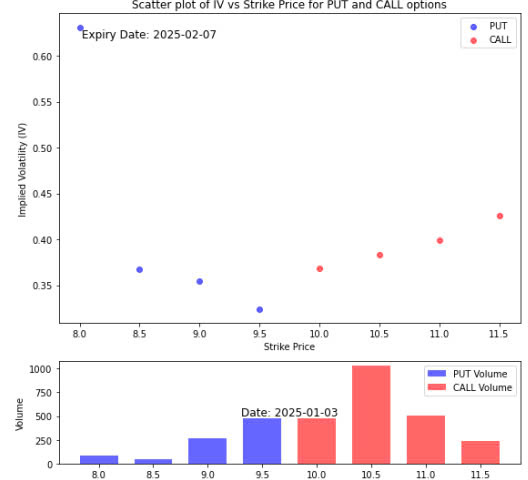

The stock is likely to experience moderate upward movement in the near future, driven by bullish sentiment and the recent price recovery. However, the presence of put options indicates that there is some caution in the market.

- Key Resistance Levels: The stock may face resistance around the 10.5 and 11 strike prices, where significant volume is concentrated. If the stock breaks through these levels, it could see further gains.

- Key Support Levels: On the downside, the stock may find support around the 9 and 9.5 strike prices, where put option volume is higher. If the stock fails to maintain upward momentum, it could retrace to these levels.

In summary, the stock is likely to trend moderately upward in the near term, but traders should remain cautious of potential pullbacks, especially if the stock fails to break through key resistance levels.

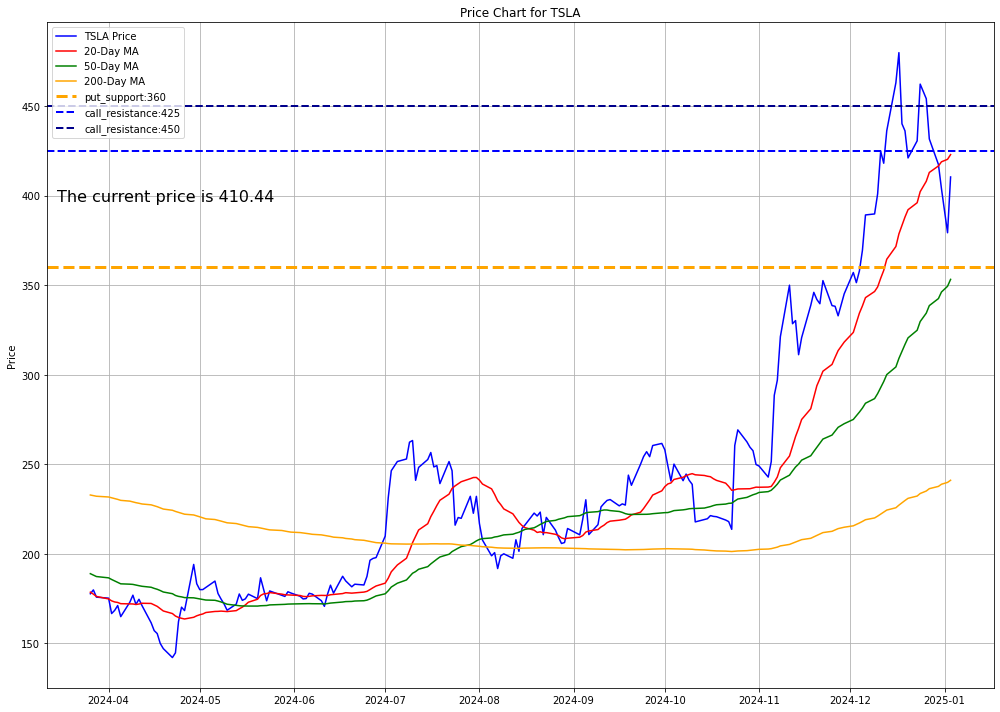

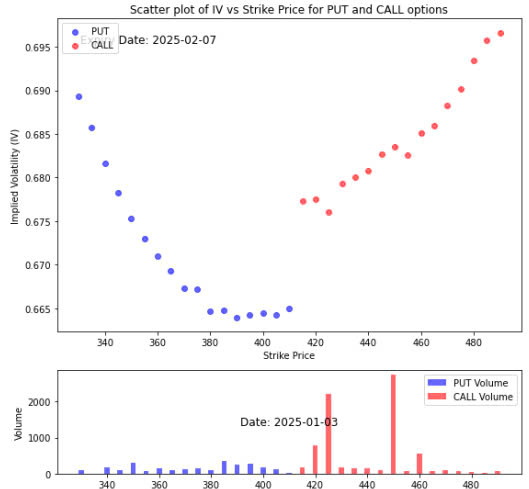

Tesla (NASDAQ: TSLA)

On Friday, Truist Securities lowered its price target for Tesla (NASDAQ: TSLA) to $351 from $360, while maintaining a Hold rating, after the company reported fourth-quarter delivery and production figures that missed expectations. Tesla’s deliveries of approximately 495,600 units, a 7.1% year-over-year increase, fell 4.4% short of Truist’s model and below the FactSet consensus. Production for the quarter was reported at 459,400 units, 12.7% below Truist’s forecast, indicating inventory reduction. With a market cap of $1.24 trillion and a P/E ratio of 96, Tesla is considered overvalued by InvestingPro’s Fair Value analysis. This led Truist to slightly reduce its forecast for Tesla’s CY26 earnings per share.

Other analysts, such as Canaccord Genuity, raised their price target to $404, maintaining a Buy rating, while Goldman Sachs kept a Neutral rating at $345. Stifel reiterated a Buy rating with a price target of $411, citing Tesla’s advancements in Full Self-Driving and other technologies. Meanwhile, Tesla CEO Elon Musk donated 268,000 shares to undisclosed charities.

- The immediate sentiment on the stock is more to the bullish side than to the bearish side. That is observable from the call implied volatilities which are consistently higher that the put implied volatilities.

- The price appears to approach the 425 level which the volume chart indicates to be a resistance level. And if the price can reach that, the next resistance level will be at 450 level. However if the price fails to do that, it may fall and find the support at 350.

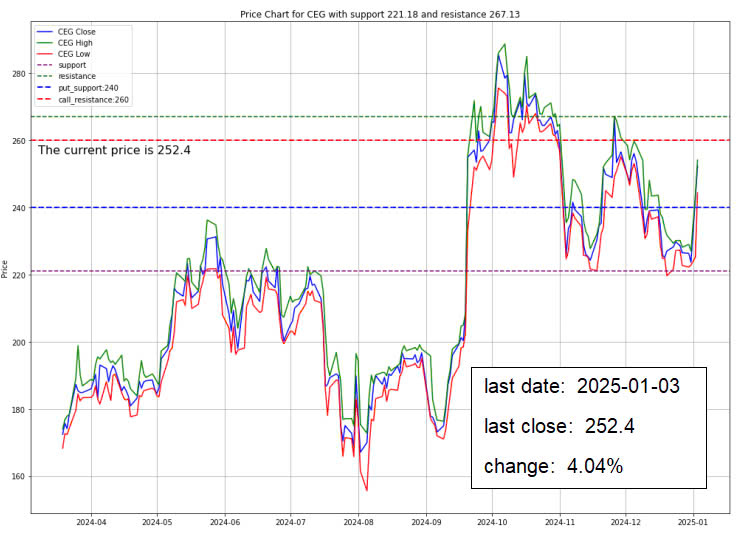

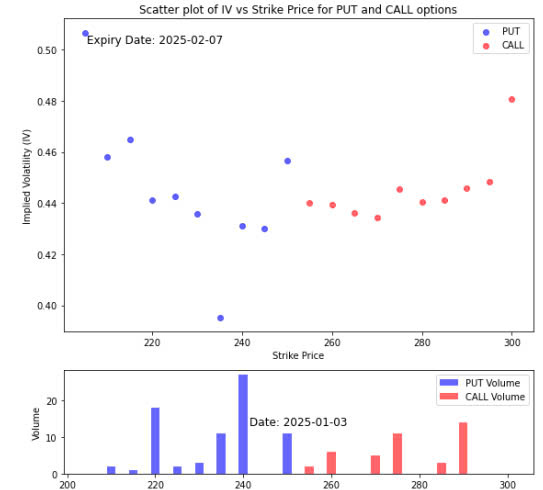

Constellation Energy Corporation (NASDAQ: CEG)

On Friday, BMO Capital Markets reaffirmed its positive stance on Constellation Energy Corporation (NASDAQ: CEG), maintaining an Outperform rating and a $291 price target, with the stock currently trading at $251.50 after a 111% return over the past year. Analyst targets range from $226 to $342, reflecting mixed opinions on the company’s $75.9B market cap.

This endorsement follows the company’s announcement of securing long-term contracts with the U.S. General Services Administration (GSA) to provide over one million megawatt-hours of carbon-free energy annually to 13 government agencies across five states. The contracts, valued at $840 million, start in April 2025 and underscore Constellation’s commitment to renewable energy. BMO Capital sees this as a major development that expands the company’s client base and strengthens its revenue stream. The company has also been declared eligible for federal tax credits for clean hydrogen production and secured a 10-year nuclear power supply deal with the GSA.

Additionally, BofA Securities upgraded Constellation from Neutral to Buy, projecting double-digit growth through 2026, while KeyBanc maintained an Overweight rating, and Jefferies reaffirmed its Hold rating. The company recently reported strong third-quarter earnings, with GAAP earnings of $3.82 per share and adjusted operating earnings of $2.74 per share, and plans to add 2,000 megawatts of new nuclear capacity by 2027.

The data suggests that traders are preparing for increased volatility, with notable support around the 240 strike (PUT options) and resistance or potential breakout around the 255-260 strike (CALL options). Given the sizable volume of the 255-260 strike, there may be a bias toward upward movement. The stock price could potentially break above the 260 mark, driven by the demand for CALL options at that level. However, the risk of a downward move remains if the stock fails to reach the 260 level and falls towards the 240 strike.

CONCLUSION

- The stock market’s strong start signals optimism about the economic outlook and potential policy shifts.

- Investors remain cautious amid evolving economic data and policy developments.

- Strong U.S. economic indicators and Federal Reserve updates will shape expectations for interest rates and growth.

- Global markets react to improving demand, policy shifts, and lingering concerns over inflation and stability.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.