dThe S&P 500 struggled as stocks traded within a narrow range on Wednesday, with investors bracing for Friday’s critical jobs report. The Dow Jones Industrial Average rose 107 points, or 0.3%, while the S&P 500 inched up 0.2%. The Nasdaq Composite, however, dipped slightly by 0.1%. Treasury yields showed mixed movements, with the 2-year note slipping to 4.288%, while longer-term yields climbed. The 10-year yield rose to 4.691%, and the 30-year yield reached 4.931%, its highest level since November 1, 2023.

Source: The Economic Times

The session saw the S&P 500 make several unsuccessful attempts to push higher, reflecting a lack of clear direction. The stock market will be closed on Thursday in honor of former President Jimmy Carter, with the bond market closing early at 2 p.m. ET.

Markets Eye Jobs Report as Fed Minutes Reveal Uncertainty

ADP’s private payrolls data came in below expectations, but all eyes are now on the Labor Department’s nonfarm payrolls report, which is expected to drive market action on Friday. Meanwhile, the release of the December Federal Open Market Committee (FOMC) minutes did little to alter the market’s sideways trend. The minutes revealed significant uncertainty among policymakers, with some admitting to using “placeholder assumptions” in their forecasts. Dylan Smith, senior economist at Rosenberg Research, noted that the minutes highlighted how political uncertainty under President-elect Donald Trump is complicating economic and monetary policy outlooks.

Source: FXStreet

Oil Futures Retreat on Inventory Builds

Oil prices declined after the U.S. Energy Information Administration (EIA) reported a second consecutive week of significant builds in distillate fuel and gasoline stocks, overshadowing a modest drawdown in crude inventories. West Texas Intermediate (WTI) crude fell 1.3% to $73.32 a barrel, while Brent crude dropped 1.2% to $76.16. Mizuho analyst Robert Yawger suggested that refinery maintenance could begin sooner than expected due to weak margins and high product inventories.

Source: Reuters

Gold Holds Steady Despite Dollar Strength

Gold futures edged up 0.3% to $2,664.50 an ounce, marking gains in four of the past six sessions despite pressure from a stronger U.S. dollar. The dollar index rose 0.5%, making gold more expensive for foreign investors and limiting its upward momentum. Quasar Elizundia of Pepperstone noted that the Federal Reserve’s reluctance to cut rates is also weighing on gold’s appeal as a safe-haven asset.

Source: FXStreet

Markets Price in Just One Fed Rate Cut for 2024

According to CME data, markets are increasingly pricing in only one interest rate cut by the Fed this year, with a 35% chance that the fed funds rate will end 2024 at 4%-4.25%. This reflects growing concerns about persistent inflation, fueled in part by President-elect Trump’s proposed tariffs and immigration policies. Upcoming consumer and producer price data next week will provide further clarity on inflation trends.

As markets await Friday’s jobs report, the focus remains on how economic data and policy developments will shape the trajectory of stocks, bonds, and commodities in the coming weeks.

Source: Investopedia

WATCHOUT

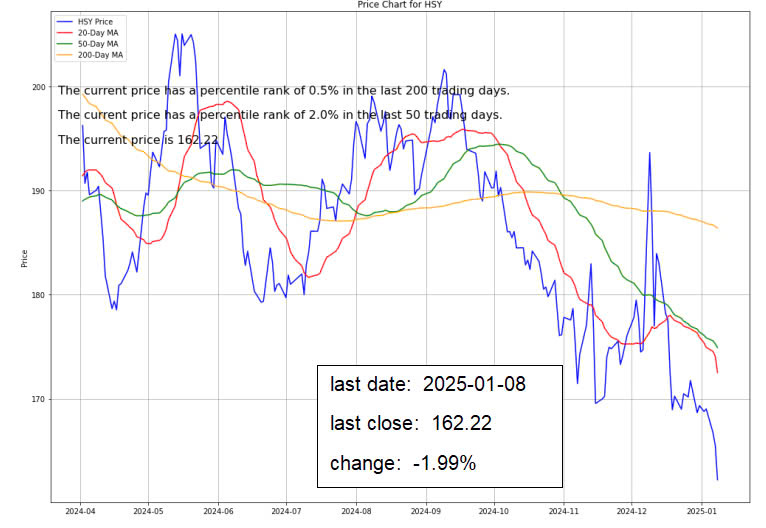

Hershey Stock Steady as JPMorgan Maintains Neutral Rating

On Wednesday, JPMorgan reiterated a Neutral rating and $171 price target on Hershey (NYSE: HSY) stock, following reports that the company is seeking CFTC approval to purchase over 90,000 metric tons of cocoa—more than nine times the current ICE Futures US limit. Initially, the request raised concerns about potential supply risks or sustained high cocoa prices, but after speaking with Hershey’s Sr. Director of IR, Anoori Naughtion, JPMorgan’s concerns eased. Hershey indicated it is well-covered for cocoa into the current year and does not foresee supply-demand shifts justifying a higher futures curve.

The move, similar to a 2020 request, appears aimed at leveraging price disparities to reduce costs. Hershey’s focus on physical cocoa acquisition, rather than futures, suggests a strategy to mitigate higher futures prices by sourcing cheaper physical cocoa, while ongoing due diligence could yield additional savings. Following the news, Hershey shares dipped, while cocoa futures rose.

Option Smile Chart for HSY

- Short-Term (Days to Weeks):

The stock is likely to remain under pressure, potentially testing support levels around 160−160−155, given the downward price trend and higher put IV at these levels. The lack of strong call volume and open interest at higher strikes suggests limited bullish conviction. - Medium-Term (Weeks to Months):If the stock stabilizes around the 160−160−155 support zone, it could see a rebound toward the 170−170−175 range, as indicated by the call open interest at these levels. However, this would depend on broader market conditions and any fundamental developments.

Downside Risk: The higher put IV indicates that traders are hedging against a potential drop below 160. If the stock breaks below 160. If the stock breaks below 155, it could trigger further selling pressure.

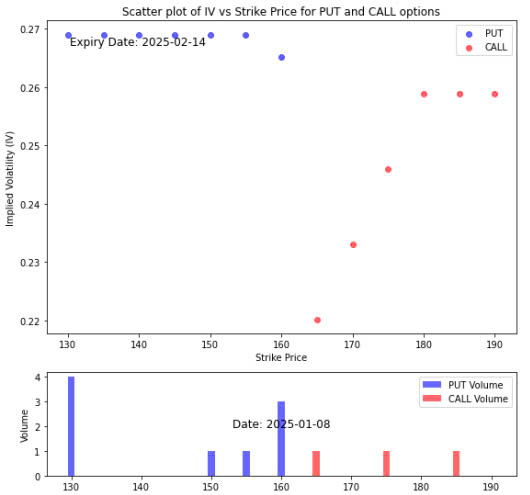

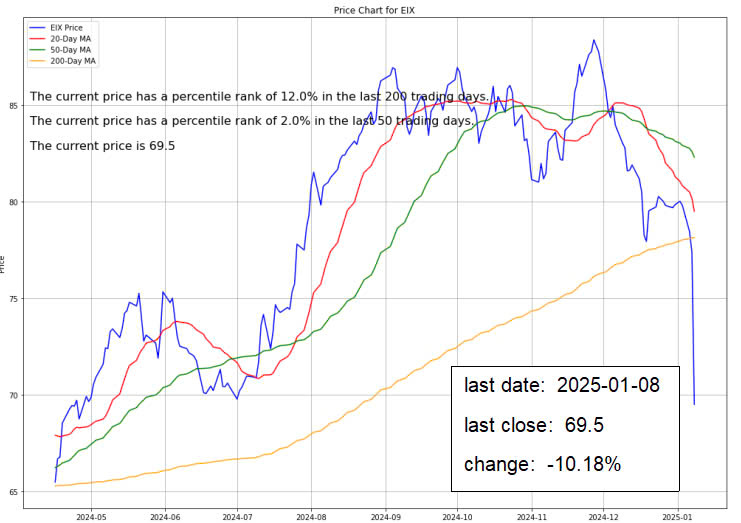

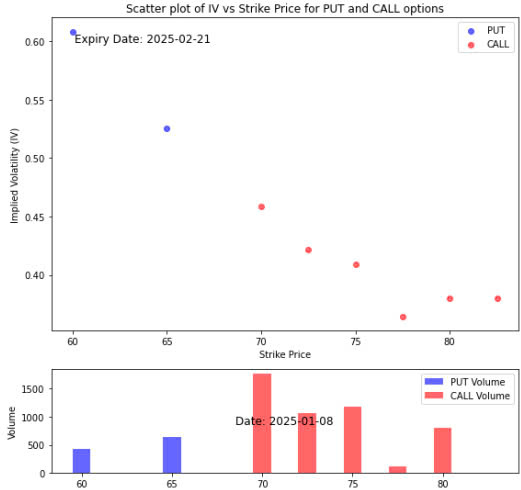

EIX Stock Volatility Rises Amid Wildfire Concerns

The situation surrounding the Palisades Fire near Los Angeles, which has burned 2,925 acres and prompted Southern California Edison (SCE), a subsidiary of Edison International (NYSE:EIX ), to implement public safety power shutoffs for 119,735 customers—with potential additional shutoffs for 441,275 customers—remains fluid and is expected to be a key discussion point during an upcoming trip to California. Analyst Levine anticipates volatility and weakness in California utility stocks until the fire’s implications are clearer, though EIX historically trades with low price volatility (beta of 0.94). The fire may also influence California’s political and regulatory stance on wildfire risks, potentially affecting SCE’s cost recovery for the legacy Woolsey fire, while its recovery for the Thomas fire and Montecito mudslides (TKM) appears less at risk as the settlement proposal has been adopted by the CPUC’s ALJ and could be voted on by January 30.

In other developments, Edison International has seen mixed analyst reactions, with Barclays upgrading its stock to Overweight, Jefferies initiating coverage with a Buy rating, and Ladenburg Thalmann downgrading it to Sell, reflecting varying perspectives on the company’s wildfire-related challenges and growth prospects. For deeper insights, investors can access detailed analysis through InvestingPro’s exclusive Pro Research Report.

Option Smile Chart for EIX

Under the current scenario, many players are expecting the stock price to fall but will rebound to the level between 70-75.

Investment Opportunity & Risk

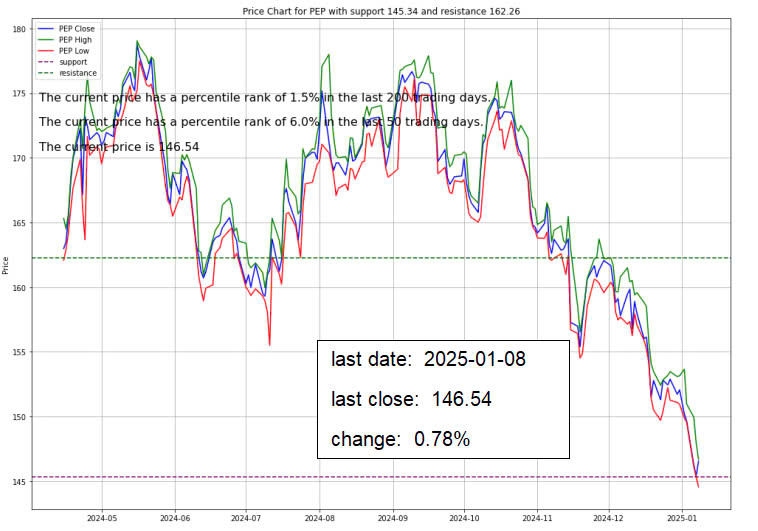

PepsiCo (NYSE: PEP)

PepsiCo (PEP), a Dividend Aristocrat, has faced significant challenges recently, including inflation, weak consumer spending, and product recalls. These factors have led to its underperformance compared to rivals like Coca-Cola and the S&P 500. However, despite these struggles, PepsiCo maintains a solid growth outlook, with expected earnings per share (EPS) growth of at least 8% in 2024, signaling potential recovery. The stock is currently undervalued, trading at a forward price-to-earnings (P/E) multiple lower than its historical average and its peer Coca-Cola.

With a dividend yield of 3.7%, higher than usual, and a track record of 53 consecutive years of dividend increases, PEP presents an attractive option for conservative investors. Analysts have a mixed but generally optimistic outlook, with the stock expected to grow significantly in 2025. Despite its current challenges, PepsiCo’s strong brand, healthy dividend, and reasonable valuations make it a compelling buy for those seeking stability and long-term growth.

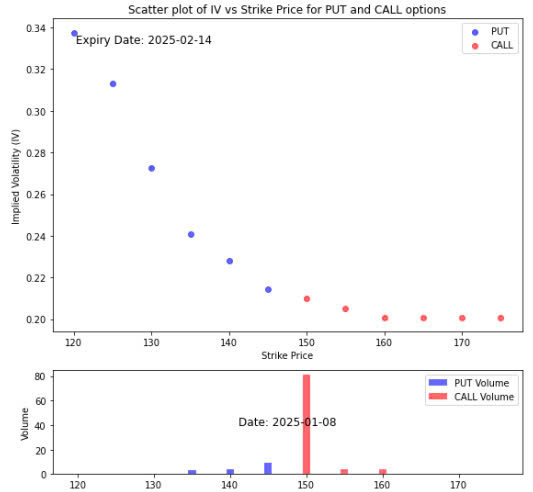

Option Smile Chart for PEP

The stock is likely to face downward pressure in the near term, potentially testing the 140-145 support levels. However, the significant call activity at higher strikes suggests that traders are positioning for a potential rebound, which could push the stock toward 150-155 if sentiment improves. The overall sentiment appears mixed, with bearish near-term risks but some bullish potential in the medium term. Traders should monitor key support and resistance levels, as well as changes in implied volatility for further clues on price direction.

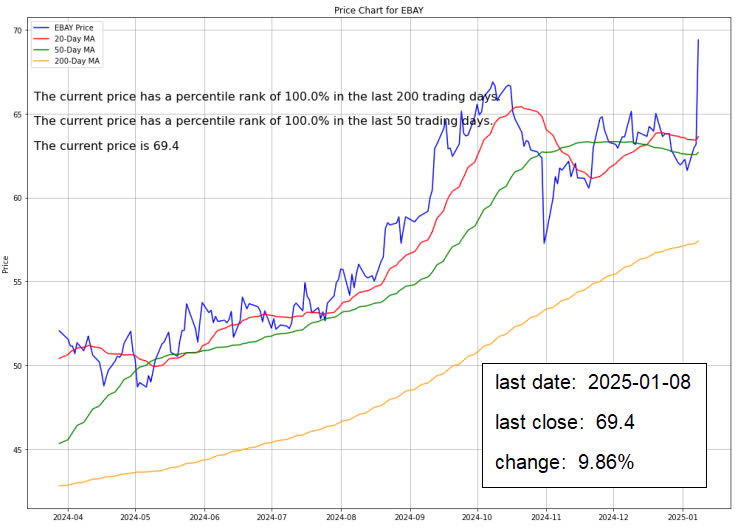

Ebay (NASDAQ: EBAY)

On Wednesday, Citi reaffirmed its Buy rating and $75.00 price target for eBay, which is currently trading near its 52-week high at $69.24, following a strategic partnership with Meta Platforms (META). This collaboration will integrate eBay listings into Facebook Marketplace, expanding eBay’s customer base, with eBay handling all transaction aspects. With over 1 billion monthly visitors, Facebook Marketplace offers significant visibility for eBay sellers. eBay’s active buyer base of 133 million presents substantial growth potential through this partnership. Citi analysts expect the collaboration to positively impact eBay’s B2C and C2C sales.

Meta sees potential benefits in increased engagement and ad revenue from boosted listings. eBay is also conducting trials in the U.S., Germany, and France, with a $3 billion stock repurchase program to enhance shareholder value. Bernstein maintains a positive outlook, citing consistent buybacks and expected growth in eBay’s GMV, advising that investing in eBay may be favorable after its fourth-quarter earnings call.

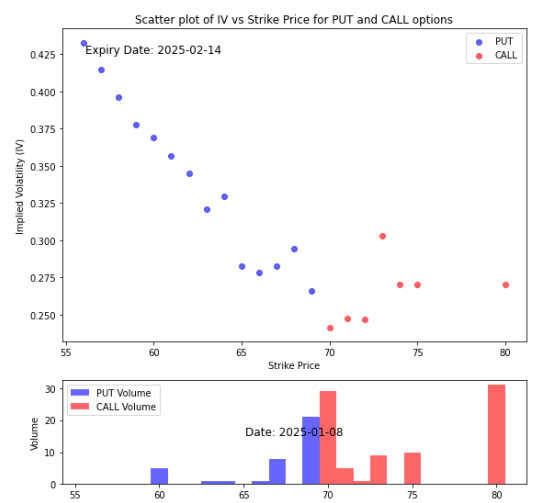

Option Smile Chart for Ebay

- Short-Term Outlook: The stock is likely to continue its upward trend, potentially testing resistance levels around 70−70−75, given the high call volume at these levels. The surge in call activity on January 8, 2025, supports this bullish outlook. However, the higher put IV at lower strikes (e.g., 53-58) indicates that traders are hedging against potential pullbacks. If the stock fails to sustain its momentum, it could retrace toward 65−65−60.

- Medium-Term Outlook: If the stock breaks above $75, it could target higher levels, as indicated by the call volume at these strikes. The stable call IV suggests that traders are not overly concerned about a sharp reversal. On the downside, if the stock loses momentum, it could find support around 60−60−65, where put open interest is concentrated.

CONCLUSION

- Market sentiment remains mixed as investors assess economic reports and corporate news.

- eBay gains from its Meta Platforms partnership, boosting customer reach and visibility.

- PepsiCo faces inflation and weak spending pressures but holds strong long-term dividend appeal.

- Hershey stays stable despite concerns over its cocoa acquisitions.

- Edison International navigates wildfire-related risks, impacting its short-term outlook.

- Investors should watch key support/resistance levels and upcoming earnings for clearer market direction.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.