The U.S. stock market experienced significant volatility last week, driven by a combination of strong economic data and shifting expectations for Federal Reserve policy. The Dow Jones Industrial Average fell approximately 700 points, marking its largest single-day decline in response to a jobs report since October 2022. The S&P 500 and Nasdaq Composite also dropped by 1.5% and 1.6%, respectively, as investors grappled with the implications of a resilient labor market and rising bond yields.

Source: WRAL News

The sell-off was triggered by the December jobs report, which showed the U.S. economy added 256,000 jobs—far exceeding the expected 155,000—and the unemployment rate edged down to 4.1%. While this robust labor market data is a positive sign for the economy, it has raised concerns that the Federal Reserve may delay or even forgo further interest rate cuts. Bond yields spiked in response, with the 10-year Treasury yield reaching 4.77%, its highest level since November 2023. Higher yields weighed on equities, particularly growth stocks, as investors recalibrated their expectations for monetary policy.

U.S. Economy Stays Strong, But Inflation Fears Cloud Fed’s Next Move

The U.S. economy continues to show remarkable strength, with the labor market leading the charge. The December jobs report was the latest in a string of positive economic indicators, including strong retail sales and industrial production data. However, this resilience has also brought inflation concerns back to the forefront. The University of Michigan’s consumer sentiment survey revealed that year-ahead inflation expectations jumped to 3.3% in January, the highest level since May 2023. This uptick in inflation expectations has further dampened hopes for additional Fed rate cuts, with markets now pricing in only one potential cut by September.

Source: CNN

The Fed’s next moves will be critical for both the economy and the stock market. While the central bank has signaled a pause in rate cuts for now, the strong jobs data and rising inflation expectations have led some economists to speculate that the Fed’s easing cycle may be over. This uncertainty is likely to keep markets on edge in the coming weeks, particularly as more economic data is released, including consumer price inflation and retail sales figures.

GLOBAL INFLUENCES

China's Export Rebound and Trade Policies Reshape U.S. Market Outlook

International developments are also playing a significant role in shaping the U.S. economic and market outlook. In China, December trade figures showed a rebound in exports, likely due to front-loading ahead of potential U.S. tariffs. This recovery is crucial for China, as rising trade protectionism threatens to curb one of its key growth drivers. The People’s Bank of China has pledged to continue easing monetary policy to support the economy, but concerns about the yuan’s stability and an overheated bond market persist.

Source: South China Morning Post

Singapore and Malaysia Tackle Trade Challenges Amid U.S. Tariff Risks

In Southeast Asia, Singapore and Malaysia are navigating the complexities of global trade. Singapore’s non-oil domestic exports are expected to show resilience, buoyed by front-loading of shipments to avoid U.S. tariffs. Meanwhile, Malaysia’s GDP growth is anticipated to have cooled slightly in the fourth quarter but remains robust, rounding out a strong year for the region.

Source: GovInsider

Investment Opportunity & Risk

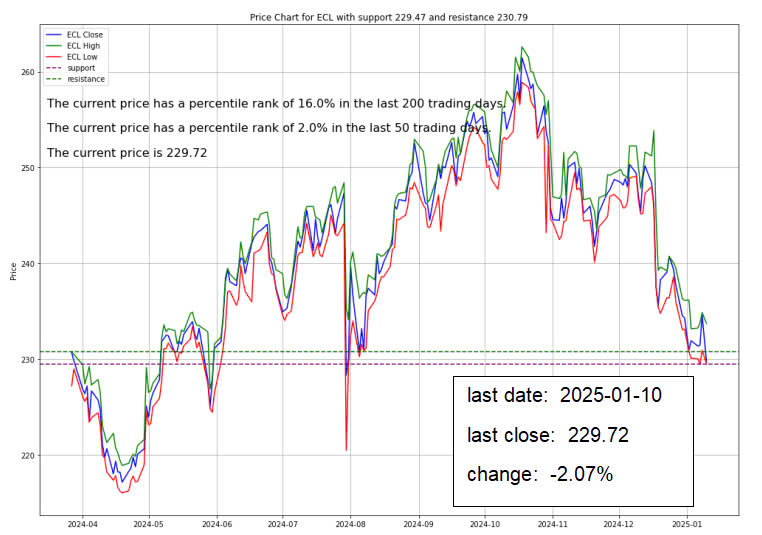

Ecolab Inc. (NYSE: ECL)

On Friday, RBC Capital Markets lowered its price target for Ecolab Inc. (NYSE: ECL) from $306 to $294, while maintaining an Outperform rating. The stock is currently trading at $232.41, with InvestingPro analysis suggesting it is slightly overvalued, as reflected in its P/E ratio of 32.6x and an EV/EBITDA multiple of 20.77x. The revised target is based on a conservative estimate of 4% organic growth for fiscal year 2025, driven by a 2% increase in volume and 2% pricing hikes, with high single-digit growth in Pest Elimination and mid-single-digit growth in Water and Institutional & Specialty segments. RBC analysts project Ecolab will reach its 20% operating income margin target by fiscal 2027 through innovation and operational efficiency improvements.

However, the forecast may face challenges from Direct Procurement Costs normalizing in 2025. The firm also revised its revenue and EPS estimates due to foreign exchange impacts, setting the price target at 35 times the forecasted fiscal 2026 EPS of $8.40.

Despite these adjustments, RBC remains confident in Ecolab’s long-term performance, supported by its diverse portfolio and 39 years of consecutive dividend increases. In other news, Piper Sandler lowered its price target to $270, anticipating slower growth, while BMO Capital upgraded the stock to Outperform with a price target of $290, citing expected double-digit EPS growth from 2025 to 2027. Ecolab also recently raised its quarterly dividend by 14% and acquired Barclay Water Management, further expanding its portfolio.

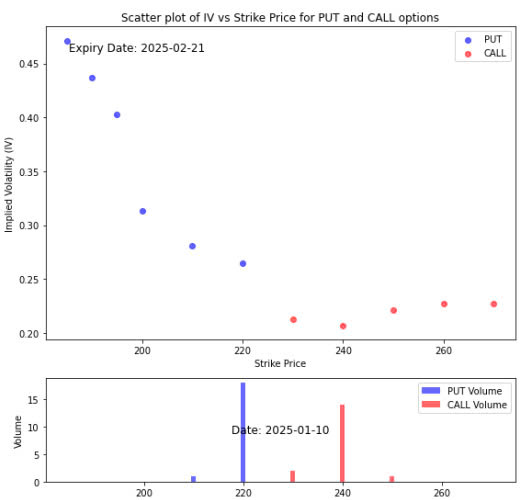

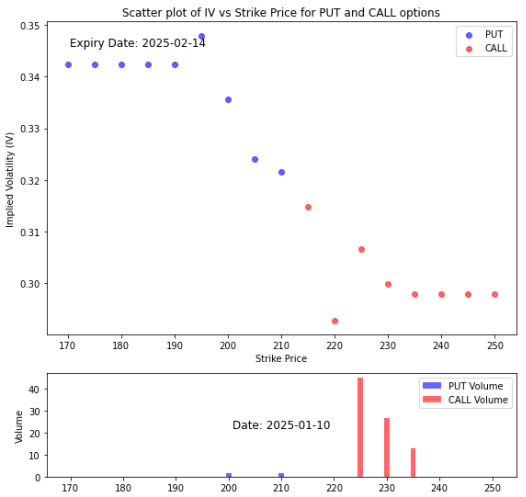

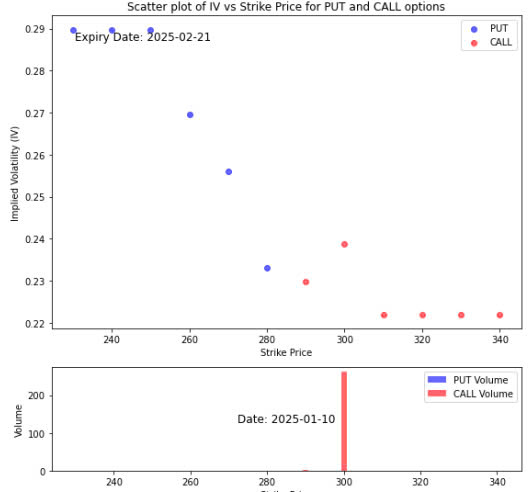

Option Smile Chart for ECL

- The scatter implied volatility smile plot shows that the greed accompanied by the rise in price is much smaller than the fear of the drop in price.

- The current put volume of the put option at the strike price of 220 is larger than the call volume at the strike price of 240. That shows more people believe that the price will drop to 220 before it may rise to 240.

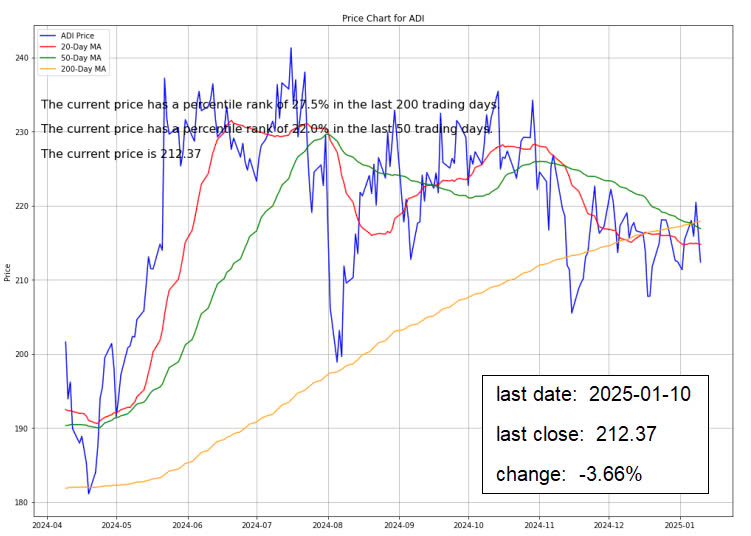

Analog Devices (NASDAQ: ADI)

On Friday, Truist Securities raised its price target for Analog Devices (NASDAQ: ADI) from $216 to $230, maintaining a Hold rating on the stock. Despite the company’s premium valuation, trading at a P/E ratio of 65.7x, Truist sees long-term growth driven by strategic investments and acquisitions like HITT, LLTC, and MXIM, which are expected to improve sales and expense efficiency. Analog Devices has a strong dividend history, having raised dividends for 22 consecutive years, underscoring its financial stability. The revised price target is based on a 27x multiple of the projected $8.87 EPS for 2026, representing a 6x discount compared to peers.

Although the firm maintains a favorable outlook, the Hold rating suggests investors should not add more shares at this time. Analog Devices has been resilient, reporting $9.4 billion in revenue and $6.38 EPS for fiscal year 2024. Analysts’ target prices for the stock range from $212 to $295, with recent updates from TD Cowen, Piper Sandler, Truist, and Goldman Sachs. The company is also focusing on strategic innovations like Code Fusion Studio and ADI Assure, with expectations of gradual recovery in fiscal 2025, particularly in the industrial sector.

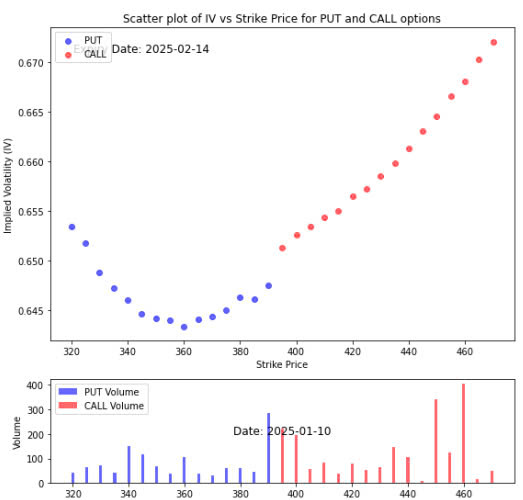

Option Smile Chart for ADI

- Based on the current higher volume at the $225 – $230 CALL strikes, it is likely that the market expects the stock to maintain or potentially increase in price in the short term. The elevated implied volatility for PUT options could indicate the elevated fear of price drop, however the tiny volumes of the put option show that the fear is not wholly translated into real commitment.

- Thus, the stock may trend upward, possibly hovering near or surpassing the $225–$230 range in the near future, barring any unforeseen changes in market conditions.

Tesla (NASDAQ: TSLA)

Tesla has launched an updated version of its popular Model Y in China, featuring a redesigned front and enhanced efficiency. While such updates are common in the auto industry to maintain market share, they often don’t lead to significant sales gains. The Model Y update, along with the Model 3 refresh in the U.S., might help boost Tesla’s sales, but it isn’t a cure-all for the company’s recent struggles, as its overall sales were down by 5% in 2024.

Despite these challenges, Tesla aims for a 20-30% growth in vehicle deliveries in 2025, partly relying on the Model Y update and the launch of a lower-priced vehicle. While investors are hopeful for growth, the company’s future success also hinges on its AI-driven initiatives, including the planned robotaxi service expected to launch in late 2025. Tesla’s stock rose significantly after the robotaxi announcement but faced a slight decline recently due to broader market conditions.

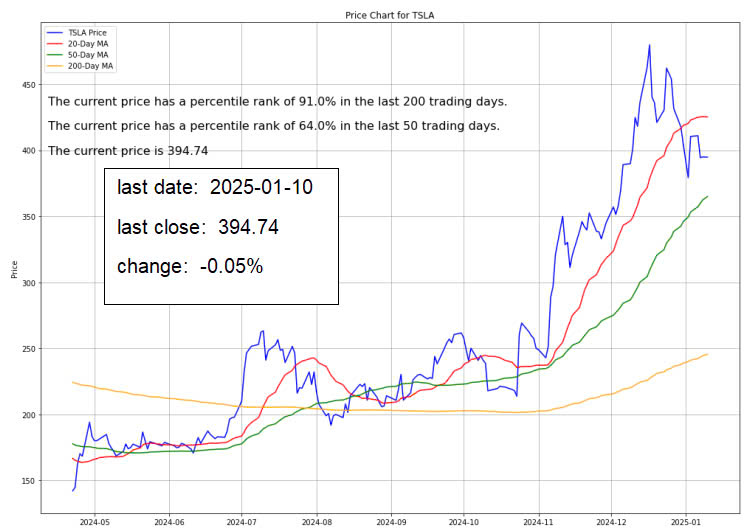

Option Smile Chart for TSLA

- Given the higher IV for CALL options at higher strike prices, along with increased volume, the market is positioning for upward potential. The implied volatility pattern suggests that traders are anticipating more upward movement and are more confident in the stock’s ability to rise towards the $420 strike and beyond.

- Thus, based on this data, it’s likely that the stock will continue its upward trend in the near future, possibly pushing toward the $420–$460 range.

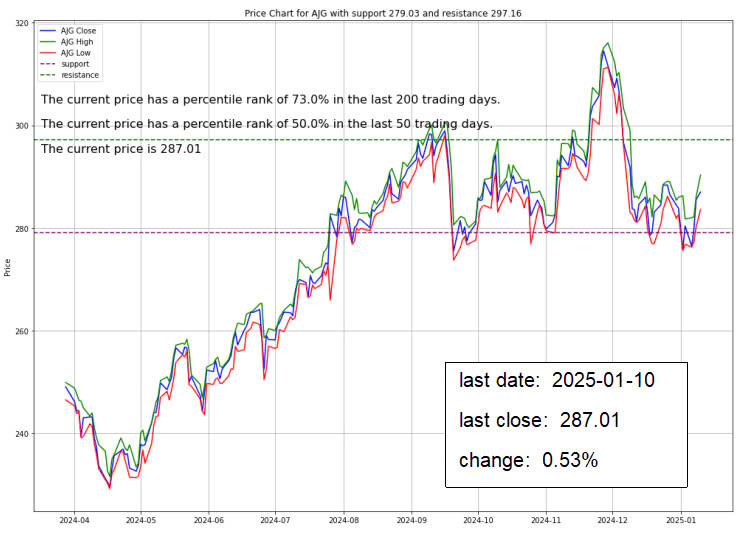

Arthur J. Gallagher & Co. (NYSE: AJG)

TD Cowen analyst Andrew Kligerman upgraded Arthur J. Gallagher & Co. (NYSE: AJG) to Buy from Hold, raising the price target to 295, following the company’s announcement of acquiring AssuredPartners for 250 to $344. The acquisition aligns with AJG’s strategy to expand its mid-market presence, supported by its proven integration capabilities and strong financial performance, including a 14-year dividend growth streak.

Option Smile Chart for AJG

- The data indicates a bullish outlook for the stock price in the near future. The high volume in call options, coupled with the upward trend in the stock price and stable implied volatility, suggest that the stock is likely to continue its upward movement. However, as with any market prediction, there are risks, and external factors could influence the stock price.

- It is noteworthy that the current sentiment in the options market suggests an expectation that the price will break through the 300 level.

CONCLUSION

- The U.S. stock market faces challenges from strong economic growth, rising inflation expectations, and global trade dynamics.

- The resilient labor market offers optimism but raises concerns about the Federal Reserve’s policy and the potential for higher bond yields.

- Persistent inflation could lead to a prolonged pause in rate cuts or even tightening, which may hurt growth stocks.

- Global trade developments, particularly in Asia, continue to influence the U.S. economic outlook and market sentiment.

- Investors should track inflation expectations, Fed policy decisions, and trade data closely as volatility persists.

- Rising bond yields may benefit financial sectors while growth sectors, like technology, could face headwinds.

- Balancing portfolios to account for economic shifts will be key to managing risks in the coming months.

- The sensitivity of markets to economic conditions requires adaptability and careful monitoring.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.