U.S. stocks showed mixed performance at the close on February 26, 2025, as investors navigated a volatile trading session marked by President Trump’s tariff remarks during a cabinet meeting and anticipation of Nvidia’s (NVDA) after-the-bell earnings, which exceeded expectations on both revenue and profit.

The market saw a divergence in sector performances, with gains in Technology, Utilities, and Industrials supporting certain indexes, while Consumer Goods, Telecoms, and Healthcare weighed on the broader market.

- The Dow Jones Industrial Average ended the session down by 0.43%.

- The S&P 500 Index saw a marginal increase of 0.02%.

- The NASDAQ Composite Index registered a gain of 0.26%.

Rising stocks outnumbered declining ones on both the New York Stock Exchange and the Nasdaq, reflecting a positive bias in overall market breadth. Meanwhile, the CBOE Volatility Index (VIX) declined by 1.70%, signaling a slight reduction in market uncertainty.

New-Home Sales Drop 10.5% in January

Sales of new single-family homes in the U.S. fell sharply in January 2025, reflecting ongoing challenges in the housing market. According to the Commerce Department report released on February 26, 2025:

- New-home sales dropped by 10.5% in January compared to December 2024, reaching 657,000 units. This figure missed economists’ expectations of 671,000 units.

- Compared to January 2024, sales were down 1.1%.

- The supply of new homes for sale increased to 495,000 units, representing 9.0 months of supply at the current sales rate, up from 8.0 months in December 2024.

The decline in new-home sales was attributed to high prices and elevated mortgage rates, which continued to weigh on potential buyers. Additionally, sales of existing homes fell by 4.9% in January, as reported by the National Association of Realtors, further highlighting the challenges in the housing market.

Source: The Economic Times Business

Consumer Confidence Plummets Despite Strong Job Market

Despite a relatively solid economy, consumer confidence has taken a hit in recent months. According to a Conference Board report, consumer confidence plummeted by 6.7% in February from January, marking the largest drop since 2021. Other surveys, including the University of Michigan’s consumer sentiment index, also recorded falling confidence levels.

Key factors contributing to this gloomy outlook include:

- Inflation concerns: Consumer price inflation rose to 3% in January, higher than expected, contributing to anxiety about future price increases.

- Partisan divide: Since the election, Democrats have turned sharply pessimistic, while Republicans have become more optimistic. Independents remain largely unchanged.

- Future uncertainty: Consumers are more worried about the future than the present, with concerns about inflation, tariffs, and potential economic policies under President Trump.

Source: Forbes

Despite these concerns, the labor market remains strong, with job growth in January and a slight drop in the unemployment rate. Stock prices, while volatile, are still higher than on Election Day, and bond yields and oil prices have fallen, providing some relief on mortgage rates and gasoline prices.

Gold Rises as Safe-Haven Demand Grows; Oil Slips Slightly

In commodity markets, gold futures rose by 0.51% to $2,933.77 per ounce, continuing its recent strength as investors sought safe-haven assets. On the other hand, both crude oil and Brent oil futures saw slight declines:

- Crude oil futures for April delivery fell by 0.19% to $68.80 per barrel.

- Brent oil futures for May delivery dipped by 0.34% to $72.25 per barrel.

Currency movements were also notable:

- The EUR/USD pair remained unchanged.

- The USD/JPY pair rose by 0.07%, reaching 149.13.

- The US Dollar Index gained 0.24%, closing at 106.48, reflecting the strength of the dollar against a basket of major currencies.

Source: Investera

Watchout

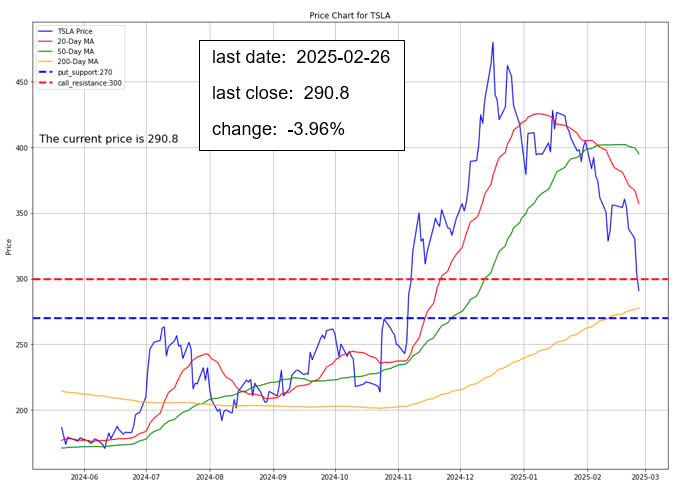

Tesla Stock Tumbles 20% in Five Days, Market Value Dips Below $1 Trillion

Tesla‘s stock has fallen for five consecutive days, dropping nearly 20% due to weakening U.S. and European sales, which have impacted investor sentiment. The stock has lost 37% of its value since its December peak, wiping out approximately $570 billion in market value. As of late February 2025, Tesla’s market value dropped below $1 trillion for the first time since November, while its shares are down 29% since the January inauguration.

However, there is hope for recovery, with analysts identifying key support levels around $275, which could stabilize the stock. Investors are looking for a sales turnaround, and the company’s potential in self-driving robo-taxis remains a key factor in regaining investor confidence.

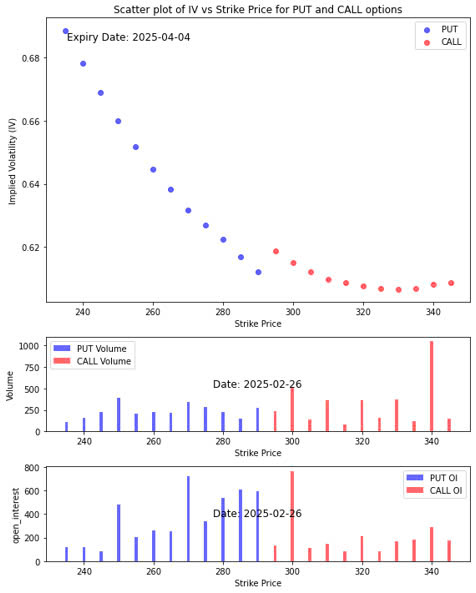

Option Smile Chart for TSLA

- Our in-house system assigns a bullish index score of 0.563 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The average implied volatility of the call options is slightly higher than the average implied volatility of the put options. That is the indication that the traders’ fear for a rise in the stock price slightly outweigh the expectation for the stock price to fall further. This could be hinting of a recovery.

- The volume near the current stock price is displaying that more traders are betting their money for the price to rise than fall. Especially at the strike price level 300 where moderate amount of call options are being placed for the price to reach and surpass that level.

- Looking at the open interest chart, there is a slippery slope on the way down until the support level of 270. For the resistance level, there is a major resistance at 300 level.

Investment Opportunity & Risk

Comcast (NASDAQ: CMCSA)

Comcast, a complex media and cable conglomerate, presents an appealing stock opportunity despite its intricacies. Trading at a significant discount, Comcast has valuable assets like a major broadband footprint, NBC, Universal Pictures, and theme parks, yet it faces shareholder unrest and potential activist involvement. The stock, down 40% from its 2021 peak, is valued attractively with a low P/E ratio and a secure dividend yield, though it struggles with broadband subscriber losses and increased competition. Analysts remain optimistic, citing potential growth from its streaming service Peacock and theme parks. With ongoing speculation around a corporate breakup or a merger with Charter Communications, Comcast’s stock offers various paths for potential upside, making it an intriguing prospect for investors despite its challenges.

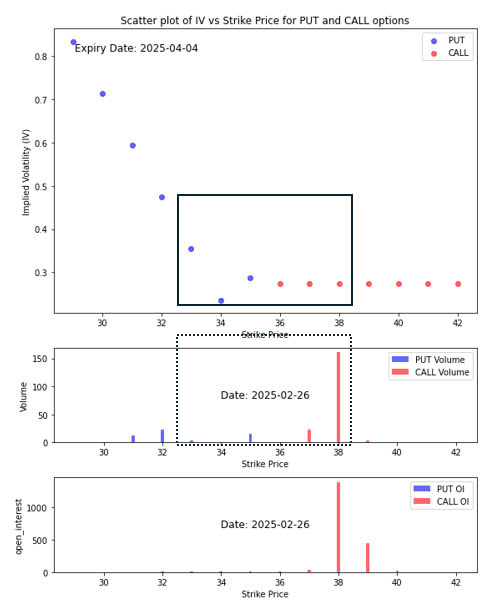

Option Smile Chart for CMCSA

- Our in-house system assigns a bullish index score of 0.621 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The average implied volatility of the put options is slightly higher than the average implied volatility of the call options. That is the indication that the traders’ fear for a fall in the stock price slightly outweigh the expectation for the stock price to rise.

- The volume near the current stock price is displaying that more traders are betting their money for the price to rise than fall. Especially at the strike price level 30 where considerable amount of call options are being placed for the price to reach and surpass that level.

- Looking at the open interest chart, there is no support level that may slow the slide if the sentiment worsen. For the resistance level, there is a major resistance at 38 level.

CONCLUSION

- Market breadth showed a slight upward trend despite sector volatility.

- Investors remained cautious amid mixed sector performances.

- The housing market continued to struggle with declining new-home sales, high prices, and elevated mortgage rates.

- Consumer sentiment remained weak due to concerns about inflation and future economic policies.

- Economic indicators suggest stability, but public confidence remains low.

- Political leaders, including President Trump, may need to address economic concerns to restore confidence.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.