U.S. stock markets ended the day on a positive note, driven by gains in the financials, technology, and consumer goods sectors. The major indices all posted significant increases, reflecting a strong performance across the board. However, global markets faced pressure due to renewed U.S. tariff threats, which spooked investors and led to declines in international shares. Meanwhile, the U.S. economy’s resilience is being tested by soaring uncertainty over President Trump’s policy agenda, raising concerns about future growth.

The U.S. economy has shown remarkable resilience in recent years, but President Trump’s rapid policy changes are generating uncertainty that could weigh on growth. Consumer spending, which accounts for more than two-thirds of demand, fell by 0.2% in January, the largest monthly drop in four years. The S&P 500, which had risen more than 6% between Election Day and mid-February, has since fallen 3.1%, reflecting growing concerns about the economic outlook.

Gold and Oil Decline as U.S. Dollar Strengthens

In commodities trading, gold futures for April delivery fell by 0.98%, while crude oil for April delivery declined by 0.48%. The May Brent oil contract also saw a drop of 0.67%. In the currency markets, the EUR/USD pair remained relatively unchanged, while the USD/JPY pair rose by 0.45%. The US Dollar Index Futures increased by 0.30%, reflecting a stronger dollar.

Source: The Economic Times Business

Stocks Rally as Dow, S&P 500, Nasdaq Post Strong Gains

The Dow Jones Industrial Average rose by 1.39%, while the S&P 500 index climbed 1.58%. The NASDAQ Composite also saw a notable increase, gaining 1.63% by the close of trading. The overall market sentiment was bullish, with advancing stocks outnumbering declining ones on both the New York Stock Exchange and the NASDAQ.

Rising stocks significantly outnumbered declining ones on the New York Stock Exchange, with 1,912 stocks advancing compared to 857 declining. On the NASDAQ, 2,018 stocks rose, while 1,271 declined. The CBOE Volatility Index, which measures market volatility, dropped by 7.10%, indicating a decrease in investor anxiety.

Source: Newsweek

The financials, technology, and consumer goods sectors were among the top performers, contributing to the overall market gains. These sectors led the charge, with several companies within them posting significant increases in their stock prices. On the other hand, some sectors faced minor declines, but these were overshadowed by the broader market rally.

Trump’s Tariff Threats Fuel Inflation Concerns

President Trump’s tariff threats are driving inflation expectations higher, which could complicate the Federal Reserve’s ability to lower interest rates if economic momentum wanes. The rapid pace of policy changes, including tariff increases and immigration crackdowns, is creating uncertainty that could weigh on business and household spending. Economists warn that these policies could drag on short-term growth, even as tax cuts and deregulation—potential growth boosters—remain stalled.

Source: Investera

International Issues

Global Markets Fall as U.S. Rallies

While U.S. markets rallied, global shares fell after President Trump threatened to implement fresh tariffs on imports from China, Canada, and Mexico. The Stoxx 600 in Europe declined by 0.6%, with the basic materials and auto sectors among the weakest. In Asia, the Hang Seng Index suffered its largest one-day loss since October, dropping 3.3%, while South Korea’s Kospi and Japan’s Nikkei also saw significant declines.

Source: Bloomberg

Chinese Stocks Rebound as Optimism Grows Amid Policy Shifts and Market Opportunities

Chinese stocks, after years of underperformance, are showing signs of recovery. The MSCI China Index has risen 18% this year, significantly outperforming the S&P 500’s 2% gain. Despite challenges such as a sluggish economy and a struggling property market, optimism is returning as the worst-case scenarios for China seem to fade.

A shift in U.S.-China relations, with reduced tariff threats and a focus on dealmaking rather than escalation, has helped boost confidence. Additionally, China’s government has introduced policies aimed at stabilizing its economy, including measures to support the tech sector and reduce investment barriers.

The Chinese market remains one of the cheapest globally, with the MSCI China trading at 12 times earnings compared to 22 for the S&P 500. Experts like Beeneet Kothari of Tekne Capital Management see this as an opportunity, particularly in China’s tech sector, where innovation is expected to drive growth.

Source: Think China

However, the geopolitical tension, especially with U.S. tariffs, continues to create volatility. Analysts also worry that Beijing’s stimulus efforts might not fully stabilize the property market, which remains a key concern. Despite this, Chinese companies are thriving in sectors like electric vehicles, with BYD outpacing Tesla in parts of Europe and Southeast Asia.

The potential for further growth in China’s technology and manufacturing sectors, especially in AI and electric vehicles, makes certain stocks appealing, even as geopolitical risks persist.

Watchout

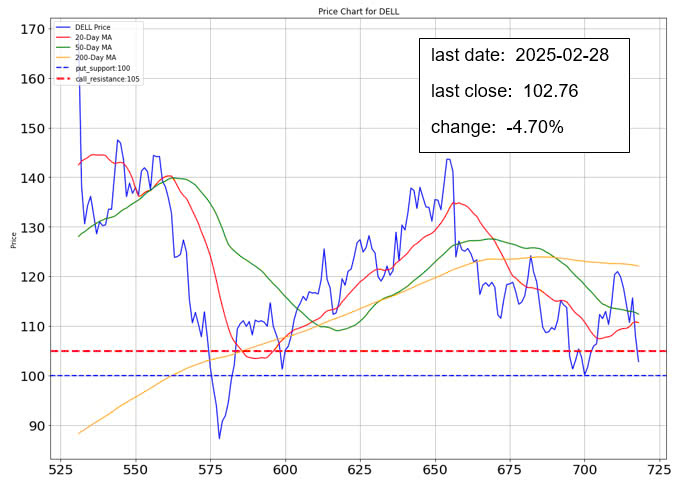

UBS Lowers Dell’s Price Target Amid AI Growth

UBS analyst David Vogt lowered the price target for Dell Technologies Inc. (NYSE: DELL) from $158 to $150 while maintaining a Buy rating on the stock, currently trading at $100.85. The price target revision follows Dell’s first-quarter earnings guidance, which met UBS forecasts but slightly missed consensus, reflecting challenges like a soft PC market and revenue recognition issues due to a GPU transition. Despite an 8.31% decline in stock price over the past week, Dell reported a significant order increase to $9 billion, with projections of $15 billion in AI server revenue for fiscal year 2026, surpassing UBS’s $13 billion estimate.

The company’s strong financial metrics include a market cap of $70.52 billion and a P/E ratio of 17.41. UBS views Dell’s revenue guidance of $101 billion to $105 billion for FY26 as reasonable, with an estimated EPS of $9.30, though any share price decline should be seen as a buying opportunity. Dell’s history of exceeding conservative guidance could mean the company will outperform its FY26 EPS forecast.

Option Smile Chart for DELL

- Our in-house system assigns a bullish index score of 0.362 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The average implied volatility of the put options is greater than the average implied volatility of the call options. That is the indication that the traders’ fear for a fall in the stock price is greater than the expectation for the stock price to rise.

- The volume near the current stock price is displaying that more traders are betting their money for the price to fall than rise. Especially at the strike price level 100 where some amount of put options are being placed for the price to fall and go below that level.

- Looking at the open interest chart, there is a minor support level at 100. For the resistance level, there is a major resistance at 105 level.

Investment Opportunity & Risk

Marvell Technology Group Ltd (NASDAQ: MRVL)

Stifel analysts maintained a Buy rating on Marvell Technology Group Ltd. (NASDAQ: MRVL) with a price target of $130.00, despite a -20.6% decline in the stock year-to-date. The company’s upcoming earnings report, due on March 5th, is expected to align with or slightly surpass analysts’ estimates of $1.80 billion in revenue and $0.59 in non-GAAP EPS. Analysts anticipate continued profitability growth, driven by strong performance in the Data Center segment, which benefits from AI and data center ramps.

Other segments, such as Carrier Infrastructure and Enterprise Networking, are also expected to show positive quarter-over-quarter growth. Looking ahead, analysts forecast positive momentum for the April quarter, especially in Data Center and AI initiatives. Marvell’s significant Data Center revenue, which constituted 73% of its October quarter revenues, is bolstered by increased capital expenditure budgets from major hyperscalers like Google, Microsoft, Meta, and Amazon. Recent innovations, including advancements in custom AI accelerator architecture, and positive analyst sentiment from firms like Melius, KeyBanc, and Raymond James, further support the stock’s growth potential, particularly in the AI and custom silicon markets.

Option Smile Chart for MRVL

- Our in-house system assigns a bullish index score of 0.703 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The average implied volatility of the put options is roughly equal with the average implied volatility of the call options. That is the indication that the traders’ fear for a fall in the stock price is more or less equal with the expectation for the stock price to rise.

- The volume near the current stock price is displaying that more traders are betting their money for the price to rise than fall. Especially at the strike price level 101 where considerable amount of call options are being placed for the price to reach and surpass that level.

- Looking at the open interest chart, there is a major support level at 85 that may slow the slide if the sentiment worsen. For the resistance level, there is a major resistance at 104 level.

CONCLUSION

- Major indices and most stocks closed higher, reflecting overall positive sentiment.

- Key sectors led the rally, offsetting minor declines in specific areas.

- The decline in the volatility index signaled reduced investor uncertainty.

- Global trade tensions and domestic policy uncertainty could still impact future growth.

- While the market remains strong, international markets may face challenges in the coming months.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.