On March 26, Wall Street stocks experienced significant losses, largely driven by concerns over upcoming U.S. tariffs on automotive imports. This uncertainty weighed heavily on major stocks such as Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA), contributing to the broader market decline. The economic atmosphere surrounding these tariffs continues to stir investor caution, especially as they await further details on the impact to industries.

Source: Zee Business

The S&P 500 declined by 1.12%, closing at 5,712.20 points. The Nasdaq Composite dropped by 2.04%, closing at 17,899.02 points, and the Dow Jones Industrial Average experienced a more modest decline of 0.31%, ending at 42,454.79 points.

Among the 11 S&P 500 sector indexes, six sectors closed lower. Information technology and communication services led the losses, falling by 2.46% and 2.04%, respectively.

Rising Trade Barriers Spark Fears of Economic Slowdown

Globally, trade barriers are rising at an alarming rate, drawing comparisons to the protectionist actions of the 1930s, which exacerbated the Great Depression. The U.S. under President Trump has imposed significant tariffs, with retaliatory measures across Europe, China, and Canada affecting hundreds of U.S. goods. The growing tide of protectionism is being met with concerns that it could lead to slower economic growth and higher inflation. Key industries such as steel, electric vehicles (EVs), and semiconductors are at the forefront of this international trade conflict.

U.S. President Donald Trump is expected to announce a major set of car industry tariffs on April 2. Analysts predict that these tariffs will raise vehicle prices and disrupt production, affecting companies such as Tesla and General Motors (NYSE:GM). Tesla’s stock fell by 5.6%, while GM lost 3.1%. The uncertainty surrounding the scale of tariffs and potential retaliatory actions from trading partners remains a major concern for the markets.

Source: BBC

The rising trade barriers around the world are creating a more fragmented global economy, with an increasing number of countries tightening import controls. The U.S., in particular, has seen a surge in tariffs since President Trump’s first term, pushing the average tariff rate on U.S. imports to its highest level since 1946, at 8.4%. If Trump’s remaining tariff threats come to fruition, tariffs on U.S. imports could rise to 18%, the highest in 90 years.

Stocks Slide as Nvidia, Broadcom Lead Tech Sell-Off

The technology sector, including key chipmakers like Nvidia and Broadcom (NASDAQ:AVGO), also experienced heavy losses. Nvidia fell nearly 6%, while Broadcom dropped 5%, leading to a 3.3% decline in the PHLX chip index. This decline further contributed to the broader market downturn.

Source: 24/7 Wall St

Business Optimism Wanes Amid Tariff Concerns

Business optimism has decreased in the first quarter, as companies worry about the inflationary effects of tariffs. Increased costs from tariffs are forcing businesses to build up inventories. As a result, durable U.S. manufactured goods orders saw an unexpected rise, indicating that businesses are preparing for higher costs.

Source: Seeking Alpha

Consumer Sentiment Declines

Later this week, market attention will turn to the release of the personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge. Minneapolis Fed President Neel Kashkari has expressed uncertainty about the impact of tariffs, suggesting they could push prices higher, potentially necessitating interest rate hikes.

Source: Marketing Week

A key consumer survey, the Conference Board’s monthly index, showed a notable decline in consumer sentiment, with forward-looking expectations for income, business, and labor-market conditions dropping to a 12-year low. This marks the fourth consecutive month of decline, signaling growing pessimism among consumers. Worries about inflation and the impact of trade policies, particularly tariffs, are contributing factors. Many consumers have cited concerns over rising prices, exacerbated by tariff uncertainties, which could lead to further economic disruption.

Dollar Tree Rises, GameStop Soars on Bitcoin News

Dollar Tree (NASDAQ:DLTR) rose 3.1% after announcing it was nearing a $1 billion sale of its Family Dollar business. GameStop (NYSE:GME) surged nearly 12% after its board unanimously approved incorporating bitcoin as a treasury reserve asset.

Source: Yahoo Finance

Barclays Lowers S&P 500 Target as Market Struggles in 2025

Barclays revised its S&P 500 target downward from 6,600 to 5,900 points. The S&P 500 has lost 3% year-to-date in 2025, while the Nasdaq is down over 7%. Advancing issues outnumbered declining ones within the S&P 500 by a ratio of 1.1-to-1. The index posted 16 new highs and 6 new lows, while the Nasdaq recorded 33 new highs and 197 new lows.

Source: Reuters

Trading volume was relatively light, with 15.5 billion shares traded on U.S. exchanges, slightly below the average of 16.2 billion shares over the previous 20 sessions.

Investment Opportunity & Risk

Advanced Micro Devices, Inc. (NASDAQ:AMD)

On Thursday, Advanced Micro Devices, Inc. (NASDAQ:AMD) had its stock rating downgraded from “Buy” to “Hold” by Jefferies, with its price target reduced from $135 to $120. This downgrade follows concerns about AMD’s progress in the artificial intelligence (AI) market, where expectations for $10-15 billion in AI revenue for 2026 and 2027 seem unlikely due to slow growth. Despite strong gross margins of 53% and a current ratio of 2.62, indicating good liquidity, AMD’s stock has fallen nearly 33% over the past six months, and 17 analysts recently revised their earnings expectations downward. Jefferies also pointed to the competitive landscape, particularly Intel’s new management, which could boost its edge in the Client PC market. The firm has adopted a cautious stance, advising a wait-and-see approach until AMD’s AI progress and Intel’s response become clearer.

Additionally, AMD recently announced that its radiation-tolerant Versal AI Edge XQRVE2302 device is qualified for spaceflight and will be part of AI-driven solutions in collaboration with Cisco, Nokia, and Jio Platforms. Meanwhile, Mizuho Securities and JPMorgan have adjusted their price targets and outlook for AMD, with Mizuho lowering its target to $120 and JPMorgan maintaining a neutral stance at $130, citing confidence in AMD’s long-term growth despite near-term AI challenges.

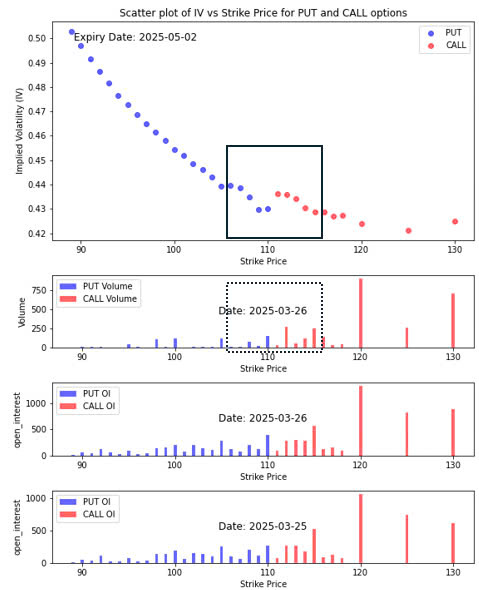

Option Smile Chart for AMP

- Our in-house system assigns a bullish index score of 0.622 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility of the strikes close to the stock price (ATM) shows that average implied volatility of the call option is bigger than that of the put option. This indicates that the traders’ expectation for the stock price to climb is greater than the traders’ fear that the stock price will decline.

- The volume chart also shows that the traders are betting more for the stock price to rise than to decline. Aggregately they set the next target price is 120.

- The open interest chart shows a minor put induced support level at 110, a minor call induced resistance level of 115 and a major call induced resistance level of 120

Roper Technologies (NASDAQ:ROP)

On Wednesday, Stifel analysts initiated coverage of Roper Technologies (NASDAQ:ROP) with a Buy rating and a price target of $685, up from its current price of $582.40. The analysts highlighted Roper’s unique position as a diversified technology holding company, focusing on software and engineered products for niche markets, including education, energy, healthcare, industrials, and government. Roper’s revenue has grown by 14% over the last twelve months to $7.04 billion, largely driven by strategic acquisitions and divestitures, and the company maintains a strong financial health score. Stifel’s $685 price target reflects a P/FCF estimate of 27 times for 2026, indicating strong financial performance, though the stock currently trades at a premium P/E ratio of 40.18. Analysts anticipate mid-to-upper-single digit organic growth for the company.

In other news, Roper recently acquired CentralReach for $1.65 billion, which is expected to add $175 million in revenue and $75 million in EBITDA by mid-2026, boosting its healthcare software segment. Other analysts, including Truist, TD Cowen, and Raymond James, have also reiterated Buy ratings, with price targets ranging from $650 to $675, noting the potential for continued growth and acquisitions.

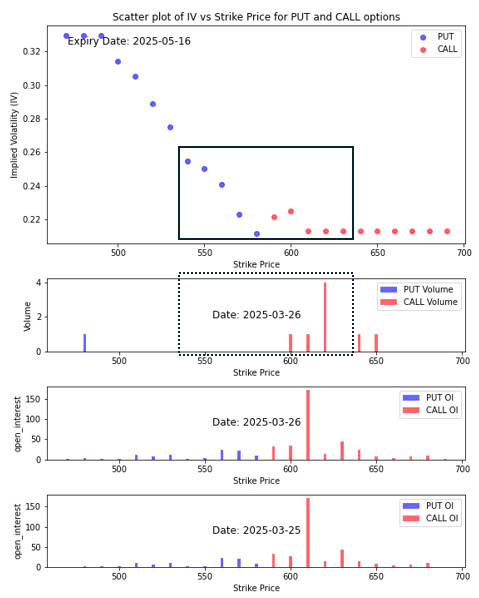

Option Smile Chart for ROP

- Our in-house system assigns a bullish index score of 0.573 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- The implied volatility of the strikes close to the stock price (ATM) shows that average implied volatility of the call option is less than that of the put option. This indicates that the traders’ expectation for the stock price to climb is less than the traders’ fear that the stock price will decline.

- However the volume chart also shows that the traders are betting more for the stock price to rise than to decline. Aggregately they set the next target price is 620.

- The open interest chart does not show any meaningful put induced support level. A major call induced resistance level is found at strike level 610.

CONCLUSION

- U.S. stock market faces increasing volatility due to escalating tariff concerns.

- Rising tariffs and protectionist policies threaten economic growth and inflation.

- Waning optimism in businesses and households signals potential slowdown.

- Key sectors like automotive and technology are feeling the strain of trade tensions.

- Investors brace for fluctuations as inflation data and policy decisions take center stage.

- Close monitoring of economic developments is crucial in the coming weeks.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.