The year has just passed its halfway mark. U.S. is once again under the limelight for battling a second Covid-19 wave. The history of Covid-19, and how it will unfold, will not be written for a long while yet. At this point in the pandemic’s progress, it is the U.S. and its economic and political model that appears to have failed. And what will be the economic and financial consequences? Meanwhile, the effect of the American failure to stop the virus is beginning to be felt in real-time economic activity. Could that possibly have an impact on markets?

TAKEAWAY

There does not appear to be any direct link between the pandemic and the performance of stock markets, in either relative or absolute terms. Markets are essentially on a one way track upwards since March 2020. However, most factors used to determine market risks are still at elevated levels.

Our robots’ algorithmic models incorporate significant market information and have determined the reward to risk of trading in the current market as not favourable.

More Than Meets The Eye

First things first, let’s look at following factors to better understand what we are getting into.

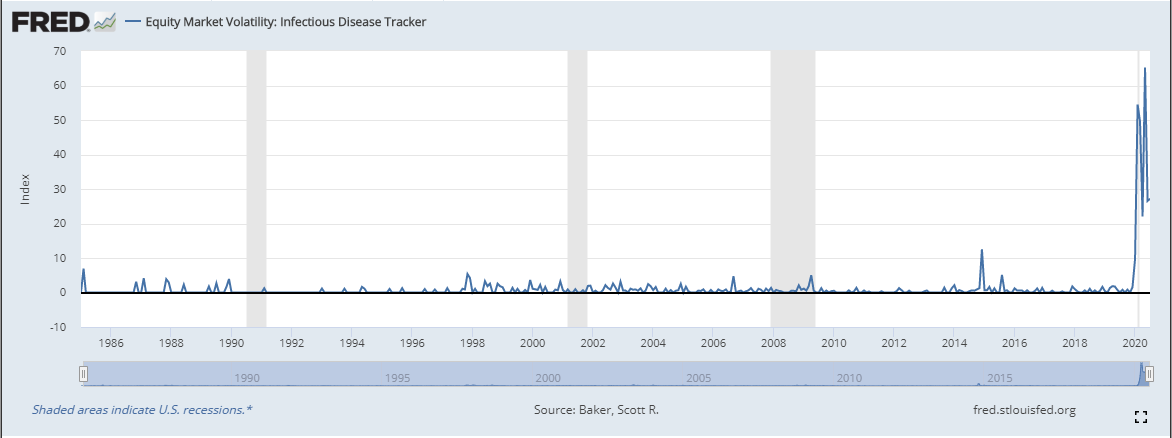

Equity Market Volatility – Infectious Disease Tracker

This factor uses three indicators: stock market volatility, newspaper-based economic uncertainty, and subjective uncertainty in business expectation surveys that provide real-time forward-looking uncertainty measures.

This ratio hit the highest reading (113) ever on 15 Mar on Covid 19 fears, and has since gradually decreased to 26. The previous highest record was 12 in the past 30 years. Market volatility concerns over Covid 19 is still relatively high.

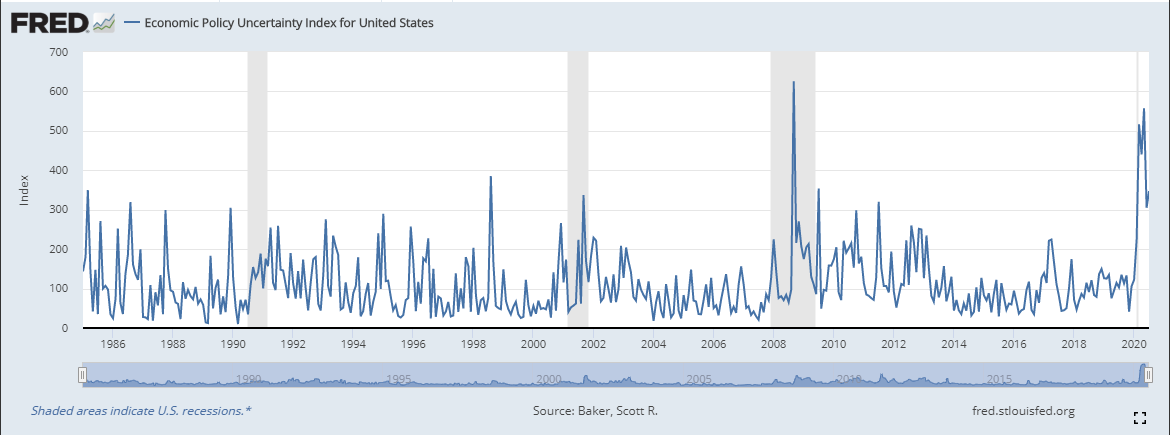

Economic Policy Uncertainty Index for United States

Economic policy uncertainty raises stock price volatility and reduces investment and employment in policy-sensitive sectors like defense, healthcare, and infrastructure construction. At the macro level, policy uncertainty innovations foreshadow declines in investment, output, and employment in the US.

This factor recently peaked at 560 before settling at 304 due to fed and Trump administration activities over Covid 19.

The previous record was 626 in the 2008 financial crisis.

Previously, this index spiked near tight presidential elections, Gulf Wars I and II, the 9/11 attacks, the failure of Lehman Brothers, the 2011 debt-ceiling dispute and other major battles over fiscal policy.

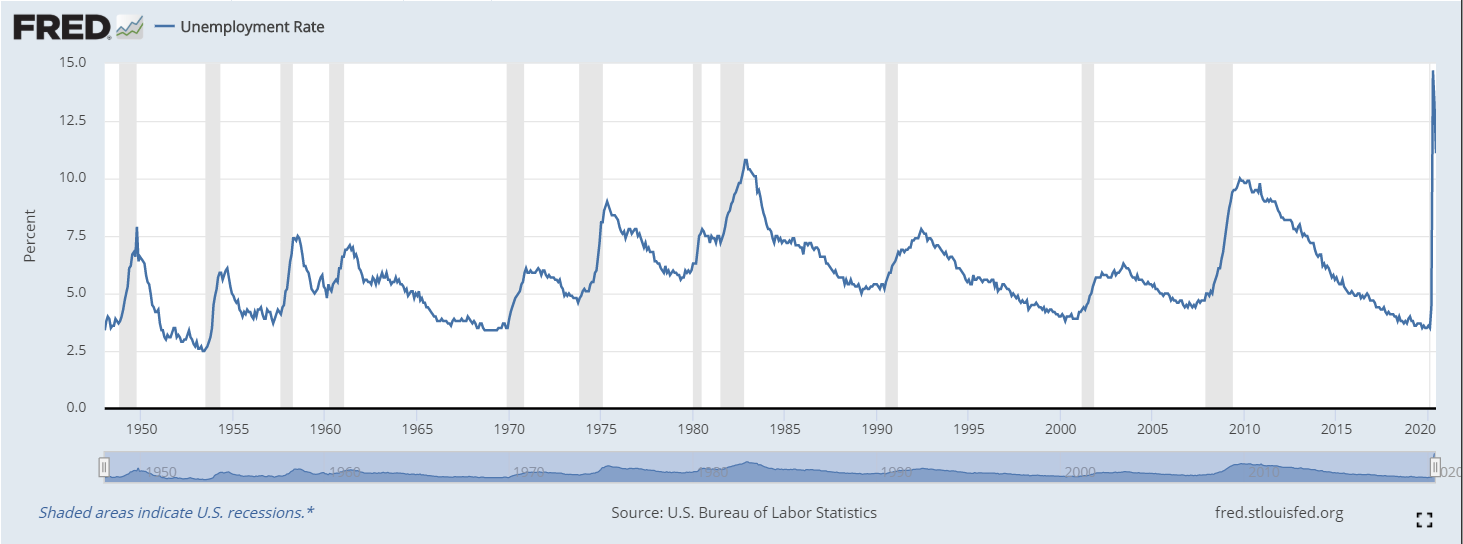

Unemployment Rate

The US unemployment rate dropped to 13.3% in May 2020 from 14.7% in April which was the largest in records back to 1939. However use this positive news with caution as the Bureau of Labor Statistics said it had misclassified data in May report. High unemployment rate indicates a decline in future corporate earnings.

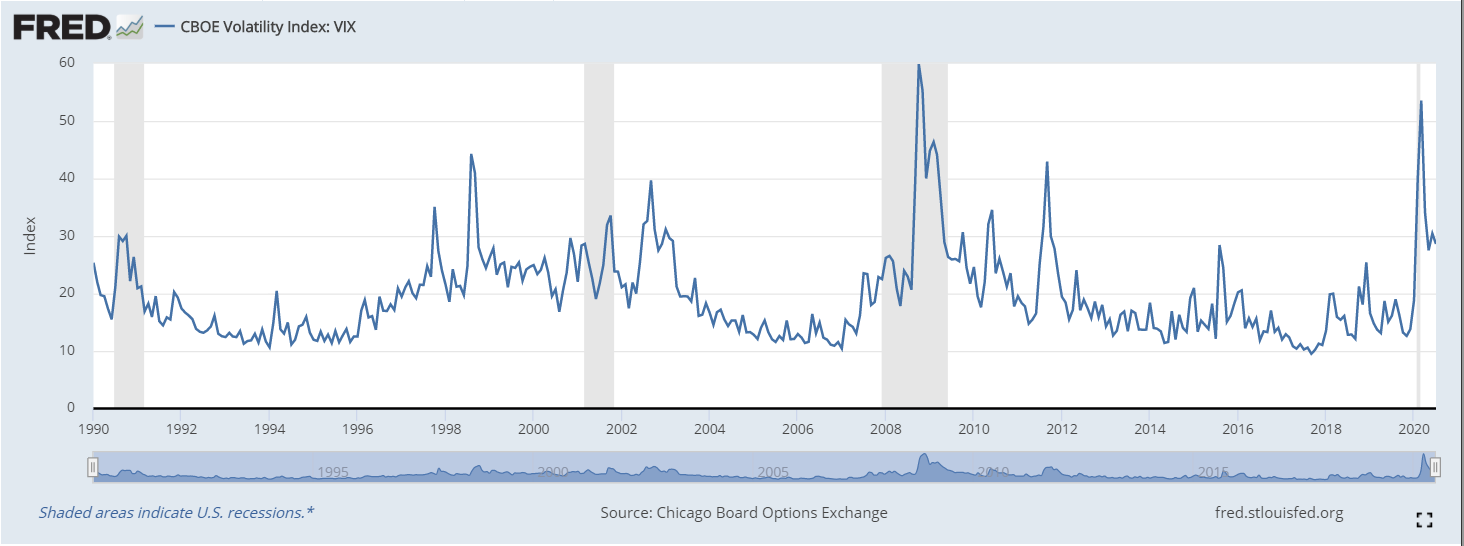

Vix

VIX is the implied volatility of the S&P 500 for the next 30 days. It typically ranges below 20 during bull markets and has not exceeded 50 since the 2008 financial crisis.

The CBOE VIX recently had another spike on 11th June due to 2nd wave covid fears. However, the index is still hovering around 30. The perceived risk of the market remains elevated.

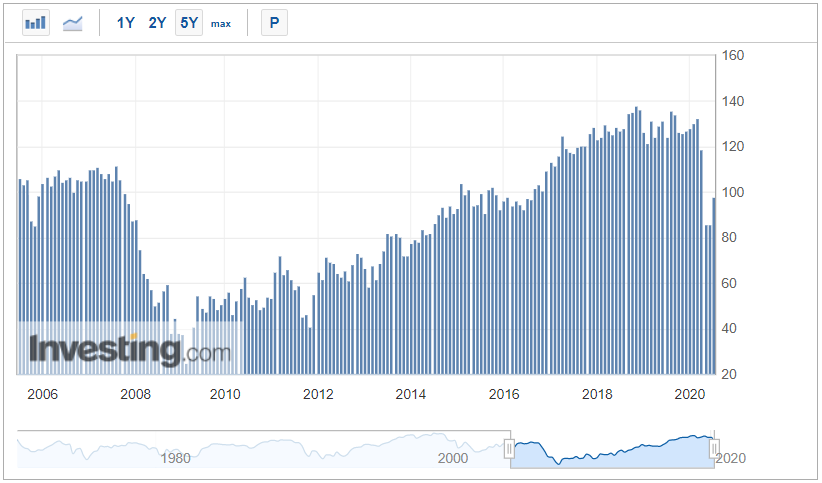

US Consumer Confidence

The US Consumer Confidence index is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. Higher readings point to higher consumer optimism.

US Consumer Confidence index rose to a reading of 98.1 this month from a downwardly revised 85.9 in May.

Gold Prices

Lastly, let’s take a look at Gold prices. The gold rose in June 20 to $1780, continuing the previous trend and at the same time the US dollar index continues to decline. If this trend continues, it indicates the drop in confidence of the US dollar and may affect the overall sentiment in investing in the US market. When money is shifting to gold and gold prices rise steadily, it often indicates that investors are looking for a safe haven due to the uncertainty in the market.

Conclusion

- Markets are clearly still concerned over the persistent Covid-19 pandemic. This concern shows up in elevated levels of Vix, unemployment rates, infectious disease tracker index, and the economic policy uncertainty index.

- The US market is taking a breather following a V shape rally since end March 2020, despite these concerns.

- Today, riding on the rally to profit seems more suitable for investors with a higher risk profile.

- We know at the end of the day, the market can go in any direction with no rational explanations behind it. But you need to know the risk of the game.