The month of October 2020 is certainly an interesting one. The beginning of October marked an early attempt to recapture the market’s all time high levels which failed towards the middle of October. Weakness started to show in the third week’s trading session, before a significant selldown materialised in the final week. From the monthly high of 3549.85, the S&P 500 closed at 3269.96, representing a -7.88% selldown to finish off the month of October 2020.

TAKEAWAY

- Global stocks suffered their biggest setback since the March meltdown, once again due to Covid-19 resurgence and US political uncertainties due to the elections.

- Interestingly, there has not been a reallocation towards typical safe haven assets like US Treasuries and Gold, despite the concerning selldown.

- This collective selloff theme across all assets, including safe haven assets, is a clear departure from the March 2020 selldown.

- It is therefore important not to assume the current Covid-19 situation affecting the stock market will be similar to March 2020.

- While the concerns are different, there are still many factors of uncertainty and the fact remains we are seeing mixed economic data, with some deterioration fears due to reinstatement of lockdowns in Europe.

Bird Eye View

Early October 2020 showed a strong equities market that was attempting to recover from the September selloff, by recapturing the recent all time high. In part that was assisted by expectations of a joint democratic and republican stimulus bill to be passed before the US elections. However, it soon became clear several impasses remained and the market’s expectation was not to be met. That eventually weakened the market’s bullish resolve.

The market clearly knows and sees Covid cases increasing both in Europe and the USA on a daily basis. In fact, President Trump contracted the Covid-19 virus himself early October which temporarily affected the markets, but quickly bounced back when he speedily recovered. The straw that broke the camel’s back occurred when Germany and France both started to impose lockdown measures in severely affected cities.

Once the announcement was made publicly, it sent global equities markets spiralling down. There is no doubt we are in the midst of another Covid-19 lockdown selldown. However, what is interesting about this selldown is that across most asset classes, including safe havens like Gold, have experienced some form of profit taking. Small stocks also sold off almost as much as big cap stocks. Both value and growth stock performed equally bad. While bonds saw no significant sell downs, there was little movement.

Perhaps this deviation from the March selldown, which saw a flight to safe haven assets like bonds and Gold, can be attributed to the uncertainty caused by the proximity of the U.S. elections, where the probability of an ugly contested voting outcome has increased.

The uncertainty over what comes next cannot be overstated, simply because it may be difficult for this situation to turn around quickly for several reasons:

- It seems unlikely for any Covid-19 vaccine to be available in mass quantities that will suppress the virus in a meaningful manner. Dr Fauci, the top US infectious diseases expert, estimates the first US Covid-19 vaccines could only be shipped late December 2020 or early January 2021.

- The next European Central Bank (ECB) meeting will only occur in December. This signals no immediate actions on the ECB to support and stimulate the badly affected European markets.

- The US Fed will meet on 4th November 2020, which is a key moment to look forward to. However, it is not immediately clear what new ammunition can be deployed by the Fed. The Fed is expected to hold interest rates steady. Jay Powell may however signal more concerning economic outlooks that warrant further central bank intervention, although that remains speculative at this moment.

- Further US stimulus bills by the federal government can only be progressed after the US elections. If the results are to be contested, which is a fear that is circulating around financial markets, it will clearly take the focus and attention away from progressing with a much needed stimulus bill.

Let’s review the latest market data that is shaping the market outlook.

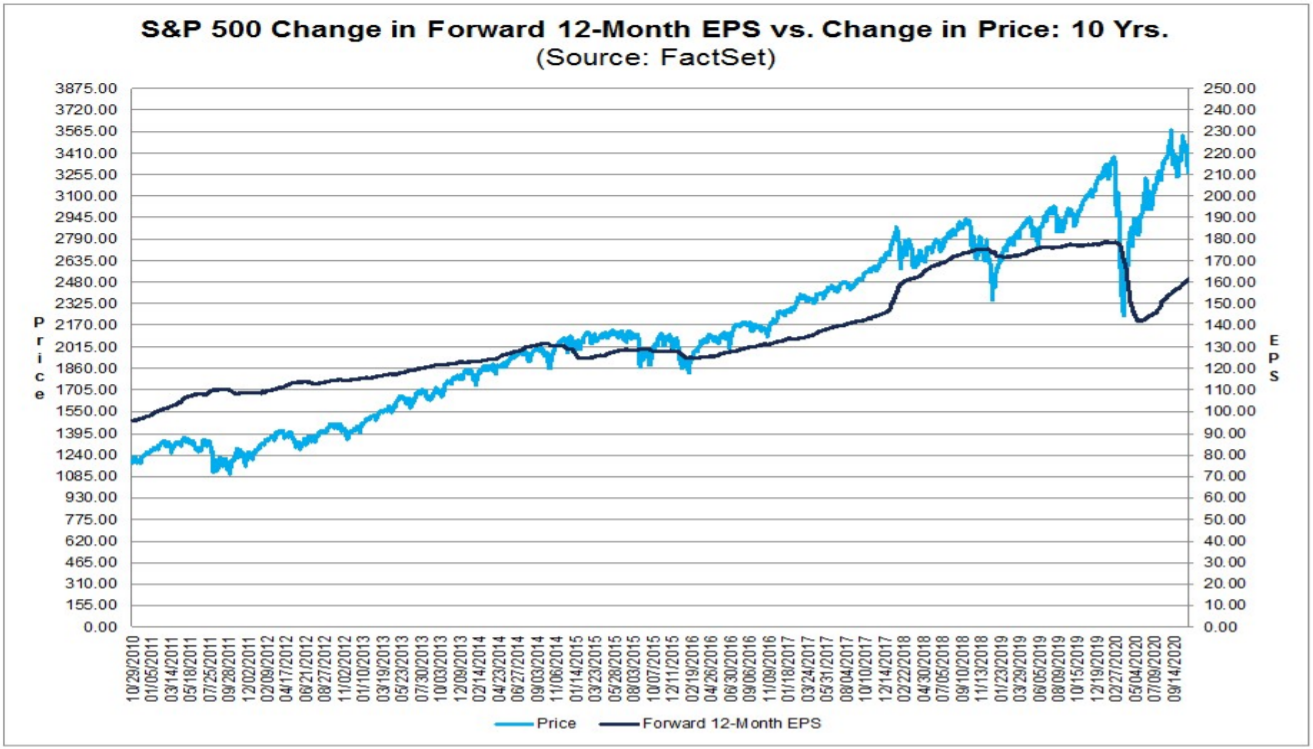

S&P 500 US Earnings – Forward 12 month P/E Ratio

As of Q3 2020, about 64% of the S&P 500 companies have reported earnings. About 86% of companies have beaten estimates, well above historical norms of approximately 70%. if 86% is the final figure, it will be the record for the biggest % of S&P 500 companies reporting a positive earnings surprise since this metric was tracked in 2008.

When actual US earnings exceed estimates, this tends to be bullish for the stock market.

Since market expectations are initially based upon earnings estimates, any actual earnings beat tends to result in higher stock prices.

The forward 12-month P/E ratio for the S&P 500 is 20.6. This P/E ratio is above the 5-year average (17.3) and above the 10-year average (15.5).

To date, more S&P 500 companies have issued positive earnings guidance than average. 46 companies in the index have issued EPS guidance for Q4 2020. Of these 46 companies, 15 have issued negative EPS guidance and 31 have issued positive EPS guidance. The percentage of companies issuing positive EPS guidance is 67% (31 out of 67), which is well above the 5-year average of 32%.

The term “guidance” is defined as a projection or estimate for EPS provided by a company in advance of the company reporting actual results. Guidance is classified as negative if the estimate (or mid-point of a range estimate) provided by a company is lower than the mean EPS estimate the day before the guidance was issued. Guidance is classified as positive if the estimate (or mid-point of a range of estimates) provided by the company is higher than the mean EPS estimate the day before the guidance was issued.

Positive guidances are generally bullish for stocks and the opposite applies for negative guidances.

However, For Q3 2020, the S&P 500 is reporting a blended (combined actual results for companies that have reported and estimated results for companies that have yet to report) year-over-year decline in earnings of -9.8%.

It would appear the lacklustre sentiment as observed in the equities market suggests there are concerns over earnings decline more than earnings beat or positive guidance results.

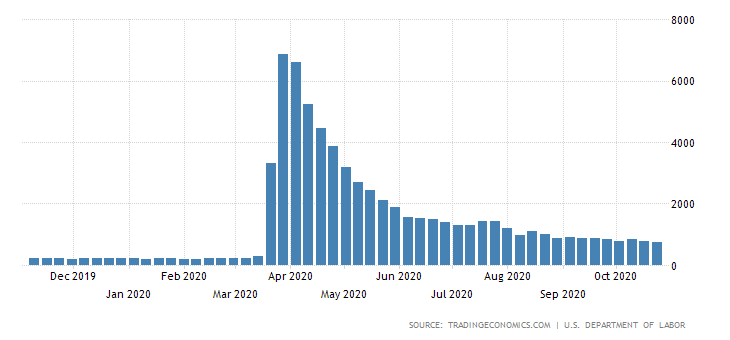

US Initial Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data and is a leading indicator.

Increasing initial jobless claims should be viewed as bearish for the financial markets.

Since the start of the Covid-19 pandemic, the US initial jobless claims peaked at 6,867K in April 2020, and has been decreasing steadily.

The latest figure of 787K is lower than most economists’ estimates of 860K and less than the previous figure of 842K signalling slightly improved conditions.

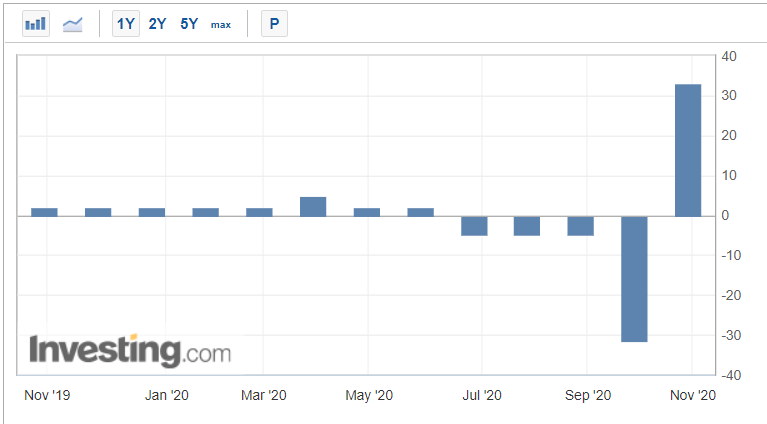

US Gross Domestic Product (GDP) – Quarterly

Gross Domestic Product (GDP) measures the annual change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

GDP — the broadest measure of economic activity — increased by an annualised rate of 33.1% in the third quarter, exceeding a 31% estimate. This represents a record breaking expansion ever, on the back of a previous record -31.4% drop in the second quarter.

Consumer spending surged and was the key lever of growth, assisted by unemployment benefits from the federal government. That said, growth was also noticeable from private and fixed investments, as well as exports. In part, decreases in federal government spending helped (Lesser fees paid to coordinate the Paycheck Protection Program loans).

Gold

Gold hit an all-time high at 2089 in the month of August 2020. However, it experienced a sharp pullback to as low as 1852 in September 2020.

Gold is currently still trading in the lower range (1,879.9) of the consolidation mode for 3 months since the September 2020 low.

Gold is currently consolidation trading at the lower end of its trading range, after experiencing 2 months worth of pullbacks and consolidation.

The concurrent pullbacks of both the stock market and gold is indeed highlighting increasing market uncertainty.

Volatility Index (VIX)

The CBOE VIX escalated in the month of October 2020 to a peak of 40.28, before closing at 38.02.

Since VIX opened at 25.78 at the beginning of October 2020, it started a sustained upwards trend due to high market uncertainties over the US elections and also resurgence of Covid-19 in both the US and Europe.

As of the October 2020 close, the Vix remains stubbornly high at 38.02.

A stubborn VIX that refuses to break below the 20 threshold is a sign of significant market concerns and indecisiveness.

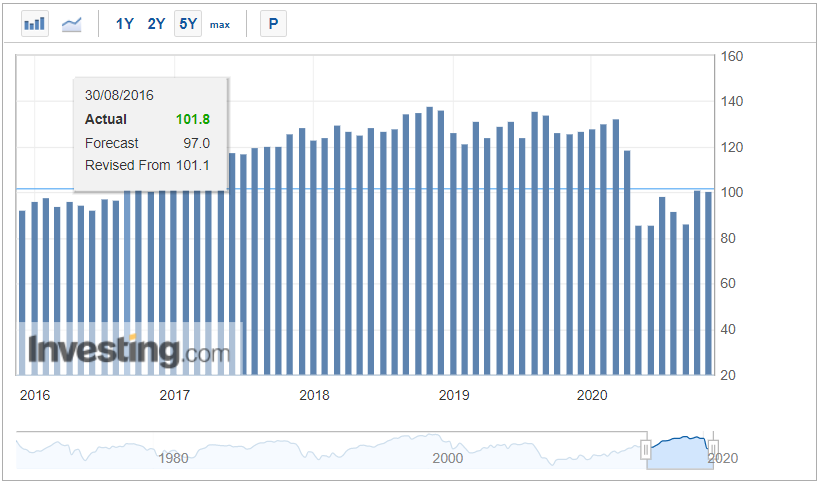

US Consumer Confidence

The consumer confidence index is closely watched as an indicator of economic health because consumer spending accounts for about 70% of economic activity.

Consumer confidence is an economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation.

The US. consumer confidence dropped in October, due to expectations that economic activity would slow in the last quarter as the boost from fiscal stimulus fades, and new fiscal stimulus discussions remain at an impasse.

The Conference Board said on Tuesday its consumer confidence index slipped to reading of 100.9 this month from 101.3 in September.

An increasing US Consumer Spending trend is bullish for the economy, whereas a decreasing trend is generally bearish/concerning.

Conclusion

- Global stocks suffered their biggest setback since the March meltdown, once again due to Covid-19 resurgence.

- Political uncertainty due to the upcoming US presidential elections in November 2020, blended with jostling messages of a joint Democrat and Republican stimulus bill drove markets initially.

- When it became clear a stimulus bill will not be on the horizon soon, Covid fears in Europe and also the US pulled the lever for the sharp pullback experienced in October.

- Interestingly, there has not been a reallocation towards typical safe haven assets like US Treasuries and Gold, despite the concerning selldown.

- This collective selloff theme across all assets, including safe haven assets, is a clear departure from the March 2020 selldown.

- It is therefore important not to assume the current Covid-19 situation affecting the stock market will be similar to March 2020.

- While the concerns are different, there are still many factors of uncertainty and the fact remains we are seeing mixed economic data, with some deterioration fears due to reinstatement of lockdowns in Europe.