INTRODUCTION

While Singapore is one of the world’s best and most efficient economies, it is very seldom we’ve had flagship companies that are renowned internationally.

Many Singaporeans have questioned how this is actually possible – to be such a strong and prosperous country (our GDP per capita is 4th in the world), and yet have so few Singaporean companies that are well known to outsiders?

Creative Technologies (SGX: C76) was probably a close one, but the sizzle went out as quickly as it formed. Sim Wong Hoo, our local and home grown technological billionaire made headways on the international front during the 1980s into the 1990s for their SoundBlaster sound cards. What made Singapore proud was Mr Sim’s entrepreneurial drive to create something from nothing. This was done through many years of self perseverance as a one man show, by creating a product that rode the Microsoft’s Window PC wave. However, the rise of Apple and key technological changes to the music, entertainment and PC industries brought forth more disruption and competition. Since the early 2000s, Creative Technologies lost its competitive advantage and quickly went into oblivion.

Perhaps Singapore Airlines (SGX:C6L), up to the point of pre-Covid-19 is Singapore’s flagship company and business that is known worldwide. SIA is renowned for her pinpoint service standards with the unforgettable kebaya dressed flight attendants. In addition to that, SIA is also famous for her luxurious flight experiences regardless of cabin class, and making every passenger feel flying is a personal experience.

However, truth be told, both stocks have been lacklustre since 2000, with SIA having lost -77% and Creative Technologies losing -91% of their stock values respectively to date.

The question now is this – is it high time we have a new market darling in Singapore? Given Singapore’s track record of not being particularly capable of nurturing a home grown business that is capable of competing head to head with the best on the international stage, is this expectation even realistic?

TAKEAWAY

- Singapore has had very few successful businesses that are truly internationally renowned.

- Singapore Airlines has to date, been the pride of joy of Singapore with its service excellence and global reputation. However, since early 2000 the SIA share price has been on a decline, and is now further exacerbated by the global Covid-19 pandemic.

- In this article, we have shared why we think Sea Ltd might be the next Singapore based company that will make international headways, including its scope for future growth as well as investment risks.

We plan to highlight to our readers, in this article, a strong candidate that can make international headways, and also provide some context as to why the current conditions are suited for this company to unseat SIA’s position as Singapore’s flagship company.

Many Singaporeans may not have heard of Sea Ltd, but most would know or have actually used the e-commerce platform Shopee. Well, Shopee is just one out of 3 Sea Ltd’s key businesses.

Also bet you didn’t know the name Sea Ltd is derived from South East Asia where the company is located and operating, with company HQ in Singapore.

It all started with Garena

Sea Ltd’s original business segment, Garena is a leading global online games developer and publisher. Thus far it is the only business segment that is profitable with an extremely large international footprint. Garena owns the mobile game “Free Fire” which happens to be the highest grossing mobile game in Latin America and Southeast Asia!

The main reason why Free Fire is so successful is Sea Ltd’s ability to consistently deliver superior quality content tailored to its global customer base. Efforts include partnering with celebrity actors and singers, introducing more social and community features into the game where users meet and hang out online socially. Furthermore, Free Fire is really into eSports having recently hosted a 2 month tournament in Brazil! More importantly, Garena understood the up and coming trend of commercialising online viewership of eSport events. For example, the grand finals for Free Fire Indonesia Masters 2020 Fall was broadcasted on national TV.

The bottom line message is very simple – Garena through Free Fire is riding and leveraging upon the new trend of mobile gaming, eSports and monetizing viewership (up and coming market), which are expected to have long runaways ahead for many years to come.

What happened in 2015 and beyond?

Very few would have been able to guess the success of Garena since its inception by founder Forrest Li in 2009. Starting out as a communication tool for video gamers, Garena expanded into third party game publishing, before creating its own game such as its big hit Free Fire.

Leveraging off its success, Garena proceeded to use its highly profitable digital gaming business to expand into other industries, such as the Digital consumer economy in the South East Asia region. Sea Ltd did something very commendable, which was to develop its own e-commerce platform from scratch, using internal resources, which many now know as Shopee.

Getting further inspiration from South America’s e-commerce juggernaut MercadoLibre (NASDAQ:MELI), it realised it could grow much faster by launching a digital financial services business, SeaMoney.

This is what Forrest Li has to say about the 3 prong business strategy:

“Even though the combination may seem ‘counterintuitive’ to some, having a finger in both pies, along with a nascent fintech unit, is helping Sea thrive.”

The e-Commerce Giant Shopee

This business segment will probably require little elaboration for our Singaporean readers.

Shopee is a growing e-commerce giant that has greatly benefited from the recent Covid-19 lockdowns, where key changes include the way consumer purchase goods have accelerated from physical retail to online, in a big way.

Shopee ranks as the leading downloaded app in the Shopping category across Southeast Asia and Taiwan, and second on a global level. Just to provide an idea of Shopee’s footprint, Indonesia, which happens to be their largest market, averages daily orders of 3.4 million!

Another simple bottom line message – Shopee’s market penetration is significant and has even more scope to grow. It may very well be the case for Shopee’s app to exist on almost all Singaporean and numerous Indonesian mobiles! Also given Free Fire’s success in Latin America, Shopee is also making headways into that region.

SeaMoney - the next big thing

Moving on to SeaMoney, which is a leading digital payments and financial services provider in Southeast Asia. SeaMoney is deepening its integration with Shopee, leveraging Shopee’s rapid growth and extensive reach to scale efficiently and effectively. In October 2020, more than 30% of Shopee’s total gross orders were paid using ShopeePay’s mobile wallet.

More importantly, this business segment will be at the heart of the recent Digital Bank License awarded to Sea Ltd. For further details on how SeaMoney is expected to grow, view our earlier Digital Banking article.

So where can I buy Sea Ltd?

Before we go into details, let’s not get disappointed when we highlight that Sea Ltd, while based in Singapore and is a Singapore registered company, did not actually list the company on the Singapore Stock Exchange.

For this very reason, trading in Sea Ltd’s stock amongst Singaporeans and PRs have not really generated widespread interest locally.

However, that is probably not a bad thing. The reason why we say this is because Sea Ltd is actually traded on the US stock market, via what is commonly known as an American Depositary Receipt (ADR) which is a flexible certificate issued by a US depository bank that represents a specific number of shares equivalent to a foreign company’s stock. This ADR can be traded on the US stock exchanges exactly like how any US domestic share would, and of course will also have to fulfil similar financial reporting requirements in the US.

The reason why this is not a bad thing is because Sea Ltd, as a direct result of it being an ADR, means that it is actually already very popular amongst US and worldwide investors. Many global fund houses, traders and institutions are already invested in this company and see its potential.

In the eyes of these foreign investors, buying Sea Ltd is ideal because they can get overseas exposure into an emerging market such as South East Asia, with the added benefit of knowing Sea Ltd is located in one of the most reliable, safe and efficient countries in the world, which is Singapore.

Sometimes there might be some truth in this saying “The best thing happens in your own backyard without you even knowing”.

CONCLUSIONS

When we scour the various businesses in Singapore, we can clearly see Sea Ltd being an outlier. It has an extremely unique business model that ranks among its international peers such as Amazon, Alibaba and Tencent. There are frankly not many up and coming companies that exist in the world having a collective footprint in the digital gaming, e-commerce, and digital banking industries. We effectively have a 3-in-1 with Sea Ltd.

All these 3 business segments are in high growth, upward trending industries with long runaways. Most importantly, thus far, Sea Ltd has shown it is perfectly capable in executing innovatively and effectively to capture market share and grow aggressively within these spaces.

Last, it is true Sea Ltd is not yet profitable as a company. Garena is the only profitable unit, with Shopee gradually showing it has a path to profitability. However SeaMoney will likely require more capital investments, R&D, merger and acquisition play, Sales and Marketing spend before it turns profitable.

Therefore the key to being invested in Sea Ltd must come, first in the understanding of the business model, having confidence it can execute and grow aggressively, and finally willingness to accept investment risks associated with a high cash outlay, but fast growing company that will take many years to achieve a net profitable bottom line.

In closing, Singaporeans and PRs should now be aware we have a new gem that is emerging within our shores, and it could very well be a role model to kick start the new wave of successful entrepreneurial spirit in Singapore!

Find out how TraderGPS can help in trading Sea Ltd

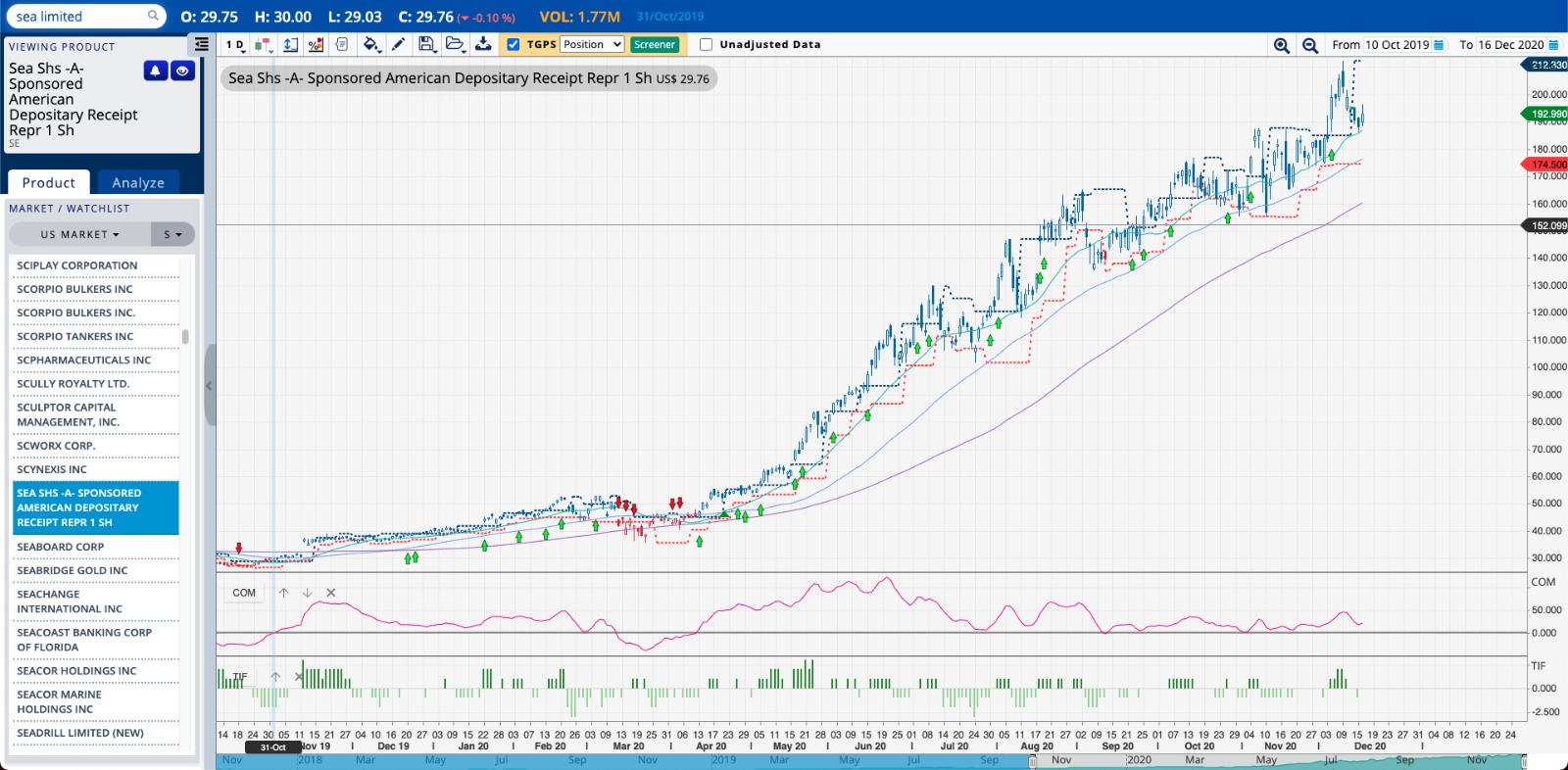

TradersGPS is a well-known, market neutral strategy. The strategy was once conceptualized by a professional trading educator, Collin Seow from Systematic Trader group, and has since been developed and enhanced by the AlgoMerchant team.

We are maintaining and keeping the original algorithm, which has proven successful in generating multi-fold returns for decades for many traders. With TradersGPS, you can identify both short and long-term trading opportunities, gain an upper hand in stock picking, and profit from breakouts. It is also now possible for traders to start building their portfolios with a relatively smaller capital.

This strategy allows traders to succeed in the stock market with little to no market knowledge. The system will show you what and when to trade.

Click on the image to check out historically the entry signals (green) and exit signals (red) recommended by TraderGPS on Sea Ltd!

Disclaimer:

AlgoMerchant does not hold any shares in Sea Ltd, nor are we paid by Sea Ltd or any other affiliates to promote the company.