Moore Capital, one of the most prominent macro hedge funds, was said to shut down its operation and return money to investors after underperformance for the past few years.

This signified the difficulty of trading the market amidst the uncertainties around geopolitical tensions and central banks’ policy. It sounds rather ironic given that by simply using ‘buy and hold’ strategy, one would have outperformed most of the asset managers.

Looking at the price actions last week, for example, S&P500 -0.33%, Oil futures -0.11%, US 10yr yield -6bps, Gold futures -0.4%, the market seemed to react to potential interruption from US-China trade deal due to the HK bill that US Congress would force Trump to sign. Now if this bill is signed, the response from China wouldn’t be positive and hence the market was trading with a bit of risk-off sentiment last week.

However, market participants are betting that Trump may delay the impending December 15 tariff hike if US-China trade talk is postponed due to spat over HK Bill signing (Trump is unlikely to be able to stop this bill).

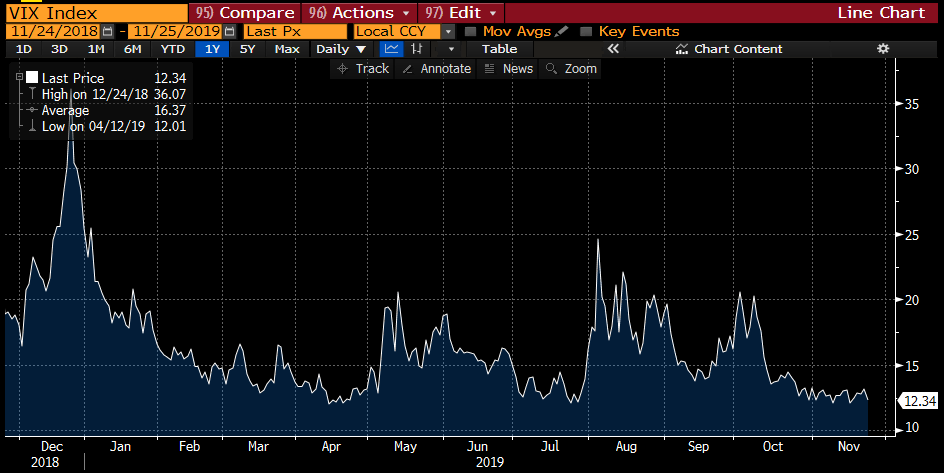

But stronger US PMI last week will keep the US data outlook supported and less likelihood of Fed for a further rate cut in January 2020. All in all, despite uncertainties on future US-China trade talks (hence future global growth expectation), the market is still poised to long equity and probably buy VIX option as a hedge as it’s still relatively cheap (see the VIX chart below).

While we agree that fundamentally it’s hard to see a flight to a safe-haven asset (Fed has been overly supportive to the stock market and keep injecting $50-60 Billion liquidity every month), it’s possibly worth looking at the fact that we’re entering the end of the year where there would be a net capital outflow from the US (This rarely happened in the past!).

This is primarily due to less foreign debt purchases (Why would China keep accumulating US Treasuries?) and yield-seeking outflow (e.g. Indo 5Y bond is yielding 6.5%) – hence it’s probably not a bad idea to diversify into the EM assets given on the back of mild market sentiment view for relative value trades. (Shanghai composite has been flattish for the past 3 months while S&P500 up almost 10%).

Next week will be relatively light in terms of data, so expect the US-China talks and HK bill signing to be the primary focus.