WHAT'S HAPPENING

Many in our AlgoMerchant Trading community would have read about the crazy buying frenzy that’s been going on with penny stocks such as GameStop and AMC Entertainment. So what’s been going on and why are the news headlines focusing on the subreddit group called WallStreetBets (#WSB)?

Truth of the matter is, we are currently experiencing disruption in financial markets. These disruptions have and will continue to change the trading dynamics and market conditions for a long time to come.

Yes, you’ve got that right. This stock market regime is distinctly different from the one post Covid-19 recovery since April 2020, and certainly miles apart from pre-Covid days.

Allow us to explain why.

Never in the history of mankind, have small and individual retail traders banded together and come to a collective agreement, using the popular technology social platform Reddit, to buy up the shares of heavily shorted stocks by big hedge fund players.

So this is the maneuver play, and a really interesting and clever one, spurred by the empowerment of the young and brave, eager to impact the world by challenging conventional wisdom.

1

Some influencer(s) in the #WSB became aware there were greedy hedge fund players that used leverage (borrowed excessively) to short certain stocks, in particular stocks like GameStop, AMC, BlackBerry, and Fubo etc

2

They know this through trading information platforms that provide readily available information on ‘Short Interest’, which show the number of shares that have been sold short but have yet to be closed.

3

Where this gets interesting is when the short interest shows that the number of shares shorted is in excess of the available shares traded in the open market.

4

This is where #WSB knew these big hedge fund players borrowed money and shares to suppress the share prices of these companies.

5

Key influencer(s) rallied the masses in the community of #WSB, on the rally cry that as small, individual retails traders they were nothing, but if they worked together they would be a reckoning force to break the backs of these previously ‘untouchable’ hedge fund players.

6

Boy were they successful, because the rule with short selling is that ALL those shares that they borrowed, MUST be paid back!

But here’s the kicker – and a really interesting one. To beat the big boys at their own game, this band of retail traders borrowed even more money to leverage, in order to drive these stock prices up.

1

Popular retail trading platforms like RobinHood allow(ed) small retail investors to use margin to buy up even more shares of these targeted stocks.

2

Speculation went even further by excessive bullish call options on the derivatives market.

3

Many have even resorted to selling put options (bearish) to deliver their intended means.

What is essential for our readers to know is the strong linkage between the derivatives market and Vix, which represents the Volatility Index, and is actually a critical data source that our robots actually use.

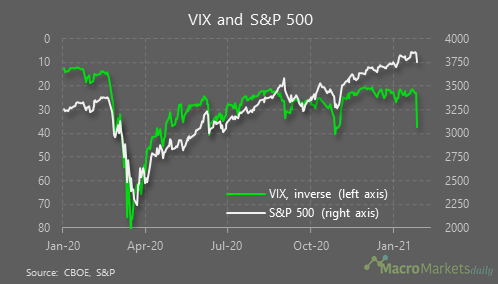

In short, the excessive speculation in the Options market resulted in a 70% increase in Vix, despite the S&P 500 dropping only -2.57%. It may be the case that this is the first time something like this has ever occurred.

So Why are markets selling down? Very simple. Speculative options trading is driving the VIX up. Increased volatility is causing de-leveraging and therefore liquidation of excessive assets.

Conclusion

In closing, where this really matters is the stock market environment has truly changed. Where it has changed principally is we now have an environment that has elevated expectations of volatility in days ahead despite a seemingly bullish uptrend market.

We do advise our AlgoMerchant community to trade and invest cautiously as these are certainly unprecedented times.