Did you know that since our first flagship AI trading robots were launched in October 2017, to date there have been a total of 9 instances of market selldowns, corrections and pullbacks? These 9 instances have peak-to-trough maximum drawdowns ranging from -5.7% to -35%.

Here’s a question for all our readers – how many of you would love to own an intelligent strategy that is able to tell you when the market bottoms during periods of heavy selldown and correction?

TAKEAWAY

- Since humans created the stock market, the human initiatives to identify market bottoms accurately and consistently have resulted in a never ending pursuit.

- At AlgoMerchant, we believe that we have created not only a human solution, but also an Artificial Intelligence (A.I.) solution that has a good track record in identifying market bottoms.

- In this article, we will demonstrate how AlgoMerchant’s flagship A.I. trading robot, Trident, has consistently identified 8 out of 9 instances of peak-to-trough drawdowns experienced by the US equities market since 2017.

- With Trident, our subscribers not only have an end-to-end automated trading solution that automatically identifies, executes and exits good reward to risk ratio trades, but also have additional benefits in accurately identifying stock market bottoms.

- This additional feature of Trident will greatly benefit traders and investors that also perform discretionary trades on their own.

Will you be surprised if we told you that AlgoMerchant’s flagship Trident AI trading robot had successfully identified and made rewarding trading positions in 8 out of these 9 market selldown instances, since October 2017 post official launch? The statistics are pointing to a lucky 88.88% success rate in Trident being able to identify market bottoms.

Most importantly, our readers may be keen to know that this 88.88% success rate is occurring during active service, where our robot subscribers can monitor and attest to the actual trades entered and exited into their live linked Interactive Brokers accounts.

The data that we are about to show you is not back test data, but ‘skin in the game’ real data!

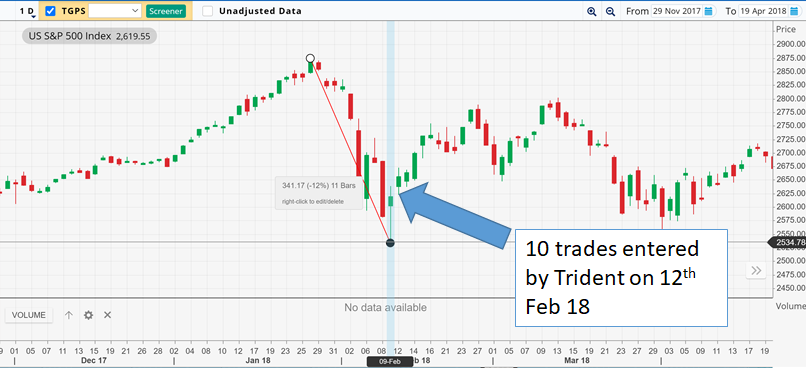

Instance #1 - Jan-Feb 2018 Inflation Fear Correction

In the beginning of 2018, after the stock market and economy had been running hot for a full year in 2017, the market experienced a panic sell after higher than anticipated inflation CPI results came out. The narrative back then was that the Fed might start to tighten monetary policy due to inflation worries.

The outcome was a flash market crash surmounting to a peak to trough -12% drawdown in a matter of days. While Trident didn’t make her move on the day low of 9 Feb 2018, it managed to follow through with a series of high ROI trades on the next trading day 12 Feb 2018!

10 trades in total were entered into by Trident with 100% win rates and net P/L ranging from 2.14 to 14.25%!

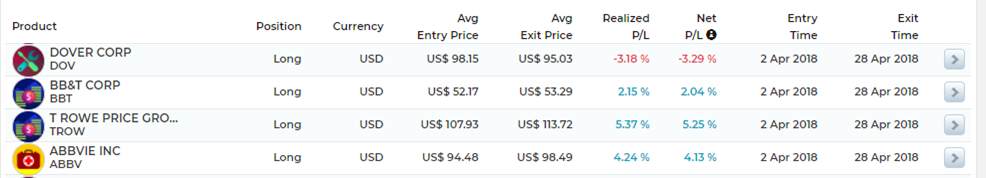

Instance #2 - Trump 1st Trade War Pullback

While the stock market was attempting its recovery from the Jan-Feb inflation selldown, Trump added more volatility to the market by initiating the start of his anti China trade war antics. That resulted in a near term peak to trough drawdown of -9% between March to April 2018.

Trident made her move on the day of the pullback low of 2nd April 2018, and entered into a total of 4 trades!

These 4 trades by Trident had a 75% win rates and net P/L ranging from -3.29 to 5.25%!

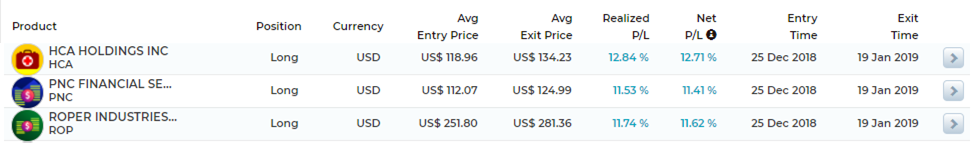

Instance #3 - Oct to Dec 2018 Market Correction

A prolonged volatile bear market occurred between October to Dec 2018, mainly due to Trump’s ongoing trade war antics with China and also Fed’s new positioning on tightening monetary policies. The net result was a peak to trough correction of -20%.

Trident made her move on the day of the correction low on 26th Dec 2018, and entered into a total of 3 trades!

These 3 trades by Trident had a 100% win rates and net P/L ranging from -11.41 to 12.71%!

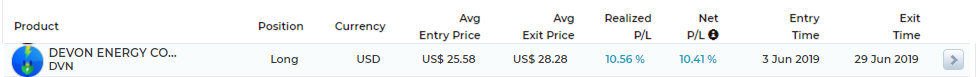

Instance #4 - Sell in May 2019 and Go Away

Stocks pulled back sharply in the month of May 2019 as investors fretted over U.S. trade relations with China and Mexico and worries over global economic growth. The net result was a peak to trough pullback of -7.6%.

Trident made her move on the day of the pullback low on 3rd June 2019, and successfully executed a 10.41% net P/L trade!

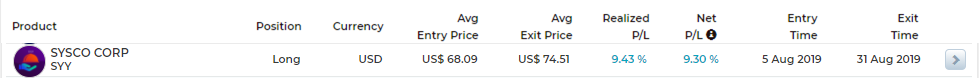

Instance #5 - Volatile July & August 2019

Stocks volatility between the end July to August 2019 was driven primarily by two factors: an escalation in the U.S.-China trade relations and a recession signal being flashed by the bond market. The net result was a peak to trough pullback of -6.9%.

Trident made her move on the day of the pullback low on 5th August 2019, and successfully executed a 9.3% net P/L trade!

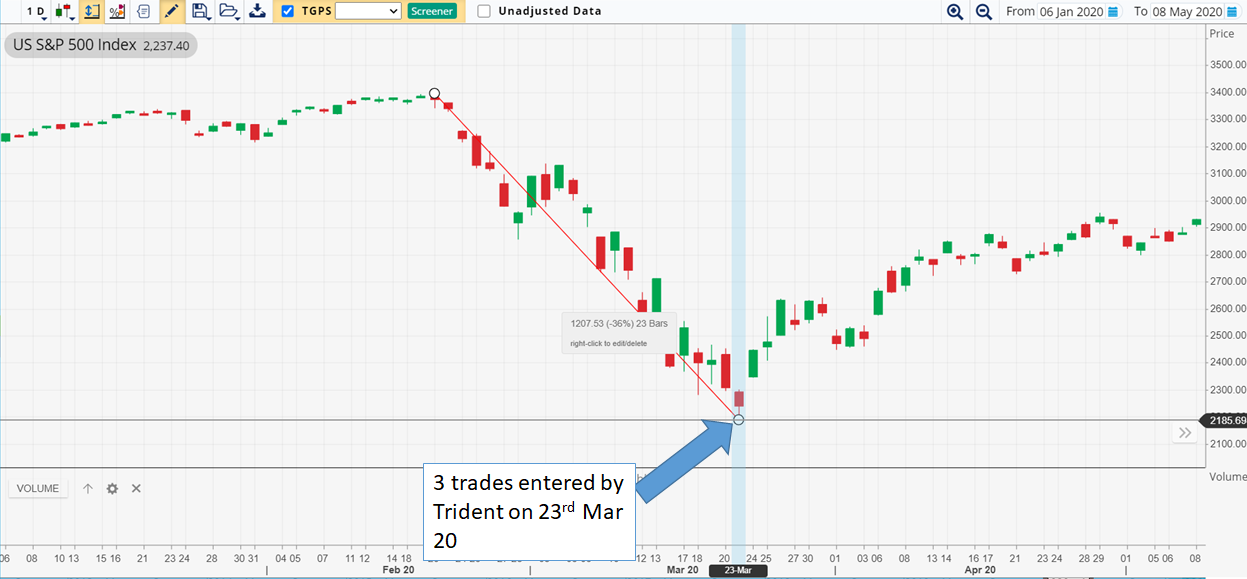

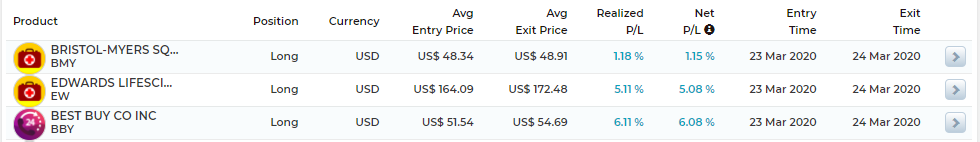

Instance #6 - Covid-19 Driven Recession

This event probably needs little write-up. The world officially entered into a recession in February due to the global Covid pandemic. Despite the world still being in recession, the US stock market bottomed on 23rd March 2020.

Trident made her move on the day of the selldown low on 23rd March 2020, and entered into a total of 3 trades!

These 3 trades by Trident had a 100% win rates and net P/L ranging from 1.15 to 6.08%!

Instance #7 - Short Market Pullback in June 2020

U.S. stocks suffered their worst one-day sell-off in three months on 11th June 2020 as growing concerns about a second wave of coronavirus cases took hold.

This was the only period/instance Trident did not identify and enter into any trades at the point of the pullback low.

Instance #8 - Inflation Fears Selldown

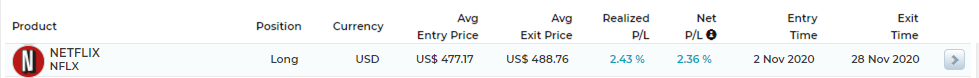

Covid-19 resurgence and US election uncertainties resulted in a choppy September to early November 2020. The outcome was a volatile seesaw surmounting to a peak to trough -10% drawdown from September to early November. While Trident didn’t make her move on the pullback low of 30 Oct 2020, Trident made her move on the next trading day 2nd November 2020, and successfully executed a 2.36% net P/L trade!

Instance #9 - Inflation Fears Selldown

Inflation fears took hold again in February and March 2021. The outcome was a minor pullback of -5.6% peak to trough. While Trident didn’t make her move on the pullback low of 4th March 2021, Trident made her move 2 trading days away on 8th March 2021, and entered into 3 new positions!

At the time of writing this article, these 3 new positions are still active and ongoing!

Conclusion

Since humans created the stock market, the human initiatives to identify market bottoms accurately and consistently have resulted in a never ending pursuit with little yield. At AlgoMerchant we believe we have created not a human solution, but an Artificial Intelligence (AI) solution that has a good track record in identifying market bottoms.

In this article we have demonstrated how AlgoMerchant’s flagship AI trading robot Trident, has consistently identified 8 out of a total 9 instances of peak to trough drawdowns experienced by the US equities market since 2017.

With Trident, our subscribers not only have an end-to-end automated trading solution that automatically identifies, executes and exits good reward to risk ratio trades, but also have additional benefits in accurately identifying stock market bottoms. This additional feature of Trident will greatly benefit traders and investors that also perform discretionary trades on their own in the following manner:

- Traders that trade US Index Futures or ETFs

- Stock Investors that often buy more of their favourite long term shares during market selldowns/dips

- Swing traders

TRI-X A.I INVESTING SOLUTION REBORN SEMINAR

27 Mar 2021 10AM @ AlgoMerchant Studio

JOIN US now for live demo on our new ROBO 2.0 Technology. Witness how it can boost trading performance by manifold!

Today Artificial Intelligence has revolutionized traditional trading by solving the major problems that human traders face:

– Capability to analyze big data and generate insights from thousands of stocks

– Stress test the trading strategy

– Automated and systematic trade execution to achieve consistent results

– Removing emotions

In this event, we will reveal A.I. trading secrets and solutions that has empowered thousands of traders globally.