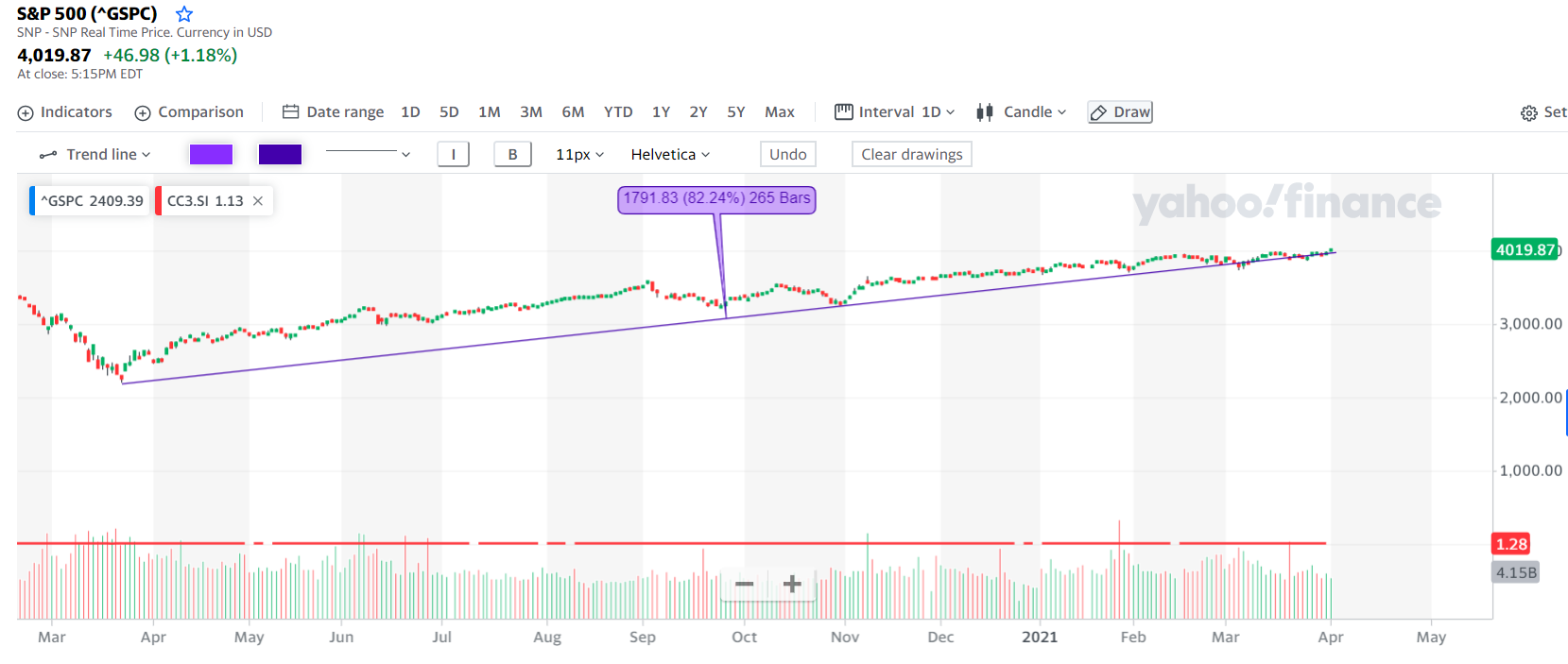

Do you know that the S&P 500 is currently trading 373 days from the Covid-19 selldown low that occurred on 27th March 2020?

Did you also know that the market has gained 82.24% since the low?

In this month’s market outlook article, we aim to answer the following question – what does market history tell us about the probability of a pullback occurring, 1 year after a V-shaped rally off a recession low?

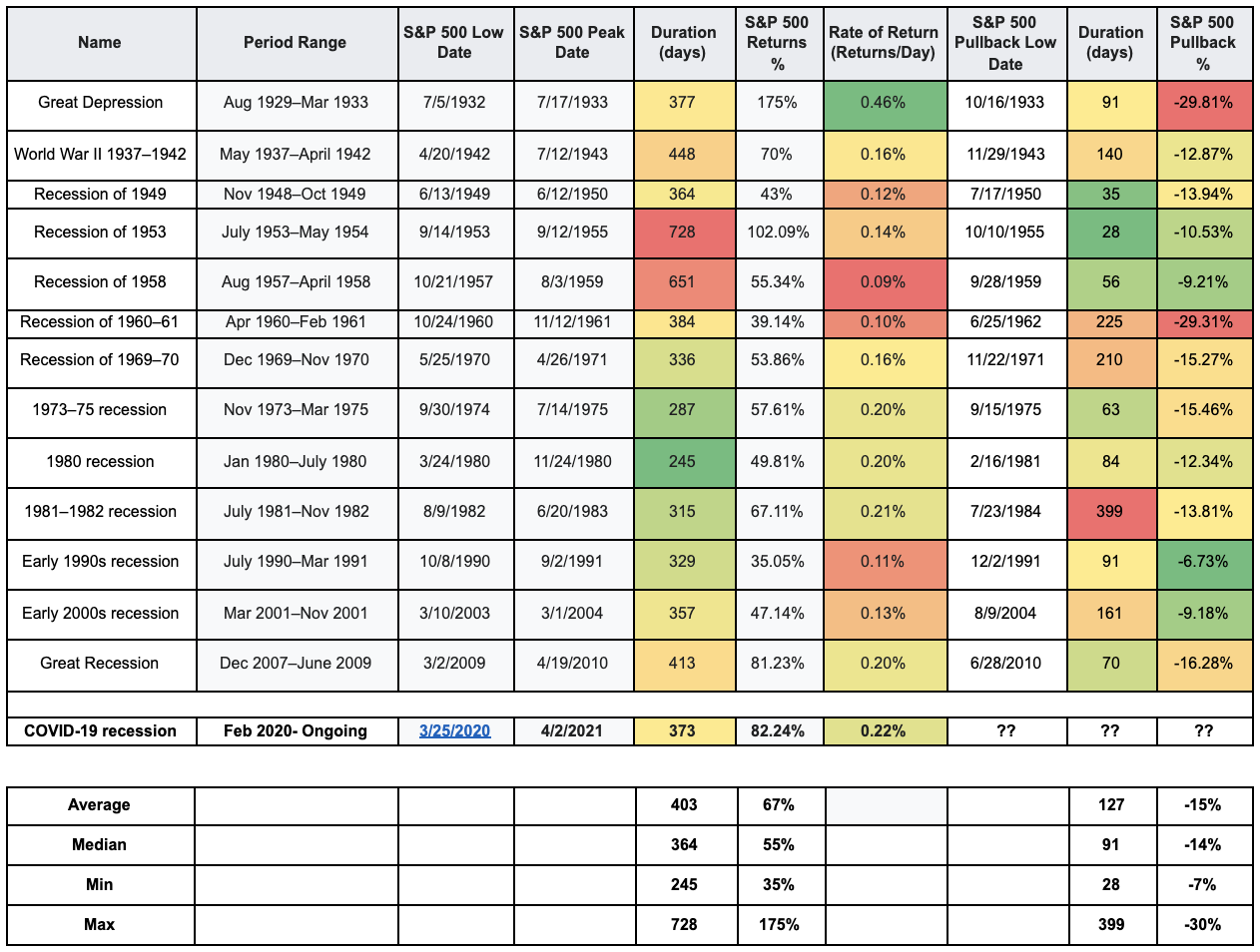

To answer this question, we’ve identified and studied all recession cases going back to the late 1920s. Including the recent Covid-19 recession, we’ve identified a total of 13 recession events.

TAKEAWAY

- This month’s market outlook article aims to answer the following question – what does market history tell us about the probability of a pullback occurring, 1 year after a V-shaped rally off a recession low?

- For all previous recession cases, a sustained rally off the recession lows occurred 100% of the time. What happened with the Covid-19 recession is no different.

- At some point in time, the market will give back some of these returns, and enter in a pullback/consolidation phase. Market history confirms this has happened 100% of the time.

- Current expectations are for a pullback to occur anytime within the next 39 days, provided the future market behaves in accordance with market history.

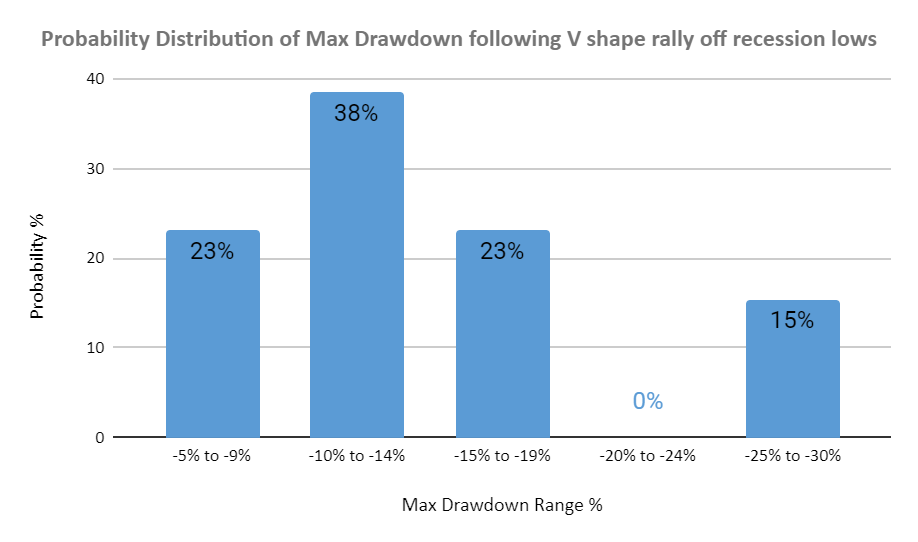

- The extreme bookends of historical drawdowns range from -7% on one end, to -30% on the other end. ~60% of the time the drawdown is expected to range between -10% to -20%.

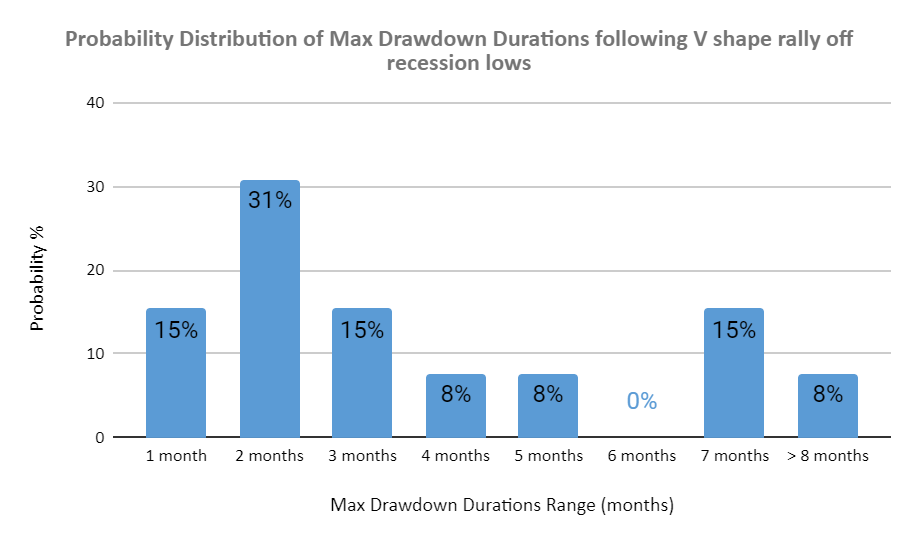

- Unfortunately, history does not provide any valuable insights into how long the next drawdown is going to take. It can range from 1 month to more than 1 year.

- In reality, financial markets are always uncertain and predictions are extremely hard, if not impossible. However, studying market history allows us to assess whether the current and future market behaviour is within expected range of what had previously happened.

- The most important thing is when it doesn’t, we will also learn something either way.

Post V-Shaped Rally Pullbacks Statistics1

BASIC FACTS

1

For all previous recession cases, a sustained rally off the recession lows had occurred 100% of the time. What happened with the Covid-19 recession is no different.

2

These sustained rallies lasted for a significant time, with a minimum duration of 245 days and a maximum of 728 days based on market history. The average rally lasts 403 days.

3

Note that we are currently 373 days off the Covid-19 selldown lows, which places us within reasonable proximity of the average and median rally duration of 403 and 364 days respectively.

4

At some point in time, the market will give back some of these returns, and enter in a pullback/consolidation phase. Market history confirms this happened 100% of the time.

5

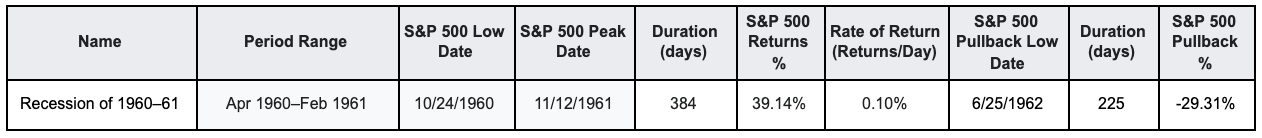

These pullbacks have a wide variance. They can last between 1 month to more than 1 year. The drawdowns can range between -7% and -30%.

Interesting Facts about this V Shape Covid-19 Rally

1

It is quite rare to have a >80% rally return. The Covid rally is the 4th out of 13 recession cases. The last time this occurred was post-2009 during the recovery from the great financial crisis.

2

This Covid-19 rally has the 2nd highest rate of return2 (0.22%/Day). This means that the Covid-19 rally is the 2nd time in history it managed to gain ~80% within such a short period of time.

3

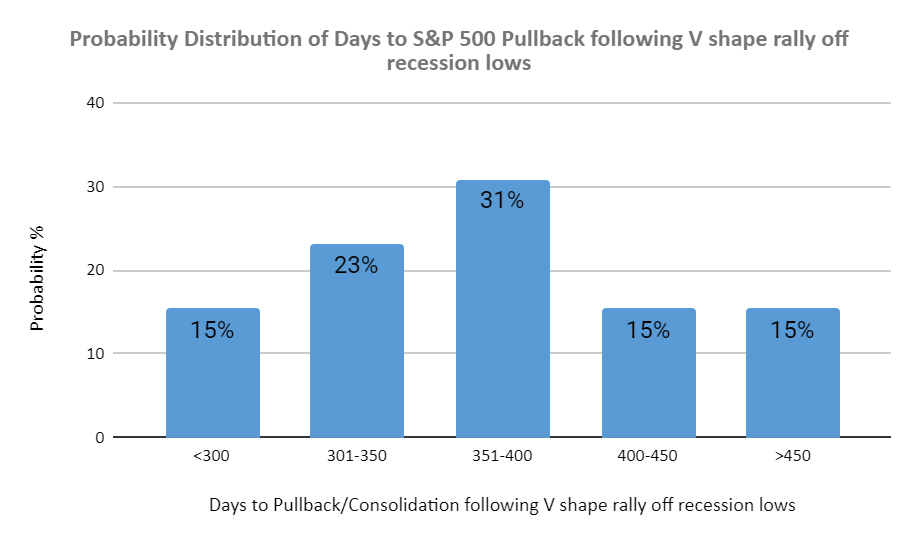

History tells us that when the rate of return was 0.20% or more, the pullbacks occurred within 245 to 413 days.

4

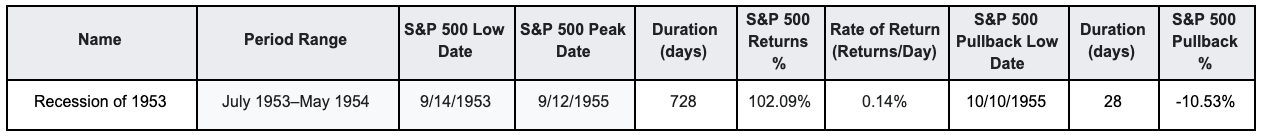

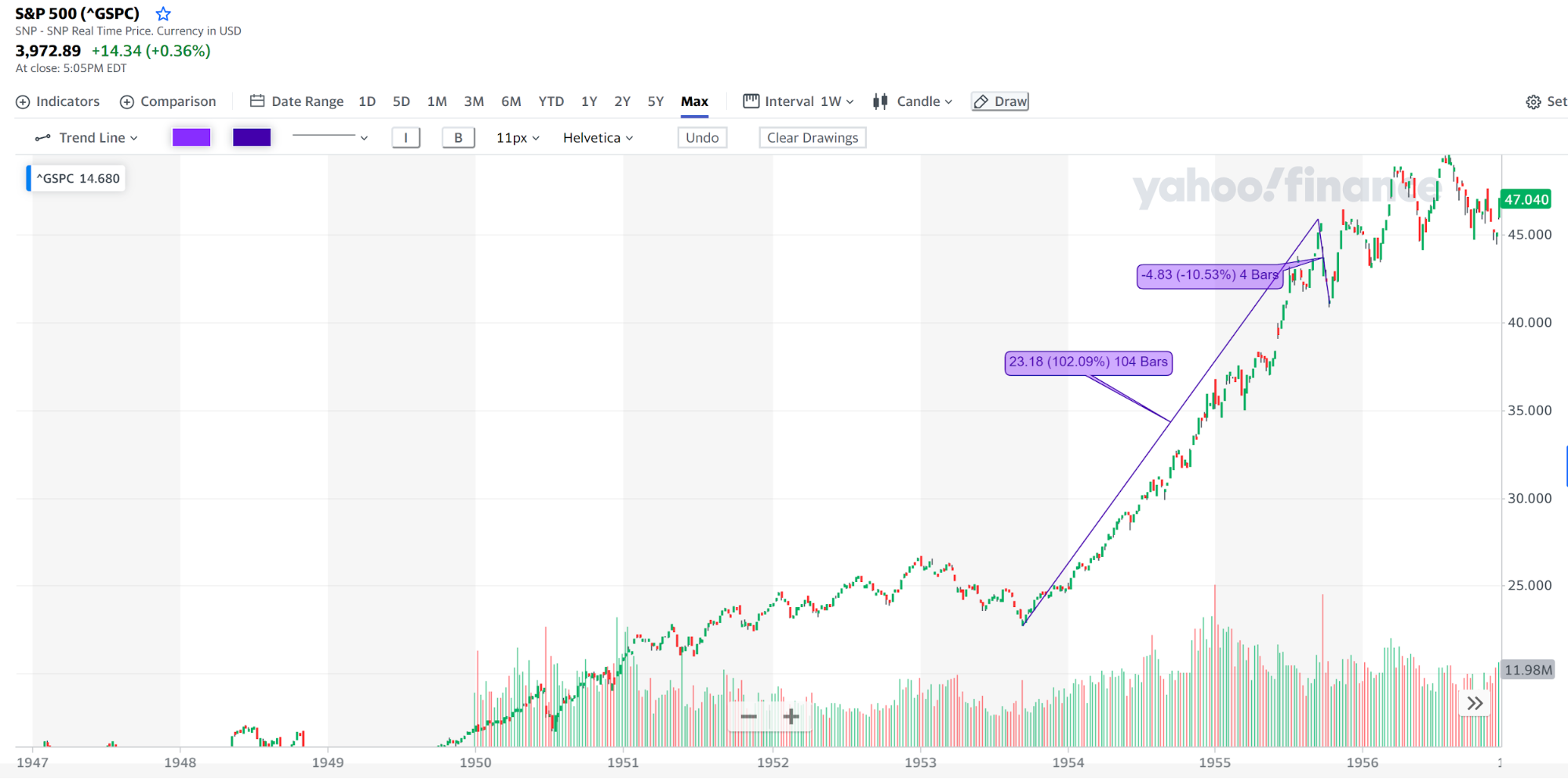

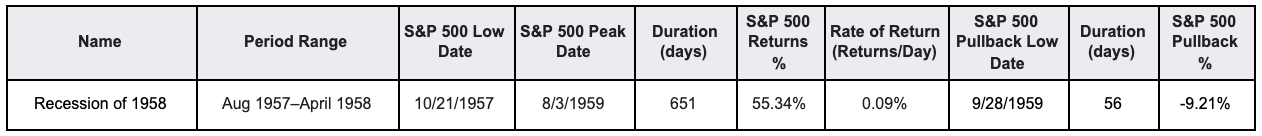

This is significant because there have been 2 instances where the durations to pullbacks have been clear outliers. These occurred following the 1953 and 1957 recessions when they took 728 and 651 days to experience pullbacks. However, what was clear was that slower rate of returns (0.14% and 0.09%) facilitated these prolonged rallies.

5

If history were to repeat for the Covid Recession, we can expect a pullback to occur anytime within the next 39 days.

What does History say about the next pullback?

1

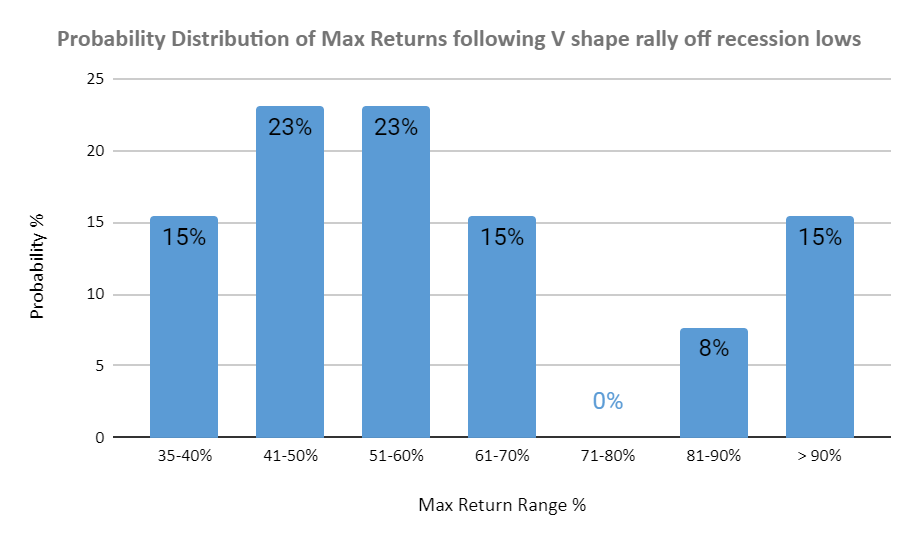

The extreme bookends of historical drawdowns range from -7% on one end to -30% on the other end. ~60% of the time, the drawdown is expected to range between -10% to -20%.

2

Unfortunately, history does not provide any valuable insights into how long the next drawdown is going to take. It can range from 1 month to more than 1 year.

1 All 13 historical recession charts relating to the rally off recession lows followed by their respective pullbacks are available in the Appendix.

2 Rate of Return is calculated via Total Rally Return (%) divided by the Total Rally Duration.

Conclusion

Increasingly, we are seeing more data leaning towards more volatility in the days ahead, in addition to the contents within this article.

The S&P 500 has hit the 4,000 level marker. We recently wrote an article showing that history had not been kind to traders and investors at the thousand level markers.

The S&P 500 remains extended above its 200 Daily Moving Average (DMA) and VIX is still not at typical bullish levels. In our January 2021 Market Outlook article, we provided some insight that normal and to-be-expected corrective pullback(s) in the magnitudes of -15% to -25% in 2021 will not be out of context based on historical market behaviour.

In reality, financial markets are always uncertain and predictions are extremely hard, if not impossible. However, studying market history allows us to assess whether the current and future market behaviour is within expected range of what had previously happened.

The most important thing is when it doesn’t, we will also learn something either way.

Disclaimer: Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

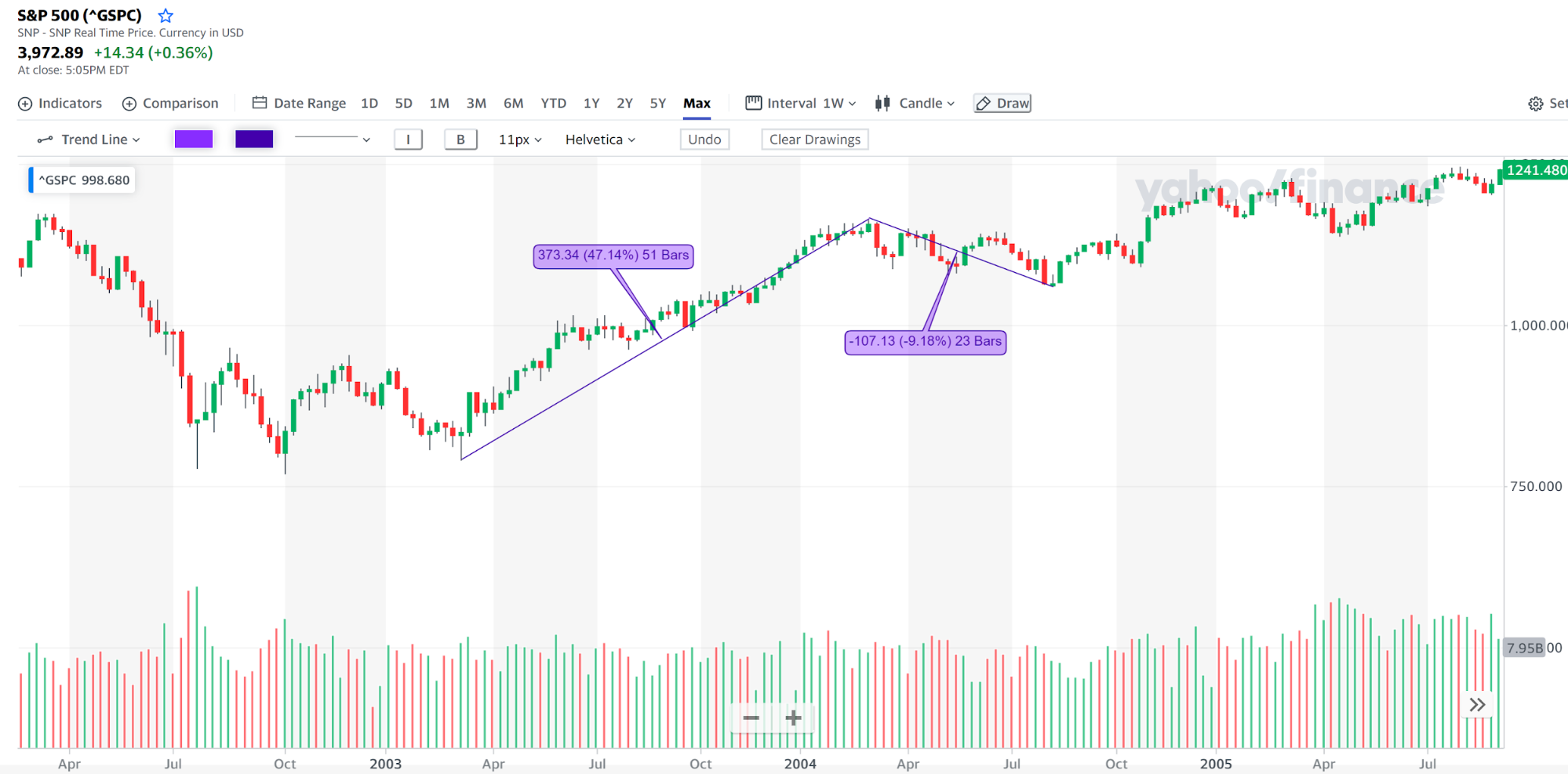

APPENDIX

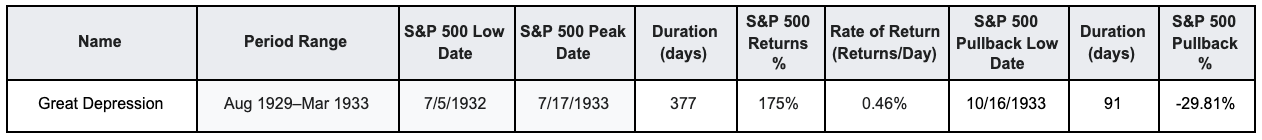

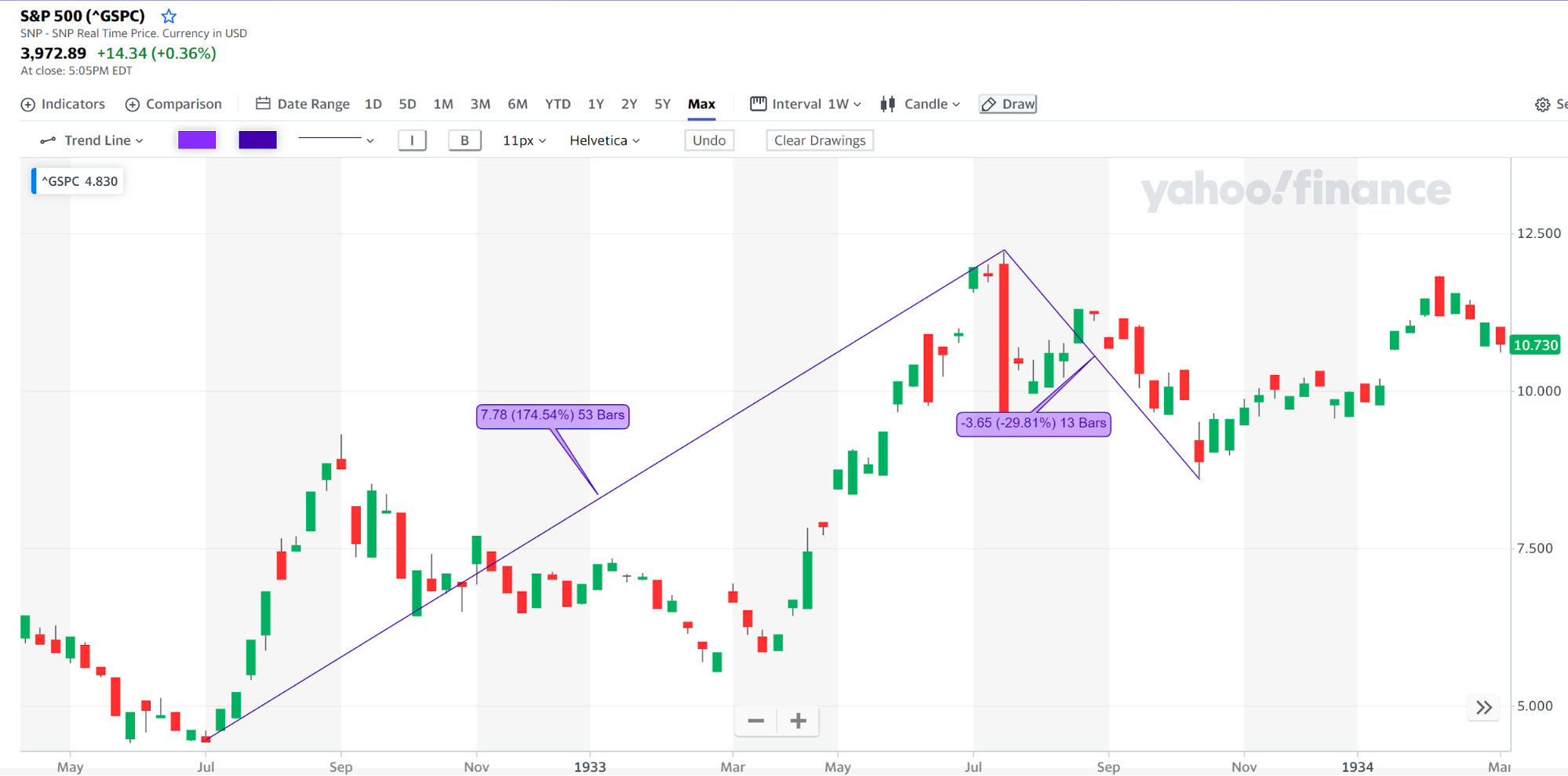

Aug 1929–Mar 1933 Recession Case Study

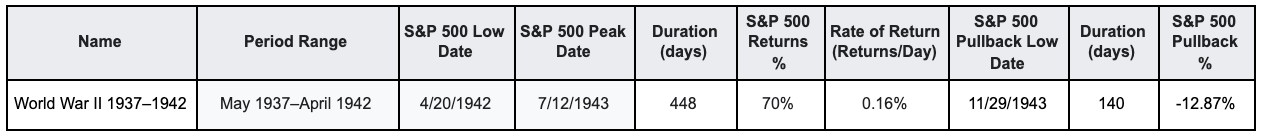

May 1937–April 1942 Recession Case Study

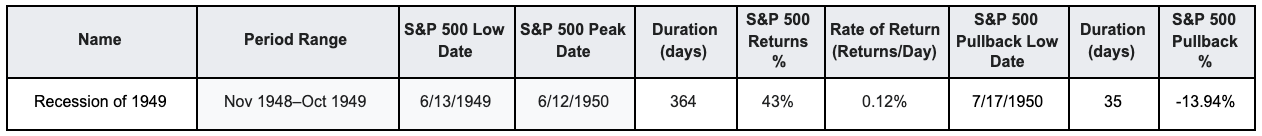

Nov 1948–Oct 1949 Recession Case Study

July 1953–May 1954 Recession Case Study

Aug 1957–April 1958 Recession Case Study

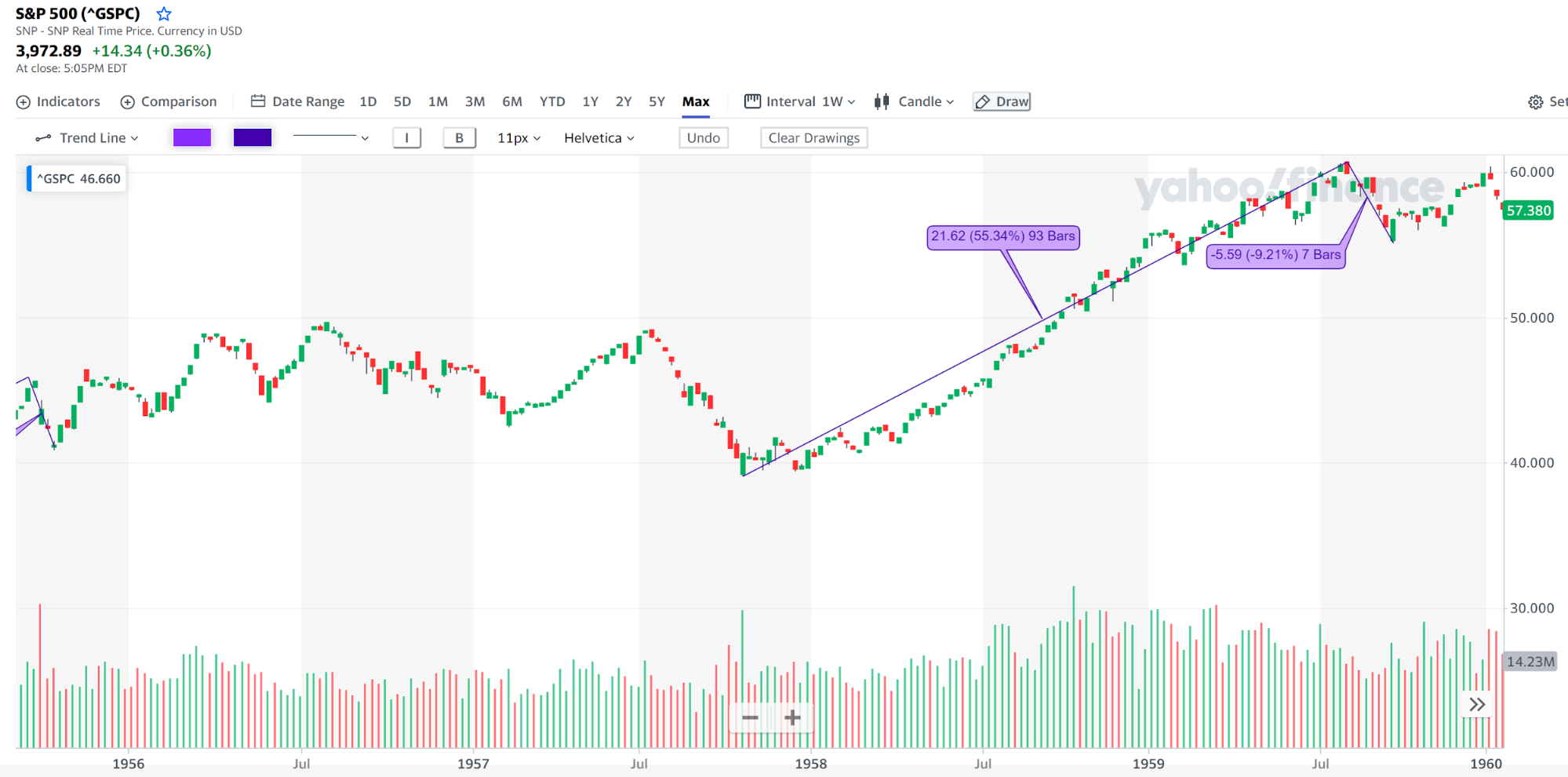

Apr 1960–Feb 1961 Recession Case Study

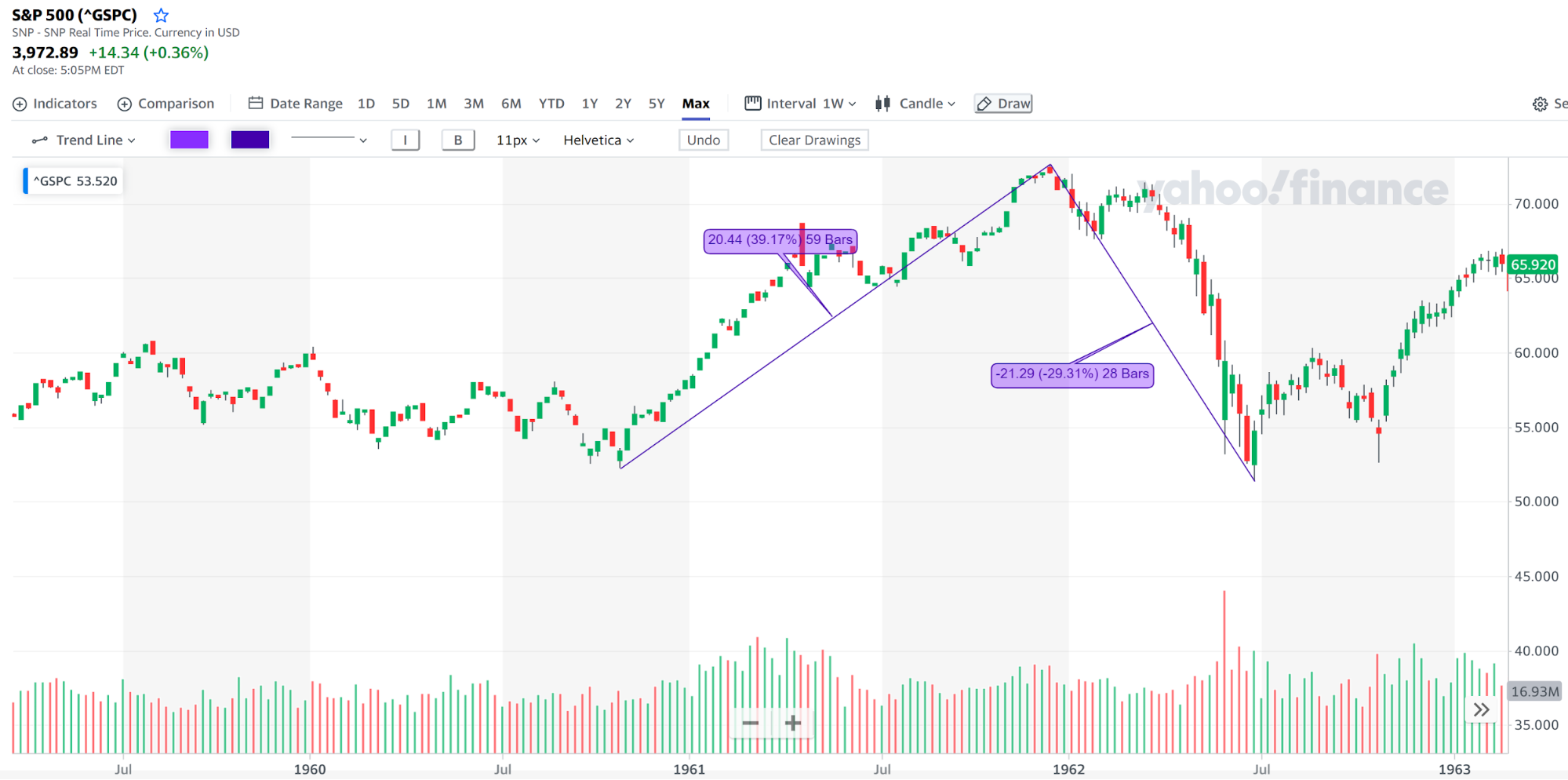

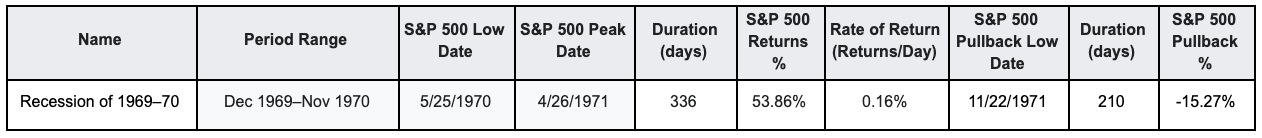

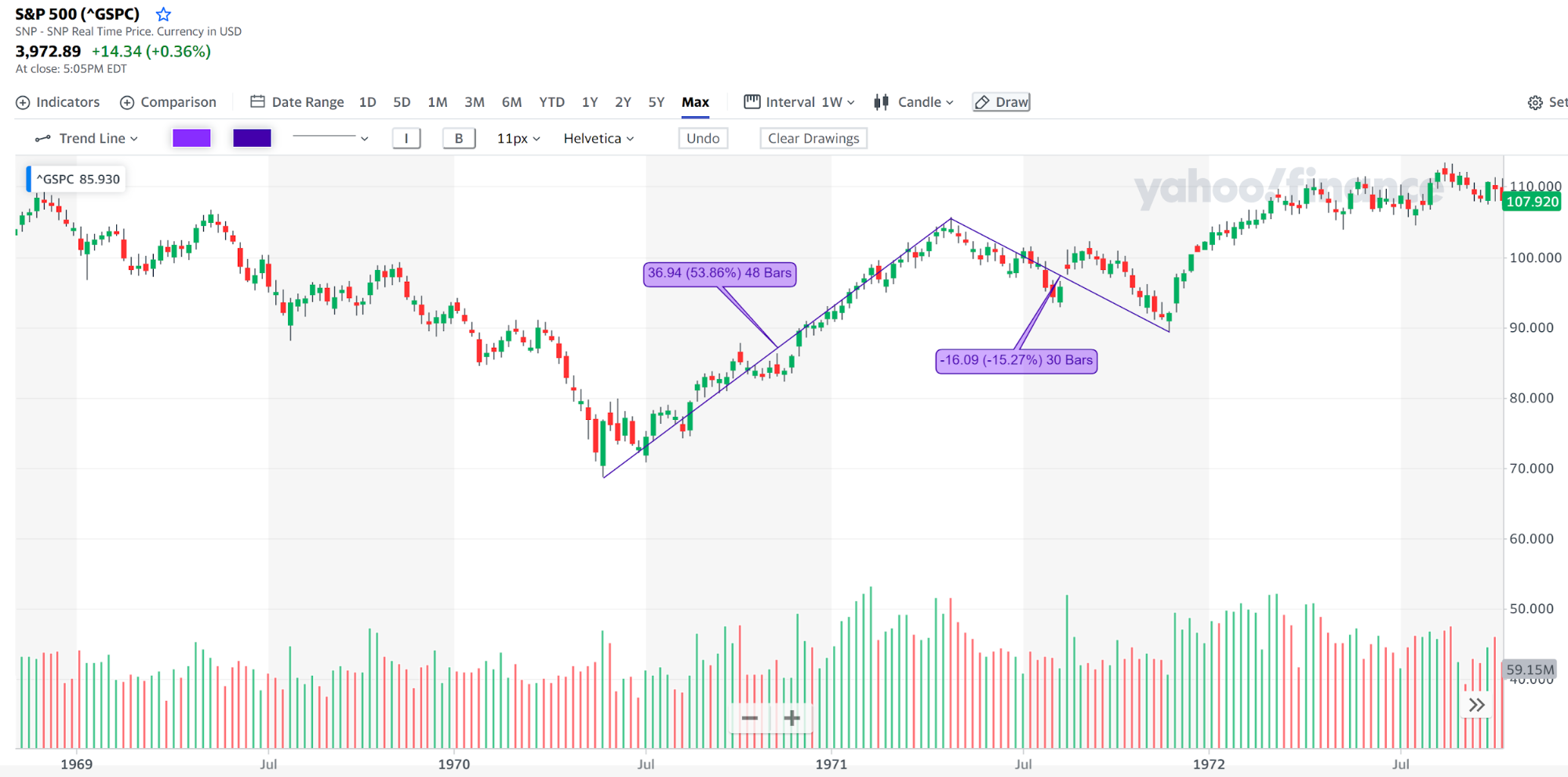

Dec 1969–Nov 1970 Recession Case Study

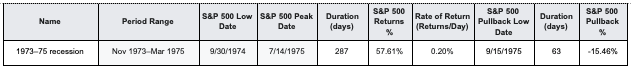

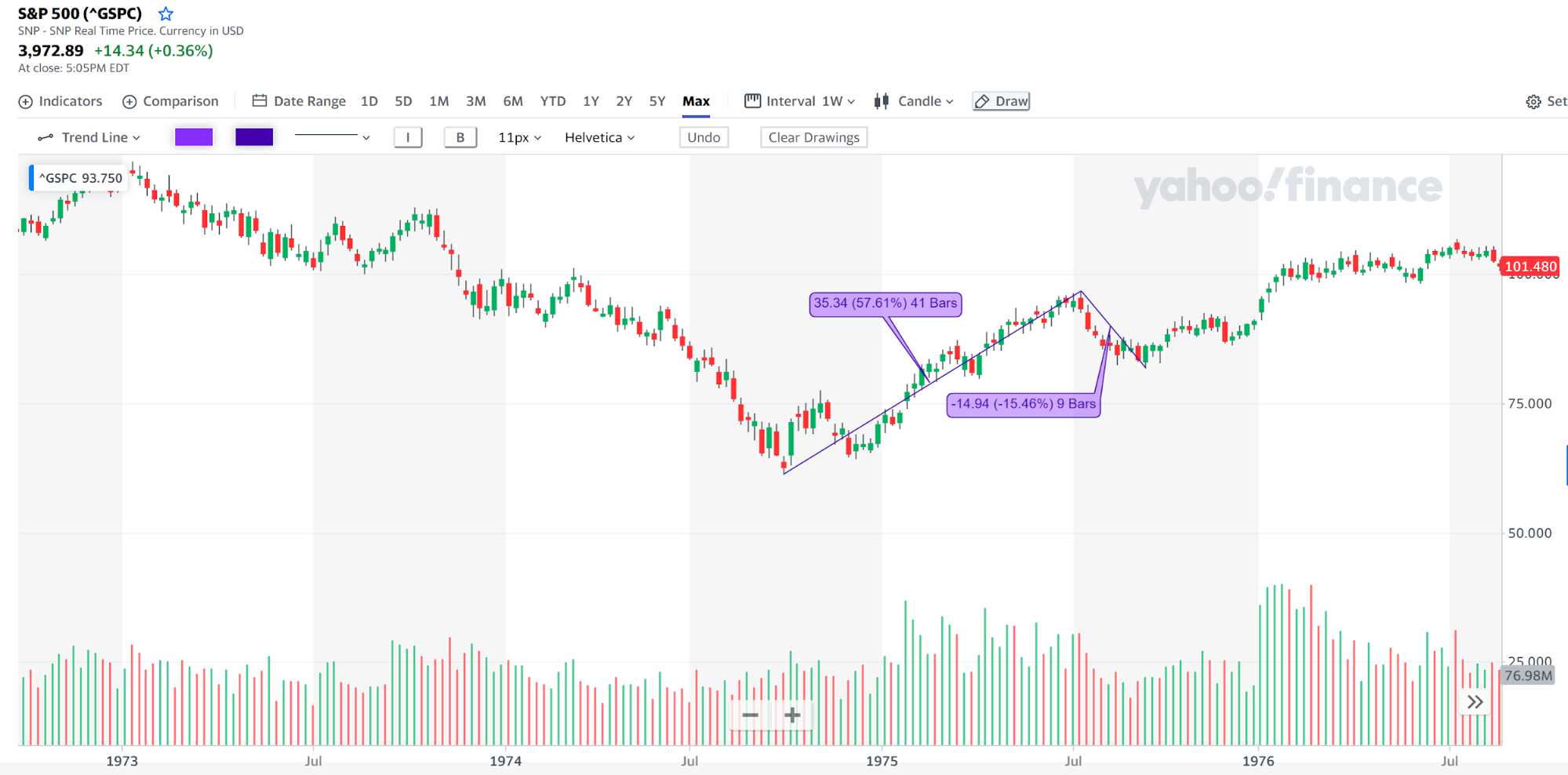

Nov 1973–Mar 1975 Recession Case Study

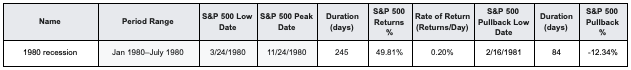

Jan 1980–July 1980 Recession Case Study

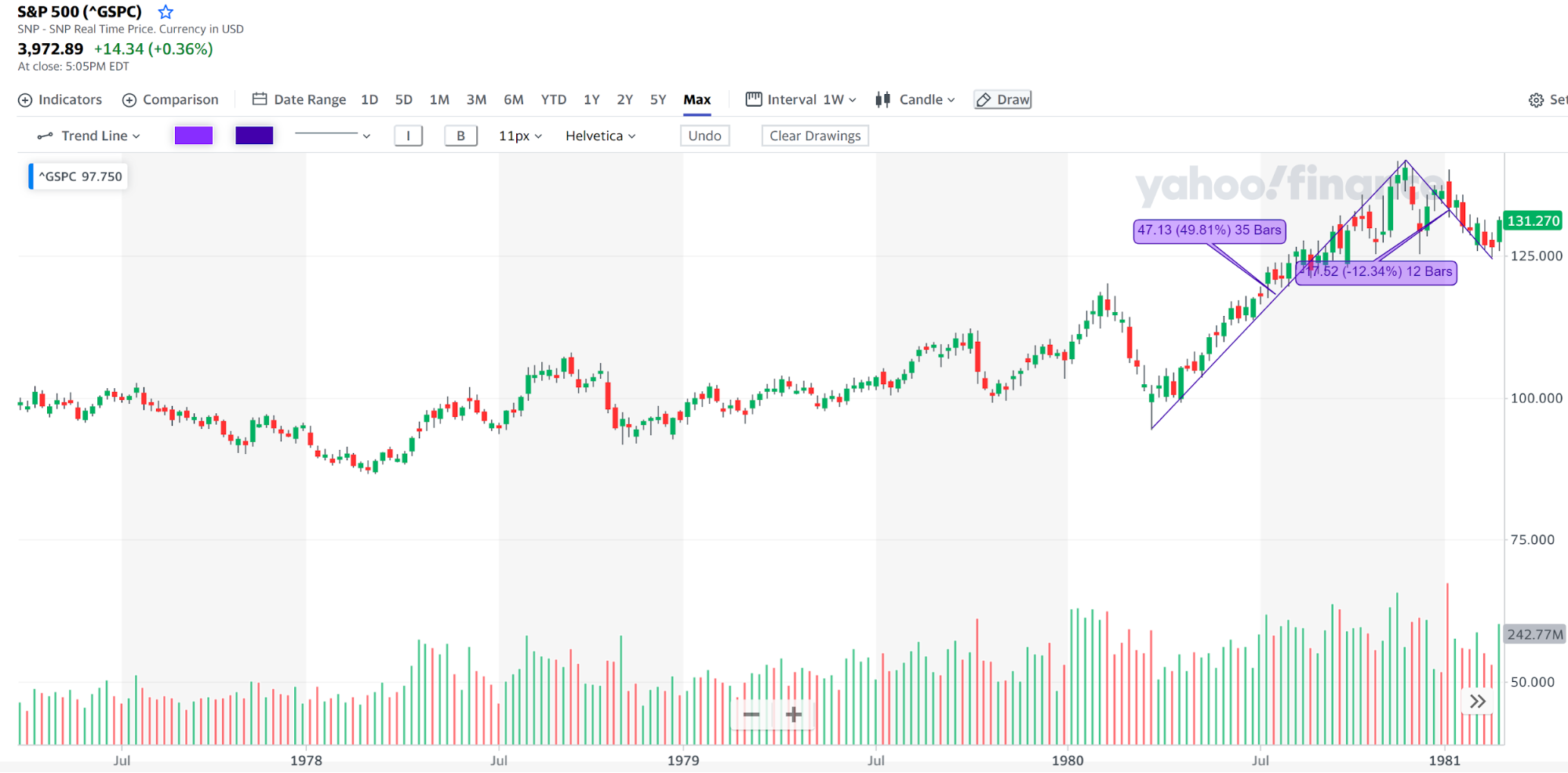

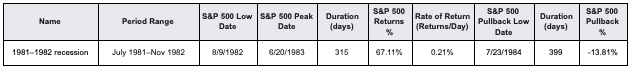

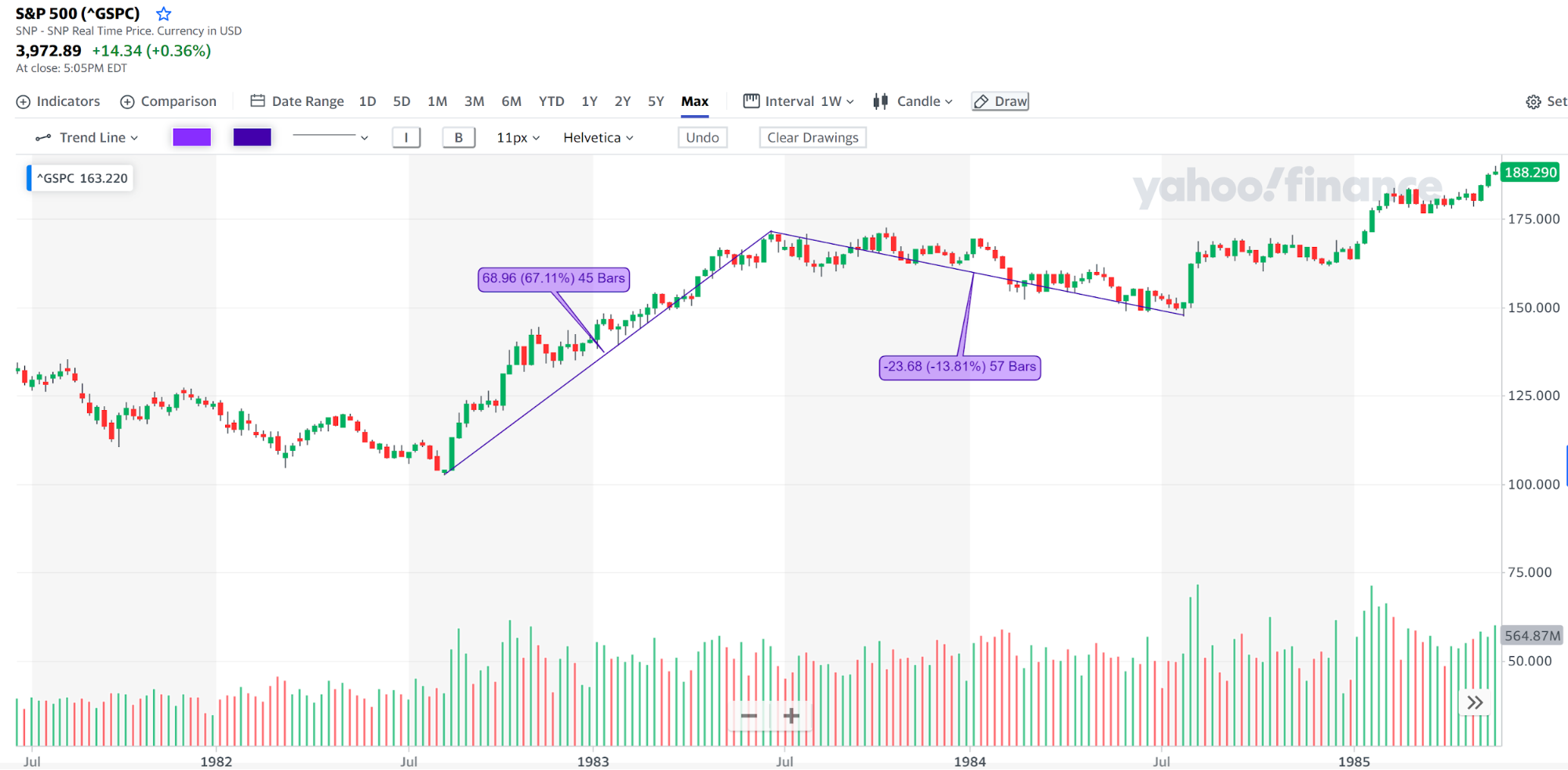

July 1981–Nov 1982 Recession Case Study

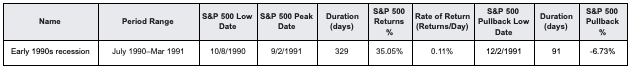

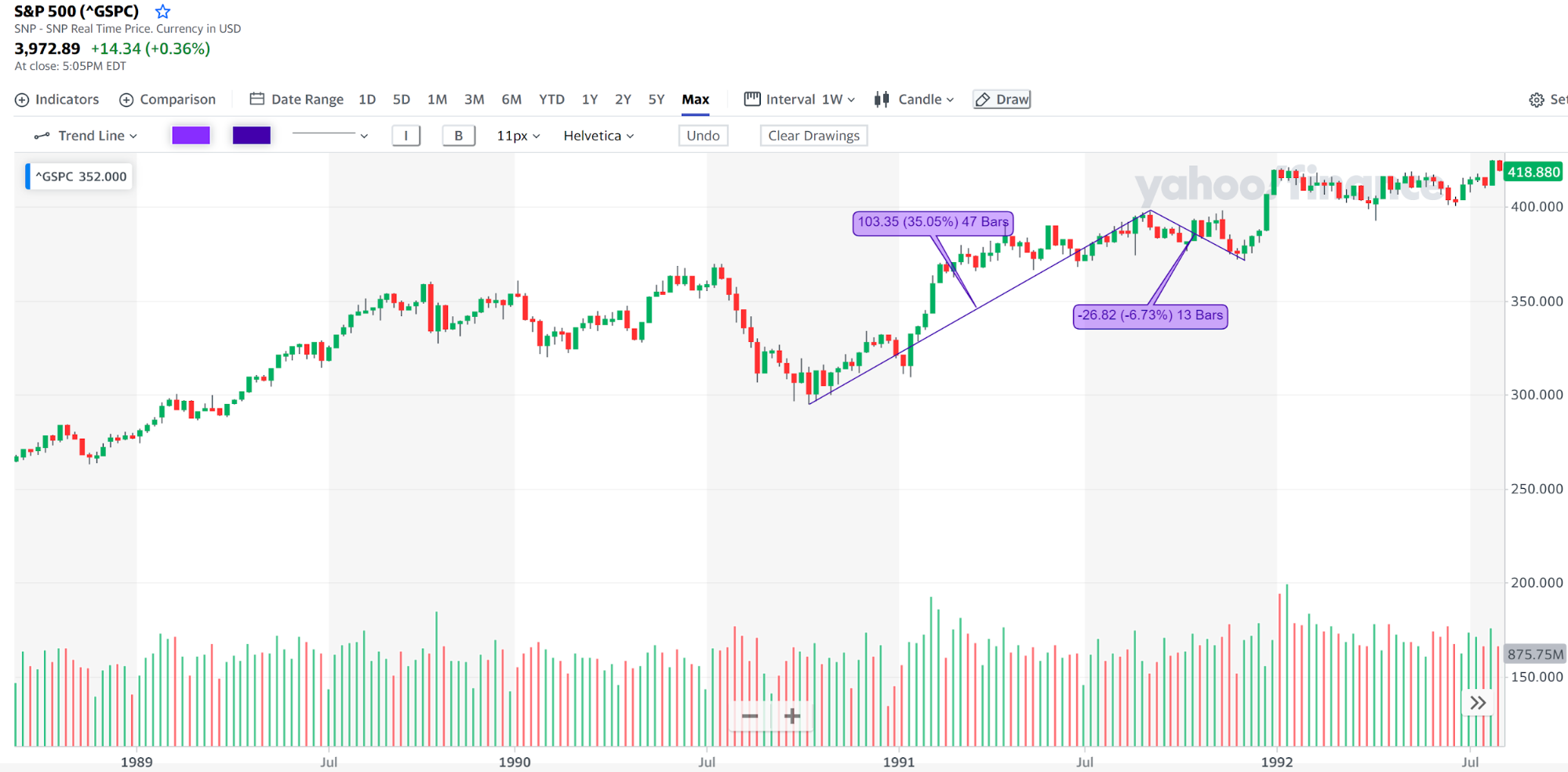

July 1990–Mar 1991 Recession Case Study

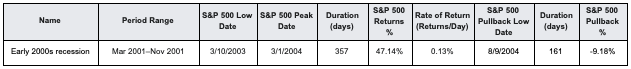

Mar 2001–Nov 2001 Recession Case Study

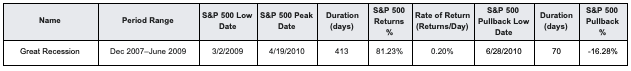

Dec 2007–June 2009 Recession Case Study