Introduction

In our October 2021 Market Outlook piece, we suggested our community readers pay close attention to economic growth indicators and also inflation data as key factors to determining whether the US stock market will continue to show strength, or experience a pullback/correction.

What Data and when?

Today the U.S. Core Consumer Price Index (CPI) MoM will be announced at 2030 hours (SG time GMT + 8:00).Why is this data important?

The US central bank (Federal Reserve) does not like persistently high inflation. If inflation is persistently high, this may force the Fed to reduce the monetary liquidity injected into the economy and also raise interest rates. Inadvertently, this will be negatively viewed by the equities market which may result in a market selldown/correction.Data Forecast and Expectation

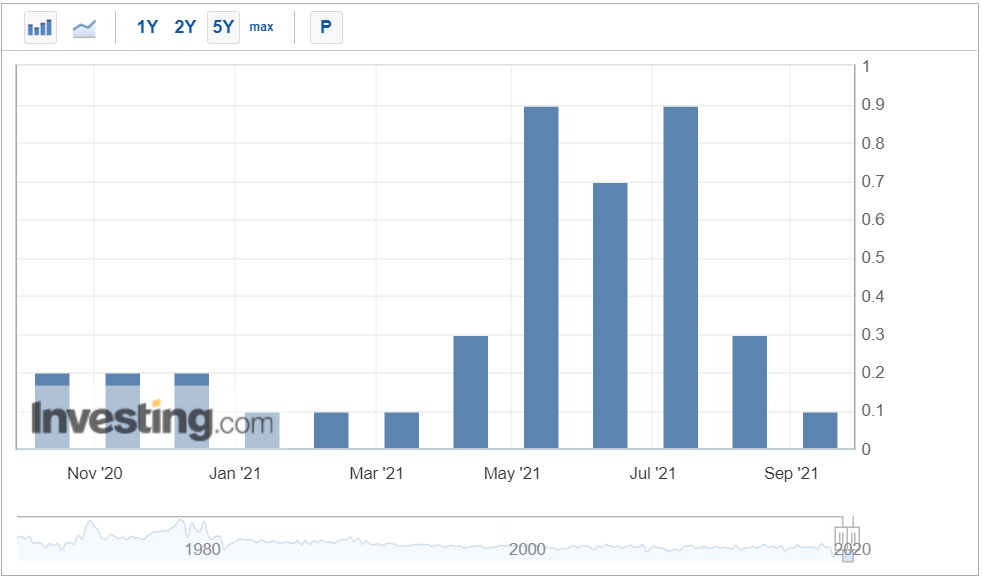

The upcoming core CPI (MoM) is forecast to be 0.3%. The previous reading was 0.1% last month.Historical Graph

The monthly CPI reading peaked between May and July 2021, and has since been on a decreasing trend.

How do we expect Markets to react?

Higher than expected CPI ( ≥0.3%)

If CPI exceeds 0.3% in a meaningful way, it is a plausible scenario that markets may start to be concerned over inflation not being transitory.

This scenario may result in a market correction/selldown.

0.3% ≥ Actual CPI

The CPI is already expected to be 0.3%. Therefore even if it were to exceed the previous month’s 0.1% by staying below 0.3%, the markets will likely not react negatively to these results.

This scenario may result in a continuation of the current bull market.

Actual CPI ≥ 0.1%

This scenario is the most bullish for the equities market since it corroborates the Fed’s expectations that inflation is transitory and provides more margin for the Fed’s accommodative monetary policies.

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.