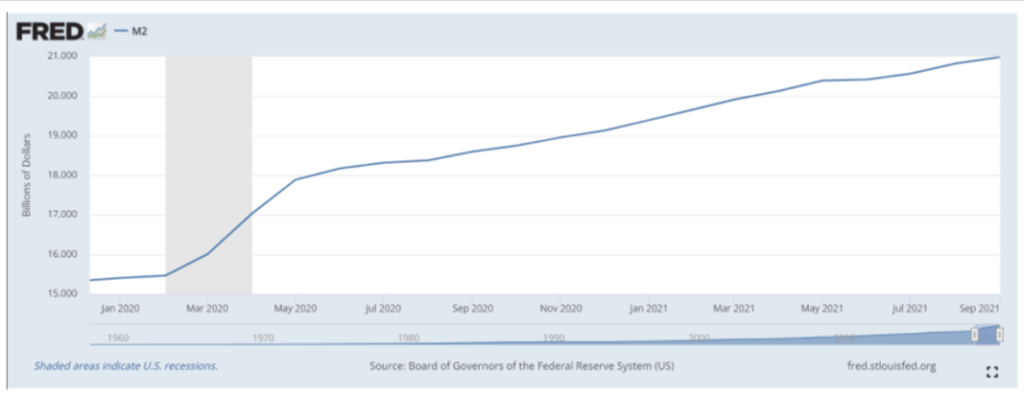

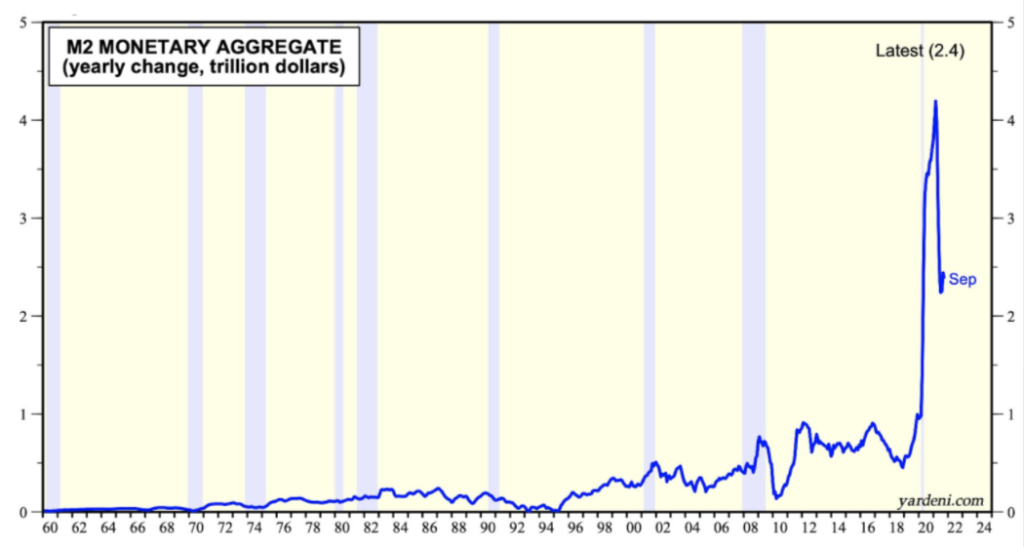

If it can be summarised in 2 words why the strength of the US stock market is so strong and bullish since the Covid 19 pandemic lows in 2020, many will agree it is all about – Money Liquidity.

One of the best measures of money liquidity is called the M2, which refers to a measure of the money supply that includes cash, checking deposits, and easily convertible near money circulating the economy.

The chart below clearly shows the upward trend of the M2 supply since the Covid 19 pandemic started.

Conclusion

In summary, there is a simple way to determine whether a Blue Chip can continue to rise – there must be a narrative for it to grow in the future.

Having a historical track record is useful, but not everything. The reason is because past performance is no guarantee of future performance.

However, the combination of historical quality track record + visionary upside narrative increases the likelihood a strong stock will only get stronger with time!