Introduction

There is a rule of thumb circulating around social media that when the U.S. The Federal Reserve starts hiking interest rates, it is in general, bad for the stock market.

In Economics 101, what is often taught in school is that if Central Banks want to curtail economic growth, one classic technique will be to increase interest rates. By increasing interest rates, the cost of borrowing for companies will increase, thereby making it more restrictive for companies to grow. Hence, the logic is that when companies are restricted, this surely is bad for listed companies in the stock market!

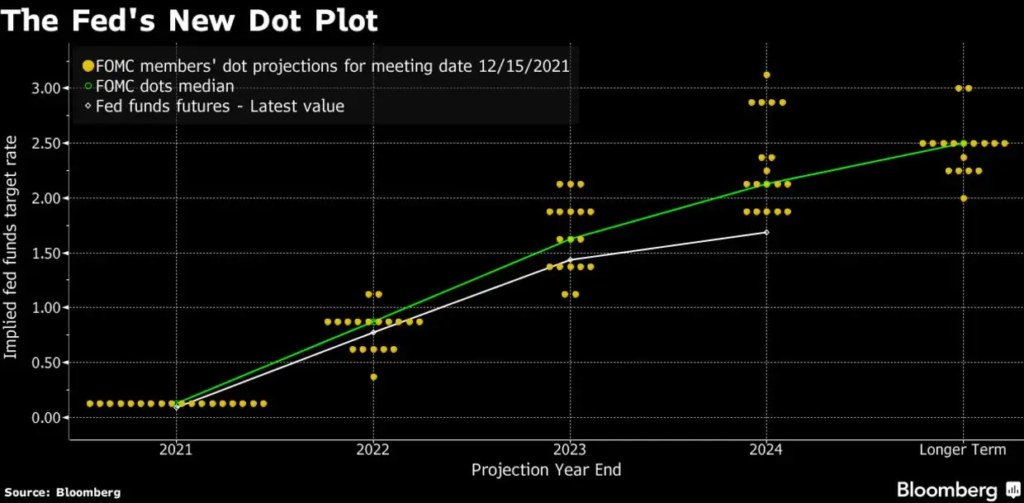

Based on the latest Fed dot plot, it appears that the voting Fed members are expecting interest rates to be hiked 3 times in 2022 and another 3 times in 2023.

Do you know that the last time the Fed hiked interest rates at such a similar pace and frequency was in 2004?

Keen to find out how and what the stock market did in 2004, and how that might also play out in 2022?

How many times did the Fed hike rates in 2004?

Do you know that the Fed hiked rates 5 times in 2004, almost at a once a month rate beginning June?

The table below summarises the details of the 2004 interest rate hikes.

Date | Rate Increase % | Interest Rate % |

30 June 2004 | 0.25 | 1.25 |

10 August 2004 | 0.25 | 1.50 |

21 September 2004 | 0.25 | 1.75 |

10 November 2004 | 0.25 | 2.00 |

14 December 2004 | 0.25 | 2.25 |

What was the maximum Drawdown Experienced by S&P 500 in 2004?

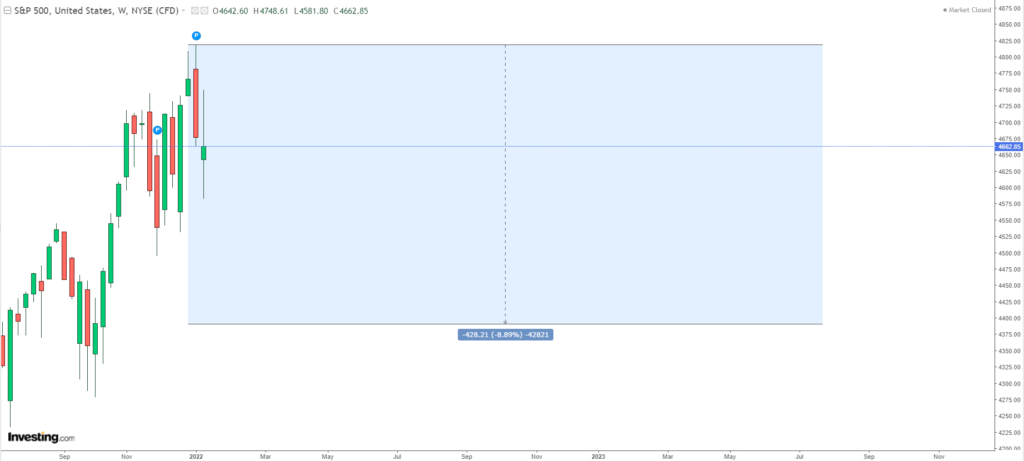

The S&P 500 traded sideways for almost 11 months in 2004, which was the year the Fed started to increase interest rates following a recession!

The maximum peak to trough drawdown experienced by the S&P 500 was 8.9% which occurred between March and August 2004!

When did the S&P 500 start to rally in 2004?

If you digest the timings of the 2004 interest rate hike dates, and correlate them to the S&P 500 price action the following pattern is clear:

Key Takeaway #1

The S&P 500 was weak and uncertain prior to the first rate hike in 2004.

Shortly after the 2nd interest rate hike in August 2004, the S&P 500 started to rally and ushered in a continuation of the bull market.

How did S&P 500 perform full year 2004?

Perhaps what may surprise many reading this article – is the fact that despite the Fed increasing interest rates 5 times in 2004, the S&P 500 was still able to increase 9.36% for the full year in 2004!

Why did the S&P 500 behave like that in 2004?

Key Takeaway #2

The stock market is a highly efficient discounting machine.

It does not like uncertainties, so once the pace and frequency of interest rate hikes are established, very often that signifies that uncertainties are over.

The stock market tends to look past what is already established and absolute (negative news headlines that economic conditions will be stifled), and will start to look forward instead.

What might an -8.9% drawdown look like for 2022?

Assuming the peak of the S&P 500 is at 4818, it is possible a -8.9% drawdown may result in the S&P 500 dropping to 4390 in 2022!

Conclusion

- It is not entirely true that the onset of interest rate hikes will trigger a recession and extreme selldown of the US stock market.

- If history is anything to go by, the year where the Fed started to increase interest rates following a recession, volatile sideways stock markets have been the norm.

- The stock market tends to trade sideways when market conditions are highly uncertain (for example periods prior to the first interest rate hikes).

- However, once the execution of the rate hikes are conducted, that element of uncertainty is removed.

- History indicates that when negative uncertainties are already priced in, the stock market, which is a forward looking machine, will start to treat ‘rate hikes’ as old news.

- It is entirely within the realms of possibility that the stock market may resume the bull market melt up once uncertainties are removed.

- A big caveat – bull runs tend to occur only when the market deems uncertain events are no longer present.

Disclaimer: Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.

If you find trading extremely difficult or are worried and not confident you can achieve portfolio profitability in 2022 – please rest assured you are not alone in feeling that way.

In fact, many professional traders, analysts and stock investors are getting ready for a tough 2022! The reason is because the stock market has run up a lot since the Covid lows, and the stock market is overpriced with high valuations. Coupled with the Fed making financial less accommodative than we had seen in the past 2 years, the only natural thing is for the stock market to take a break.

Therefore, the US stock market is expected to either trade sideways or in the worst case, experience a correction in 2022.

Do you know that when markets trade sideways or enter into correction territory. AlgoMerchant’s fully automated AI trading strategies are designed to exploit such market conditions?

If you are keen to explore alternative ways to profit from a tough market next year, we have an upcoming VIKI seminar. Click the link below to register for the event to learn how VIKI can profit when the market cannot!