How is the Market Currently doing?

Let’s start off with the major averages which gave up their leads of the last four months. Both DJI and S&P 500 witnessed significant correction last week, by reporting more than 4% drawdown from their weekly highs, amid rising tensions between Russia and Ukraine.

The 10-year Treasury yield has dropped by 8 basis points. Wall Street’s fear gauge, the VIX index, is soaring to its highest level of 32, since January 31st.

Oil futures rose over 6%, to $94.79 a barrel. The US Dollar is strengthening on the invasion fears of Ukraine. And defence names are soaring higher.

Geopolitical Uncertainty

Fears of Russia invading Ukraine are rising in the geopolitical world, raising tensions in global financial markets and escalating the possibility of a longer-term correction. In response to this, oil and gold prices soared, while the stock market plummeted.

And to put it bluntly, no one knows how this geopolitical unrest will unfold in the coming months. Market soothsayers have an old rule of thumb that investors hate uncertainty more than anything else.

So, where can we expect to find some reassurance in the midst of so much uncertainty? Well, the answer lies in the historical market trends.

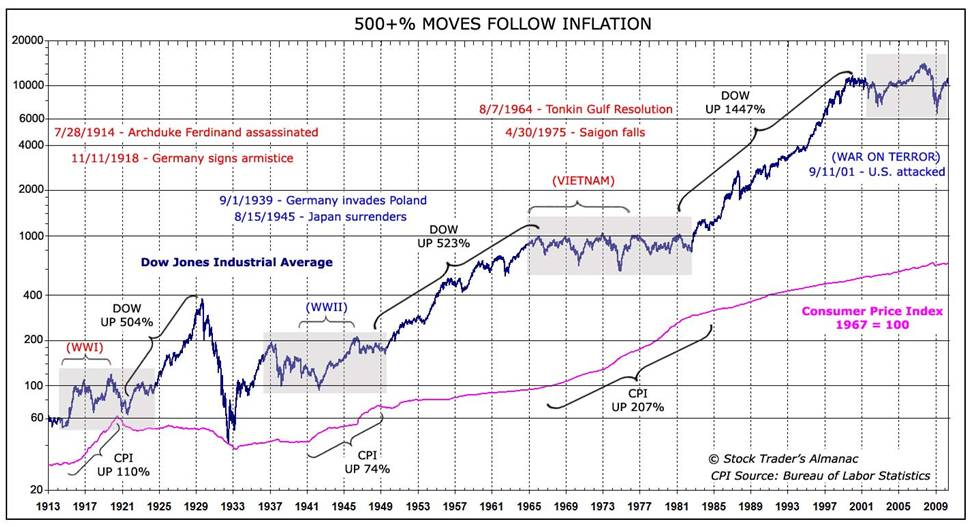

Understanding the historical market behaviour during wartime will help us draw a fair idea of how we should respond to this geopolitical uncertainty to see if we could find any consistent correlations.

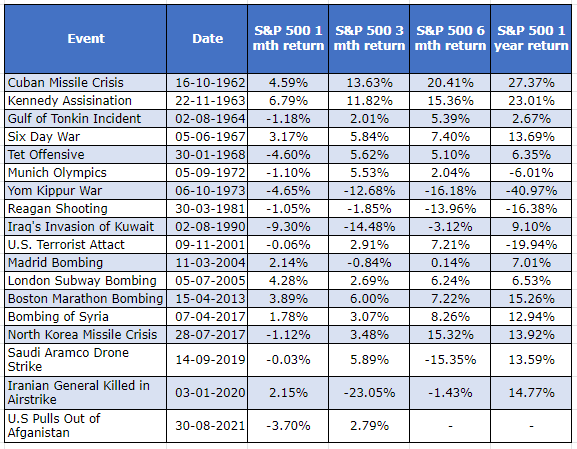

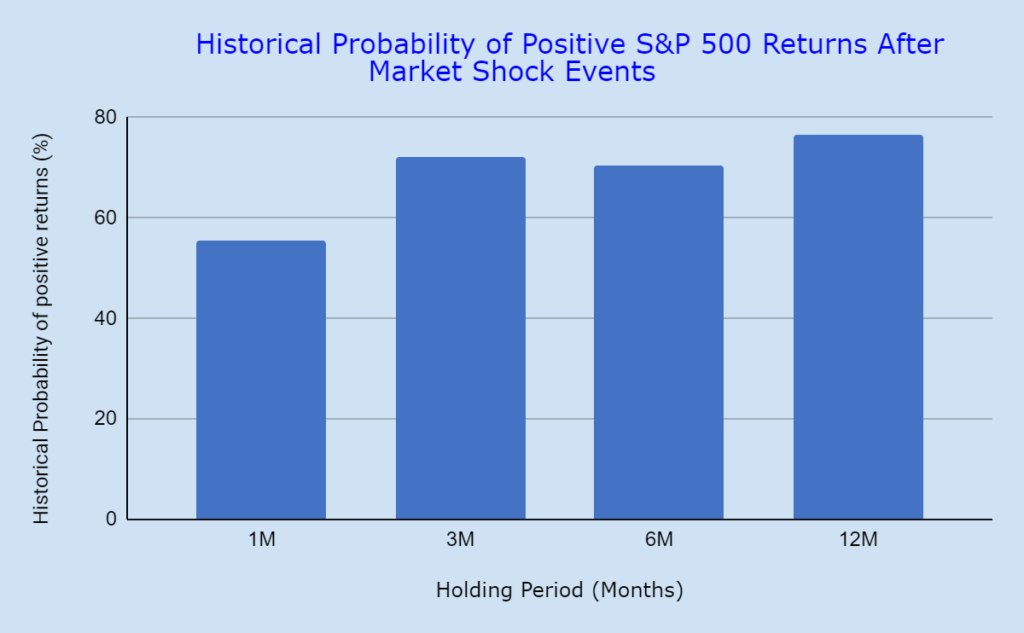

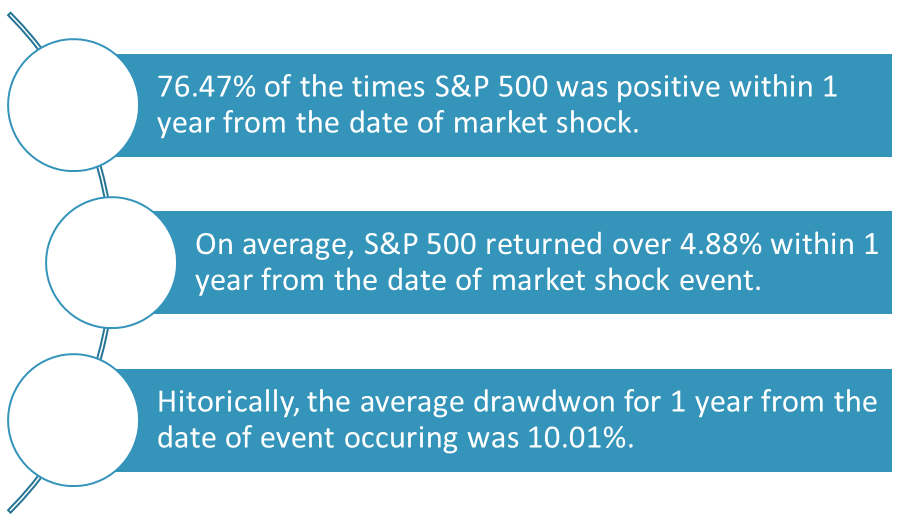

In the table below, we have examined 18 prior war/terrorists market shock events over the last six decades, and then assessed how the S&P 500 performed 1, 3, 6 and 12 months out following these events.

According to this statistics, the longer your time horizon, the higher your probability of seeing a positive returns in the stock market.

Now let’s take a closer look at market behaviour during some of the most significant market shocks

Markets during World War I & II

To start off with World War 1, the Dow dropped more than 30% in the six months following the outbreak of the war in 1914. The war had effectively brought the economic activity to a halt and all the market liquidity dried up.

The decision was made to shut the stock markets for the entire year. While this, lasted for six straight months. Making up for lost time, the Dow soared more than 88% after reopening in 1915, setting a new record for the biggest annual return on the DJIA until 2020.

In fact, from the start of the war in 1914 to the end of the war in late 1918, the Dow gained more than 43 percent, roughly 8.7% per year.

Markets during World War I & II

Source: Smedley Financial

The World War II had similar counterintuitive market outcome. On September 1, 1939, Hitler attacked Poland, sparking the World War II. On September 5, the Dow Jones Industrial Average soared over 10%.

When the attack on the US naval station at Pearl Harbour happened in early December 1941, equities opened down 2.9% the following Monday, but recovered the entire loss in less than a month. The Dow, then rose more than 5% over the next month and a total of 50% from the start of World War II in 1939 until the end in late 1945, with more than 7% per year.

As a result, the US stock market increased by massive 115% during two of the worst conflicts in the modern history.

Dow hitting new highs during Korean War

During the Korean War, which began in 1950 when North Korea invaded South Korea and lasted until the summer of 1953, the Dow rose by 16% on an annualised basis, or nearly 60 percent in just three years.

The controversial war of Vietnam

In March of 1965, the United States sent soldiers to Vietnam and the Dow went on to gain over 10% for the rest of the year. The stock market had risen over 43% in that time, or little under 5% per year, by the time the last American troops were evacuated out of Vietnam in 1973.

Cuban Missile Crisis

And lastly, when the United States and Russia were locked in a standoff in October 1962, the world was on the verge of nuclear war. The clash lasted for 13 days and the Dow Jones stayed remarkably stable over that two-week period, dropping only 1.2%. And then, the Dow again went on to gain more than 8% for the rest of the year.

WHAT TO EXPECT IN THE EVENT OF MARKET SHOCK

The market’s reaction to war and geopolitical crises can be counterintuitive at times, at least in the short term. It’s always difficult to know how investors will react in the short term because so much of the market’s reaction to such events is context dependent.

In the context of Russia and Ukraine conflict, we may see energy prices to surge, as Russia is a key supplier of crude oil and natural gas, with pipelines connecting many parts of the Europe.

In addition, the dollar may appreciate and commodities such as wheat and palladium may rise in value.

This geopolitical turmoil may also have an impact on the Federal Reserve’s intentions to tighten monetary policy, as the Fed will be dovisher than the market currently anticipates, as the war would make the situation even more uncertain.

KEY TAKEAWAYS

Over the past two weeks, market volatility has increased amid rising tensions between Russia and Ukraine, implying that equities may face greater challenges in the near future.

However, as we have have witnessed in the history, the stock markets, in the long run can rebound from the most threatening market shocks, be it a World War, Financial Crisis or any other geopolitical concern.

As we have shown in this article, historically the stock market’s longer-term probability is skewed to the upside.

As long as the capitalism prevails and the economy stays in harmony, and not severely disturbed, investors can expect that the conflict will be a temporary strain on the general economy, and might even benefit from the increased government spending.

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.