In short, there is no good news yet - this is why...

Last night the US issued a very important economic indicator – the consumer price index (CPI) result which highlights the inflation in the world’s largest economy.

Inflation concerns are front, left, right, and centre in everyone’s mind right now. Therefore, our expert market research team has decided to send out a note to share our views on the matter.

The CPI, which is a broad-based measure of goods and services prices, rallied 8.3% compared to a year ago, higher than the consensus estimate of 8.1%.

While many news headlines attempted to downplay the results, stating that peak inflation appears to be over comparing April’s results to March, the financial market as a forward-looking machinery is no longer interested in pure numbers.

As is our usual practice, we look under the hood to filter and explain the most important factors and narratives that will determine the way the financial market behaves in the days ahead.

Let’s begin with the end

The bottom line is that the latest inflation result increases the likelihood that the Fed will have to go with an exponential, more aggressive rate hike and monetary tightening path to slow down inflation.

As mentioned earlier, inflation ”slowed down” to 8.3% Year on Year (YoY) in April compared to March.

However, under the hood, the broad base effects of inflation are indeed worrying to the point that Powell himself told us they are focusing on Month on Month (MoM) changes and focusing on the composition of inflationary pressures.

What do we mean by the composition of inflationary pressures?

Bear with us at this point, it is getting heavier and we will do our best to simplify this.

Before you read, we want to introduce the concepts of non-sticky and sticky inflation. There are various components of goods and services that make up the CPI.

Certain goods, for example, are very reactive in nature but once the inflationary pressures for these goods start to ease, they fall into the less sticky bucket of the CPI. However, broad based services tend to have a longer term impact and should inflationary pressures start to build up in these components, they tend to fall into the more sticky bucket of the CPI.

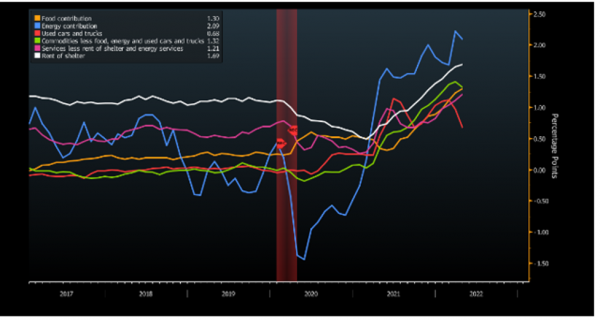

What is very important to highlight is that the contributions to the CPI basket are evolving:

There are indications of decreasing inflation from used cars (non sticky, red), and increasing from shelter (sticky, white).

Goods inflation is receding and broad-based services inflation is picking up.

Why did this happen?

The Fed’s lack of pace in withdrawing accommodative monetary policies has allowed inflation to feed into the stickier items of the CPI basket.

What might happen going forward?

The Fed has clearly stated that by the end of 2022 they will hike to around 2% and they expect this will slow inflation down to 4%.

The question therefore now is whether that is going to be enough?

Right now it is an established fact that the Fed has been wrong about inflation.

It is also a fact that they have also acknowledged they have been wrong about their inflation expectations.

Based on the stock market price action, it can be inferred that stock market participants are beginning to trust less and less about the Fed’s ability to control inflation, without hurting the economy and plunging the US economy into recession.

Conclusion

- Markets are unlikely to resolve themselves until the Fed is able to prove they can tame inflation.

- We now know that the Fed is paying extremely close attention to the stickier aspects of the CPI, and are focused on MoM changes.

- While we can never predict the direction of the stock market, it is a fact that market uncertainty has increased due to inflation and that will likely weigh on the broader financial markets

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.