Introduction

It may feel weird to be reading an article about how “Stocks are a safer investment than x asset.” Admittedly, it really is a sentence you probably do not come by a lot!

This is especially the case when most traditional financial metrics label stocks as one of, if not the riskiest asset you cans have! However, this has been the case for a long time. So, is there something newer and fancier?

Enter the world of cryptocurrency. Where the favorite motto is “to the moon!”

Nothing embodied this motto better than a crypto project called “Terra LUNA”. In fact, they get their name from this inspiration. However, how fast the price went to the moon is nothing compared with how it landed back on earth and hit the ocean’s depths.

One of the biggest projects and dubbed Cryptocurrency’s “Crown Jewel” Within five days, its governance token, UST, lost 95% in value, while its native token, LUNA virtually lost 100% of its value.

The article below provides a SIMPLE EXPLANATION on why it is the case and why it has been dubbed the BIGGEST CRASH IN CRYPTOCURRENCY.

The Biggest Crash in Cryptocurrency – LUNA and UST Disaster!

The downfall of UST and its sister token LUNA is the biggest crash in the history of Cryptocurrency. A supposedly “stablecoin,” UST not only lost the confidence of investors, but more importantly, it lost its status of being “stable” against the US Dollar.

In just a few days, UST and LUNA came from one of the most promising projects in Cryptocurrency to one of the most “memed” projects and have sent shockwaves to the whole cryptocurrency market, pulling down Bitcoin (BTC) and Ethereum (ETH) in double digits percentage decline!

How the Terra Ecosystem Works

Terraform Labs, a Seoul-based company, is the ecosystem behind Anchor Protocol, a savings protocol launched in March of 2021.

Essentially, it created “stable high-earning savings” of up to 20% Annual Percentage Yield (sounds fishy) by accepting TerraUSD (UST) deposits from investors and rewarding them with high-yield and low-volatility interest rates (now, that is definitely fishy).

On the other hand, LUNA is the native token of the whole Terra ecosystem. It is being used for staking, governance, and, most importantly, as collateral for Terra’s stablecoin – UST and is running under the ecosystem’s “algorithm code.”

The Downfall of the Terra Ecosystem

The downfall started on Saturday, May 7, when UST deposits on Anchor started dropping.

Before it began to decline, Anchor Protocol catered to around 75% or 3/4 of UST’s entire circulating supply, translating to roughly $14 billion of UST out of its total supply of $18 billion.

The UST deposits dropped from $14 billion to a whopping $3 billion in days! The massive drop coincides with an enormous panic selling from investors whose confidence in the project vanished.

NOW THE BIG QUESTION IS, WHY ARE STOCKS SAFER THAN CRYPTO?

- The Stock Market is regulated, while Cryptocurrency is not. This fact adds to the peace of mind of holding a stock compared to a cryptocurrency token or coin.

- There is a floor and ceiling price a stock can move in a day, providing a maximum drawdown of not more than 50% a day. In Crypto, there is no such thing as a ceiling or floor price, hence the rapid loss of almost 100% value of LUNA in a span of five days.

- Listed Companies in the Stock Market must report or disclose important announcements or changes in their business. In Crypto, the next day, the founders can just disappear.

- In Cryptocurrency, often, real Founders and Owners are anonymous. Criminals have been known to be some of the founders of notable projects in Crypto, such as the “Wonderland” token.

Chart of Terra UST/USD

UST went down as low as 95% in a span of five days! From its supposed $1 price to now, a mere 10 cents.

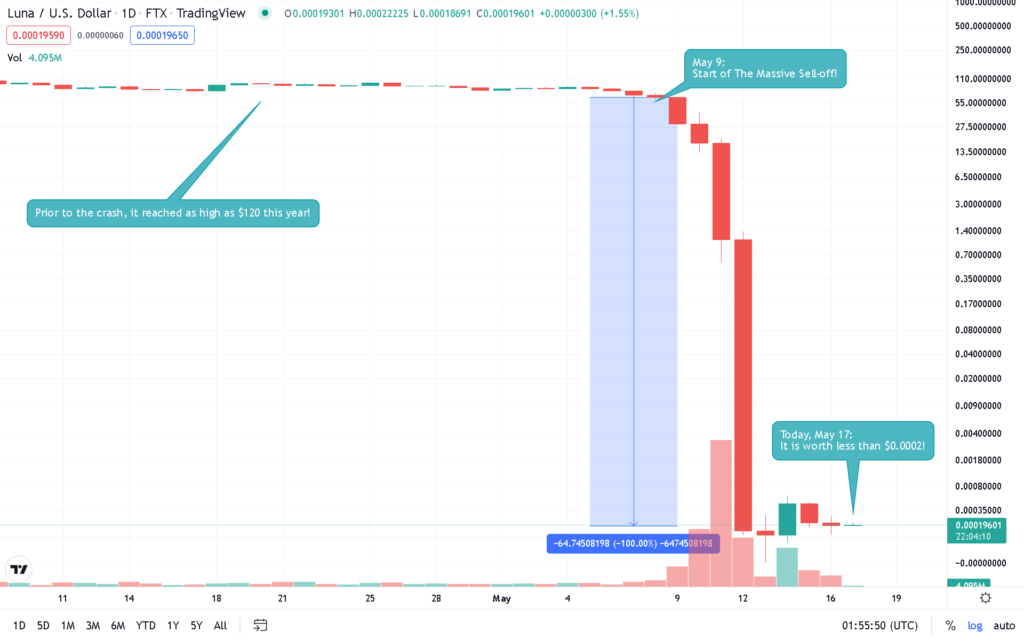

Chart of LUNA/USD

In a span of the same period, LUNA wiped out almost all of its value! From a high of close to $120 to today’s price of less than 0.0002 Cents. If you invested $1 Million, it is worth about 3 dollars today!

Chart of S&P 500

Despite the massive fall of the S&P 500 since the start of the year, compared to LUNA & UST, at its lowest price on May 12, it was only less than a 20% decrease YTD. Today, it is currently at -16% YTD, a giant difference from LUNA’s 100% and UST’s 95% price decrease, AND in just a span of five days!

Kindly see below a summary table comparing S&P 500 and the LUNA/UST crypto as different asset classes!

S&P 500, UST $ LUNA Benchmark | ||

Highest Gain (2022) | Highest Drawback (2022) | |

S&P 500 | About 10% gain from April 14-29 | About -20% this year |

UST | Hovers around its $1 peg | About -95% in five days |

LUNA | About 150% gain in 1.5 months (February 24 – April 5, 2022) | Almost -100% in five days |

FINAL WORDS

- Despite the current market downturn, the stock market’s historical track record shows that it always recovers after every major crisis (Financial crises, Pandemics, Wars, etc.). On the other hand, the Cryptocurrency world is so new that it has no past reference if it will be sustainable or not.

- Cryptocurrency Projects such as LUNA and its sister token, UST, are speculative and have a high chance of failure.

- If an investment is too good to be true, in this case, Terra Luna offers up to a 20% interest rate for a “relatively safe” investment. Unfortunately, it probably is TOO GOOD TO BE TRUE, which turns out to be the actual case with LUNA.

- Our community members should always take note that there is this concept of market returns, which is often regarded as the S&P 500 index return. On average, historically, the S&P 500 has provided a Compounded Average Growth Rate (CAGR) of 10%, with historical drawdowns as bad as -50%.

- Therefore, any investment that offers a return higher than the market, should expect a correspondingly higher risk of losses!

Please note that all the information contained in this content is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.