INTRODUCTION

Did you know that a rare data signal occurred in only 12 other instances in the past 50 years since 1970?

That rare data signal is called ‘Back-to-Back-to-Back 80% Up Days’!

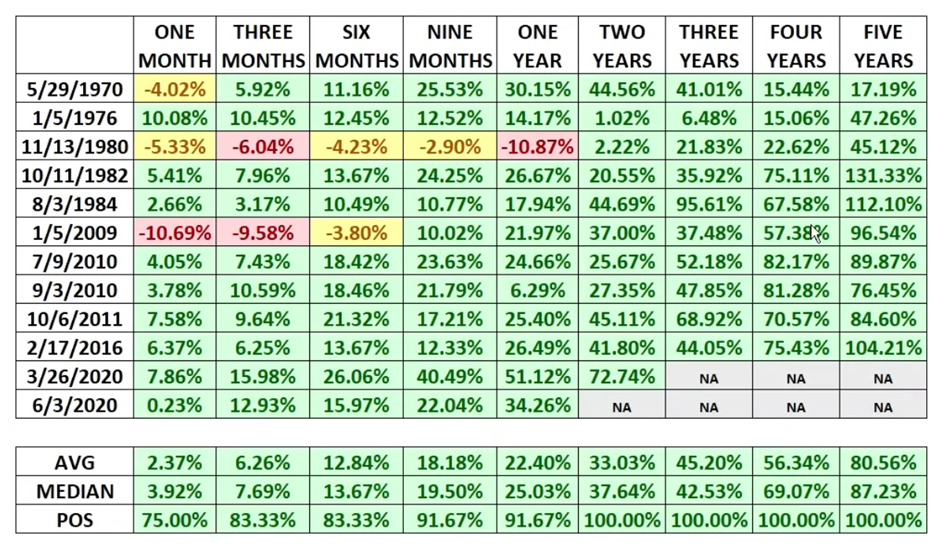

In this special data insight article, we will cover what had happened to the S&P 500 every time this signal occurred in the past 50 years, such as how the S&P 500 performed 1 month, 3 months, 6 months, 9 months, 1 year, 2 years, 3 years, 4 years and 5 years out!

We will also address the maximum drawdowns the S&P 500 encountered following the rare signal. Based on historical context, our readers can form a good appreciation of the risk/reward probability.

Please read on to find out more!

WHAT IS THE SIGNAL?

The signal is called a “Back-to-Back-to-Back 80% Up Days,” which is an Upside/Downside Ratio, a form of a “Market Breadth” indicator, and an advanced variation of the commonly-used Advance-Decline Ratio (ADR) indicator.

Simply put, the signal is a customized indicator that shows the relationship between the volumes of both declining and advancing stocks in the Stock Market, utilizing its unique proprietary variation.

So, what is unique and special about it? Below is the 50-year historical performance of utilizing this signal:

S&P 500 Performance Following

Back-To-Back-To-Back NYSE 80% Up Days (1968-2022)

Source: https://www.ccmmarketmodel.com/short-takes/failed-stock-rally

As you can see, the table extends for 50 years, from the 1970s to 2020. This provides a comprehensive view of the performance of this rare signal.

If you look closely at these cases based on back-to-back-to-back 80% up days, the outcome is exceptionally bullish in most cases. A sea of green while only a handful of drawdowns.

The average gain for a year throughout 50 years is a staggering 22.4% and an even bigger median gain of about 25%, outperforming the average market returns.

In terms of probabilities, the signal proves to be a highly profitable and consistent indicator over a long period of time.

WHAT ARE THE LIMITATIONS OF THE SIGNAL?

S&P 500 Performance Following

Back-To-Back-To-Back NYSE 80% Up Days (1968-2022)

Maximum One-Year S&P 500 Drawdown

Like any market signal, it is not a fail-safe system as in cases in yellow and red. As shown, the Back-to-Back-to-Back 80% Up Days is not a 100% perfect signal.

For example, in the 1980 case, there was a significant drawdown after the third 80% up days, resulting in a loss of -17.38%. Afterwards, the back-to-back-to-back 80% up days from the 2nd of January 2009 ending to the 9th of March 2009 incurred a loss of -27.4%.

Factoring all of the recorded drawdowns from 19750s until 2020, the average drawdown of utilizing the signal was -5.71%. Meanwhile, the median drawdown is much better at -2%.

In the above-mentioned two notable cases, buying on the date of the signal turned out to be a huge loss. To best mitigate this, a scoring system (will touch on it in a while) that replicates the successful instances throughout the 50 years back-test would prove valuable.

A SCORING SYSTEM TO AVOID THE SIGNAL’S MASSIVE DRAWDOWN

Two prominent conditions must be fulfilled to pass the signal’s scoring system:

The price must close above the chosen MA.

Furthermore, the chosen MA must be relevant to the particular time-frame and,

It must be a reliable indicator; this could be done by comparing how the particular MA performed in the past price action of the security/stock.

A period of significant consolidation (sideways movement within a determined price range) that sets up a rally attempt to establish a trending move.

Below is an example of what this might look like:

S&P 500’s Failed and Successful Rallies

As shown on the right side of the chart, the 6th of October 2011 is one of the back-to-back-to-back 80% up days that resulted in a shift in momentum, preparing it to break its consolidation phase.

Looking at the chart, this turned out to be a rally for an upcoming uptrend; This is because the S&P 500 fulfilled the two conditions we mentioned. However, from a trend perspective, it is crucial to look at why the price is shown to be unable to clear the 47-day MA slope prior to the rally.

As you can see, it failed when it was unable to 1) close above the 47-day (chosen) MA shown in orange.

Why? It is because of the other factor, which is that 2) the trending move had a period of consolidation.

In this scenario, the market had just started to stabilize (moving sideways), coming from a sharp decline in late July to August of 2011, the period of consolidation is almost non-existent.

In Technical analysis, a form of consolidation (especially those that take a relatively long sideways movement) would improve the probability of a trend reversal. This chart (starting late July to early November 2011) proved to be a set-up for a successful uptrend.

As you can see, when it finally broke the 47-day MA, the trend eventually shifted and rallied to an uptrend. On the other hand, the price never closed above the 47-day MA from July to early October 2011.

All of these are, of course, in probability terms, as there is no 100% guarantee that past cases will replicate themselves in the future.

WHY ARE MOVING AVERAGES IMPORTANT IN THIS SETUP?

As shown, there are three MAs in the chart. From the fastest or short-term MA, 8-day MA (blue), to the longest or long-term MA, the 138-day MA (green).

In Technical Analysis (TA), if the price is above all the MAs and thus the price was held and sustained, this indicates that the trend is intact and going strong.

This is the opposite of what happened from July to October 2011, where it became bearish as the price sustained below the MAs.

This concept can be applied to any MA, regardless of your desired MA days, from a long-term MA following the general price trend to a short-term MA representing faster price action. The concept remains the same.

It is crucial to remember that there is no fail-safe system or setup, so proper risk management and expectation management are essential for your long-term success as a trader.

NOTE: Despite the lower MAs, such as 8 MA, are not helpful for long-term investing, they may prove valuable for possible reversal signals (turning point).

WHAT DOES THE SIGNAL TELL US ABOUT S&P 500 GOING FORWARD?

So how does this signal help us predict the movement of the S&P 500?

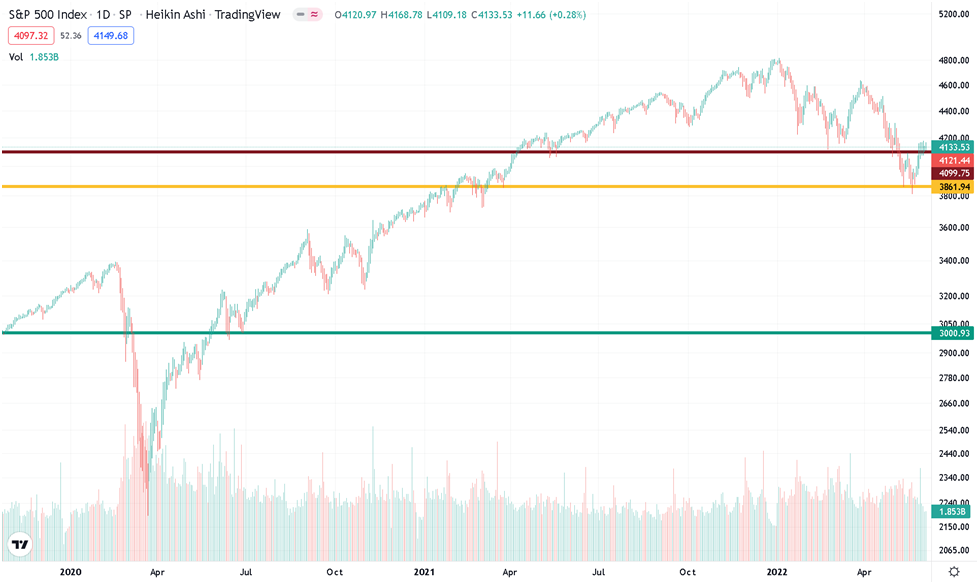

To best demonstrate this, let’s look at 2020 to present a chart of the S&P 500.

Across the board, backtracking for 50 years revealed a “hold in price near the recent lows” or held at any retest of the prior low in most of these drawdowns proves to be effective.

It is useful when we look at the recent stock market movement in 2022, where you can see a double bottom formed on the rightmost side of the chart.

This provides a possible buying opportunity as it may start to consolidate before attempting a successful rally to the upside.

Important Caveat

Due to global contractionary or tightening monetary measures, it is prudent not to ignore a possible significant drawdown similar to the magnitude of the notable examples we mentioned. This is due to the S&P 500 going as low as 3000 in early 2020, as shown in the chart, only to dive deeper because of a black swan event in the form of the COVID-19 pandemic.

At the end of the day, in terms of probabilities, as long as we hold the recent double bottom lows, the odds are in our favour that it will gain momentum moving forward.

CONCLUSION

- The average gain of the rare “Market Breadth Indicator” signaling a year throughout 50 years is a staggering 22.4% and an even bigger median gain of about 25%, outperforming the average market returns.

- The signal is highly reliable as it has been back-tested for fifty years. However, it does have limitations and is not 100% perfect.

- To minimize the massive downside or risk of the signal, it is crucial to always look at the particular MA that sets the pace of the price action and examine if there has been a consolidation phase prior.

- In terms of Technical Analysis, Moving Averages (MAs) is crucial to this signal as it confirms the strength of the price action.

- Remember that there is no fail-safe signal or system, so proper risk management and expectation management are crucial for your long-term success as a trader.

- Backtracking for 50 years revealed a “hold in price near the recent lows” or held at any retest of the prior low in most of these drawdowns proves to be effective.

- However, if the price can’t hold these lows and subsequently closes below this, then the longer we stay below this level, the higher the probability of a much more significant drawdown.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.