As of late April 2020, S&P 500 had tanked > 30% and recovered more than half of those losses.

Many have expected a relief rally following an unprecedented crash of such magnitude and speed – But not this scale! What you see now in price action is the aggregate opinion of the market. Perhaps the predominant market opinion could be wrong, as history would suggest.

Never in this history of the financial market, there is such a huge drawdown goes without a retest of the lows or lower lows.

Things To Consider

So here are some tips to consider if you want to participate in the market’s rally today.

Restarting may not be easy? China offers us a glimpse into restarting attempts. China relaxed many of its lockdown measures with Wuhan coming off the hook last week. Yet, social distancing still prevails, which limit seats on trains, planes and restaurants. This limits sales. Retail malls and shops have reported dismal sales and lower foot traffic as most people still stay home. Latest Economic data like statistics on imports and exports show the economy has begun to recover but still has a long way to go.

Are valuations still off the Charts? Earnings season is coming up. While the lockdown only started in anger for most countries end-of-first quarter, we may not see the full impact on the latest earnings. However, based on Bloomberg’s survey of estimated earning going forward into next year, and comparing to the S&P 500, we see this unexpected chart:

We’ve reached an 18-year high level not previously seen since the dot com crisis. Is it prudent to buy at record optimism level, with the global economy still on its knees?

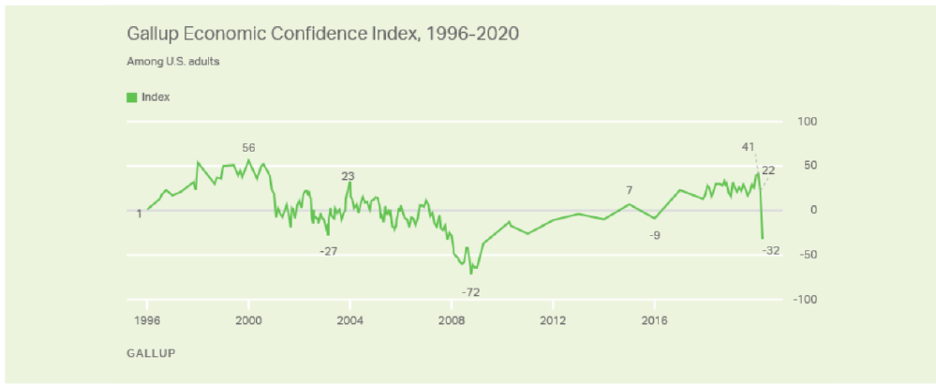

Economic Confidence at a low? A Gallup recent survey of U.S. adults shows economic confidence index is at a low not seen since 2008. Adults are the ones with spending power. If they aren’t confident about the economy, undoubtedly this will impact consumer spending. Let’s just bear in mind Consumer spending accounts for 70% of US GDP. Will this have a substantial impact on a consumer-based economy such as the US?

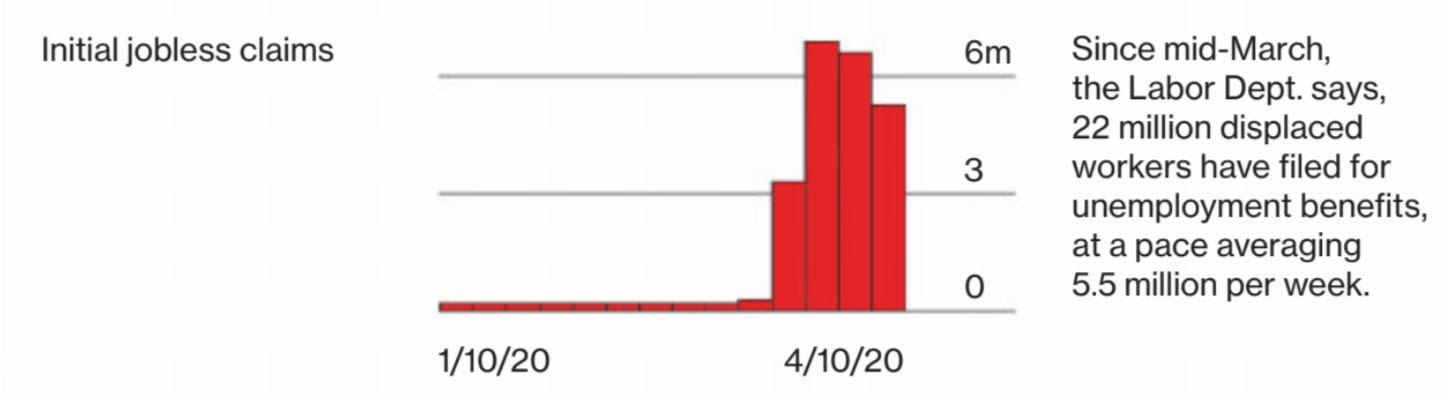

Unemployment Claims at record highs. Since mid-march 2020, the US labour department reports that a record 22 million unemployed workers have applied for jobless benefits. This rate shadows even what was experienced in the 2008 great financial crisis. For now, financial markets are holding up, but can they continue to do so if the economic stalemate continues?

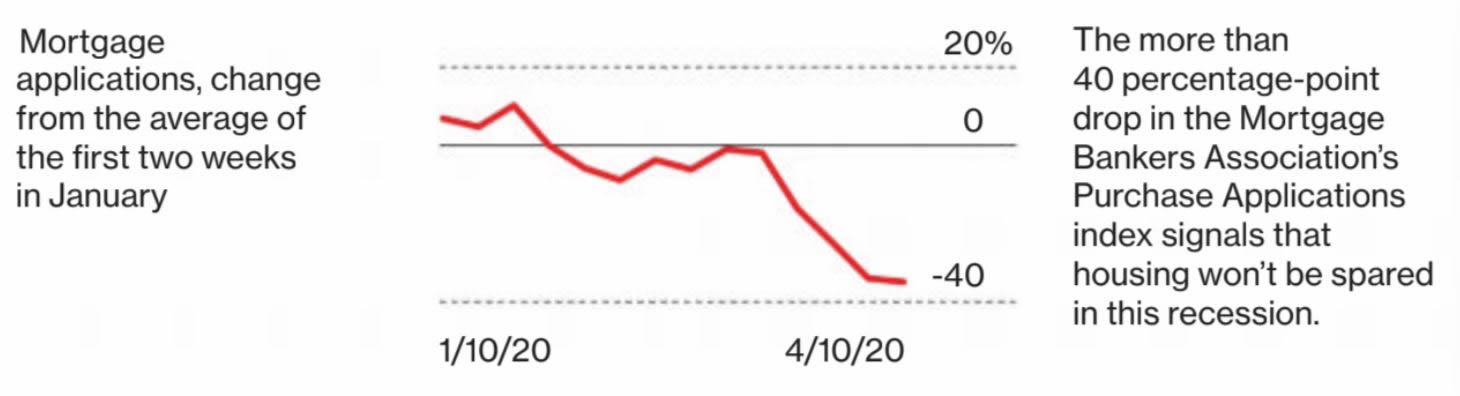

Mortgage applications have slowed. The Mortgage Bankers Association’s Purchase Application index shows a > 40% drop in mortgage applications. The start of a housing purchase slowdown could very well escalate into a housing crisis with repercussions throughout the economy?

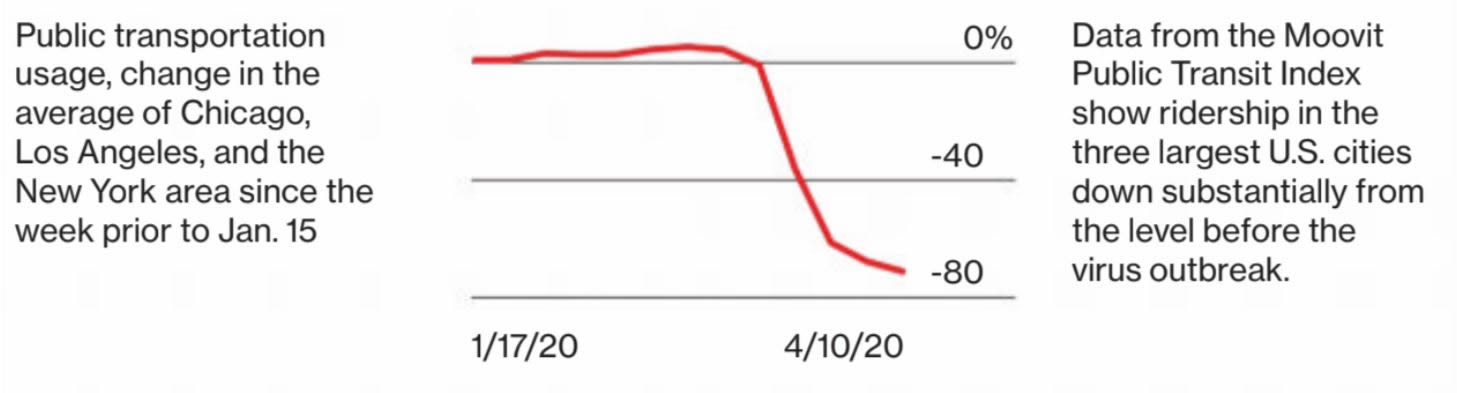

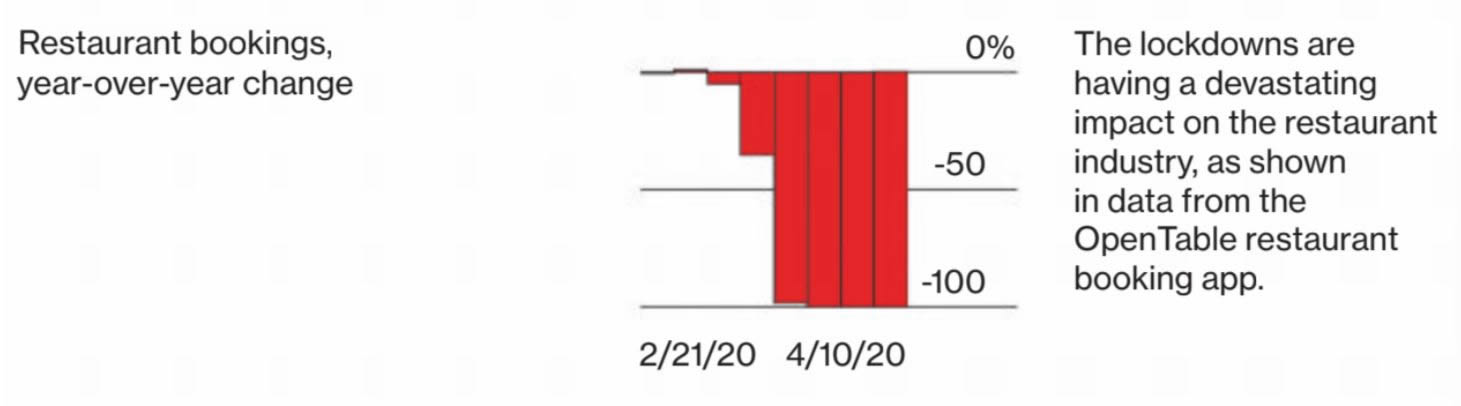

The population is travelling and spending less. The Moovit Public Transit Index signals that public transport usage in the three largest cities in the US has declined by almost 80%. Open table restaurant bookings have plummeted 100%. Will consumers change their spending behaviours going forward? If they do, many traditional businesses in the world as we previously know will have to adjust or even shut down as we move into a new world order.

Conclusion

Despite the rally, the economic fundamental is still undeniably broken. Today, riding on the rally to profit seems more suitable for investors with a higher risk profile. We know at the end of the day, the market can go to any direction with no rational explanations behind it. But you need to know the risk of the game.