The former chairman of the US Federal Reserve, Alan Greenspan, has quite a keen interest in men’s underwear. No, it’s not like he collects them for a living these days. Instead, his interest lies in economic matters. He believes that sales of men’s underwear could help anticipate an economic recession!

Wait…what?

Well, the idea is pretty straightforward!

According to Greenspan’s theory, annual sales of men’s underwear are quite stable. Men mostly rotate their private collections once a year. And when they do, they do it with remarkable consistency. However, Greenspan states, “…on those few occasions when sales decline; it signifies that men are so strapped for cash that they choose not even to replace their underwear.”

According to the former Fed chairman, this is a telltale sign that we are on the verge of a recession.

Greenspan’s theory is also backed up by the men’s underwear index (yes, it exists). Sales of men’s underwear in the US plummeted dramatically during the financial crisis in 2008 but rebounded in 2010 as the economy began to recover.

So how’s the current performance, you may ask?

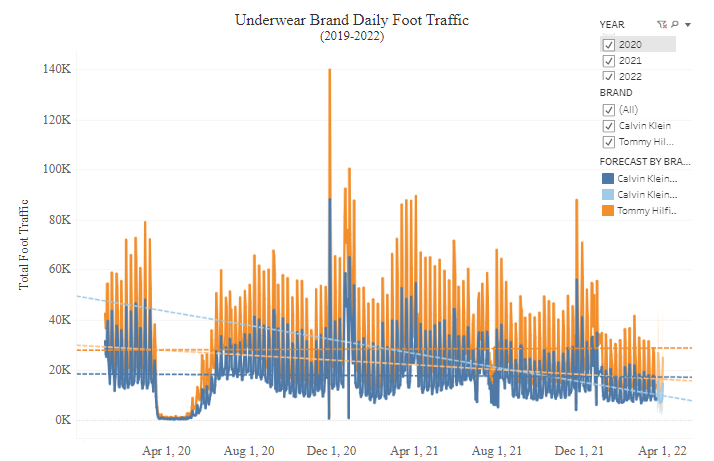

Well, after more than a decade, history seems to be repeating itself. The two major underwear brands in the US, Calvin Klein and Tommy Hilfiger, are witnessing a steady decline in their daily foot traffic since December 2020 and the downward pace seems to be accelerated in the recent months, as shown in the chart below:

So, are we heading towards a recession?

Well, two consecutive quarters of declining GDP is the most widely accepted definition of a recession, and we are currently one quarter away from entering one. However, looking at the current state of the economy, many experts believe that the U.S. economy is already in recession; it simply hasn’t officially declared it:

The yield curve inverted on March 29 for the first time since 2019. This occurs when short-term treasury bills attract higher interest rates than longer-term treasuries – an indication that investors are losing confidence in the economy.

US Q1 GDP shrunk at a 1.6% annualized rate last quarter amid a record trade deficit.

Inflation then skyrocketed to 8.6% in May 2022, the biggest jump since 1981.

The S&P 500 index, a well-known leading indicator of the economy, is down 22% for the year.

After two previous recessions in 2008 and 2020, “recession” is once again trending in Google searches.

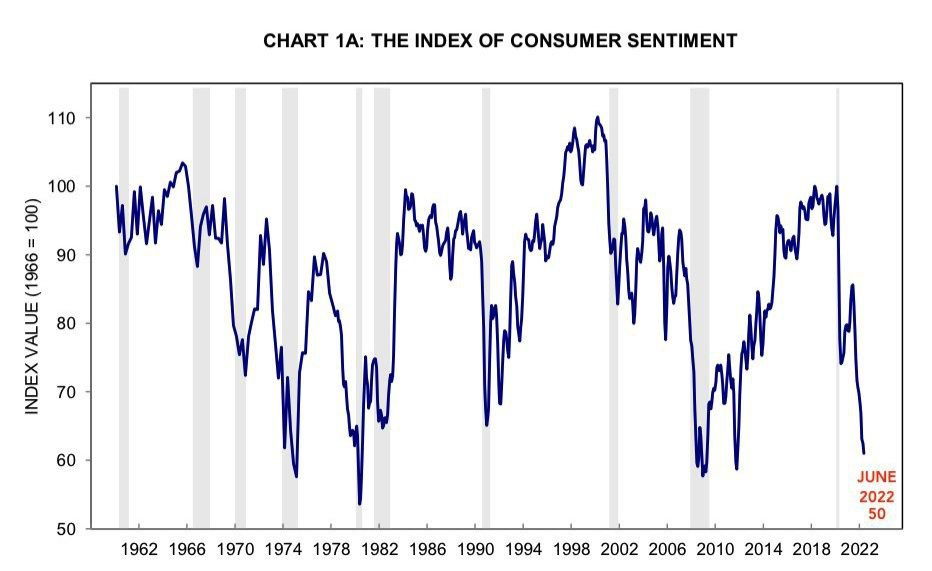

The US consumer sentiment index is at historically low levels for the post-war era, only matched by the pessimism during the 2008 recession and the late 1970s/early 1980s recessions.

All eyes on the Fed

The Fed raised the fed funds rate by 75 bps in its June meeting, the highest since 1994, and flagged no major changes in its interest rate or balance sheet policies.

On June 23, Jerome Powell testified before Congress, calling his commitment to curbing inflation “unconditional.” To restore price stability, Powell stated, “We must get inflation back down to 2%, which currently is 8.6%.”

Underscoring a bit of a hawkish tilt, the FOMC—in its dots plot—signalled they now expect two interest rate hikes with the target of 3.8% by 2023.

Powell further stated that recession is “certainly a possibility” and warned that avoiding a recession largely depends on factors outside Fed’s control. |

In turn, it’s no wonder that investors are worried about the Fed’s ability to achieve a “soft landing” — lowering inflation without heading towards a recession.

But what does a recession mean to the stock market?

Let’s quickly brush up on the basics…

During a recession, consumer spending typically falls while unemployment rises (It is thought that a rise in interest rates will affect consumer spending).

As a result, businesses tend to experience financial headwinds, which can cause stock prices to decline during a recession.

Furthermore, during a recession, investors become more risk-averse and are less inclined to invest in equities, causing stock prices to remain depressed.

How the Stock Market performed during the past recessions

Even though we are not officially in a recession, considering the current state of the economy, no one knows when the U.S. will enter a recession again. And this is precisely why it is essential to always be prepared for a market or economic slump rather than trying to foresee one.

|

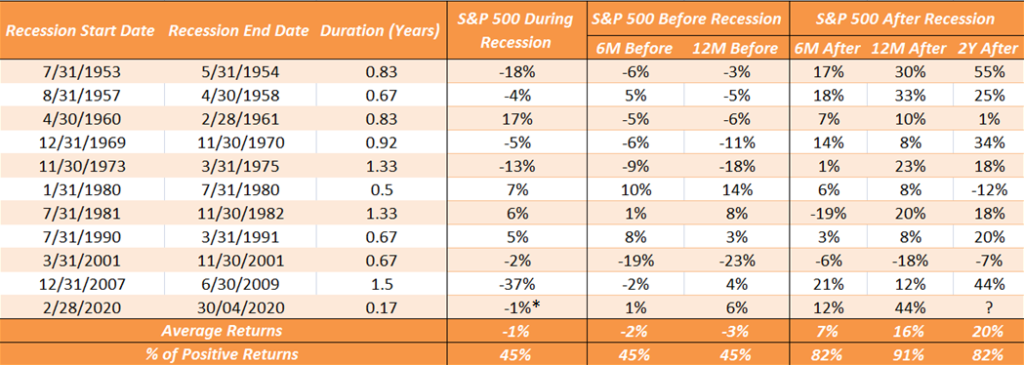

Our community readers may be surprised to learn that for the last 69 years, the S&P 500 had performed worse in the year before a recession than during the recession itself! |

The table below lists the average S&P 500 returns during the last 11 recessionary periods. For each event listed, the table shows:

Start and end dates of the recession,

The duration for which the recession lasted and,

How the S&P 500 performed before, during, and after recessions.

- The definition of the ‘S&P 500 During Recession’ column is the average return value calculated based upon the actual S&P 500 performance from the time period between the Recession start date and the recession end date.

- The definition of the ‘S&P 500 Before Recession’ column is the average return value calculated based upon the actual S&P 500 performance 6 and 12 months before the start of the recession.

- The definition of the ‘S&P 500 after Recession’ column is the average return value calculated based upon the actual S&P 500 performance 6 months, 12 months, and 2 years after the recession started.

Duration of the recessions:

In the 11 recessions since 1953, the average duration was 10.3 months. The COVID recession* lasted less than two months, neutralising the entire drawdown in 09 weeks, while the 2008 Great Financial Crisis was almost twice the average.

S&P 500 before and during recessions:

The S&P 500 returned -3% in the year preceding a recession, -2% six months before, and lost only 1% during the recession. This suggests that markets are forward-looking while economic data lags!

S&P 500 after recessions:

It should come as no surprise that average returns become increasingly positive as time passes after a recession. After all, markets tend to go up more than down. Following a recession, the S&P 500 returned 16% on average in one year and 20% in two years. Additionally, the frequency of positive returns nearly doubles.

Finally, what should one do during a recession?

A recession does not mean sitting on the sidelines and watching your investment portfolio dwindle. There are steps you may consider to safeguard yourself against a recessionary downturn.

Here’s a contrarian strategy to consider…

As Warren Buffett famously said, “be greedy when others are fearful.” Meaning, when people are panic-selling, it may be a good time to buy the companies you are most confident in!

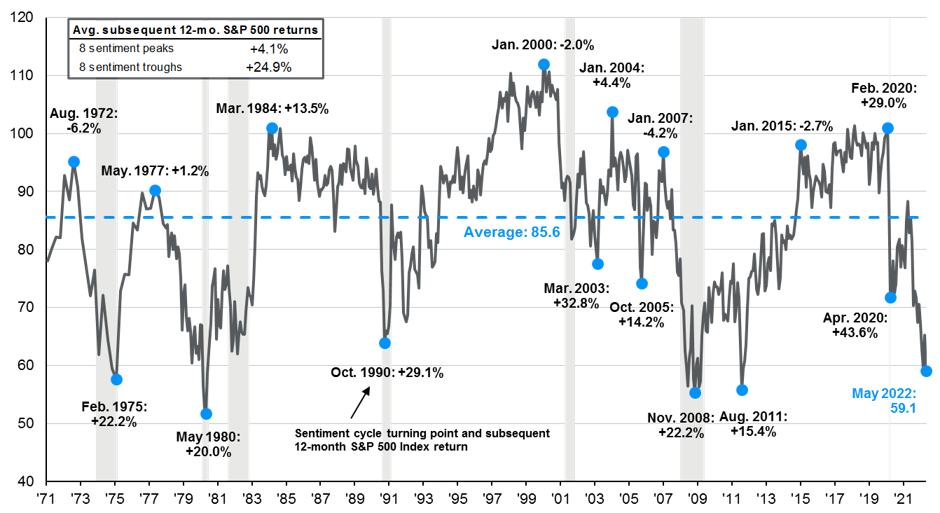

According to research by J.P. Morgan, investors who bought equities during periods of low consumer sentiment, i.e., when people are afraid and selling in a panic, would have earned an average of 24.9% over the following year.

For example, in the 12 months after November 2008, when investors were exceedingly pessimistic, the S&P 500 returned 22.2%, as indicated in the graph below.

On the other hand, when investors are confident, and consumer sentiment is high, JP Morgan’s research shows that the S&P 500 returned an average of over 4% the following year.

Investors, however, note that this isn’t an encouragement to time the market. Nobody can predict the market’s top or bottom. Instead, this is simply an illustration of how, after a significant market decline, there is a higher probability of significant upside potential as markets are positively skewed.

Final Words

What was only transitory has now become the Federal Reserve’s top priority. With inflation rattling the economy, the Fed is getting offensive against it. And consequently, the magnitude of the successive rate hikes will continue to be the primary driver influencing the markets in the near future.

Nevertheless, given the current state of the economy, it would appear that it is no longer a question of if a recession is on the cards but simply a matter of when.

However, even if the U.S. economy eventually slides into a recession, our community readers should keep in mind that recessions are a natural part of the long-term economic cycle, and markets have always rebounded over time.

Finally, it is worth remembering that “markets are always forward-looking”, and if history is any guide, markets typically discount the recessionary fears well ahead of the economic data.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.