With a net worth of over $100 billion, Warren Buffett is perhaps the best investor of all time. But have you ever wondered what makes him so successful?

Most people believe that he just buys quality stocks at good prices and then holds them for years, and this is the only part of his investing success.

Well, they couldn’t be more wrong anymore….

He also profits by trading options, a type of derivative!

Wait, what?

That’s right; Warren Buffett’s Berkshire Hathaway deals in derivatives.

Even though he stated in his 2002 annual shareholders’ letter that:

“In our view… derivatives are financial weapons of mass destruction, carrying dangers that are potentially lethal.”

In the same letter, Buffett also said, which most people ignored:

‘‘I sometimes engage in large-scale option transactions to facilitate certain investment strategies.’’

In another annual report, Buffett reported that Berkshire collected $7.6 billion in premiums from 94 option contracts.

So, while he acknowledges the risk associated with derivatives…he does not discard the fact that options come with huge profit-making potential.

However, consistently making profits in options isn’t that straightforward. Even though it follows the fundamentals of stock trading, there is quite a bit going on in the background that you need to understand and be aware of.

In this quick and essential guide to options trading, we will take you through everything you need to know to get started in options trading…

Options: A Derivatives Contract

The first thing you need to know about an option is to understand its classification.

An option is a ‘derivative contract,’ which derives its value from an ‘underlying asset.’ |

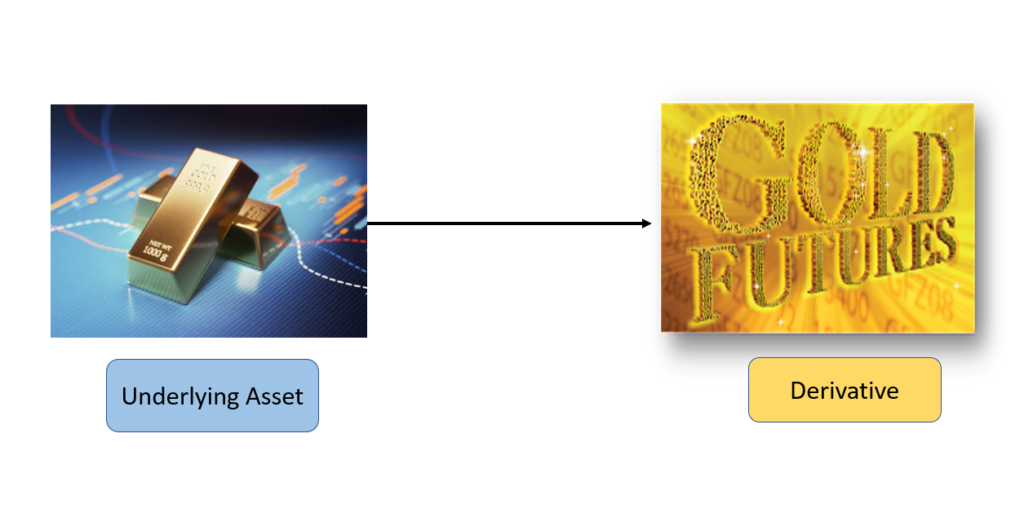

A ‘derivative’ is a financial instrument whose value is derived from the value of another asset, known as the ‘underlying asset.’

When the value of the underlying changes, the value of the derivative also changes. A derivative is not a product. It is a ‘contract’ that derives its value from the changes in the price of an underlying asset.

- Example: The value of a gold futures contract is derived from the value of the underlying asset, i.e., gold.

In the case of stock options, the underlying asset is the stock itself. Therefore, the stock is an ‘underlying asset,’ and the option contract is the ‘derivative’ of the stock.

“If the stock price rises or falls, the price of an option will behave accordingly.” |

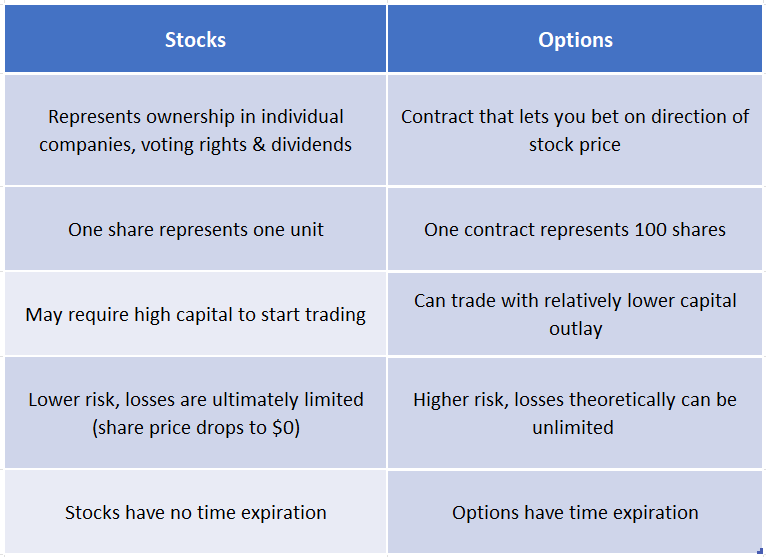

Stocks vs. Options - What's the difference?

Options: A Special Contract

The best way to understand the options is to first deal with a hypothetical example. And once we understand this example, we will extrapolate the same to options trading. So let’s get started.

Consider this situation:

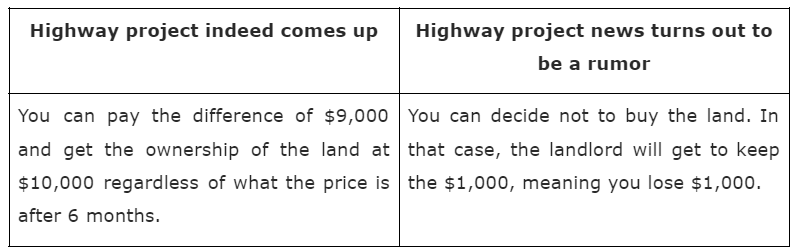

Suppose you want to buy a piece of land worth $10,000 because you’ve heard a news that in the next 6 months, a mega highway project is likely to get sanctioned near the land.

If the highway project indeed comes up, the valuation of the land is bound to soar. But if the news turns out to be a rumor, you would be stuck with a useless piece of land!

And that’s why to play it safe; you propose a special contract to the landlord which you think is a win-win situation for both of you, the details of which are as follows:

You pay the landlord a one-time, non-refundable fee of $1,000 to “hold the land” for you for the next six months.

In exchange for the fees, the landlord agrees to sell the land to you at the end of 6 months.

The price of the land is fixed today at $10,000. That is, you can buy the land for $10,000 regardless of what the price is after 6 months.

Because you have paid an upfront fee, you have the ‘right’ to cancel the contract, unlike the landlord.

And if you cancel the contract, the landlord gets to keep the upfront fees of $1,000.

At the end of 6 months, one of the two scenarios will occur:

With this simple analogy, we have understood the essential concepts of options trading, such as:

An option is a contract: A contract that exists between a buyer and a seller (You & Landlord).

Option buyer & seller: Since you’re paying an advance, you’re the option buyer, and the landlord is the option seller/writer.

Premium: The cost of the contract, paid to the seller ($1,000 non-refundable charges).

Expiration date: A period during which the contract must be carried out (6 months).

Strike price: The agreement happens at a pre-determined price (the pre-fixed price of the land, i.e., $10,000).

A rule of thumb: In an options contract, the buyer always has a right, and the seller always has an obligation. |

How option trading works!

There are four basic options positions:

Buying a call option

Selling a call option

Buying a put option

Selling a put option

Call option:

It provides an option to buy the asset at a predetermined price called ‘Strike Price.’ Someone who anticipates a price increase (bull) purchases a call option. However, in order to do so, he must pay an up-front fee called “Premium” to the call seller, who is not so optimistic about the price increase.

Put Option:

It provides an option to sell the asset at a predetermined price called ‘Strike Price.’ Someone who anticipates a price decline (bear) purchases a put option. However, in order to do so, he must pay an up-front fee called “Premium” to the put seller, who is not so pessimistic about the price decline.

Consider these examples for understanding these concepts:

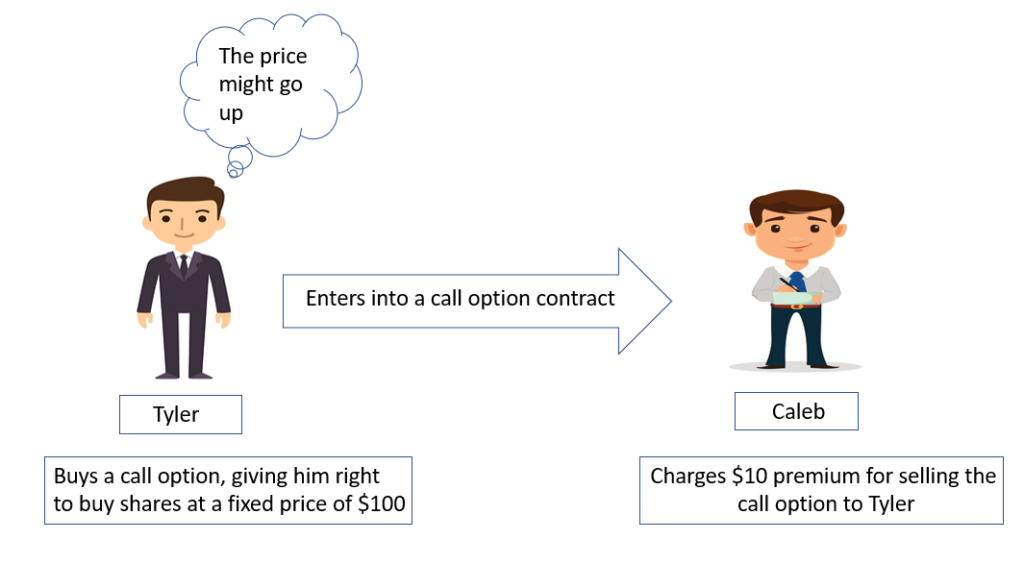

#1: How a ‘Call option’ works?

Let’s say the share price of XYZ Inc is currently trading at $100 per share. Investor Tyler thinks the stock price will go up within the next month, while investor Caleb thinks the opposite: it will go down.

So Tyler enters into a call options contract with Caleb with a strike price of $100 per share and a premium of $10.

After one month, one of the two scenarios will occur:

If, after one month, the price of XYZ Inc increases to $150, Tyler can buy the shares from Caleb at $100 and sell them at $150. Hence, his profit shall be $50. But, he paid $10 as a premium too. So, in a nutshell, he will earn $40 as net profit.

As the seller of the option, Caleb owes Tyler $50, and his total loss will be $40 ($50–$10) because he has already received $10 for the premium.

Result: Tyler = +$40, Caleb: -$40

If, after one month, XYZ Inc declines to $80, then there is no use of the call option. Mind you, here ‘Tyler’ is not under an obligation to buy. Remember, it is an option! Consequently, the $10 he paid as a premium would be his loss, which Caleb retains.

Result: Tyler = -$10, Caleb: +$10

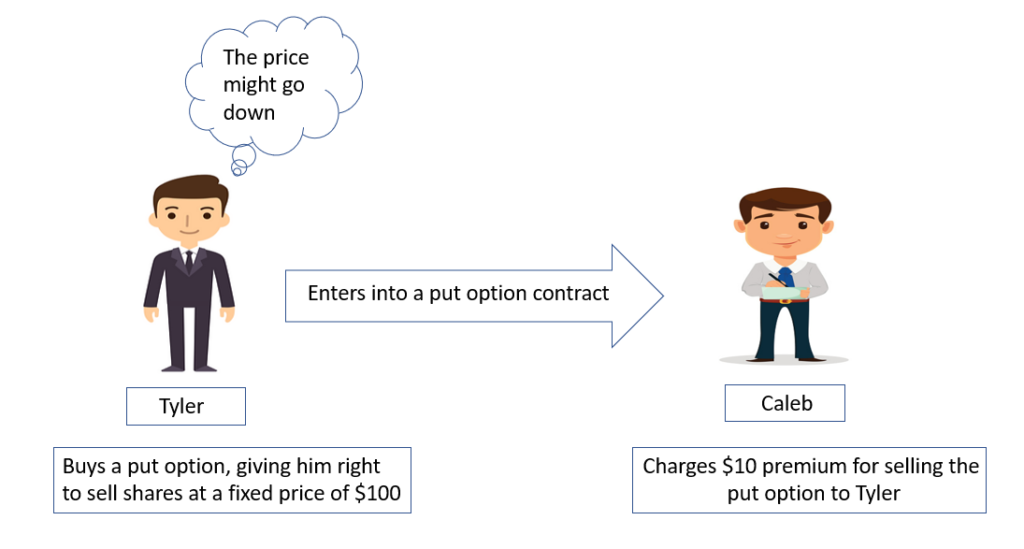

#2: How a ‘put option’ works?

Continuing with Tyler and Caleb’s example, Tyler is anticipating a decline in the price of XYZ Inc within the next month, while Caleb thinks it will go up.

So, Tyler enters into a put options contract with Caleb with a strike price of $100 per share and a premium of $10.

After one month, one of the two scenarios will occur:

If the price of XYZ Inc falls from $100 to $60, then ‘Tyler’ can still sell it at $100, and his net profit shall be $30 ($100-$60-$10). Correspondingly, Caleb suffers a loss of $30.

Result: Tyler = +$30, Caleb: -$30

If XYZ Inc rises from $100 to $150, then ‘Tyler’ shall lose the premium money paid. And Caleb will make $10 as a premium.

Result: Tyler = -$10, Caleb: +$10

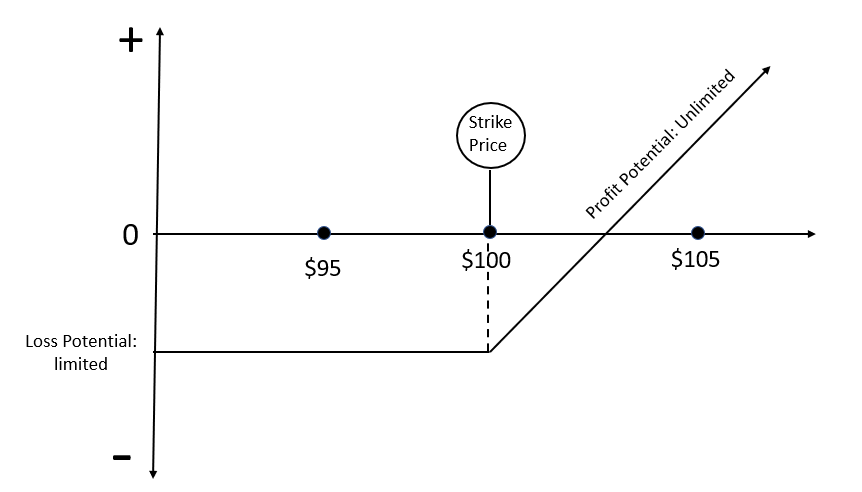

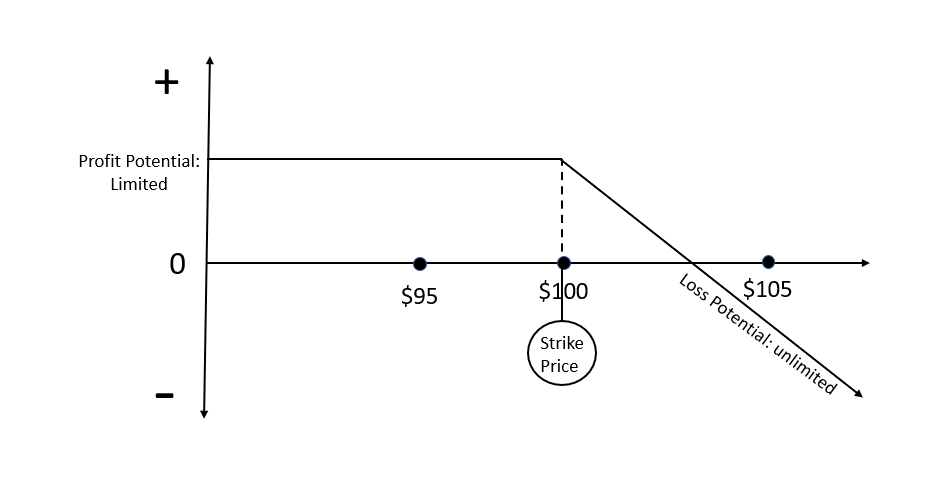

Profitability is different for buyers and sellers

In the above examples, it appears that the option seller (Caleb) has come out on the losing end. His profits appear to be limited only to the value of the premium, whereas the losses are much higher.

On the other hand, Tyler, the option buyer, appears to have losses limited only to the value of the premium while enjoying much higher profits.

|

Option buyers’ losses are limited only to the amount of premiums paid to sellers. In contrast, their potential profits are unlimited. |

|

While option sellers’ gains are limited only to the value of premium, while their losses are potentially unlimited. |

So, is it better to buy options rather than sell them?

Not really. According to a 1990s study, the odds of options trades being profitable for option sellers are a whopping 75%, while the odds for option buyers are only around 25%.

As a result, deciding whether to buy or sell options comes down to your risk tolerance.

Would you prefer a 25% chance of making high profits or a 75% chance of making lower profits?

FINAL WORDS

This article only scratches the surface of options trading. There are many advanced option trading concepts and strategies that you can start to use after you master the basics.

For example, concepts like “moneyness of options” will allow you to decide which strike price to trade in options, while “option greeks” can be used to define the different dimensions of risk involved in taking an option position.

Then there are specific options strategies like covered calls, iron condor, butterfly, and many more that allow you to potentially generate more profits, limit your risk, and even hedge against market fluctuations at the same time.

Options trading certainly can’t be explained in a single blog. But you now have the building blocks needed to take the next steps.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.