This earnings season, a lot is working against American stocks:

Sky-high inflation, a hawkish Fed, growing recession fears, supply-chain snarls, and slowing consumer demand…

Investors, however, need to factor in a growing threat: A STRONG US DOLLAR!

Since the previous earnings season, companies have been warning about the harmful effects of a strong dollar on their earning potential…

But those concerns have been elevated in recent weeks as the greenback broached significant milestones, such as hitting a new record high of $114.79 for the first time in 20 years!

The dollar has posted a sharp rise since early 2022!

Part of the reason is that the Federal Reserve has been more hawkish and hiked interest rates to the highest level since 2008 in an effort to quash the steaky inflation.

Given the dollar’s prominence as the global reserve currency…

Its appreciation has far-reaching impacts on the economy and stock markets around the world.

This article delves into the factors behind the dollar’s recent strength, what it means for investors, and what the endgame could be.

First off, What Does a Strong Dollar Mean?

Finance 101 tells us that a ‘strong dollar’ refers to the relatively strong value of the U.S. dollar against a half-dozen major currencies. A currency isn’t strong or weak on its own; it can only be so compared to something else.

Generally speaking, the relative value of the U.S. dollar changes due to a complex array of factors, including:

- Supply and demand,

- Interest rates,

- Foreign investments,

- Geopolitical events, etc…

A stronger dollar bull market has been negative for stocks mainly because it adversely impacts the profits of global corporations. A stronger dollar makes imports cheaper but makes exports more expensive and less competitive on world markets.

But Why Is The Dollar Strengthening Now?

Currently, the dollar is strengthening against other currencies for a variety of reasons. Here are just a few:

A. The Federal Reserve’s strong dollar policy

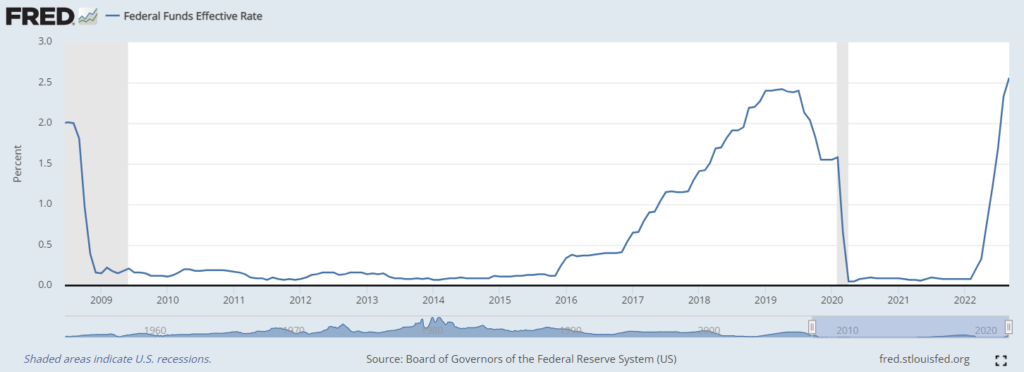

Since the beginning of 2022, the Fed has rapidly changed course from its crisis-era policy of keeping rates at 0% to lifting the federal funds rate to a range of 3.0% and 3.25% at the September FOMC meeting, the highest since 2008.

At its September 2022 meeting, the Federal Open Market Committee (FOMC) predicted a rate of 4.6% in 2023, with the possibility of upward revisions in subsequent discussions.

In response to the Federal Reserve’s aggressive pace of rate hikes, yields on U.S. Treasuries posted staggering gains and are now remarkably higher than in most G-7 countries.

The benchmark 10-year U.S. treasury yield briefly traded above 4% last month, compared with the 10-year German bond at 1.25% and Japan’s 10-year Treasury at 0.22%.

The high-interest rates on U.S. bonds are luring foreign investors to buy U.S. treasuries – which obviously require dollars to buy. This has increased demand for the dollar and is driving up its value.

B. Safe-haven status

The U.S. dollar is one of the few currencies viewed as a “safe haven.” When the economic and geopolitical landscapes look worrying, investors have a tendency to purchase dollars.

Currently, the U.S. economy is on the verge of a recession; European economies are taking the brunt of Russia’s war on Ukraine, especially in the form of dramatically higher energy prices.

Japan is struggling with lower global demand while China’s economic worries continue to mount due to its zero Covid policy and bursting real estate bubble.

The sheer tonnage of economic risks is swamping the global economy, prompting investors to seek safe-haven investments like the U.S. dollar, owing to its inverse relationship to equity movement.

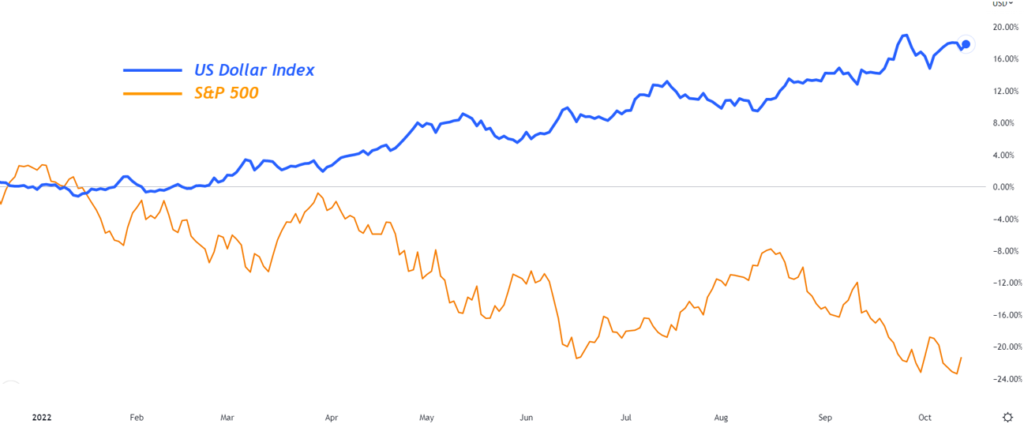

The graph below demonstrates the strength of this relationship between stocks (represented by the S&P 500 Index) and the U.S. dollar.

Since the beginning of the year, the S&P 500 posted a -24.96% decline while the US dollar has risen to a two-decade high, gaining as much as 20.16%, posting the highest YTD gain since 2000!

When foreign investors pour money into U.S. dollars, they sell other currencies. Buying dollars pushes up the greenback’s value while selling other currencies decreases their value.

U.S. consumers are clear beneficiaries of the trend who are already feeling the pinch from high prices and will appreciate the fact that any imported goods or services purchased in euros, pounds, or yen are now significantly cheaper than they were a year ago.

The strong dollar is providing an offset to inflationary pressures, which we’ve seen via improving consumer spending.

“High-interest rates, combined with the dollar’s position as a safe haven, are a potent mix and have driven the dollar index to appreciate the most since 2002.”

How Does the Dollar Impact U.S. Equity Markets?

As previously stated, the dollar moves inversely to equity prices, and the current bear market is no exception. A strong dollar may drag down equities for a variety of reasons, including the following:

A. Strong dollar bruises corporate earnings

U.S.-based companies with overseas businesses will eventually need to convert their foreign income back into dollars. Converting a weaker currency (Euro, yen, pound, etc.) into the stronger dollar will translate into fewer dollars, potentially impacting sales and profit expectations.

Approximately 30% of S&P 500 Index revenues are generated overseas, which can significantly impact index performance.

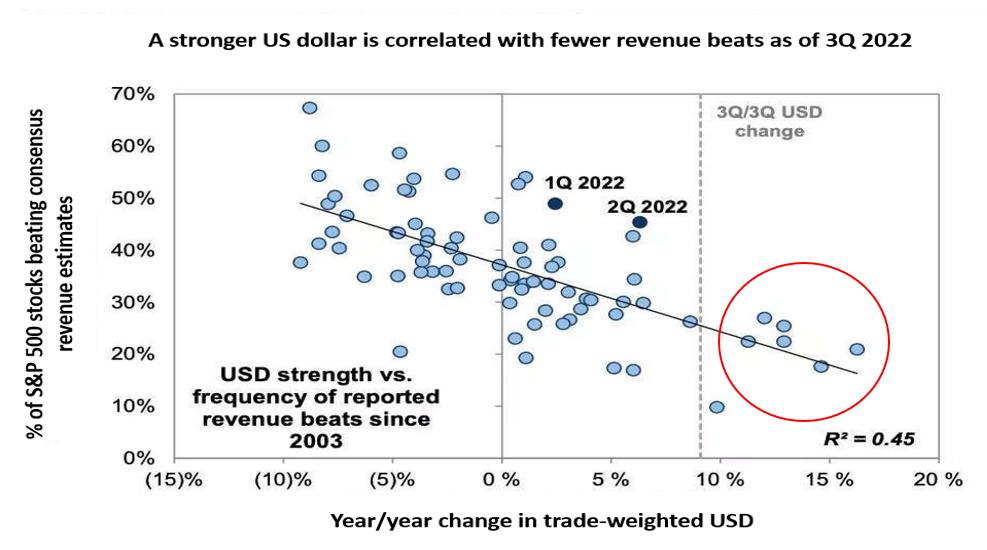

The graph below shows how, as the dollar strengthens, the percentage of S&P 500 companies beating consensus revenue estimates in the third quarter of 2022 decreases.

As more companies miss their earnings estimates amid the strong U.S. dollar, stocks get punished, sending markets even lower as the contagion spreads and grows.

Because of the stronger dollar, companies with outsized exposure to international markets tend to see less demand for their products as they are more expensive compared to their domestic rivals.

Since the last earnings report, U.S.-based global corporations such as Microsoft ($MSFT), Procter & Gamble ($PG), Philip Morris ($PM), and Coca-Cola ($KO) are among those that have lowered profit expectations based on currency impacts.

The tech sector will be especially troubled by the greenback’s rise since it derives nearly 50% of its revenue from outside the U.S., meaning that swings in foreign-exchange rates have an outsized influence on profit.

That’s not to say there are no safe havens from a strong dollar.

Companies with less international exposure, such as utility companies and regional banks, could be shielded from the foreign-exchange headwinds.

B. Trade Imbalance dampens growth:

Extensive studies have been conducted to determine a strong dollar’s effects on the global economy. However, most are based on historical conditions of low inflation and fully-functioning international trade.

With prices trending up and much of the world experiencing an energy crisis or other disruptions, normal conditions might not apply.

Historically speaking, when the dollar was strong, the rest of the world would send more goods to the U.S. to take advantage of the stronger greenback, hurting U.S. economic growth and causing the dollar to weaken.

But we aren’t in normal times.

With Europe constrained by the energy crisis and China still disrupted by Covid-related shutdowns, there’s a big question over how foreign manufacturers can take advantage of weaker local currencies to export more to the U.S. in the way they used to.

A strong US dollar, therefore, presents an added risk to global growth.

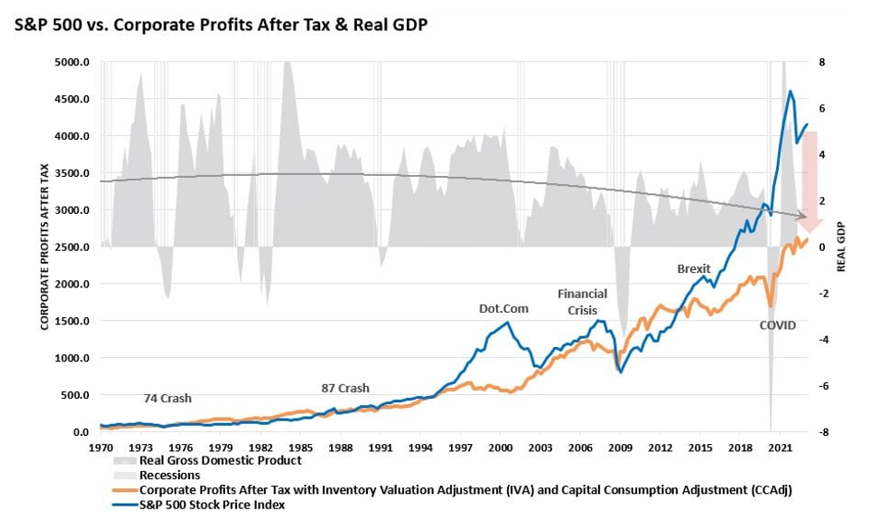

As domestic and global demand weakens, investors should not expect corporate profits to remain near record levels. The chart below indicates the current spread between stock prices and corporate profits, which is the widest on record.

C. Decline in foreign capital inflows:

For foreign investors, a stronger dollar means it will take more of their local currency to equal the same number of dollars, meaning the price of U.S. financial assets increases when denoted in other currencies.

This may discourage overseas investment in U.S. stocks.

Furthermore, foreign investors may face growing pressure to sell their existing U.S.-based holdings to reap currency-related gains, especially as local opportunities become available, further pressuring demand for U.S. stocks.

FINAL WORDS

First, the macro headwinds that drove the U.S. dollar to multi-decade highs seem unlikely to reverse anytime soon. Traders and investors will probably have to deal with the continued stock-specific volatility that comes with a strong dollar.

Second, a strong U.S. dollar will likely have an asymmetric impact on global economic growth, which will probably be weaker and may tend to depress stock valuations.

Third, a strong U.S. dollar makes U.S. assets expensive relative to foreign investments, eventually affecting cross-border capital flows. The same is true for profitability—U.S. dollar strength tends to lower U.S. company profitability relative to foreign firms.

However, a strong U.S. dollar may cool down the decade-high inflation, prompting the Fed to switch from fighting inflation to protecting growth. This could reduce the pace of rate hikes and weigh on the dollar.

If the dollar tends to fall in value, we could see riskier assets; notably stocks, begin to recover, but there are no guarantees.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.