During 2023, the US economy has withstood economic headwinds better than anticipated. Yet, much of the data has been contradictory and financial participants are uncertain of what lies ahead.

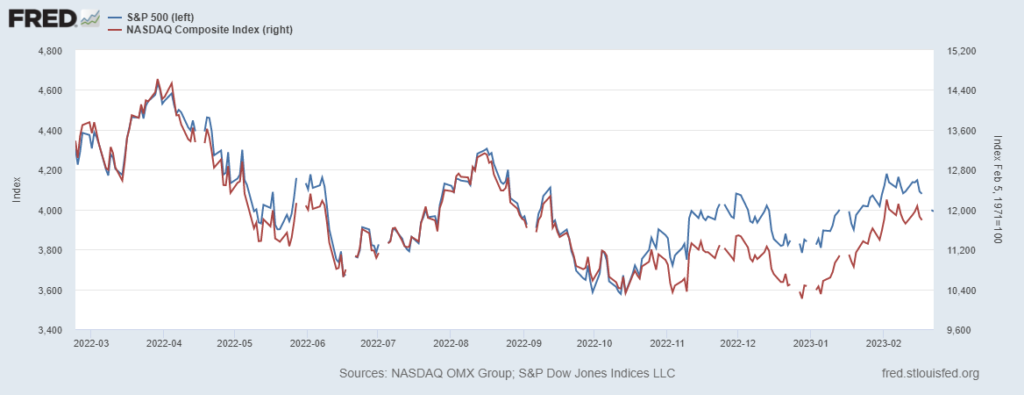

Having said that, the equity markets have by and large signalled an improvement in market sentiment, driven by expectations of a softer landing despite the ongoing monetary tightening.

The labour market has surprised policymakers with its resilience contributing to the Federal Reserve’s hawkish outlook as inflation continues to pose a threat.

As the Federal Open Market Committee (FOMC) approaches the terminal rate, Jerome Powell must tread an ever-narrower path, to avoid overtightening into a painful crash, or risk pausing too soon and stoking bubbling inflation.

TL;DR

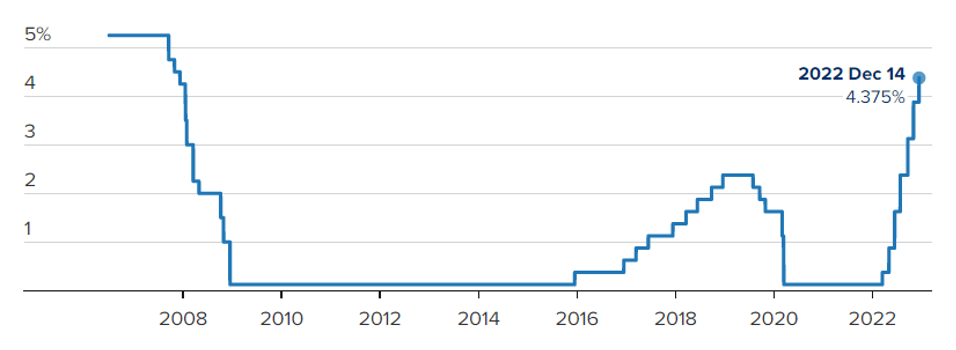

Through 2022, the Fed embarked on an unprecedented tightening pathway, with the Federal Funds Rate rising from effectively zero to 4.50% – 4.75% today.

The Federal Reserve in its February 1 announcement eased to a 25-bps hike.

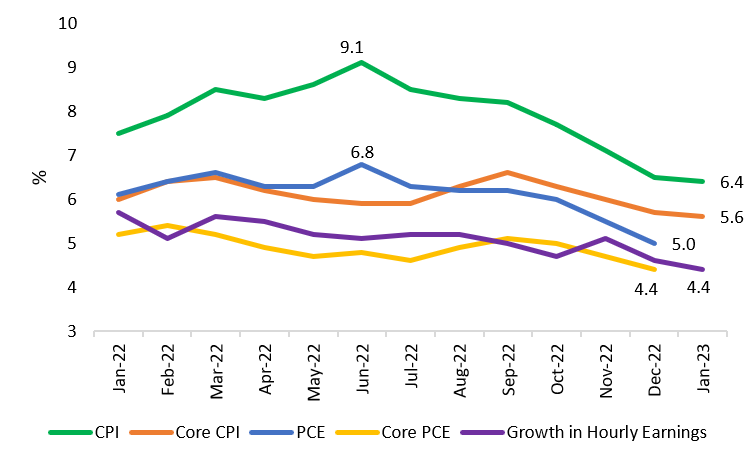

Despite its hawkish narrative and tightened financial conditions, inflation continues to exhibit an upward bias.

Current estimates suggest that US GDP will contract in Q1 2023 despite a surge in nonfarm payroll jobs.

Discretionary expenditure is slated to fall due to high inflation among food items and rents.

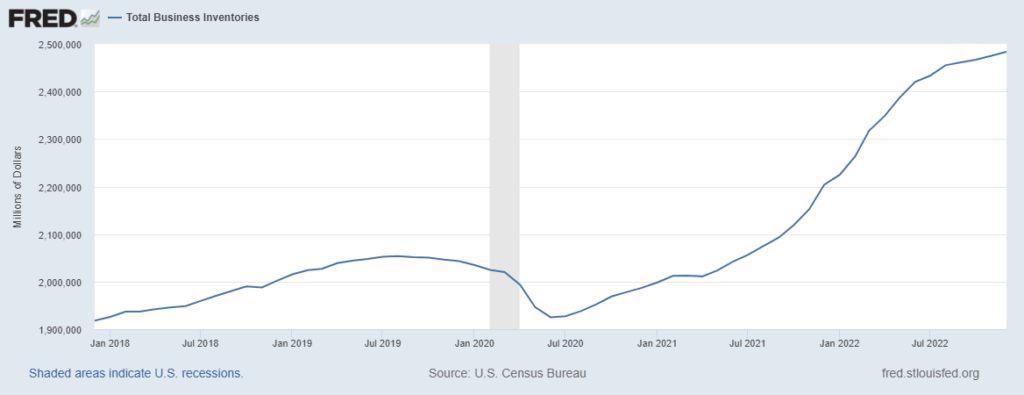

High inventory stocks, slower consumption, a higher savings rate and weaker manufacturing data are expected to be a drag on growth.

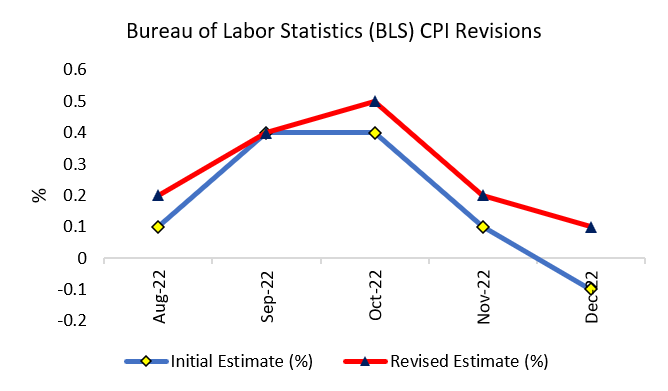

Analysts have advised a cautious investment approach following heavy revisions in labour and inflation data.

Markets continue to be watchful as the Fed navigates risks of overtightening versus premature easing. Several additional national and global market factors could push the balance in either direction. Due to this dynamic, equity markets may see elevated volatility in the coming months.

The Fed is expected to implement an additional quarter-point hike in March and publish the much-awaited Summary of Economic Projects (SEP) and dot-plot.

HANGING ON The FED's every word

On February 1, the FOMC statement noted,

“In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy…”

This single sentence caught the attention of market players and global investors, due to the change of just one word.

The Fed replaced “pace” with “extent”, clearly indicating that the rate hike cycle was coming to a close as policymakers expected to be nearing the terminal rate sufficient to sustainably bring down inflation.

Although largely expected, this officially marked a shift from just a few months earlier, when the Fed churned out four successive 75 bps hikes.

The downshift in monetary policy was a result of easing inflation, calmer geopolitical headwinds and burdensome interest payments on the national debt.

According to Worldometer figures, the total annual interest payable is comparable to the GDP of Switzerland, Ukraine and Luxembourg, combined.

However, the Fed has maintained that high inflation remains a serious concern, and will continue to tighten in traditional 25 bps increments.

Economic growth outlook

During Q1, growth is likely to be subdued due to the continuing low consumer expenditure towards the end of Q4 2022 following high inflation in food and shelter, and despite the surge in nonfarm payrolls in January.

Moreover, excess inventories will pull down economic activity.

Most economists would argue that the Fed’s accelerated tightening regime is likely to push the US into a recession later this year.

Early estimates suggest that the GDP for the first three months of the year may contract by 0.6% YoY.

inflation outlook

Inflation remains two-and-a-half times the Fed’s stated target, while the dangers of de-anchoring expectations still loom overhead as the hiking cycle comes to a close.

Shelter inflation, for instance, is particularly stubborn, rising 0.7% in January, fuelling concerns that inflation may persist.

The NY Fed’s January consumer expectations survey found that median one-year expectations remained elevated at 5%.

At the same time, median household income is expected to cool indicating a pullback in economic activity.

With the importance of both monetary and fiscal coordination in managing such high levels of inflation, a fractured US government will be less effective going forward.

Perhaps most concerningly were the substantial revisions to the Consumer Price Index (CPI) data for preceding months, suggesting that the reported rates may not be doing justice to the reality on the ground, dispelling any premature deflationary expectations.

labour market strength

Labour market data surged in January, coming in well above expectations at 517,000, after five consecutive months of declines. Market analysts had projected this figure to be between 180,000 – 200,000.

The strength in the nonfarm payrolls has been one of the strongest factors driving the Fed’s hawkish rhetoric.

However, given the significant revisions to the data, the BLS itself cautioned that,

“…adjustments can affect the comparability of household data series over time.”

The high proportion of part-time employment is another factor to keep in mind.

The unemployment level fell to a 53-year low of 3.4%, although the ISM Manufacturing PMI contracted to 47.4 which could be a source of fragility in the jobs market.

Labour data has undoubtedly surprised to the upside but market participants should be cautious when interpreting this sudden increase.

two scenarios

factors supporting a hard crash

- The Federal Reserve tightened at an unprecedented pace throughout 2022 and continues to remain hawkish. There is a strong possibility that the economy may yet feel the accumulated effects of these policies.

- Delinquency rates are headed higher with rising defaults on auto loan payments and credit card loans.

- Mortgage applications have continued to decline, dampening the residential market with existing-home sales falling by nearly 18% YoY and housing inventories up over 15% YoY.

- The resignation of Dr Lael Brainard as VP of the Federal Reserve has been viewed as a pathway to a more hawkish FOMC.

- A sustainable economic recovery may be further compromised by ageing demographics, reduced capital investment, low productivity growth and intensifying geopolitical tensions.

factors supporting a soft landing

- Remarkable labour market growth in January may ensure the adverse effects of a recession are relatively muted.

- Retail sales surprisingly increased by 3% in January perhaps responding to the stronger-than-anticipated jobs data.

- Earnings calls from Walmart and Home Depot were positive. However, uncertain corporate guidance regarding future consumer demand dented equity valuations, adding to market confusion.

- The Bureau of Economic Analysis reports that savings rates reached 3.4% in December 2022, a 7-month high. This would provide a vital financial cushion to households.

- The University of Michigan’s Survey of Consumers February report showed an improvement in sentiment to a 13-month high at 66.4, well above forecasts of 65.0.

- Market participants are optimistic that the reopening of the Chinese economy will help revive growth.

- The Fed minutes also noted that a number of local government bodies had “sizeable budget surpluses” that could ease community transitions amid an economic slowdown.

- A subset of market analysts anticipate that inflation may come down faster than anticipated. One potential reason could be the decline in the M2 Money stock.

Expectations

There is a very high likelihood that the Federal Reserve will continue to tighten policy in March, and at least once more in its following meeting.

The CME Fedwatch tool shows a 73% likelihood of a hike by 25 bps and a 27% chance of a 50-bps increase given inflation’s upward bias.

‘Bond King’ and CEO of DoubleLine Capital, Jeffrey Gundlach warned this week that the likelihood of a recession is high given the Fed’s hawkish position, while financial markets appear broadly hopeful that this remains shallow and short-lived.

However, maintaining elevated rates throughout 2023 to restore price stability to 2% will be challenging given pre-existing debt burdens, advancing recessionary risks and potential labour market weakness.

The Fed is itself in an exploratory phase and its decided pathway will only become clearer as more data becomes available.

Market watchers will keenly follow the Fed’s SEP published after the March meeting. The dot plot is likely to shift higher demonstrating the hawkish views of FOMC members.

Until there is clarity in the market on interest rates, equity markets will likely see more volatility in the months ahead. Although historically low, the VIX reached 22.87 on the 21st of February, the highest value since the first trading session this year.

Given the conundrum policymakers are faced with, the likelihood of overshooting the terminal rate or making other macroeconomic mistakes has risen.

FINAL WORDS

The Federal Reserve is expected to tighten rates by 25 bps in its March meeting, while the target terminal rate may shift higher.

- Q1 will likely see a contraction following a pullback in spending and an improvement in the savings rate.

- The Fed’s hawkish stance and commitment to bringing inflation down to 2% has driven recessionary fears. Given the strong labour market and higher savings rate, markets are hopeful that the fallout will be relatively mild and contained.

- Markets are also wary of a resurgence in inflation as the Fed looks to end its rate hike cycle. The BLS revised the CPI data upwards for several recent months.

- Given the policy difficulty in navigating high inflation and recessionary risks, equities and other financial instruments may see higher volatility in the coming months.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.