Recent events have signaled that that monetary tightness and illiquidity may be having devastating effects on bank stability.

Besieged by a combination of high-interest rates, widespread bank runs and the threat of broader insolvency, the US banking system has had to face the music.

Crypto-focused Silvergate underwent liquidation, while turmoil in Silicon Valley Bank and Signature Bank marked the second and third-largest bank failures in US history, respectively.

Crumbling under deposit outflows estimated at $89 billion, the capital-starved First Republic Bank was rescued from the brink by a collective of marquee banks.

The collapse of the Swiss major Credit Suisse highlighted the global nature of the liquidity crunch.

The Fed and other central bank are propping up dollar liquidity to calm international markets.

a snapshot of inflation and bank stress

In January 2023, the markets were relatively optimistic as the Federal Reserve was expected to shift gears to its traditional 25 bps hikes, a signal that the rate cycle was nearing its conclusion.

Unfortunately, with rates having been ultra-low for a prolonged period and the magnitude of fiscal injections during the pandemic, inflation is proving to be much more challenging than initially expected.

According to the most recent data, the annualized CPI for January eased only just from 6.5% to 6.4%, while core CPI moderated from 5.7% to 5.6%.

Personal Consumption Expenditures (PCE), rose from 5.3% to 5.4%, while core PCE edged higher to 4.7% from 4.6% in the previous month.

Nonfarm payrolls came in extremely hot, while unemployment fell to a historic low, further driving inflationary concerns.

Inflation expectations as measured by the University of Michigan ticked up from 3.9% to 4.1%, indicating that the Fed will have to tighten for longer to stave off inflation.

In addition, the US banking system is perched precariously having lived through three high-profile bank failures in recent days.

Silicon Valley Bank (SVB), an umbrella bank for innovative tech sector companies witnessed a 60% dip in its share price during a single session. The next day was no better, showing a further crash of 60% before regulators halted trading and closed its operations.

Reeling from a liquidity crunch, anxious customers rushed to withdraw their funds, particularly from regional and local institutions.

To calm the markets, regulators announced the unprecedented decision to insure 100% of depositor funds of both SVB and Signature Bank.

This was in stark contrast to the established regulations of the Federal Deposit Insurance Corporation (FDIC) protecting holdings up to $250,000.

Yet, bank stock prices across the board have plummeted this month, driving concerns of a potential widespread financial system failure.

TL;DR

- The US banking system has seen significant stress, resulting in the closure of SVB and Signature Bank.

- The Fed and financial authorities in the US stepped in to protect 100% of deposits in both institutions.

- The FDIC provides insurance for deposits up to $250,000 which should protect most depositors in the US.

- Regional and potentially global banks are increasing borrowings to combat liquidity stress but are doing so under the threat of rating downgrades and potential insolvency.

- With tightness and liquidity shortages overseas, the Fed along with 5 other central banks have operationalized facilities to inject more dollars into the global market.

- If the Fed were to hike rates in its meeting this week, the global banking system could face additional stress.

- Due to elevated rates today, refinancing costs could be a major risk for several businesses. In particular, below investment grade issuances are likely to see a downside in the future.

TROUBLING DEVELOPMENTS in the banking sector

the surge in yields and the fall of SVB

SVB was the go-to bank for cash-rich technology companies and business owners based in Silicon Valley.

In 2020, when the pandemic hit, massive fiscal injections by the government resulted in the banks being flushed with excess deposits.

SVB was no different and saw its deposit base grow nearly three times during that period.

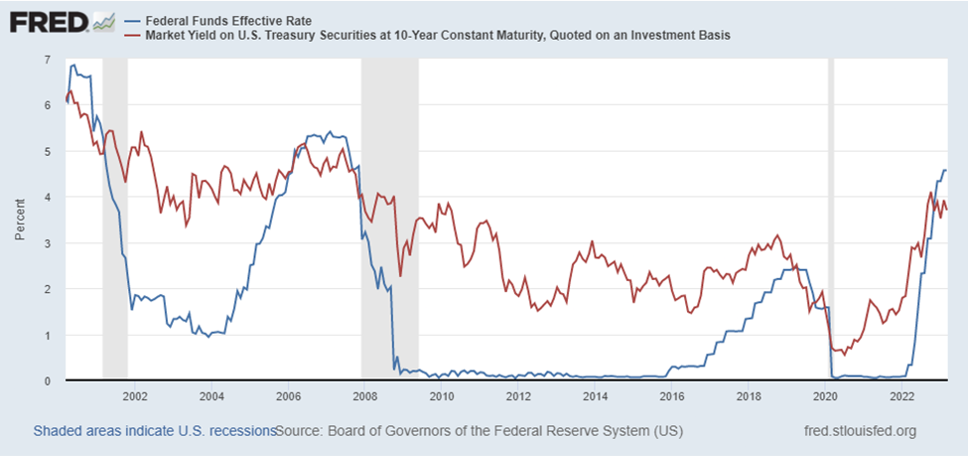

Yet, safe investment avenues were difficult to identify leading to an over-reliance on the bedrock of global economic strength, the US 10-year treasury.

Bank strategists and asset managers assumed that yields which were under 1% levels would remain subdued ensuring a secure investment.

However, with the Fed’s decision to raise rates at an unprecedented rate, these yields shot up to even above 4% which was unthinkable not long ago, pushing heavy treasury owners into an untenable position.

Earlier this month, Chairman Powell’s decision to announce that rates may head higher by 50 bps in the March meeting seems to have at least partly contributed to the collapse of SVB by exacerbating the pre-existing liquidity crunch, with regulators forced to move the institution into receivership.

Source: US FRED

Along with Signature bank, regulators froze nearly $265 bn in deposits as the broader public began to panic about the state of the financial system.

deposits are flowing from local and regional banks to big institutions

Amid the panic, bank customers withdrew vast amounts of their funds from smaller, local banks.

PacWest for instance reported an outflow of $700 mn of depositor funds in a few short days.

On the other hand, marquee institutions such as JP Morgan, Bank of America and CitiBank received voluminous inflows of deposits, well above standard weekly averages.

Despite the government guarantees, it appears that most customers believe that the larger institutions will be better protected in the case of widespread losses in the financial sector. For instance, Bloomberg reported that Bank of America received more than $15 bn in new depositor money in a very short period.

The size of these outflows poses a major threat to the sustainability of regional banks which are searching for new methods to retain customer confidence.

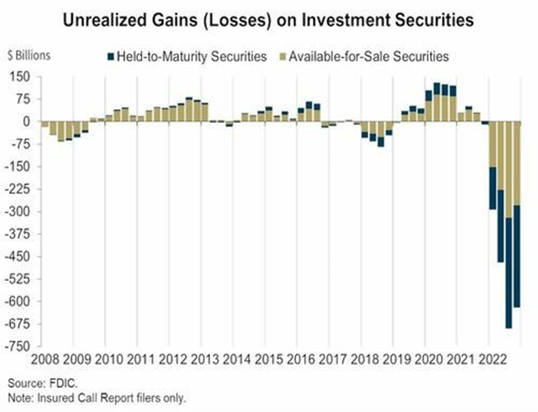

Massive unrealized losses

Having accumulated excess deposits during the pandemic and operating in an environment where money was essentially free, bank portfolios have faced heavy losses as both bond prices and equities collapsed.

The FDIC reports that insured banks are facing unrealized losses of at least $620 bn.

These unrealized losses are the source of the liquidity issue. They are unrealized because the bank has not yet sold these assets. They can essentially not be sold because these institutions would incur a massive loss.

Banks are no longer certain which of the peers is credit-worthy and which may be on the brink of insolvency, and potentially, unable to repay borrowings in the vital overnight markets.

Source: FDIC

As a result, the FRA-OIS spread which describes the health of the overnight markets surged from around 3.0 on March 8th to 59.80 in three working days.

Essentially, in normal times, the spread remains small, while a wider spread points to more stress and institutional distrust in the overnight markets.

This was the highest level since the Lehman collapse, except for during the pandemic.

Although the indicator eased considerably thereafter, it is still at an elevated 47.38 as of Friday, 17th March 2023.

POTENTIAL FOR DOWNGRADES AS REGIONAL BANKS LOOK TO BORROW MORE FUNDS

Due to the scale of unrealized losses, regional banks and other institutions are unable to sell their assets to unlock liquidity.

At the same time, the sharp outflow of deposits means it is much harder for the bank to fund its obligations, continue operations and maintain customer confidence.

There is little alternative but to borrow more money from willing lenders.

The Federal Home Loan Banks (FHBL) system raised nearly $90 bn in short-term debt to lend to regional banks that are in dire need.

This raise was well above the stated target of $65 bn indicating the degree of stress FHLB expects these banks to undergo.

Lastly, Moody’s Investment Service does not expect public anxiety to evaporate in a hurry, and has placed several mid-sized banking institutions on rating watch, and will review their progress and consider downgrades, if necessary.

The international banking system is also starting to indicate stress as well with trading in a major European bank being suspended last week.

THE FOMC’S DILEMMA

One of the key reasons that liquidity is tight in the system is the surge in the federal funds rate, raising borrowing costs dramatically.

Thus, the Fed is now faced with two problems, having contradictory solutions.

High inflation, which despite the Fed’s efforts is still near four-decade highs would force a higher interest rate.

Simultaneously, the banking sector is displaying fragility, demanding a stop to tightening or even a shift to lower rates.

First Republic Bank which primarily services high net-worth individuals was under threat with fears of an SVB-like bank run.

Markets reacted positively when the immediate danger was thwarted last week when a group of 11 large banks including Citi, Bank of America, Wells Fargo, Morgan Stanley, and Goldman Sachs offered a $30 bn deposit to rescue the financial institution.

To address this, major global central banks including the Federal Reserve, Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank agreed on coordinated action to inject more dollars into the global financial system.

Although confidence in the financial system has been bolstered by the measures of the Fed, FDIC and the Treasury, which raised expectations that the Fed would continue its 25 bps tightening pathway, the market is uncertain on the outcome of the Fed meeting this week.

On the 20th of March 2023, CME FedWatch Tool continued to see-saw, reporting a 56.5% chance of rates remaining unchanged with a 43.5% chance of a hike by 25 bps.

If banking sector stress suddenly intensifies, the FOMC may be forced to at least pause the tightening cycle for now.

GLOBAL CENTRAL BANK ACTIONS

In the United States, authorities and other market players have taken constructive steps towards providing liquidity, supporting troubled institutions and preserving depositor confidence.

As discussed above, leading banks collaborated to support First Republic Bank, likely averting the possibility of bank failure.

Secondly, the Fed, the Federal Deposit Insurance Corporation (FDIC) and the Treasury Department had stepped in earlier this month to preserve 100% of the deposits at both SVB and Signature.

This was a bold move on the part of policymakers since the standing FDIC protection only covers accounts to a size of $250,000 each.

Although markets remain watchful, most deposits in the US should be safe because they fall under this limit, providing families and businesses with a crucial safety net.

However, there are rising concerns that the banking crisis could extend beyond US borders and into the global arena. Fears among financial institutions of possible contagion and other banking challenges have resulted in a need to improve liquidity conditions.

To address this, major global central banks including the Federal Reserve, Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank agreed on coordinated action to inject more dollars into the global financial system.

Drawing on US dollar swap lines, the central banks will increase the flow of US dollars to ease the conditions of those facing liquidity crunches.

With the positive strides made by the US authorities, dollar demand is expected to see an uptick, however, this would also depend on the Fed’s interest rate decision this week.

In addition, authorities will be closely watching the performance of financial equities across Europe and other regions to gauge the market reaction to this move.

If stock markets perform poorly, this may persuade the Fed to loosen monetary policy in its March meeting.

WHAT’S LIKELY TO HAPPEN NEXT?

As the world’s reserve currency, the potential for interest rate hikes in the US is not an isolated concern and instead has international ramifications. As a result, there is a likelihood that an increase in the Fed’s Funds Rate could lead to elevated banking stress globally.

The Federal Reserve and other central banks are expected to continue their intervention in some shape or form to resolve these risks.

Given the tightness in the markets and the need for many businesses to continue to borrow, refinancing costs could become a potential area of concern, where the once cheap financing due to low-interest rates will now be subjected to much higher refinancing costs.

Many businesses were fortunate enough to borrow at muted rates of 1% and lower during the era of easy-money policies.

However, today interest rates and bond yields have spiked sharply making refinancing costs a major challenge for most entities.

Although US treasuries are still the gold standard portfolio investment and considered very safe in the high-grade short-term debt market, corporate issuances that are below investment grade could face a major issue refinancing debt, and may very well be the next domino to fall if unaddressed.

In particular, we can sound out corporate bond issuances as an asset class, especially those at a C-rating and below, that are highly likely to see more downside as a result of previous debt and refinancing stress.

FINAL WORDS

The US banking system was rocked by failures and near-failures of multiple regional banks.

- The banking system is suffering from elevated risk in the overnight markets, a liquidity crunch, huge unrealized losses and high inflation and is still at risk of more bank runs.

- The tight monetary environment and Chairman Powell’s hawkish statements last week led to a crisis of confidence in the banking sector.

- Silicon Valley Bank collapsed earlier this month, marking the largest bank failure since the GFC.

- The Fed, FDIC and the Treasury Department have intervened to provide liquidity and maintain depositor confidence.

- With emergency funding made available to First Republic Bank, the markets seem to have calmed down for the moment, on the belief that any possibility of contagion has been contained.

- To respond to increasing banking stress in the global arena, the Fed and five other major central banks have agreed to provide more liquidity via US dollar swap lines.

- Due to the high rate environment, refinancing is becoming a considerable challenge for many companies. Below investment grade corporate bonds may be vulnerable to significant downside risks in the future.

Note: The information in this article is as of the 20th of March, 2023 but is also subject to rapid developments.