Since the Federal Reserve began its rate hikes in March 2022, the US economy has been far more resilient than initially anticipated.

The labour market has remained tight while GDP growth has been relatively strong.

In the past few weeks, the US financial system was rocked by the second and third-largest bank failures in its history, leading to volatility in the VIX and turmoil in banking equities.

Contagion fears gripped markets and overnight markets suddenly tightened, over and above the Fed’s monetary actions.

Lending institutions were on edge, forcing the Fed, Treasury and FDIC to intervene in a bid to fortify depositor confidence.

Burdened by the weight of unrealized losses, marquee names including JP Morgan and CitiGroup infused $30 billion to rescue First Republic Bank after shares of the HNI servicer dropped by 90%.

The international banking system began to show cracks with the collapse of Credit Suisse and subsequent sale to UBS.

However, the intervention of government authorities and regulators around the world to strengthen liquidity and deposit insurance has calmed markets and big funds have begun to re-enter equities.

Despite financial system concerns not being entirely in the rearview mirror, the S&P 500 is up 7.02% YTD and has risen 5.58% in the past month.

Although near-term economic prospects remain somewhat uncertain, the outlook has certainly improved as Federal Reserve policymakers continue to remain vigilant ahead of the next FOMC meeting on May 3rd.

Jerome Powell and the board of governors will likely continue to tighten rates with a quarter-point hike given that confidence is returning to the financial sector, but will confirm their decision only after closely monitoring the inflation situation and banking risks.

TL;DR

- In the last few weeks, the US banking system has seen significant stress, resulting in the closure of SVB and Signature Bank.

- Regional banks and potentially global banks that are facing liquidity stress and were under heightened threat of rating downgrades and potential insolvency, continue to be monitored.

- However, due to measures taken by regulatory authorities, emergency injections and relatively sound capital adequacy-liquidity in the broader banking system, market sentiment has improved from bearish to slightly bullish but vigilant.

- Big money funds have begun to source opportunities in the equity markets that may be undervalued

following last month’s banking stress.

- Globally, central banks have coordinated to boost dollar liquidity.

- There is a risk that US inflation may yet see a return to higher levels, due to which the Fed will likely continue to tighten rates in the next two meetings.

- The BRICS Summit in August aims to operationalize an alternative to the dollar-led SWIFT system for international settlements, which could slow demand for the greenback.

PRICE STABILITY CONSIDERATIONS

PERSISTENT INFLATION

Although fighting inflation has been the number one agenda for the FOMC for over a year, the sudden emergence of the banking sector crisis amplified pre-existing uncertainties.

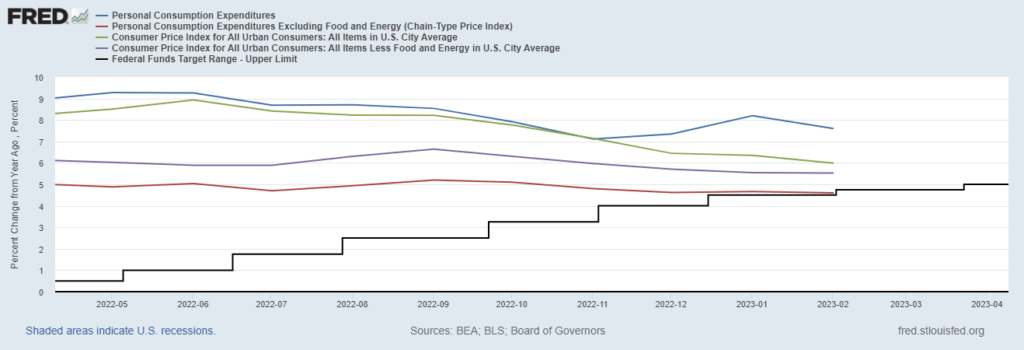

Source: US FRED

During the previous month, the Fed’s preferred inflation gauge, the PCE, eased from 5.3% to 5.0%.

Following a warmer European winter, a weaker demand outlook and a relative decline in global geopolitical tensions, energy prices eased considerably from a 52-week high of $123.68 to $80.9 at the time of writing.

Although a welcome decline, inflation is appearing relatively persistent especially due to sticky shelter prices and concerns about rising food costs.

Further, geopolitical tensions could spark higher supply chain costs without much notice.

As a result, headline inflation may still be susceptible to unforeseen reversals, and managing these risks would likely drive a continued hawkish outlook from the Fed.

LABOUR MARKET

The job market has remained more robust than anticipated, weathering the surge in borrowing costs relatively soundly.

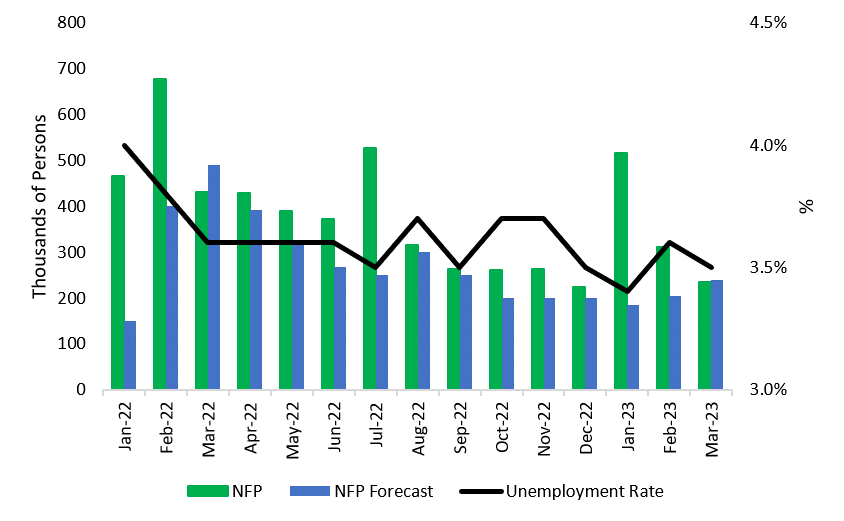

Source: BLS

Investor sentiment was mixed following the moderation in the latest jobs report, which indicated cooling economic forces.

NFP counts fell to 236,000 from 311,000 in February, which was a shade below market estimates, but remains above the pre-pandemic averages.

Unemployment, however, fell from 3.6% to 3.5% and is likely to remain suppressed given ageing demographics and the mass exodus of workers during the pandemic.

Average hourly earnings rose 4.2% compared to 4.6% in the month prior, but remain well above the inflation target.

During March, both manufacturing and non-manufacturing jobs data from the Institute of Supply Management (ISM) were weaker than expected, although the latter stayed in expansionary territory.

This suggests that the jobs market may finally be showing signs of stress, but is likely robust enough to encourage the FOMC to continue to tighten in the near term.

Dollar strength

The dollar weakened following the banking crisis, and the DXY is lower by 1.4% YTD at the time of writing.

However, as confidence begins to return to the markets, and big funds look to scout undervalued equities, the DXY is showing signs of recovery, rising 0.18% in the past 5 trading sessions.

With a high probability that the FOMC will raise rates once more in its May meeting, the dollar is likely to continue to be robust in the near future.

A potential source of weakness for the greenback may be the attempt by the BRICS and several other governments to operationalize a substitute international payment system for settlement purposes that does not depend on the dollar.

If this effort succeeds, global markets may quickly see declining dollar demand.

In such an event, excess dollars could flow back to the country leading to additional inflationary pressures, which may lead to a higher terminal rate for the Fed.

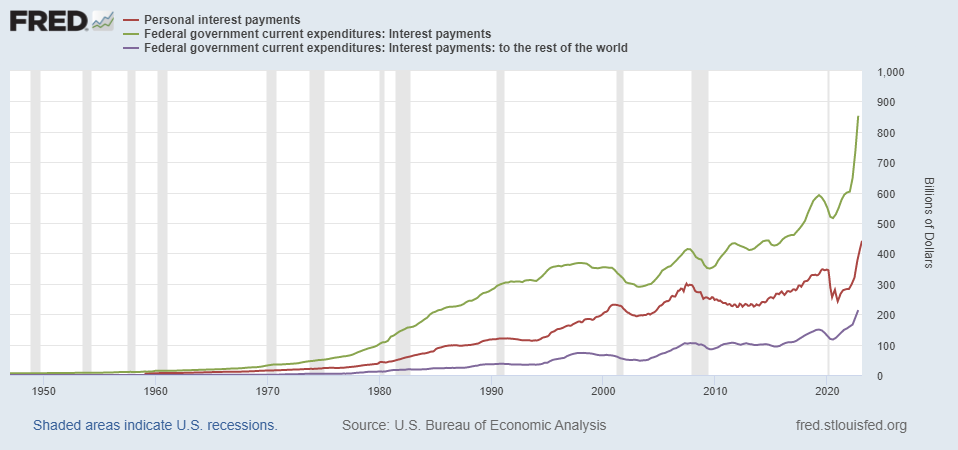

Yet, financial market concerns have not completely dissipated and with interest burdens mounting, it is unclear how sustainably the FOMC will be able to continue to tighten after already making nine consecutive rate hikes including six supersized moves.

Source: US FRED

RESTORING CONFIDENCE IN THE BANKING SECTOR

The underlying weaknesses in the US banking system were exposed last month with the fallout at Silvergate, SVB and Signature.

Several banks had lent money to individuals and businesses at suppressed interest rates during the era of zero-rate policies and amid the pandemic.

However, surging bond yields over the last year made these business models unviable, forcing runs and near-runs on banks, as well as opening the door for credit rating downgrades.

Given the volumes of uninsured deposits amid tighter monetary policy, this raised a host of regulatory concerns, questions about supervisory gaps and fears of insolvency.

As a result, the FRA-OIS spread which describes the uncertainty of the overnight lending markets surged from around 3.0 on March 8th to 59.80 within three working days.

However, emergency measures taken by authorities such as the Fed, FDIC and the Treasury appear to have contained the fallout.

Fortunately, contagion fears appear to have cooled for now, with the spread having eased to 31.20 as of April 10th.

In part, some confidence may have been restored as the commercial banking system appears adequately capitalized with a relatively high percentage of liquid holdings.

A Wells Fargo report found that US commercial banks have 14% of tier-1 assets and 14% of total assets available in liquid cash.

In addition, emergency capital deployed by the big banks such as JP Morgan and Citi to protect troubled institutions boosted investor sentiment.

Globally, coordinated central bank action by The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank enhanced dollar liquidity through swap lines.

As a result, the FOMC will likely have enough confidence in the banking system to continue to hike rates in a bid to curtail inflation.

NEAR-TERM GROWTH PROSPECTS AND A MILD RECESSION IN H2

Despite the recent recovery, economic activity has likely been dented by the banking crisis. The Atlanta Fed’s Q1 GDPNow estimate was downwardly revised from 1.7% to 1.5%.

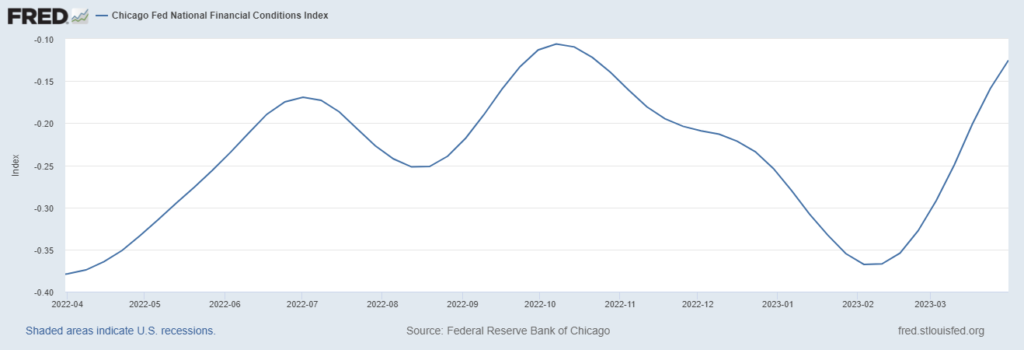

The Chicago Fed’s National Financial Conditions Index has tightened considerably and private corporations may adopt a wait-and-watch approach that may also impact capital investments and pressure hiring trends.

Source: US FRED

The sudden steepening of the curve is a sign of rapidly tightening conditions, which may also shift into positive (historically tight) territory in the coming quarter.

Given the likelihood of another rate hike, prevailing high borrowing costs, potential for lower investments and a slowdown in hiring, the economy may experience a recession in H2 2023.

However, in part due to the resilient labour market, the relatively sound corporate balance sheets and improvement in banking outlook, any such downturn will likely be mild compared to the GFC or during the pandemic.

FED TO CONTINUE TO TIGHTEN IN MAY 2023

In its coming meeting, the Federal Reserve will be looking to balance competing forces in its policy decision, i.e., elevated inflation and banking weakness.

The relative calm in the financial system has boosted expectations that monetary authorities will continue to tighten.

At the time of writing, the CME FedWatch Tool suggests a 71.0% chance of a quarter-point increase to above 5% in its May meeting.

Markets will be awaiting the CPI and PCE prints this month and shall continue to closely monitor any indications of fresh weakness in the labour market.

If nothing breaks, the FOMC will likely look to tighten further in its June meeting.

However, it is unclear how effective these measures will be, particularly in the near-term, given the tightness in financial conditions.

Over a longer horizon, the Conference Board has estimated real GDP growth in the US to moderate to 0.7% in 2023 and 0.9% in 2024. The OECD is more optimistic, placing the 2024 growth rate at 1.5%.

FINAL WORDS

In March, the US banking system was rocked by failures and near-failures of multiple regional banks, including the second and third-largest such instances in its history.

Interventions by the Fed, FDIC, and the Treasury Department to provide liquidity, as well as strategic injections by major banks appear to have prevented further contagion.

Emergency funding made available to fortify the First Republic Bank has improved market confidence.

To preserve the integrity of the financial system, the FOMC policymakers should ideally consider undertaking a more dovish policy.

- Given the elevated inflation, overall strength in the labour market and the relatively robust capital adequacy in the banking sector, the Federal Reserve is likely to continue to tighten by a quarter percentage point in its May meeting.

Note: The information in this article is as of the 20th of March, 2023 but is also subject to rapid developments.