Currencies are among the most fascinating techno-financial-social solutions developed by mankind.

Throughout human history, they have acted as a measure of value, stored economic energy, and enabled the exchange of goods and services.

If we did not have currencies, how would we know what to pay for a box of pencils or a packet of sweets? How would we know what to ask for in return?

That is the challenge that currencies have consistently resolved.

Having said that, not all currencies are equal.

Select currencies have earned the distinction of being ‘reserve currencies.’

These are currencies that inspire trust, are widely utilised for exchange, and retain their purchasing power even in tough economic times.

In the past, reserve currencies have included the likes of the Florentine Florin, Venetian Ducat, Spanish Real and the British Pound.

Today, the US dollar is by far the most dominant reserve currency. It is internationally accepted by economic agents and held as a credible store of value

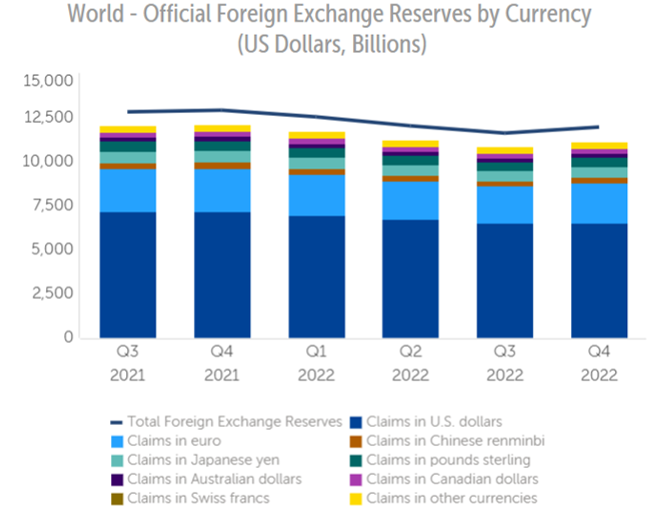

Source: IMF COFER

IMF data shows that the dollar is the dominant reserve currency accounting for nearly 60% of reserves at the end of 2022.

Equally, the dollar is central to global export invoicing which ensures a continued high demand for the greenback and maintenance of reserve currency status.

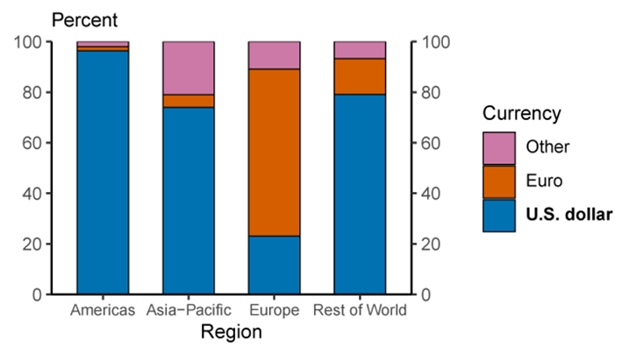

Source: Federal Reserve (2021)

Incredibly, as recently as October 2022, the Bank of International Settlements reported that the US dollar was on one side of 88% of foreign exchange trades.

TL;DR

- Only a few currencies are considered to be reserve currencies, which are globally accepted and expected to maintain purchasing power.

- Since 1944, the US dollar has been the official reserve currency of the global monetary system.

- The US dollar was on one side of 88% of foreign exchange trades.

- The Chinese government has been trying to elevate the RMB to the status of an international currency for many years, but this process has accelerated since the start of the Ukraine War.

- The key reason for the growing distrust in the dollar is the scale of sanctions imposed on Russia since its intervention.

- Several governments are wary that they themselves may someday become subject to sanctions or see restrictions imposed on their close partners.

- The Chinese government’s recent objective has been to enter into non-dollar agreements with multiple partners and activate its swap lines.

- The Chinese RMB surpassed the use of the dollar in international trade while taking measures to boost the currency’s global appeal.

- Despite the improvements in the RMB’s position, restrictive capital controls and tight currency management deter uptake.

- The RMB’s rise to reserve status will likely be a gradual process unless the USD is met with sudden systemic shock.

HOW DID THE DOLLAR BECOME THE WORLD'S CHOSEN RESERVE CURRENCY?

In the initial decades of the twentieth century, the greenback began to come to international prominence.

However, it was its role as the relatively insulated global manufacturing hub during the world wars, the establishment of the Federal Reserve in 1913, its deep base of federal taxpayers, and the flexibility of its financial markets that ushered the dollar into the position it holds today.

The Bretton Woods Agreement officially formalized the dollar’s role as the global reserve currency in 1944.

The importance of the depth of its bond markets cannot be overstated. The US market has provided investors with an ever-standing facility to buy or sell limitless treasuries such that price discovery is transparent and instantaneous.

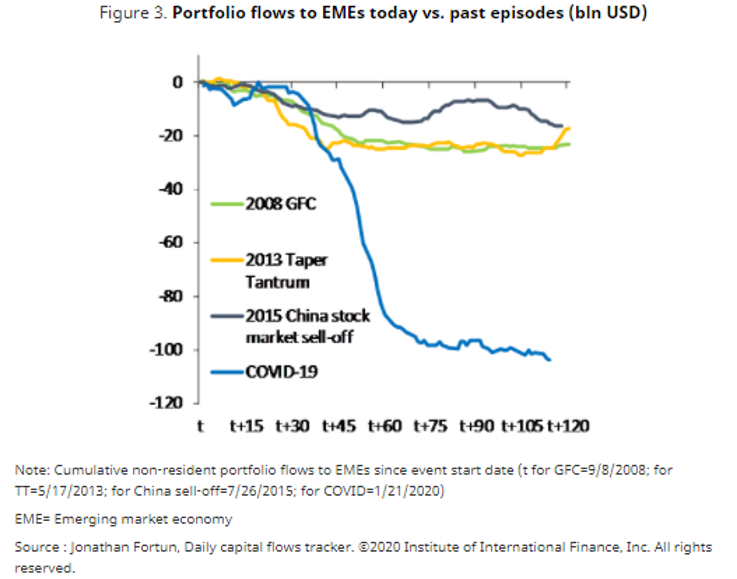

Most remarkably, in times of economic turmoil, even in cases where the US is the source of market disruption, the dollar continues to be the ultimate safe haven for portfolio managers the world over.

Source: International Institute of Finance (2020)

Due to this privilege, the dollar has also been able to borrow at a discount compared to other issuers.

MAINTENANCE OF RESERVE STATUS

Over the past eight decades, the greenback has endured many challenges but maintained its grip on the global monetary system.

This is primarily because a reserve currency must command significant economic size; possess deep bond markets; relatively sound institutions such as contract enforcement, judicial transparency, and responsive governance; and be able to draw upon a robust tax base.

In addition, the issuer should have a truly open capital account, which means that investors can enter and exit the bond market or other investment avenues, without excessive interference from policymakers.

Renowned LSE anthropologist, the Late David Graeber also highlighted the importance of a powerful military in this regard.

Since the dawn of the dollar age, no other country or issuing bloc, has been able to acquire the goodwill and confidence needed across all these aspects to outdo the dollar’s appeal.

The dollar has remained the universal standard of value despite the case of currencies such as the euro which initially made significant inroads.

GLOBAL CONCERNS

Reserve currencies are products of the economic situation, political forces, and societal perceptions of the issuer. As a result, they are necessarily time-bound and will eventually fall out of favour.

Overseas governments sought to diversify away from their dependence on the greenback due to the sometimes-violent impacts of US monetary policy, the prolonged era of rock bottom returns, the speed of capital outflows and the instability this brought with it, and the degree of control the American institutions had in the global financial system.

In addition, there have been murmurs for decades regarding the sustainability of the US model given the surging debt levels, debt ceiling impasse and burdensome interest payments.

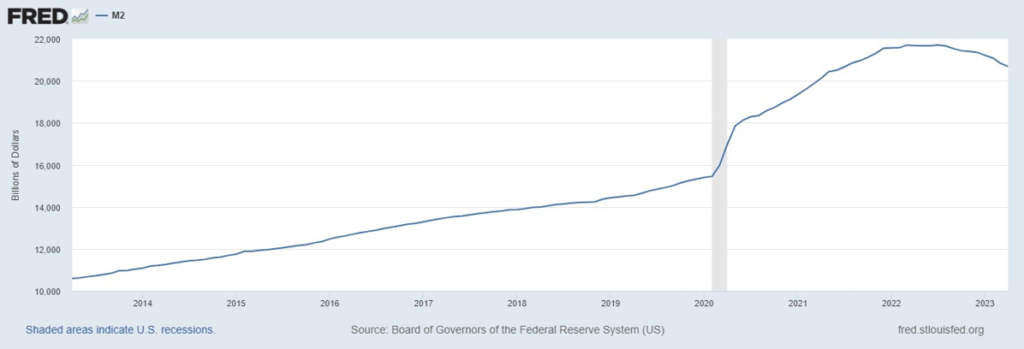

According to the US Bureau of Economic Analysis, national interest payments were nearly $1 trillion for Q1 2023, pressuring the economy and expanding the US money supply overseas.

Money printing has become increasingly untenable with the onset of the global health crisis and seemingly unlimited monetary and fiscal stimulus, threatening inflation, and a weaker dollar.

Source: FRED Database

SANCTIONS AND WEAPONIZATION

In theory, money is neutral.

However, with the sheer quantity of USD circulating all over the world, American policymakers have been able to impose unilateral sanctions on players they deem to be acting unethically.

Most emerging economies became aware of the dangers of dollar dependence amid the Asian Financial Crisis of 1997.

Another key point of concern has been the ability of the US to issue sanctions through the SWIFT platform, a global payment network that enables the transfer of funds between member financial institutions.

Despite these concerns, the lack of any credible alternative favoured the continuation of the US dollar’s supremacy.

However, global financial perceptions have changed dramatically in the past 15 months.

The sheer speed and scale of sanctions deployed against Russia after the Ukraine invasion has highlighted the importance of shifting to alternative currency and payment channels, and has overall had a detrimental impact on global trust in the dollar.

CHINA'S PERSPECTIVE AND THE RMB PUSH

Given the friction between the US and China following the trade war, claims of IP infringement, accusations of corporate espionage, and geopolitical tensions relating to Hong Kong and Taiwan, President Xi’s government issued a communication entitled ‘US Hegemony and its Perils’ in 2023, to the narrative away from the dollar-led financial system and towards the need for an alternative medium of exchange.

As per the Chinese government, US sanctions have become increasingly frequent, rising an incredible 933% between 2000 and 2021.

RMB-DENOMINATED TRANSACTIONS

China has been on at least a decade-long quest to internationalize the RMB, and its efforts have been galvanized by the aggression the US and its partners have shown towards Russia.

Remarkably, the yuan was used in 48.4% of all cross-border transactions in March 2023, as compared to the USD which declined to 46.7% to register a shocking second place. This is a major development given that the perception of the Chinese currency is usually dented by the high degree of state control.

This was powered by China’s multiple unique non-dollar agreements, a process that it accelerated in 2023.

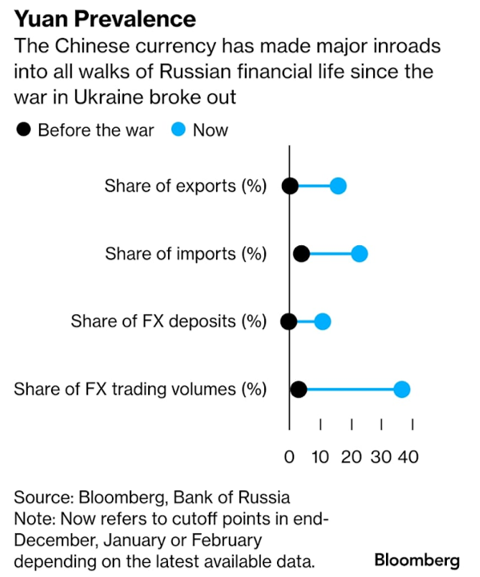

Since the war began, the most significant uptake of RMB has been by Russia, which has seen a staggering 32-fold increase in its usage for export payments.

Russian entities and individuals have begun to heavily use the RMB for private savings, trade, and forex transactions, which has pushed the RMB to be the most traded currency in the country, ahead of the USD and EUR.

Source: Bloomberg

Reports suggest that more than 50% of Russia’s $640 billion foreign currency reserves have been frozen. Bloomberg forecasts that the Kremlin will look to purchase $200 million worth of yuan per month for this purpose.

In a landmark deal, Brazil and China, two very important trading partners have agreed to settle trade in their respective currencies rather than in USD, reducing expected demand for the greenback by US$150 billion per year.

Argentina too expects to pay for approximately $800 million worth of monthly imports using the yuan.

Bangladesh has settled for payments related to the Rooppur nuclear power plant using RMB, while the Iraqi central bank is looking to establish an RMB trade mechanism.

China, as the world’s largest oil importer is in talks with Saudi Arabia to accept yuan instead of dollars, as in the case of Venezuela. Such a development could land a significant body blow to the dollar which has benefited from elevated dollar demand with commodity trade being priced in the greenback.

However, it should be noted that this idea has been around for a long time and it is unclear to what extent it could be successful at this juncture. Notably, in March 2023, a Chinese-owned national oil company settled a trade for LNG with France’s TotalEnergies in yuan.

In addition, the Chinese government was able to broker an agreement to restore diplomatic relations between Saudi Arabia and Iran after seven years. Such initiatives are a major boost to China’s image, temper US influence in the Middle East and establish a strong foundation for the RMB to push out globally.

REFORMS AND HURDLES FOR THE RMB

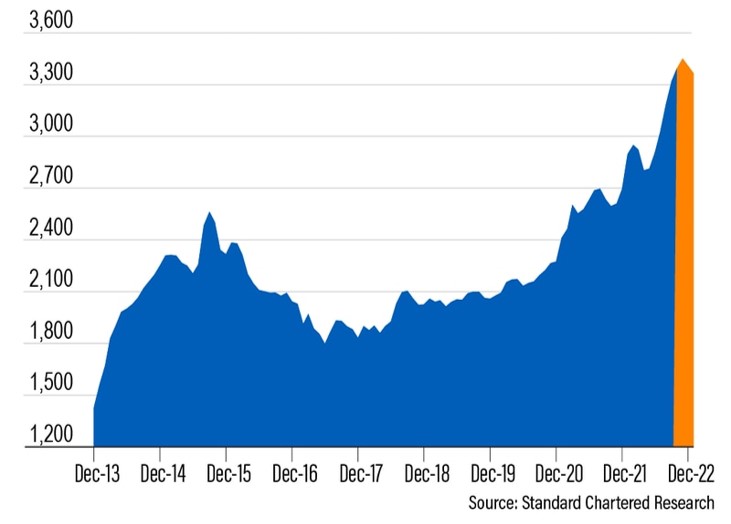

The RMB had a strong showing in 2022, with the Standard Chartered Renminbi Globalisation Index (RGI) rising from 18.5% in 2021 to 26.6% in 2022.

Source: Standard Chartered Research

Given the Fed’s high-interest rates and market uncertainties, this is an impressive performance by the yuan which only accounted for 4% of global currency trades in 2019 and now stands at 7%.

The People’s Bank of China reported that total cross-border payments in yuan have increased for five consecutive years from 9.2 trillion yuan in 2017 to 42.1 trillion yuan in 2022.

The government has taken significant steps to ease its tight control on the currency and push internationalization by the establishment of a global offshore yuan market in major financial centres such as Singapore, London, Paris, Hong Kong, and Luxembourg.

Perhaps most importantly, China is at the forefront of the digitization of currencies and rolled out the Cross-Border Interbank Payment System (CIPS) in 2015, which is available in all major economies and enables the internationalization of the RMB across nearly 1,500 global banks and financial institutions in over 100 countries.

As of 2021, the country had over 260 million users in its e-CNY trial and is being expanded.y

Major challenges

One of the key concerns is the relative unattractiveness of Chinese assets for holders of the yuan.

Most managers would much rather invest in US treasuries than in Chinese government bonds, while restrictions on capital account convertibility (i.e., to buy and sell financial assets freely) deter international investors.

Chinese banks tend to hold most Chinese bonds to maturity which prevents straightforward price discovery and liquidity.

At the same time, the market structure is still developing amid worrying levels of local government debt and other portfolio restrictions.

As recently as March 2023, Bloomberg reported that legendary investor Mark Mobius was having difficulties transferring yuan out of the country due to excessive documentation requests and bureaucratic hurdles.

Although the government has allowed the exchange rate to gradually widen, the yuan is maintained within a 2% band since March 2014, which markets find restrictive.

As a result, the RMB still only accounts for 1.7% of cross-country payments (excluding CIPS) as compared to above 50% for the USD.

Despite these difficulties, the looming threat of sanctions is strengthening RMB operations.

Data released by the People’s Bank of China in May 2023 showed that the use of RMB swap lines is at a record high, with overseas central banks holding an outstanding balance of $15.6 billion in Q1 2023, a strong vote of confidence in favour of RMB internationalization.

THE DOLLAR'S ACHILLES

Although the RMB is gaining much traction in overseas markets, it is unlikely to dislodge the dollar as the global reserve currency any time soon.

The key hurdles here are capital control policies, the relative depth of bond markets, the complexity of its financial instruments, and the natural inertia of dollar traders.

Unknowns that could hamper the dollar’s appeal in the near term are:

1. US inflation is expected to persist with sticky core and services inflation as well as elevated labour costs. If inflation stays well above the Fed’s 2% target, this could lead to falling confidence in the currency due to a significant loss in purchasing power.

2. On a related note, it is unclear how long the Fed may keep an elevated rate. This hurts consumer and investor sentiments, while the interest payment burden continues to mount. On the other hand, if the Fed does cut back on rates, we could see inflation pick up faster.

3. There are fears that as early as June, the US could default on its external debt without a debt ceiling deal. This could spark a global economic crisis, and dent the US’s leadership in the monetary domain.

4. Lastly, the BRICS initiative has been gaining steam, with an additional 19 nations looking to join the group ahead of its August Summit. One of the key drivers of this demand is the desperation to come up with an alternative monetary framework to bypass the dollar. If such a shift does occur, the dollar may lose much of its appeal in the not-so-distant future.

CONCLUSION

At a global level, de-dollarization has picked up substantially.

Although the demand for a dollar alternative is becoming ever-louder and countries are in broad agreement that dollar reliance should be reduced, there are no competitor currencies that could take up the mantle soon.

Although China is one of the key competitors, the consensus is that this will likely be a more gradual, multi-decade process, at least not without a seismic economic event.

For instance, Citigroup and Goldman Sachs forecast that the yuan could be the 3rd most used currency in international payments (as compared to the fifth today) by 2030, particularly among lasting geopolitical tensions.

The question is not whether the dollar is losing its sheen, but if global markets believe that the yuan can play the dual role of being heavily traded while becoming the ultimate safe haven.

FINAL WORDS

In an unprecedented shift, RMB cross-border flows were greater than the USD during March 2023.

Since the Ukraine conflict, the extent of US-led sanctions on Russia through facilities such as SWIFT have highlighted the need for monetary alternatives.

Due to this situation, the Chinese RMB has become the most traded currency in Russia, outpacing the USD and EUR.

Bloomberg estimates that the Russian government may begin to purchase $200 mn worth of yuan per month to build up foreign exchange reserves.

- The mainstay of the Chinese strategy has been to enter into non-dollar agreements with multiple trading partners including Brazil, Argentina, Bangladesh, Laos and Kazakhstan.

- Capital controls and restrictions on portfolio flows are still hampering the wider adoption of the RMB.

- The process of de-dollarization is likely to be a gradual one that is yet to take many decades for the RMB to become a truly global reserve currency.

Note: The information in this article is as of the 26th of April, 2023 but is also subject to rapid developments.