Imagine you are driving down a highway and you see a sign that says “Road ahead closed.” What would you do?

You would probably slow down and start looking for an alternative route. After all, you don’t want to get stranded.

The same is true for the economy. When there are signs that a recession is on the horizon, it’s important to slow down and prepare.

There are many indicators that can point to a recession, such as declining consumer confidence, rising unemployment, and falling housing sales. In recent months, we have seen all of these indicators trend in the wrong direction.

So, is a recession inevitable? No, not necessarily. But the risk is increasing, and it’s important to be prepared.

In this market outlook article, we will take a closer look at the recent economic data and discuss what it means for the future.

Lending standards tightening to alarming levels

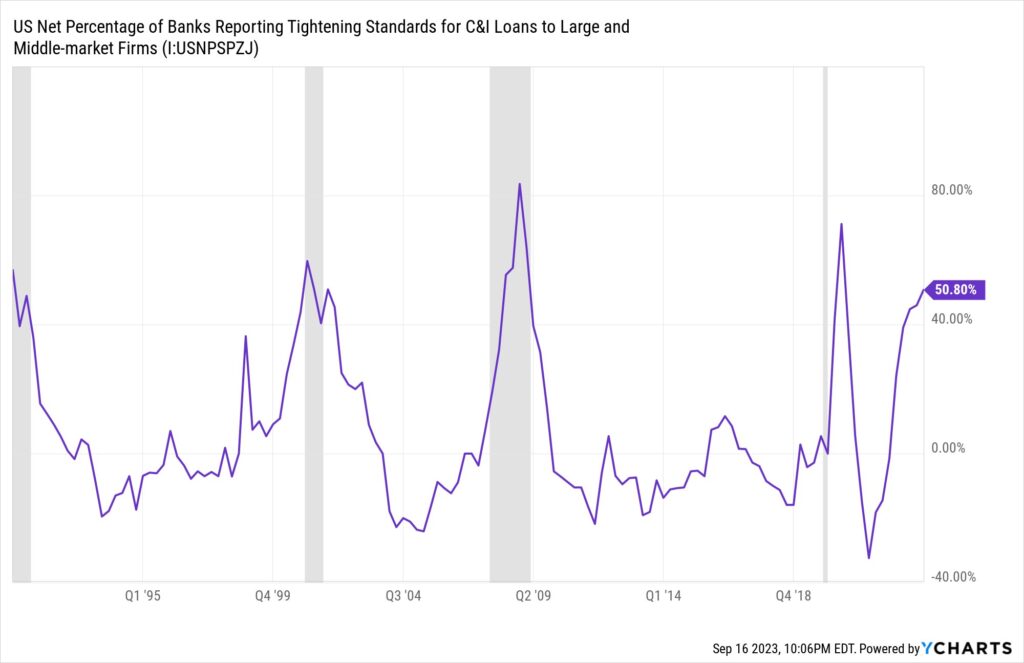

The graph above shows a net percentage of US banks reporting tightening loan standards to large and middle sized market firms since 1990 to date.

The grey shaded areas are periods depicting prior recessions.

The net percentage of US banks reporting tightening loan standards to large and middle-sized market firms is currently at 50.80%, as of Q3 2023. This is the second highest level since 2008, and it is significantly higher than the long-term average of 6.34%.

There are a few reasons why banks may be tightening loan standards. First, they may be concerned about the risk of a recession. When there is a recession, businesses are more likely to default on their loans. Second, banks may be concerned about rising interest rates. When interest rates rise, the cost of borrowing money increases, which can make it more difficult for businesses to repay their loans.

Historically, when the net percentage of US banks reporting tightening loan standards to large and middle-sized market firms has been high, it has often been a precursor to or associated with a recession. For example, in 2008, the net percentage of banks reporting tightening loan standards reached a record high of 73.10%. Just a few months later, the Great Recession began.

It is important to note that there is no guarantee that a recession will occur when banks tighten loan standards. However, it is a sign that banks are concerned about the risk of a recession, and it is something that businesses and investors should be aware of.

Here are some examples of how banks have tightened loan standards in recent months:

- Banks are requiring higher credit scores and larger down payments from borrowers.

- Banks are also shortening the terms of loans and charging higher interest rates.

- Banks are also becoming more selective about the types of businesses they are willing to lend to.

These changes are making it more difficult for businesses to get loans, which can have a negative impact on economic growth.

Deepest and longest yield curve inversion

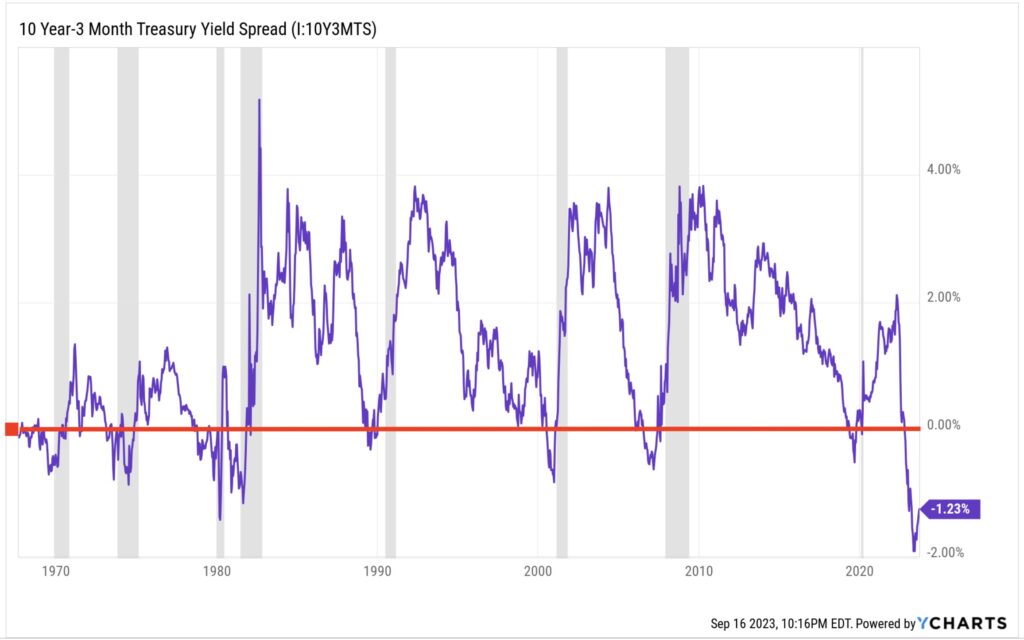

The 10-year to 3-month treasury yield spread is currently inverted at the highest spread going back to 1970, meaning that the yield on the 3-month treasury bill is higher than the yield on the 10-year treasury note. This is a rare occurrence, and it is often seen as a precursor to a recession.

Historically, when the yield curve has inverted, it has been followed by a recession within 12 to 18 months with a 100% probability. For example, the yield curve inverted in 2006, and the Great Recession began in 2008. The yield curve also inverted in 2019, and the COVID-19 recession began in 2020.

It is important to note that a yield curve inversion does not guarantee that a recession will occur. However, it is a strong warning sign, and it is something that businesses and investors should take seriously.

There are a few reasons why a yield curve inversion may be a precursor to a recession. First, it can be a sign that investors are concerned about the future of the economy. When investors are worried about a recession, they tend to sell longer-term bonds, which causes the yields on those bonds to rise.

Second, a yield curve inversion can make it more difficult for businesses to borrow money. When interest rates on short-term loans are higher than interest rates on long-term loans, businesses are less likely to invest in new projects and hire new workers. This can lead to a slowdown in economic growth.

Consumer confidence index surprise giveback

Source: AdvisorPerspectives

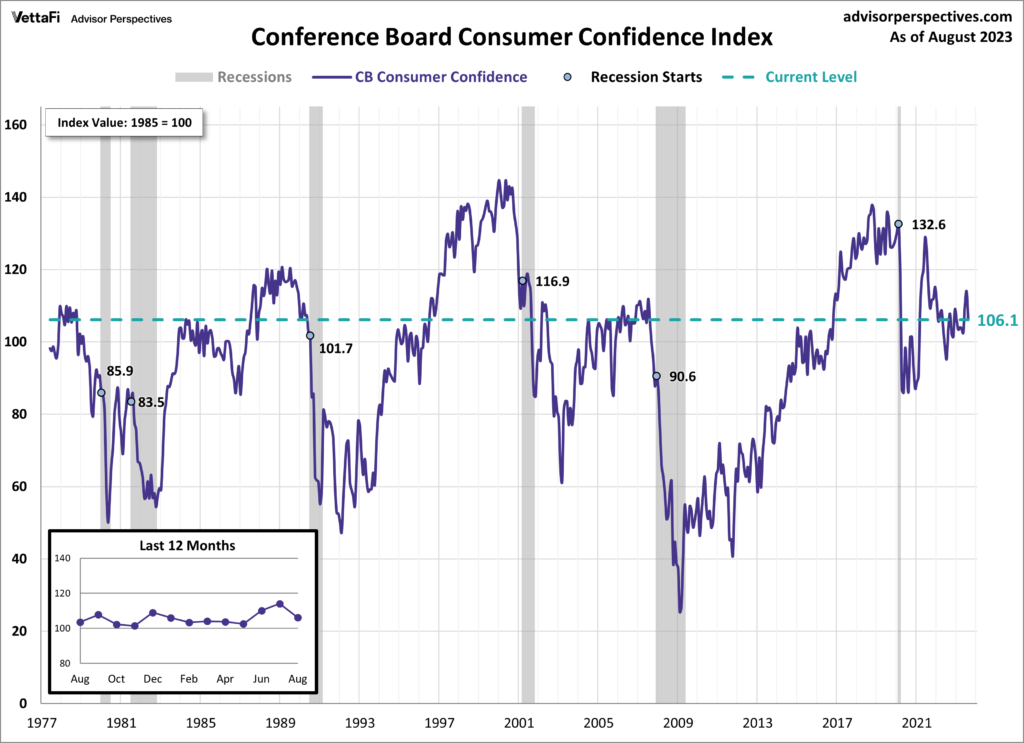

The Conference Board Consumer Confidence Index® declined in August to 106.1 (1985=100), from a downwardly revised 114.0 in July.

“Consumer confidence fell in August 2023, erasing back-to-back increases in June and July,” said Dana Peterson, Chief Economist at The Conference Board. “August’s disappointing headline number reflected dips in both the current conditions and expectations indexes. Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular. The pullback in consumer confidence was evident across all age groups—and most notable among consumers with household incomes of $100,000 or more, as well as those earning less than $50,000.

Consumer confidence is a leading indicator of economic activity, meaning that it can predict future trends in economic growth. A decline in consumer confidence suggests that consumers are becoming less optimistic about the economy, which could lead to a decrease in spending and investment.

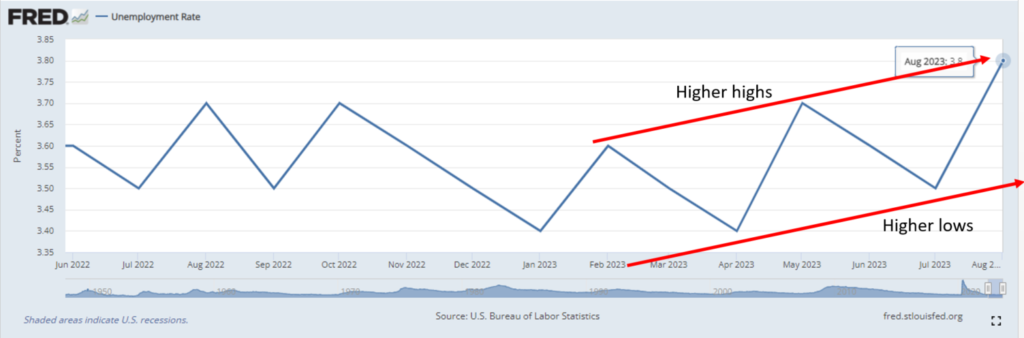

Evidence of passing peak employment

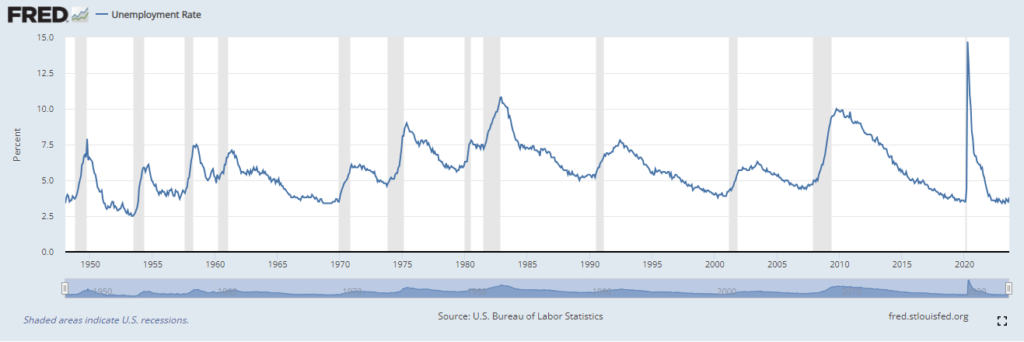

Going back to unemployment data since the 1950s, every recession that had occurred had been accompanied by a rapid rise in unemployment levels.

If you zoom in on recent unemployment data, you may notice that since the beginning of 2023, the unemployment levels have been making a series of higher highs and higher lows, indicating that we may have passed ‘Peak Employment’. The unemployment rate rose to 3.8% in August, up from 3.5% in July. This is the first time the unemployment rate has increased to this extent since January 2021.

Peak employment is the highest level of employment reached during an economic expansion. It is typically followed by a period of slowing employment growth and then an increase in unemployment.

Historically, after peak employment levels were reached and unemployment levels started to increase, it has often been a precursor to a recession occurring. For example, in the 2008 recession, peak employment was reached in January 2008, and the unemployment rate began to increase in March 2008. The recession officially began in December 2007.

There are a few reasons why peak employment may be a precursor to a recession. First, it can be a sign that the economy is overheating. When the economy is overheating, there is too much demand for goods and services, and not enough supply. This can lead to inflation and higher interest rates.

Second, peak employment may be a sign that the economy is becoming less productive. When the economy is less productive, it can produce fewer goods and services with the same amount of labour. This can lead to lower wages and job losses.

Third, peak employment may be a sign that the economy is becoming more vulnerable to shocks. For example, if there is a sudden decline in consumer spending or investment, it can lead to a recession.

It is important to note that peak employment is not a guarantee that a recession will occur. However, it is a strong warning sign, and it is something that businesses and investors should take seriously.

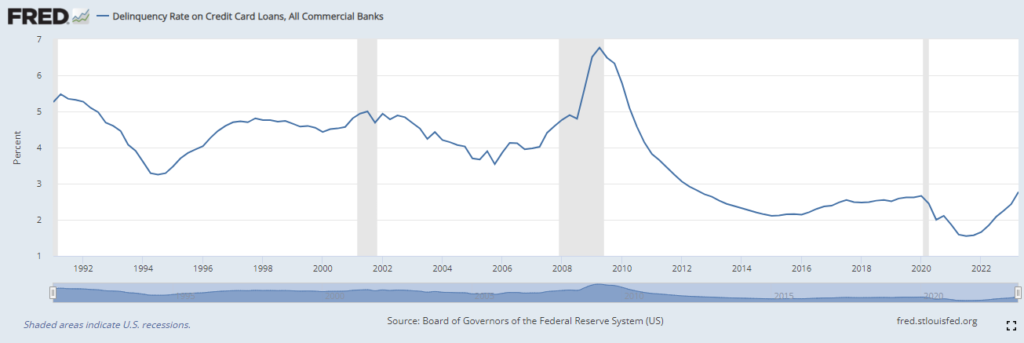

Credit Card Delinquency Rates surpassed pre-covid levels

Source: Fred St Louis

The delinquency rate on credit card loans is the percentage of borrowers who are at least 30 days late on their payments. The delinquency rate is a key indicator of the health of the consumer credit market and the overall economy.

The delinquency rate on credit card loans has been rising in recent months. In Q2 2023, the delinquency rate was 2.77%, up from 2.53% in Q1 2023. This is the highest level since Q4 2019 (pre-Covid).

The increase in the delinquency rate is likely due to a number of factors, including:

● Rising inflation

● Rising interest rates

● Slowing wage growth

● Increased consumer debt

The current situation on credit card delinquency rates is showing indications that a recession may be on the horizon. This is because when the delinquency rate rises, it means that more consumers are struggling to repay their debts. This can be a sign of economic weakness, as consumers are less likely to spend money when they are in debt.

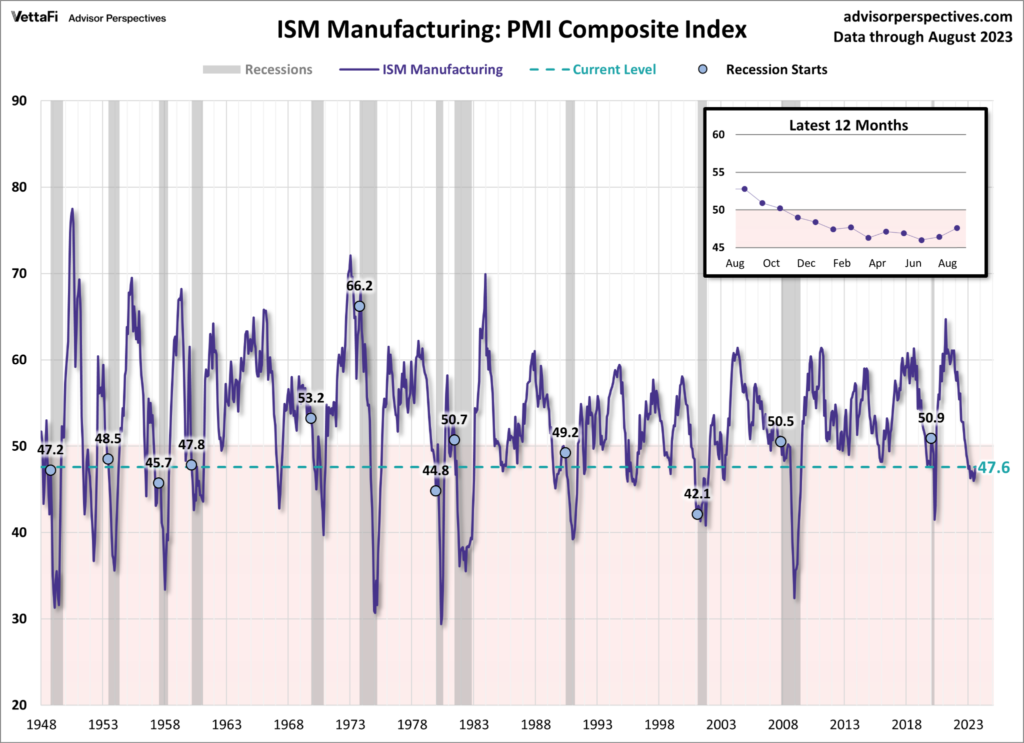

Watch out for ISM PM Falling below 45 levels

The ISM PMI is a monthly economic indicator that measures the performance of the U.S. manufacturing sector. It is based on a survey of over 300 purchasing managers at manufacturing companies across the country.

The ISM PMI is a composite index that takes into account five key indicators: new orders, production, employment, supplier deliveries, and inventories. A reading above 50 indicates that the manufacturing sector is expanding, while a reading below 50 indicates that the sector is contracting.

The ISM PMI has been declining in recent months. In August 2023, the ISM PMI registered 47.6. The latest figure marks the tenth consecutive month the index has been in contraction territory after a 29-month period of growth dating back to June 2020.

The graph above shows the correlation between ISM PMI and prior recessions.

Historically, whenever the ISM PMI fell below the 45 level, a recession had already occurred, or this level was breached prior to a recession occurring 100% of the time.

FINAL WORDS

● The evidence presented in this article suggests that the US economy is presenting risks of entering a recession in the near future.

● The net percentage of US banks reporting tightening loan standards to large and middle-sized market firms is currently at the highest level since 2008.

● The 10-year to 3-month treasury yield spread is currently inverted, which has been a precursor to every recession in the past 50 years.

● Consumer confidence has been declining in recent months, and the unemployment rate has begun to increase.

● The ISM PMI has been declining in recent months, and it is at risk of breaking below the 45 level, which has been a precursor to every recession in the past 50 years.