In this article, we shall explore the Fed’s stance as the FOMC meeting approaches; the growth, employment, and inflation factors that could influence its rate cut trajectory; the expectations of market players and their focus on the Fed’s forward guidance; and potential outlook and macroeconomic risks ahead.

We also speak to an experienced shipping analyst who shall shed light on the prevailing situation in global logistics, and what this may mean for the Federal Reserve’s decision-making.

THE UPCOMING MEETING AND FORWARD GUIDANCE

All eyes are on the Federal Reserve’s FOMC which will convene its first policy meeting of the year on January 30-31, 2024.

However, markets may not be paying such close attention to the rate decision announcement, as compared to the Fed’s forward guidance.

As per the CME FedWatch Tool, there is virtual unanimity that rates will remain unchanged in next week’s meeting.

This is despite the FOMC’s dovish narrative towards the end of last year, and Q4 market optimism that monetary easing was imminent.

Having held rates at 5.25%-5.50% since June 2023, the Federal Reserve is not only interested in lowering rates but in doing so without sparking more inflation and executing a soft landing.

Given the complicated economic conditions at play, what matters most to the markets is understanding the Fed’s intended timing and depth of rate cuts over the coming months.

CURRENT FED POLICY

The Fed’s unprecedented tightening during this cycle was the most rapid since the 1980s and included 11 consecutive rate hikes while the CPI peaked above 9% in the United States.

However, owing to aggressive tightening and a broad decline in global energy prices, US inflation moderated significantly in 2023.

While holding rates steady at a two-decade high of 5.25%-5.50% through the second half of last year, policymakers foresaw the potential for three rate cuts in 2024 amid slowing growth projections.

In its December 2023 Summary of Economic Projections, the Fed estimated GDP growth of 1.4% and 1.8% in 2024 and 2025, respectively.

Following the shift in the narrative around inflation in the final quarter, investor sentiment greatly improved and powered a sharp run-up in equities, with the S&P 500 eventually posting gains of nearly 25% in 2023.

TL;DR

- The next FOMC meeting shall be held on 30-31 January 2024.

- Markets expect rates to be unchanged at 5.25%-5.50%.

- Investors will be closely following the Fed’s forward guidance to understand when and by how much interest rates may be cut.

- Cutting rates too early could risk more inflation, while delays could result in a hard landing.

- The latest data shows that core PCE unexpectedly increased, while CPI remains elevated.

- Growth numbers from GDP data, housing, and employment remain robust.

- As a result, inflation and economic growth are both still above expectations.

- The Fed will likely look to maintain rates until the macroeconomic picture is clearer.

- At this time, markets are pricing in a high probability that the Fed shall ease rates in May 2024.

- Looking ahead, the Fed will closely monitor signals of banking stress, geopolitical developments, and global supply chains to ascertain the optimal rate trajectory.

- Despite the recent rally, equities could come under some pressure if rate cuts are significantly delayed.

ECONOMIC SITUATION

The narrative around easing rates had taken hold towards the end of 2023.

As far as the markets were concerned, rate cuts were just around the corner.

This propelled stocks higher, and in 2024, the S&P touched fresh all-time highs.

However, circumstances change – the growth trajectory surprised to the upside while inflation is proving stickier than anticipated.

US ECONOMY GROWTH STATUS

In data released earlier this month, US GDP in Q4 2023 expanded by 3.3% YoY.

Although this was a slowdown from 4.9% YoY in Q3, it significantly outperformed industry projections of a 2.0% increase amid the Fed’s concerns about monetary lags and weakening demand.

Further, the latest Purchasing Managers’ Index (PMI) for the US showed that flash indices for manufacturing, services, and the composite component were each in expansionary territory (i.e. above 50).

This was most notable for manufacturing which accelerated from 47.9 in December 2023 to 50.3 in January, achieving its highest level since October 2022.

Crucially, companies expect an increase in volumes of new orders in the coming months, while business confidence sped to its post-May 2022 peak.

In addition, retail sales for December 2023 expanded to 0.6%, outperforming industry forecasts of 0.4%, registering the second consecutive monthly increase, and the largest growth in three months.

The crucial automobile sector, which benefits from a multitude of linkages with other industries led the increase, rising 1.2%.

Lastly, US building permits continued to drive higher, increasing 1.8% in December 2023, with single-family authorizations reaching their highest level in over a year and a half.

Thus, strong activity in the construction and house-building sectors suggests robust growth moving ahead, which is in lockstep with a potential soft-landing scenario.

INFLATION SITUATION

Earlier this week, the Fed’s favoured inflation gauge, core PCE moderated to 2.9% YoY for December 2023.

This marked the twelfth consecutive month of declines through 2023 and registered its lowest level since March 2021.

However, inflation remains well above the Fed’s 2.0% inflation target.

Moreover, in its December Summary of Economic Projections, the FOMC anticipated that core PCE would be at 2.4% this year and 2.2% in 2025.

This would suggest that the FOMC members expect inflation to continue to remain elevated for the time being.

Turning to the CPI, the December 2023 report surprised to the upside, reaching 3.4% from 3.1% in the earlier month.

This was also above projections of 3.2% published by Investing.com.

In addition, it marked the snapping of a two-month streak of moderating inflation with September, October, and November registering CPIs of 3.7%, 3.2%, and 3.1%, respectively.

In the month of December, although core CPI fell to 3.9% from 4.0%, this too was above industry forecasts of 3.8%, potentially signaling a flattening in inflation trends.

Encouragingly, the latest University of Michigan survey data has found that one year ahead inflation expectations have declined to 2.9%, the lowest since 2020.

US EMPLOYMENT STATUS

The state of the labour market has been the central macroeconomic consideration that has guided the Fed’s rate decisions.

Since tightening began, the unemployment rate has performed exceedingly well, even reaching historical lows in early 2023.

In the month of December, it stood unchanged at 3.7% having moderated from the 2023 high of 3.9% in October.

In addition, December 2023 nonfarm payrolls (NFP) have been robust, rising to 216,000, well above the 173,000 in November, and 105,000 in October – demonstrating continued resilience in the jobs market and broader economy.

Crucial job-creating sectors such as the government, leisure and hospitality, and healthcare continued to lead the way in employment generation.

In the latest employment situation report, wages increased by 4.1% YoY, remaining well above the prevailing inflation rate.

Having risen from 4.0% in the previous month, this marked the first acceleration since February 2023.

The latest data suggests that US economic growth drivers are proving stronger than anticipated, while employment and wage growth are relatively robust, but inflationary forces may be showing signs of stubbornness and a slowing descent. Thus, the FOMC is unlikely to lower rates in its upcoming meeting, and being a data-driven organization will wait to see how these trends unfold to determine the depth and timing of future cuts.

This uncertainty is evidenced by CME data which shows a 48.1% probability of a March 2024 rate cut versus 50.7% that these will be unchanged.

This is in sharp contrast to the nearly 90% probability of a quarter-point rate cut in March 2024 as recently as one month ago.

The change in expectations of the Fed’s timing has been reflected in the dollar index (DXY) which rose by nearly 2% in the last month to 103.2.

While the Fed sets the trend, it is worth noting that under the prevailing global conditions, the Bank of Canada and the ECB chose to leave rates unchanged in their policy announcements earlier this week.

MOVING AHEAD

On balance, even as inflation has unexpectedly risen in December 2023, markets expect the Fed to begin cutting rates at some point this year.

However, the timing of these cuts remains uncertain.

Currently, CME FedWatch data places a 90.9% likelihood of rates being cut in the May 2024 meeting.

The eventual timing will depend on how economic conditions evolve while the Fed tries to navigate a soft landing.

lowering rates or upside risks?

However, to maintain rates, the Fed would require that in the interim, tight policy does not trigger concerns in the banking sector, or lead to rising job losses.

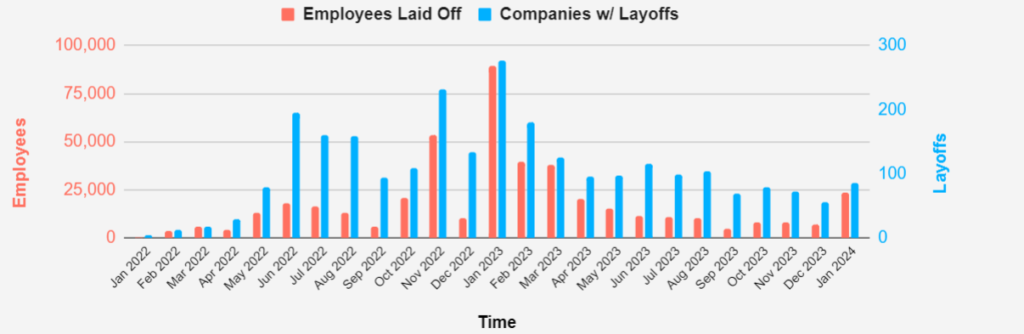

The tech sector is highly sensitive to the rate of interest and may be facing some stress with Microsoft cutting 9% of its global gaming unit workforce earlier this week.

Google too is forecasting more job cuts later in 2024.

Source: Layoffs.fyi

The above data shows that job cuts in the tech sector have seen a sharp uptick in January 2024 from 7,159 to 23,670.

This three-fold increase marks the highest number of monthly layoffs in the database since March 2023.

Due to the highly skilled and well-compensated nature of many tech sector jobs, downsizing could have further knock-on effects on consumer spending and broader economic activity.

In addition, excess savings from pandemic-era fiscal stimulus have been largely drawn down, which could leave households more vulnerable if incomes were to reduce.

The Fed shall also be closely monitoring the corporate earnings season, which could offer vital clues about financial resilience, debt sustainability, employee retention, and market demand.

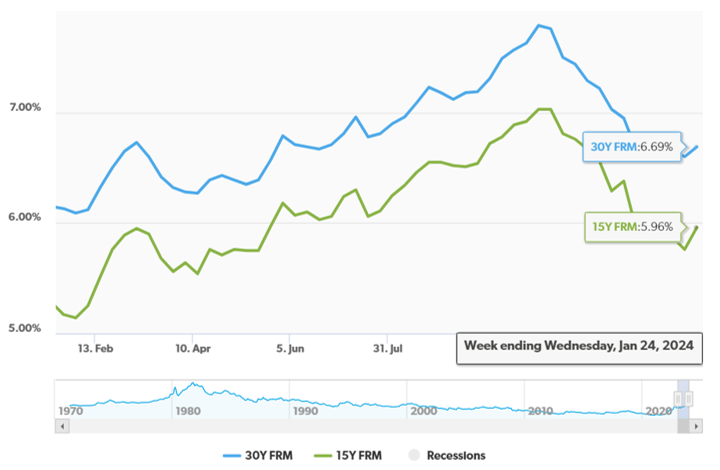

Although sentiment around home building appears to be optimistic, mortgage rates have seen a recent increase which may have the potential to dampen demand if they persist.

Source: Freddie Mac

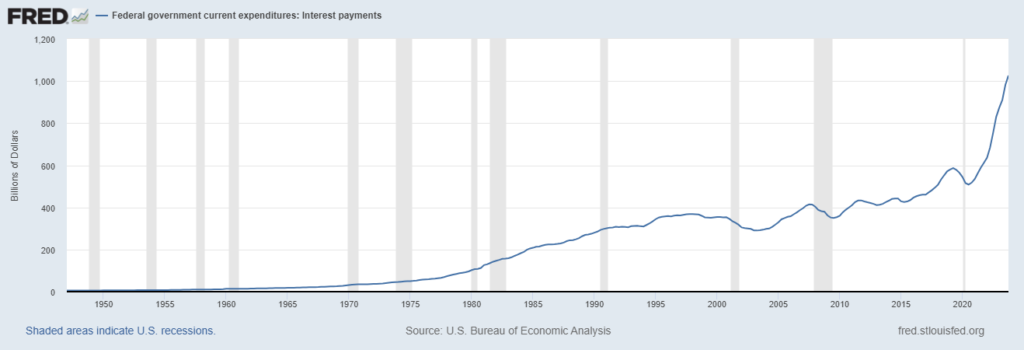

Source: FRED Database

UPSIDE RISKS

Geopolitical uncertainty will also keep policymakers on their guard, especially in relation to the Middle East, Ukraine and Russia, and potentially Taiwan.

Moreover, tensions in the Red Sea have continued to escalate, disrupting global supply chains.

If the conflict continues, this will likely lead to further delays and cost increases, which could contribute to the wider stubbornness in inflation.

Source: BofA, Bloomberg, Game of Trades

Speaking to AlgoMerchant, Shefali, a lead shipping analyst based in the Middle East, said,

“The Federal Reserve and other central banks will need to be cautious of changing conditions that could impact inflation in 2024. In particular, global supply chains have been fractured by the crisis in the Red Sea. Although some novel and alternative land routes have become operational, and are providing a degree of relief in certain cases, the journey around the Cape of Good Hope is raising costs significantly which will eventually flow down to consumers. Further, the rollout of the EU-ETS is impacting shipping costs all over Europe, and could contribute to sustaining inflationary forces.”

OUTLOOK

The Fed has consistently maintained the importance of carefully monitoring economic conditions, and remaining data-driven in a bid to fulfill its dual mandate of managing inflation and maximum employment.

Overall, since inflation is above target levels, the Fed may have little option but to wait and digest fresh data as and when it becomes available.

Although equities have continued to show strength, the pace of their ascent appears to be noticeably slowing.

The portfolio concern for markets could stem from the perception that the ongoing rally has been too dependent on the FOMC’s narrative.

If so, it may become challenging to sustain the current momentum.

Further upside risks could emerge from geopolitical upheaval, shipping delays, and the new EU-ETS program.

At the same time, job losses, banking stress, and interest payments could rise substantially, which may force early rate cuts.

On aggregate, the Fed appears to be more inclined to keep rates elevated until the trend in inflation and other macroeconomic variables becomes clearer.

This take was supported by Federal Reserve Governor Michelle Bowman, who in a recent speech argued that in terms of rate cuts, the Fed is,

“…not yet at that point.”

FINAL WORDS

● The Fed has tightened policy aggressively since March 2022.

● Having maintained a pause since mid-2023, optimism around rate cuts rose in Q4 2023, which powered a rally in equities.

● However, against expectations, inflationary forces have been stubborn, and economic activity has been significantly more robust than expected.

● At the same time, the labour market has been relatively strong, giving the Fed the confidence to tighten policy throughout the cycle or maintain elevated rates.

● Geopolitical developments and the rising costs of shipping continue to present upside risks to inflation.

● The Fed will most likely maintain policy rates in its coming meeting and will wait to consider fresh data when it becomes available.