In the dynamic world of retail stock buying, traders typically align with one of two strategies:

1. The “Buy Low, Sell High” approach.

2. The “Buy High, Sell Higher” approach.

Today, we analyze data to determine which strategy might offer traders a better edge. To conduct this analysis, we use our proprietary Moving Price Relative indicator. This tool assesses a stock’s relative price over the past N days by using multiple horizontal separators to classify price levels from lowest to highest. This provides investors with a clear understanding of whether a price is low or high at a given time.

Next, we will observe how stock prices move after X days to see if price movements are influenced by their relative position—whether low or high.

Moving Price Relative Indicator

To determine whether a price is high or low, we group prices based on their percentile levels, dividing them into 10 different percentiles. The 1st percentile (the lowest) includes all prices below 10%. The 2nd percentile covers prices between 10% and 20%, the 3rd percentile includes prices between 20% and 30%, and so on. The 10th percentile (the highest) encompasses prices ranging from 90% to 100%.

The analysis will be done for 500 US major stocks (known as S&P 500 stocks) from January 2010 to January 2024. The assumption here is that the portfolio buys each of these 500 stocks on every trading day. (Yes, I know that it is a huge, about 1.7Million data analysis).

We also try the same experiment directly with SPX, the S&P 500 Index

Let’s start with the experiment.

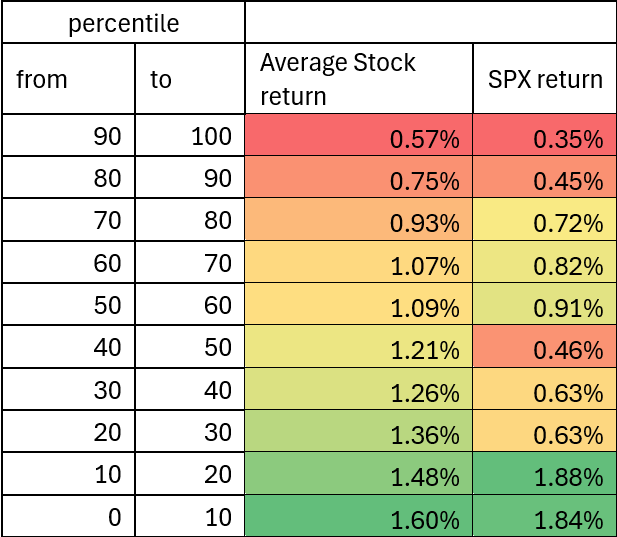

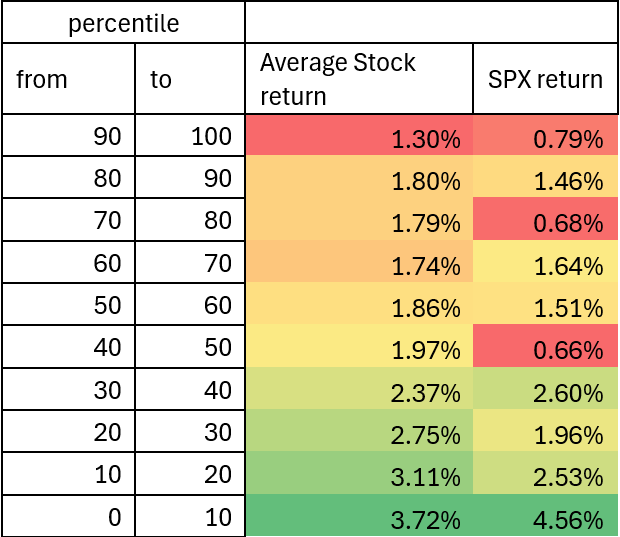

How the Stocks move 15 days later based on 50Days Moving Price Relative. (X=15, N=50)

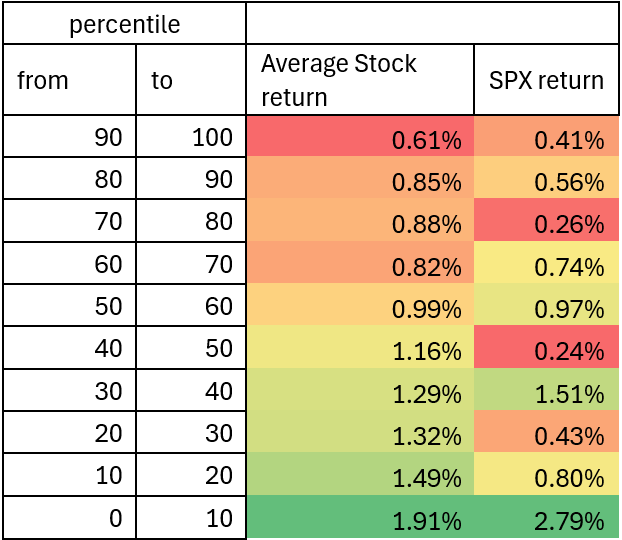

How the Stocks move 15 days later based on 100Days Moving Price Relative. (X=15, N=100)

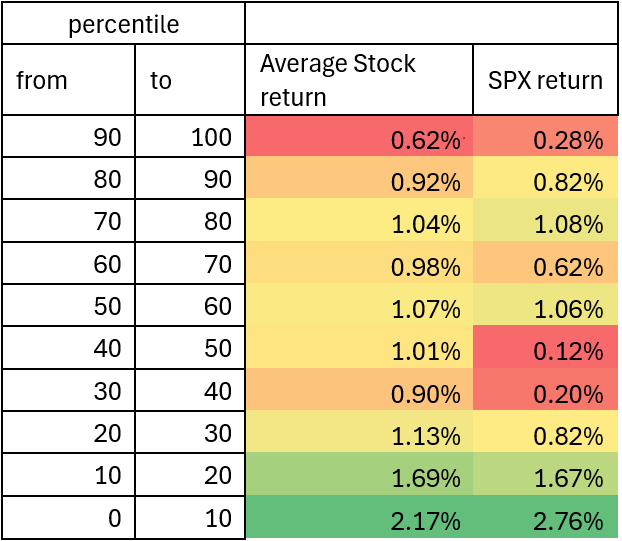

How the Stocks move 15 days later based on 200Days Moving Price Relative. (X=15, N=200)

For short-term traders, we have some good news. Generally, holding a position for 15 days before selling it off tends to yield a positive return. A consistent pattern has been observed with 50, 100, and 200-day moving price relative: lower prices typically result in higher returns compared to higher prices. The lowest percentile (0 to 10%) appears to provide the most return, whereas the highest percentile (90 to 100%) yields the least. This data suggests a trend of decreasing returns as the price or percentile increases.

This trend is also noticeable in the individual SPX index, though it is not as pronounced as it is across the 500 stocks.

Let's see if the trend remains consistent during the 30-day holding period.

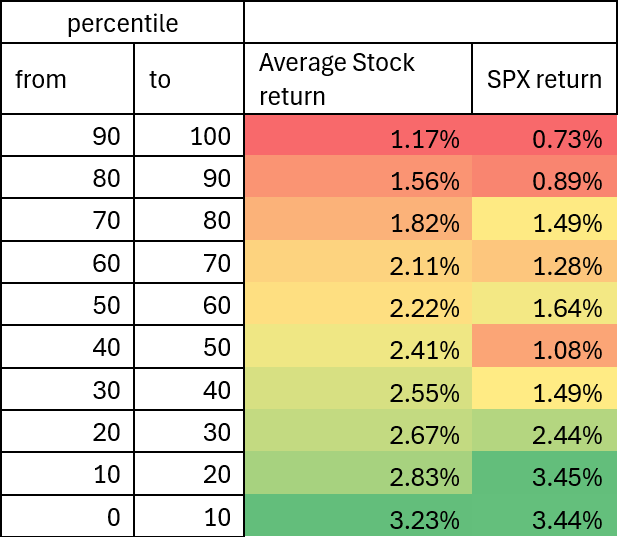

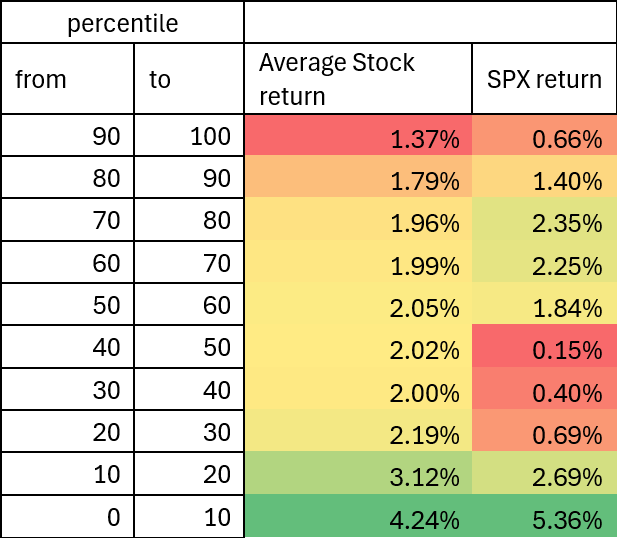

How the Stocks move 30 days later based on 50Days Moving Price Relative. (X=30, N=50)

How the Stocks move 30 days later based on 100Days Moving Price Relative. (X=30, N=100)

How the Stocks move 30 days later based on 200Days Moving Price Relative. (X=30, N=200)

Apparently, holding a position for 30 days generally yields higher returns than a 15-day holding period. This pattern can be observed across different tables. Additionally, a similar trend of higher returns from lower-priced stocks is evident in the 30-day holding period. Therefore, in general, without any in-depth analysis, targeting stocks in the lower price range or percentile for 15 or 30-day holding periods tends to provide a better trading edge according to the data.

FINAL WORDS

We do not consider the strategy of buying high and selling higher to be inferior. Various factors influence trading outcomes, and the advantage of buying low and selling high may not be applicable to momentum stocks. If you excel in sentiment analysis or other detailed analyses, the statistical trend discussed may not pertain to your strategy. Please keep in mind that this result is merely a statistical observation.

Please note that all the information contained in this letter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.