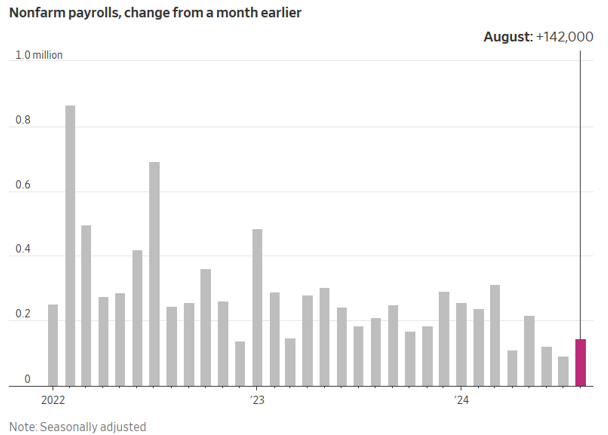

The Market had Stumbled 1.73% Last Friday

The market stumbled last Friday following the release of August job data showing a modest gain of 142,000 jobs, falling short of expectations and highlighting concerns about a weakening labor market. Today, the U.S. economy faces a challenging environment marked by slower job growth, persistent inflation, and fluctuating consumer spending. This softening job market has prompted the Federal Reserve to shift its focus, as officials consider potential rate cuts to prevent a deeper economic downturn. While unemployment has edged down to 4.2%, certain sectors—such as construction and healthcare—remain strong, but worries about declining consumer confidence and slower corporate earnings growth continue to loom.

Source: Labor Department

Although inflationary pressures have moderated, ongoing global uncertainties—such as the economic impact of China’s sluggish growth and geopolitical tensions—are casting shadows over the U.S. economic outlook. The Federal Reserve remains cautiously optimistic, with the expectation of a series of smaller rate cuts designed to stabilize the labour market and encourage spending.

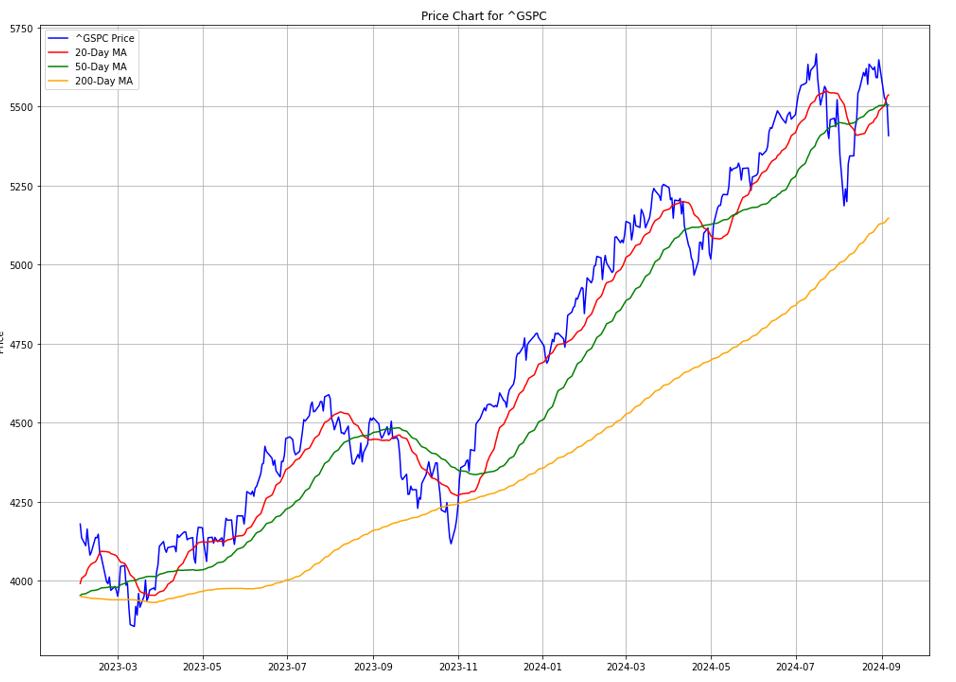

Wall Street posted its worst week since early 2023

The U.S. stock market has experienced increased volatility throughout 2024. Recent performance has been marked by sharp declines, with Wall Street posting its worst week since early 2023.

S&P 500 Index Chart

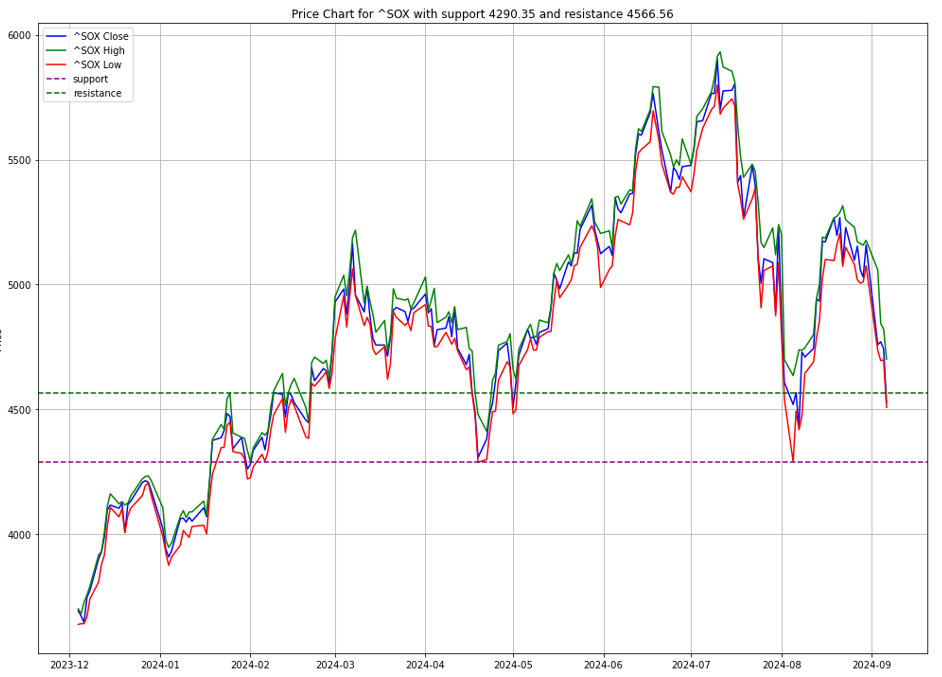

Semiconductor stocks, in particular, have dragged down the broader technology sector, which had been a significant driver of the market’s performance earlier in the year.

PHLX Semiconductor Index Chart

The broader market continues to grapple with uncertainties around corporate earnings, particularly as companies like Micron Technology face challenges stemming from fluctuations in AI investments and economic troubles in key global markets like China.

Source: Reuters

Despite these concerns, certain sectors such as energy and mining have performed well, buoyed by higher demand for commodities and geopolitical dynamics.

Dividends have become increasingly important for investors, especially in sectors like real estate and logistics. For example, Apple Hospitality REIT, United Parcel Service (UPS), and Nutrien have been noted for their high yields despite broader market turbulence. These stocks provide steady income streams to investors, making them attractive despite the overall market’s volatility.

Investment Opportunity & Risk

Despite the market stumbled, several stocks and sectors continue to stand out in the current market landscape:

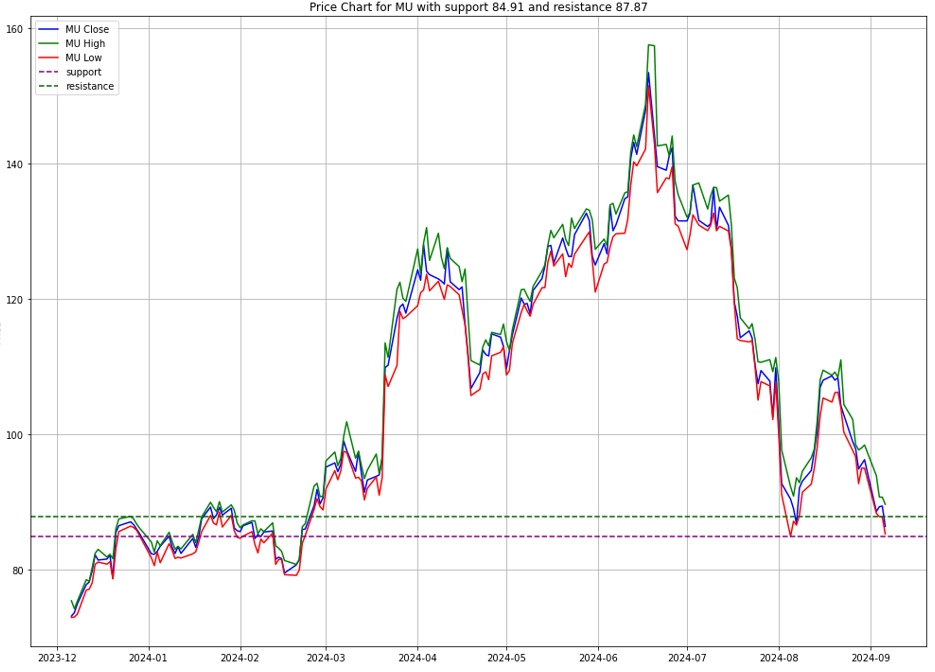

Micron Technology (NASDAQ: MU)

- Despite the semiconductor sector’s struggles, Micron remains a strong pick for investors, driven by its leading position in memory chips and DRAM pricing. While shares have fallen from their highs, long-term growth potential, particularly in AI and data centers, makes this a stock worth considering.

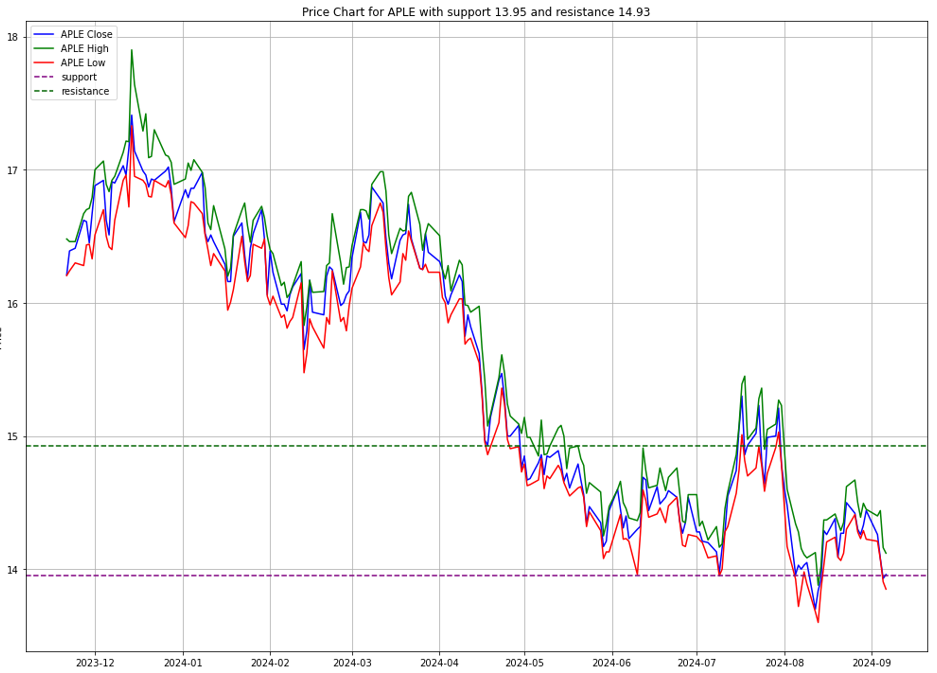

Apple Hospitality REIT (NYSE: APLE)

- This real estate investment trust has seen renewed interest from investors due to its focus on upscale hotels, offering a 6.89% yield. With its stock trading close to its 52-week low, it provides a compelling option for those seeking both income and growth.

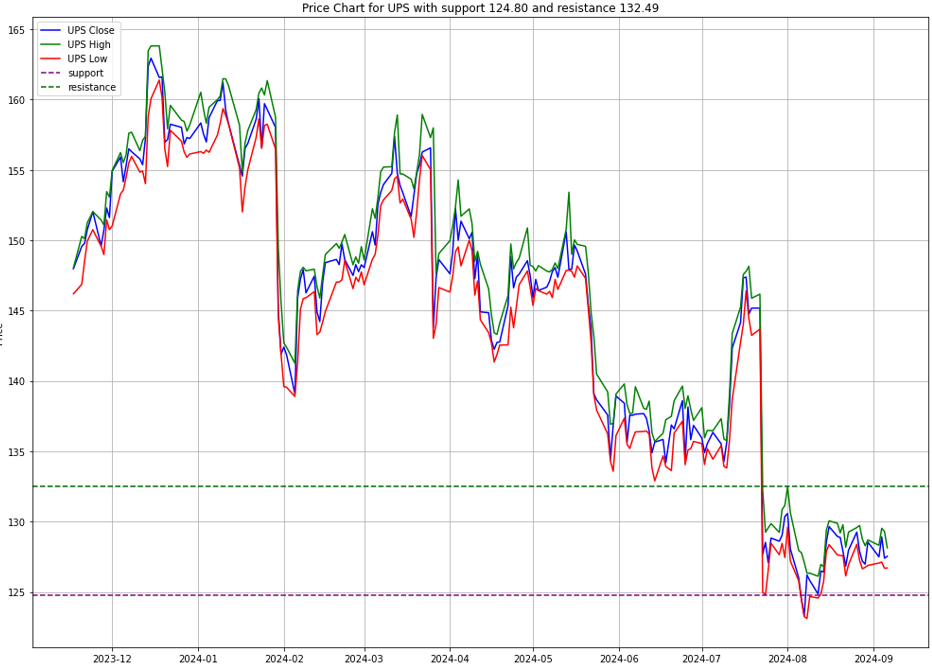

United Parcel Service (NYSE: UPS)

- Known for its reliable dividend payouts, UPS continues to attract investors looking for stability. Despite trading near its 52-week low, UPS’s solid track record of dividend increases makes it a standout in the logistics sector.

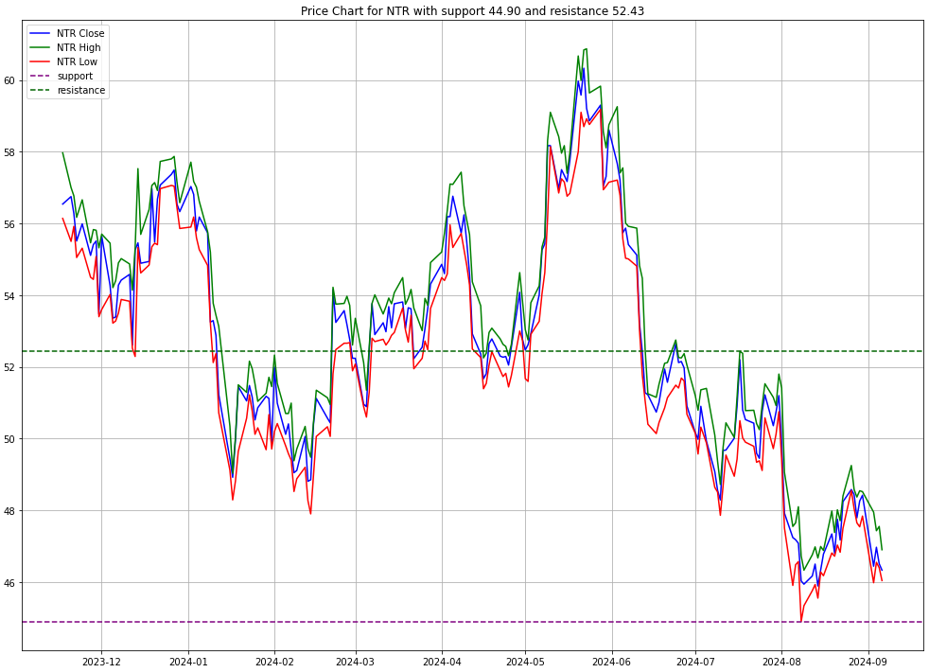

Nutrien Ltd. (NYSE: NTR)

- As the world’s largest potash producer, Nutrien has faced its own challenges, but the stock remains attractive due to its substantial dividend yield and positioning in the agricultural supply chain.

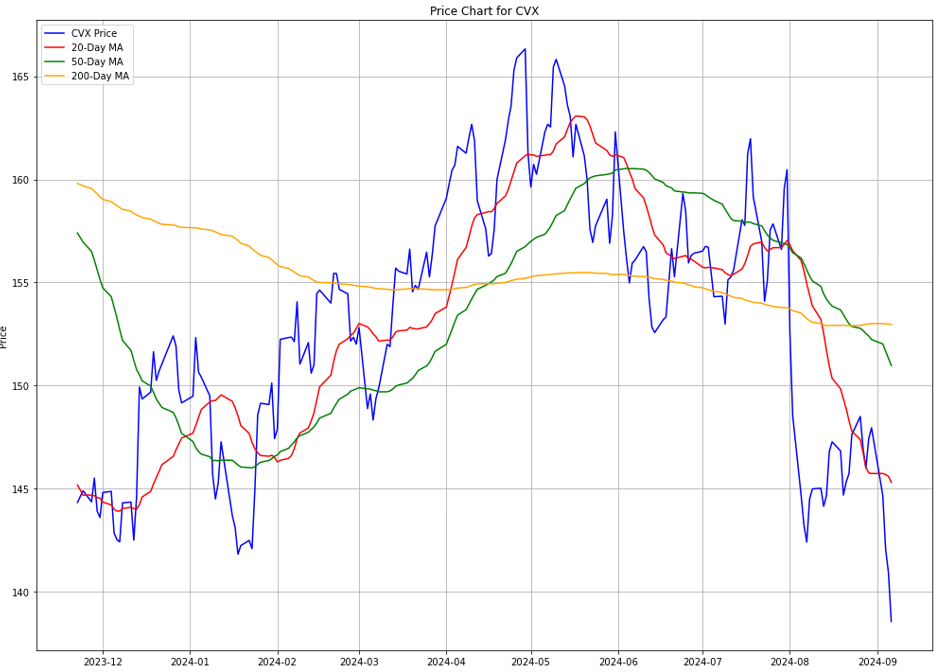

Chevron (NYSE: CVX)

- Despite global political instability, Chevron continues to play a crucial role in the U.S. energy market. The company’s strategic position in Venezuela, where it continues to pump oil despite contested elections, emphasizes its importance to both the U.S. and global energy security.

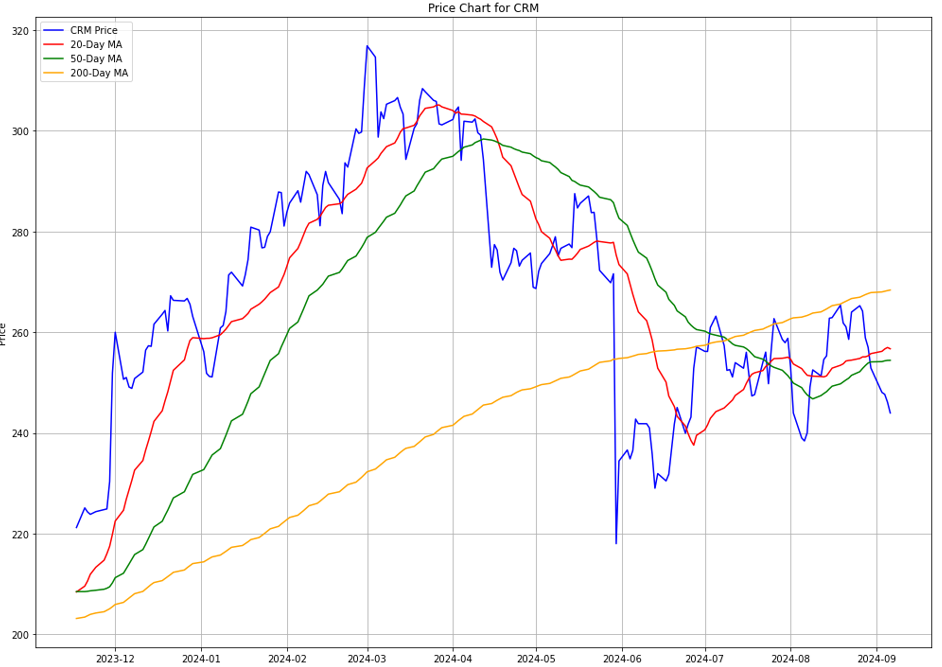

Salesforce (NYSE: CRM)

- Salesforce has been actively expanding its data protection capabilities with the acquisition of Own Company. This move underscores Salesforce’s commitment to enhancing data security and compliance as companies become more focused on protecting against cyber threats.

Red Lobster

- The restaurant chain’s sale after filing for bankruptcy represents a broader trend of consumer-facing industries struggling amidst economic uncertainty. The acquisition by Fortress Investment Group highlights opportunities for revitalization in the sector.

CONCLUSION

- The U.S. stock market stumbled, navigating a complex set of challenges, from macroeconomic headwinds to sector-specific struggles.

- The Federal Reserve’s anticipated rate cuts may provide some relief, but the overall outlook remains cautious.

- Investors are turning towards high-yield dividend stocks and companies in defensive sectors as uncertainty prevails.

- Semiconductors, energy, and logistics companies offer both risks and opportunities, while the broader market faces headwinds from global factors like China’s economic slowdown and continued geopolitical tensions.

- However, key acquisitions in the energy, technology, and retail sectors suggest that there are still growth opportunities for strategic investors willing to weather near-term volatility.

- As the market adjusts to evolving economic conditions, it will be critical for investors to focus on diversified portfolios, including stocks with strong dividends and long-term growth potential.