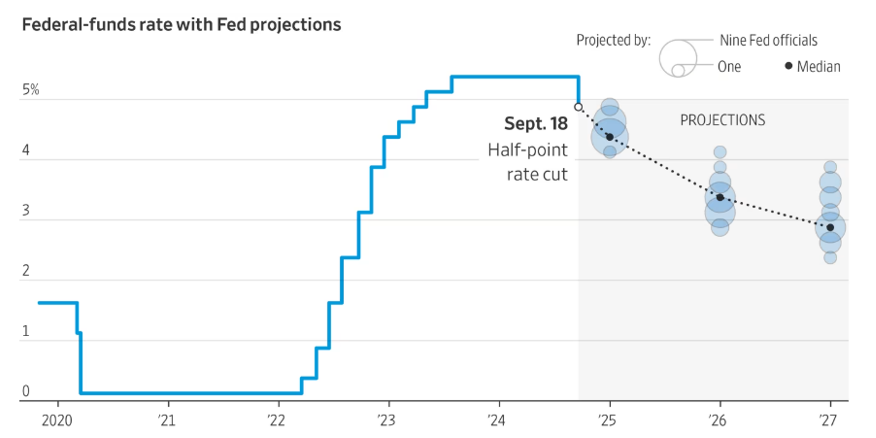

On September 18, 2024, the Federal Reserve(FED) implemented a bold half-point rate cut, reducing the federal funds target range to 4.75% to 5%. This move responds to cooling inflation and a softening labor market. The Fed aims to prevent the economy from sliding into recession. This decision represents a shift in monetary policy focused on sustaining economic growth while managing inflation, which is showing signs of easing.

Despite these challenges, many see the job market as strong. Fed Chair Jerome Powell emphasized the labor market’s resilience. The Fed’s recent bold rate cut aims to maintain stability while addressing inflation. However, as the Fed adjusts its monetary policy, observers will closely monitor employment trends. They are particularly concerned about the risks of a more significant slowdown in hiring or an unexpected rise in unemployment.

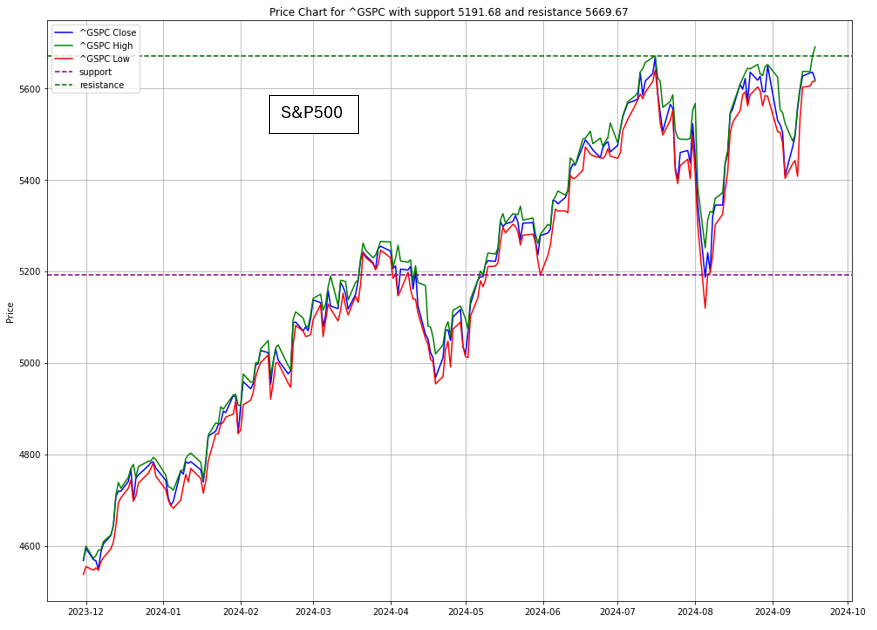

The Fed’s rate cut has had mixed effects on the stock market. Major U.S. indexes initially surged after the announcement but later retreated, showing investor uncertainty about the Fed’s future actions and the broader economic outlook. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all ended slightly lower, highlighting the market’s cautious stance.

Entering a phase of cautious optimism

The U.S. economy is now in a phase of cautious optimism, with the Federal Reserve’s recent actions greatly enhancing the chances of a “soft landing.” The Fed’s decision to cut rates by 50 basis points signals a crucial shift toward normalizing economic conditions. This move is essential to address a prolonged period of instability marked by high inflation and aggressive interest rate hikes.

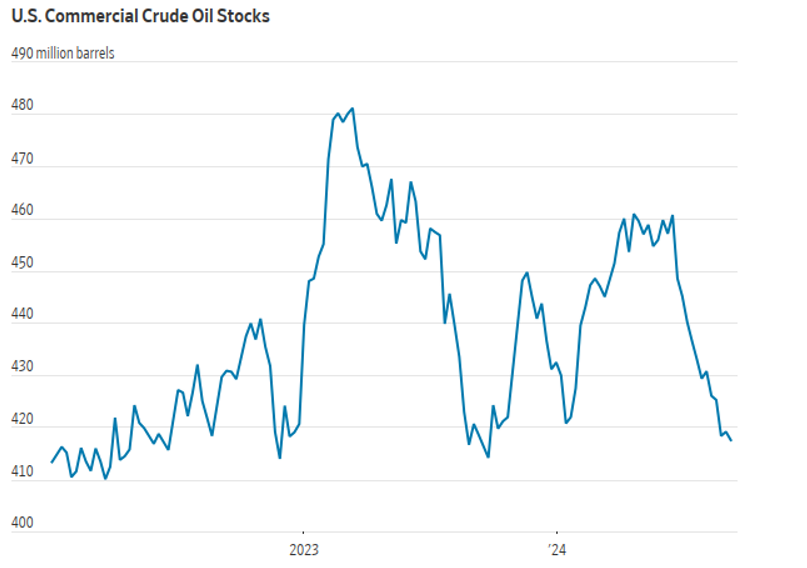

Meanwhile, U.S. crude oil inventories have fallen, with stockpiles excluding the Strategic Petroleum Reserve dropping by 1.6 million barrels in the week ending September 13. This decline, coupled with disruptions in Gulf of Mexico production due to Hurricane Francine, has raised concerns about potential price spikes in West Texas Intermediate.

KEY HIGHLIGHT

A Bold Rate Cut to Protect Weakening Job Market

Source: REUTERS

The labor market, once a pillar of strength in the U.S. economy, is now showing signs of cooling. The unemployment rate has edged up to 4.2%, from a low of 3.5% a year earlier, reflecting a moderation in labor demand.

Private-sector job growth has slowed significantly, with recent monthly gains averaging just under 100,000 jobs, down from nearly 200,000 per month last year. This slowdown is mostly driven by companies pausing hiring, while layoffs have remained relatively low

Despite these challenges, the job market is still seen as strong. Fed Chair Jerome Powell stated that the labor market remains resilient. The Fed’s recent bold rate cut aims to maintain this stability while tackling inflation. However, as the Fed adjusts monetary policy, employment trends will be closely monitored, especially with the risks of slower hiring or a rise in unemployment.

Investment Opportunity & Risk

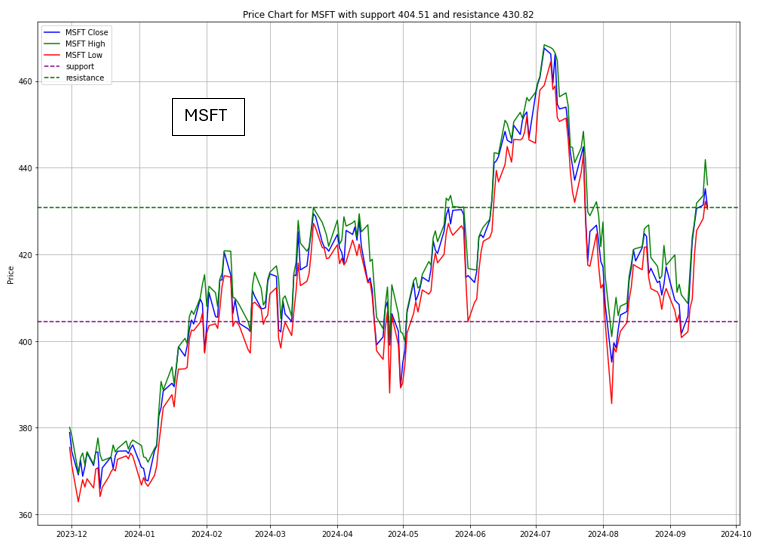

Microsoft (MSFT)

- Microsoft has continued to strengthen its financial position by boosting its quarterly dividend by 11% and authorizing a new $60 billion stock repurchase program. These moves reflect confidence in the company’s long-term growth prospects, particularly as it continues to invest heavily in artificial intelligence and cloud computing.

Electronic Arts (EA)

- EA recently experienced a challenging market reaction after its first analyst meeting in eight years. While the company’s ambitious plans for new game releases and AI-driven content creation have been well-received for the long term, the absence of specific financial guidance and unclear timelines for game launches caused a decline in its stock price.

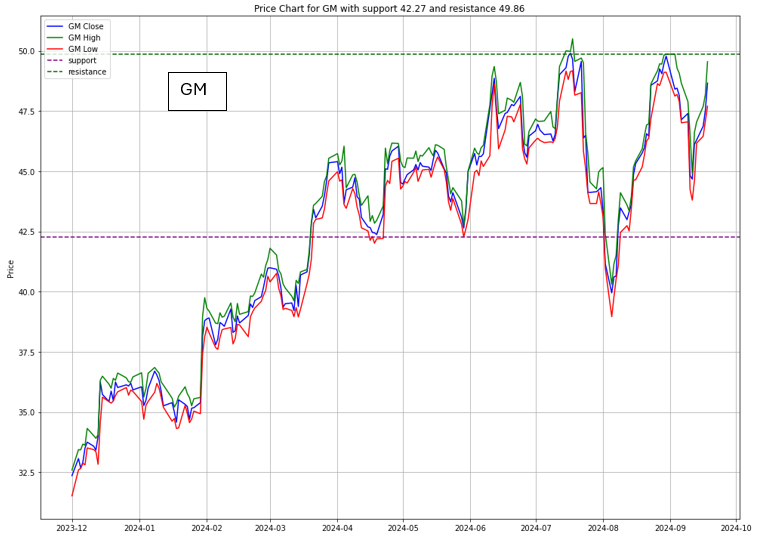

General Motors (GM)

- General Motors saw a 2.4% increase in its stock price after the Federal Reserve’s rate cut. Anticipation of lower borrowing costs is expected to boost sales of high-ticket items like vehicles, benefiting automakers like GM. This optimism persists despite broader challenges in the global automotive market, especially in Europe, where demand has weakened significantly.

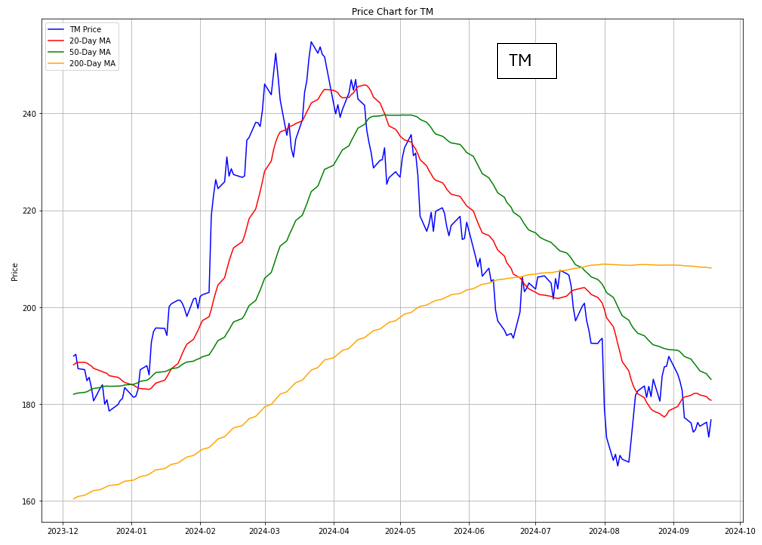

Toyota (TM)

- Toyota also experienced a positive reaction in the market, with its stock rising by 2%. The company is likely to benefit from the same favorable borrowing conditions expected to drive consumer purchases of vehicles. Toyota’s gains reflect the broader market sentiment that sees the Fed’s rate cuts as a potential catalyst for increased sales in the automotive sector.

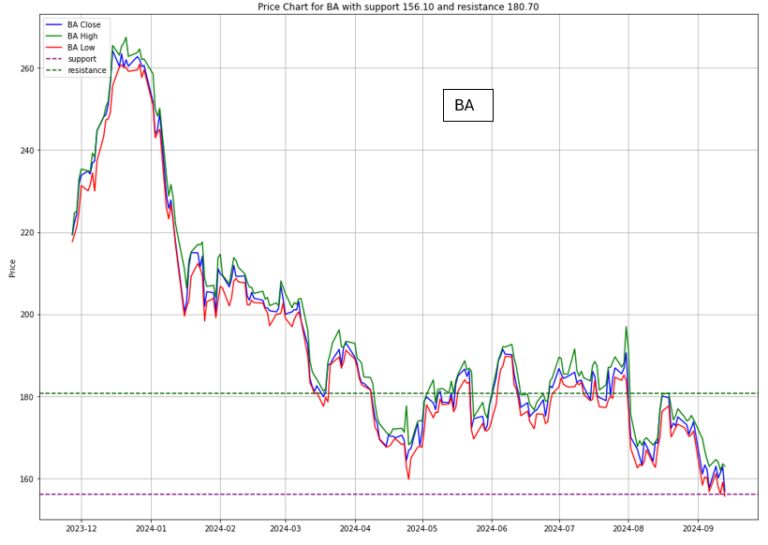

Boeing (NYSE: BA)

- Boeing is facing severe financial strain due to an ongoing strike by its largest union, which has halted production of key aircraft models like the 737. In response, the company is furloughing white-collar workers and freezing hiring to manage cash flow, as it risks a credit-rating downgrade if the strike continues.

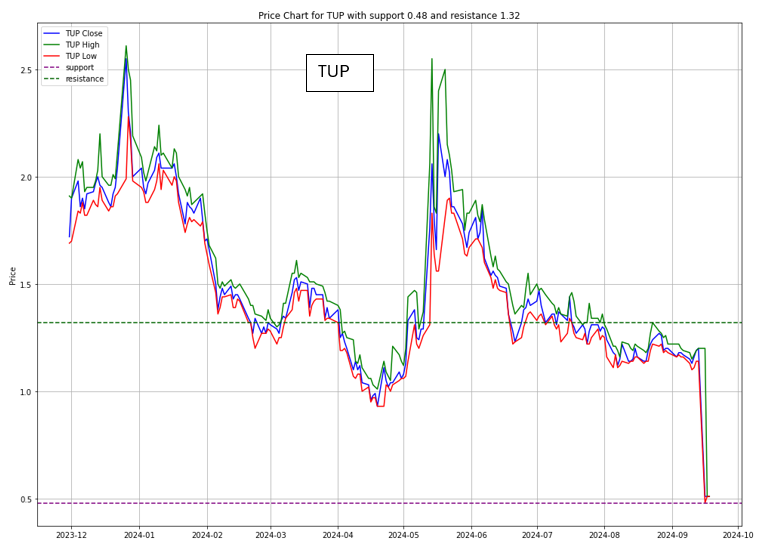

Tupperware Brands (TUP)

- The iconic kitchenware company has filed for bankruptcy after years of declining sales and financial struggles. Tupperware’s traditional direct-sales model has struggled against modern retail and e-commerce trends, resulting in a significant drop in market value. The company’s future now hinges on the outcome of a bankruptcy court-led bidding process.

CONCLUSION

- The U.S. economy is navigating a complex landscape.

- The Federal Reserve’s recent bold rate cuts have boosted market confidence.

- However, challenges persist across sectors like technology and consumer goods as companies adapt to changing economic conditions and consumer behaviors.

- The coming months will be crucial in determining whether the Fed’s strategy will result in a soft landing or if further adjustments will be needed to sustain economic growth.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.