Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), has recently warned that most investors do not fully understand the nature of their investments in Chinese companies.

Investors who buy Chinese shares from US stock exchanges of, say, Alibaba, JD.com, or Pinduoduo actually do not own a stake in the actual operating entity but rather own a stake in an offshore shell company!

Wait….What?

Yes, that’s right!

This is because Chinese tech firms use so-called “variable interest entity structures.”

In simpler words, to avoid the stricter restrictions imposed by US stock exchanges, Chinese corporations set up offshore shell companies in places like the Cayman Islands, which are permitted to enter into contracts with the Chinese companies and “consolidate the operating company into its financial statements.”

Now it seems like the SEC and investors are becoming increasingly concerned about the nature of this legal construction, and it almost seems like there’s no end to the stream of bad news for Alibaba investors in particular.

Before getting into the Delisting Fiasco, let's take a quick glimpse of what happened to ALIBABA over the last two years:

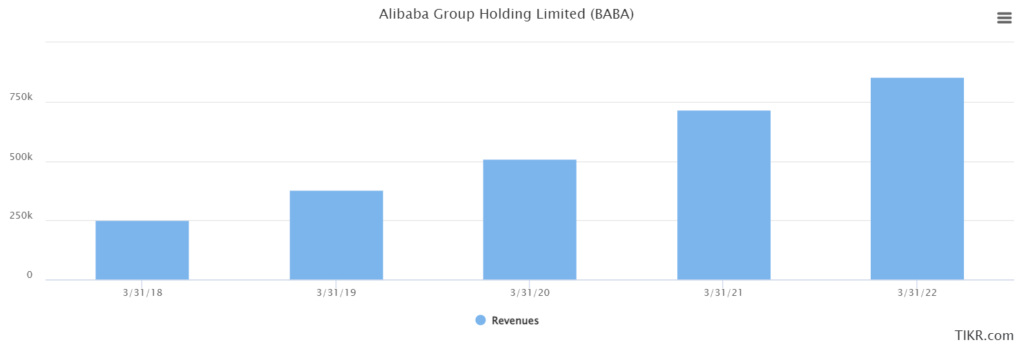

There’s no doubt about the fact that when one only looks at the fundamentals of Alibaba, a business that averaged almost 50% in revenue growth over the last five years, the stock is currently undervalued.

The main reason for the massive discount on the stock is not the firm’s ability to continue growing in the future but rather the uncertain future of the stock, which is caused by a multitude of reasons:

- Last year, China’s antitrust officials cracked down on Alibaba’s e-commerce business, fining it a record $2.8 billion.

- It was also prohibited from enticing retailers with special discounts and employing excessive promotions. This crackdown damaged Alibaba’s market share in China’s crowded e-commerce market.

- It also coincided with a broader slowdown in China’s e-commerce as customers curbed their spending during the nationwide lockdown.

- Alibaba’s cloud growth also cooled as China’s regulators cracked down on online games, streaming video platforms, online education services, and other internet-based apps that thrived during the pandemic. Many of these services were hosted on Alibaba Cloud.

New Threats from SEC

The Securities and Exchange Commission added Alibaba to its list of possible delisting candidates, putting additional pressure on the company’s stock.

That threat has hung over Alibaba since the ‘Holding Foreign Firms Accountable Act’ (HFCAA) became law in December 2020, requiring foreign companies (especially Chinese ones) to open their books to US auditors.

Under the HFCAA, Chinese companies failing to meet the stricter auditing standards for three years will be delisted from all U.S. exchanges, including over-the-counter (OTC).

Following that, China’s Securities Regulatory Commission (CSRC) held talks with the SEC to avoid the delistings, but those discussions have been fruitless thus far.

So Will Alibaba Be Delisted?

Alibaba had previously not been mentioned explicitly by the SEC but now has made it onto the SEC’s list of potential delisting candidates.

However, this does not imply that delisting is imminent. It simply means that the SEC has selected Alibaba as one of several firms that may be delisted in the future if certain disclosure and transparency requirements are not met.

Furthermore, Alibaba is attempting a secondary listing on the Hong Kong Stock Exchange.

By the end of the year, Alibaba expects to complete the primary listing process in Hong Kong. So, even in the worst case of a forced U.S. delisting, U.S. investors can still simply buy and sell their shares on the Hong Kong stock exchange.

Alibaba’s June Quarter Results

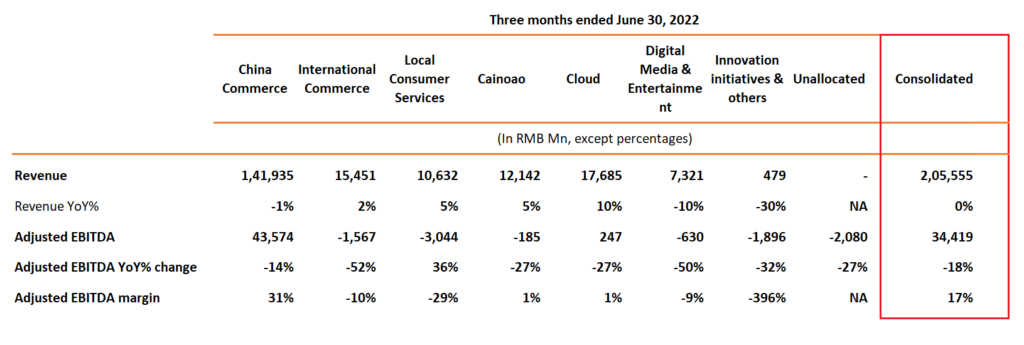

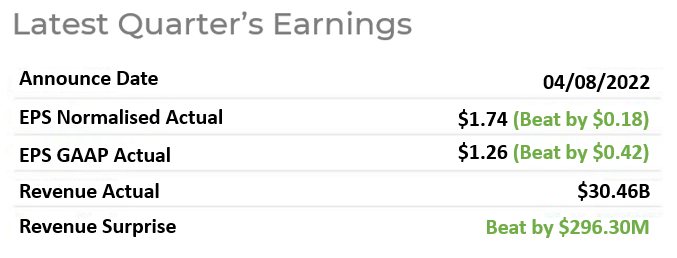

From April to June 2022, Alibaba generated revenues of $30.69 billion, which indicates neither growth nor contraction compared to the same period one year prior.

Despite the fact that revenues remained flat, the performance exceeded analyst consensus expectations, which predicted a 1.5% fall year-over-year.

Alibaba’s income from operations was $3.7 billion, a decrease of around 19% from the June quarter of 2021. But again, the performance is ahead of analysts’ estimates.

|

Despite the challenges created by the COVID-19 resurgence, we delivered consistent revenue growth year on year. We have reduced losses in key strategic businesses given ongoing improvements in operating efficiency and a greater emphasis on cost management. -Daniel Zhang, Alibaba’s CEO |

It is worth emphasizing that Alibaba performed in a highly adverse macro-environment in China, which was impacted by:

Inflation,

International trade tensions.

Real estate crisis.

A regulatory crackdown on internet/tech enterprises.

Decreasing consumer confidence.

Thus, Alibaba’s results clearly stand out positively.

Alibaba Has 1 Monster Hidden Asset

Jack Ma founded ‘Alipay,’ an online payment platform, currently operated by the ‘Ant Group’ and has a total of 1.3 billion active users who transact on Alibaba’s e-commerce websites and anywhere mobile payments are accepted.

The app allows users to access its money market fund, buy now, pay later service, and online banking. Alibaba owns a massive 33% of the Ant Group.

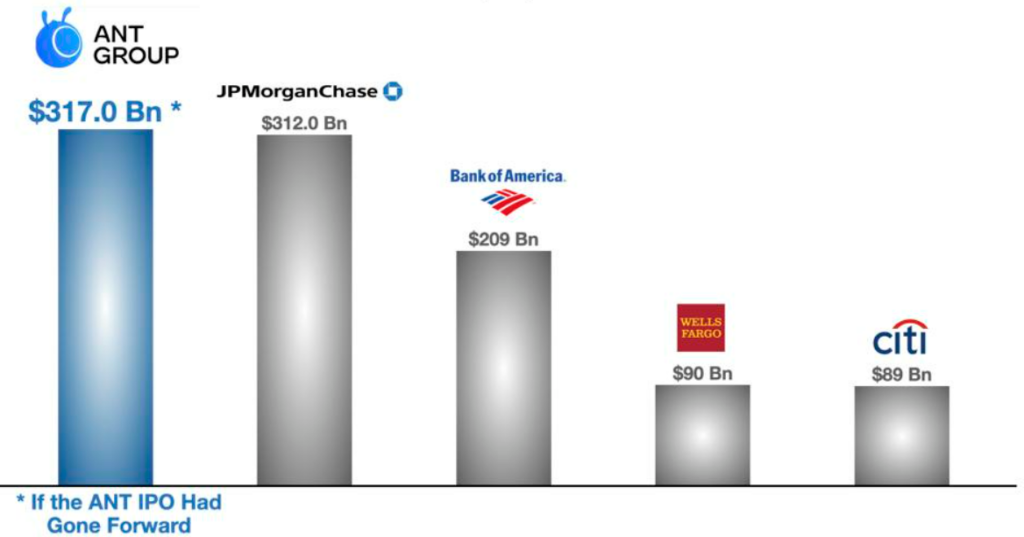

Ant planned to go public as a standalone business in 2020, valuing over $300 billion!

At that time, Ant Group would’ve been larger than Bank of America and even J.P. Morgan Chase!

Unfortunately for Ant stockholders, the IPO was scrapped at the last minute by the Chinese government, which began issuing sweeping regulations on Chinese internet businesses, such as Ant, that conducted financial services but were not regulated like financial institutions.

However, the People’s Bank of China recently granted Ant’s application to establish a financial holding company. Their approval could signal that Ant is now in compliance with regulations, paving the way for another IPO effort.

If the IPO effort turns out to be successful and if the Ant Group is worth more than $300 billion, as it was before, Alibaba’s one-third stake would be worth around $100 billion!

However, there’s now a twist to the story!

Jack Ma to Reportedly Cede Control of Ant Group

According to a report in the Wall Street Journal, Jack Ma intends to relinquish his stake in Ant Group!

Experts believe it is a part of the Ant Group’s strategy to reduce its dependency on Jack Ma as it works with the government to overhaul its business. The Chinese government also targeted Jack Ma in an attempt to limit his influence in the country’s booming tech sector.

Ant Group hopes that by reducing the influence of Ma, it will be able to finally go public.

If Jack Ma indeed relinquishes his stake, it will dilute Alibaba’s stake in Ant Group and may create further downside pressure on Alibaba’s shares!

Following the announcement on July 29, Alibaba’s share price dropped as much as 11.1% before settling down at $89.37 per share.

FINAL WORDS

In the ongoing tug-of-war between a growing risk profile and attractive valuations, it is difficult to conclude who will take the stronger hold on the Alibaba stock.

At this stage, the company’s growth relies on the development of the Chinese regulations, and given its behavior over the last two years, it poses an existential threat to Alibaba.

Also, an exodus from the U.S. market may weigh on Alibaba’s valuation and could create liquidity issues for Alibaba investors.

However, Alibaba is still a solidly profitable company even with all of the challenges that have been thrown its way.

Its first-quarter earnings report exceeded all expectations, which was more than we could have imagined. Taking the macro environment into account, that is a win.

A full reopening of the Chinese economy, the potential listing of Ant Group, and the question of whether or not Jack Ma relinquishes his stake in Ant Group would undoubtedly be a big catalyst for Alibaba’s shares!

Therefore, before diving in, investors should consider all the upside potential and the downside risks mentioned above.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.