Believe it or not, the concept of Alpha returns is commonly misunderstood. But why is it important? Does it make a material difference in how one decides to trade and/or invest?

The short answer is yes.

To begin understanding what Alpha even is, you really have to begin with understanding what Beta is.

Beta returns essentially means what a diversified stock market will return to investors. Some commonly used benchmarks for a diversified stock market are S&P 500, Dow 30 and Nasdaq 100 based in the USA. In Singapore we have the STI index. In Hong Kong we have the Hang Seng Index and in China the A50.

I am sure many have heard this expression before “Do not try to beat the market”.

What that really refers to is attempting to beat beta returns. Perhaps the most commonly used market return benchmark is the S&P 500 from the USA, since it represents the best 500 companies based out of the world’s largest economy by wealth.

Thus when someone says, do not try to beat the market, they basically mean do not actively trade on your own discretion because it is unlikely you will be able to consistently outperform the S&P 500. Said another way, the average investor is better off just buying a low cost fund tracking the S&P 500 – a strategy commonly known as Passive Investing.

That said, Alpha strategies do exist, and are readily available if you know where to look. More importantly, it is even more crucial to know what to look out for in determining whether a trading strategy has True Alpha.

Read on to find out more!

Official Alpha Return Definition1

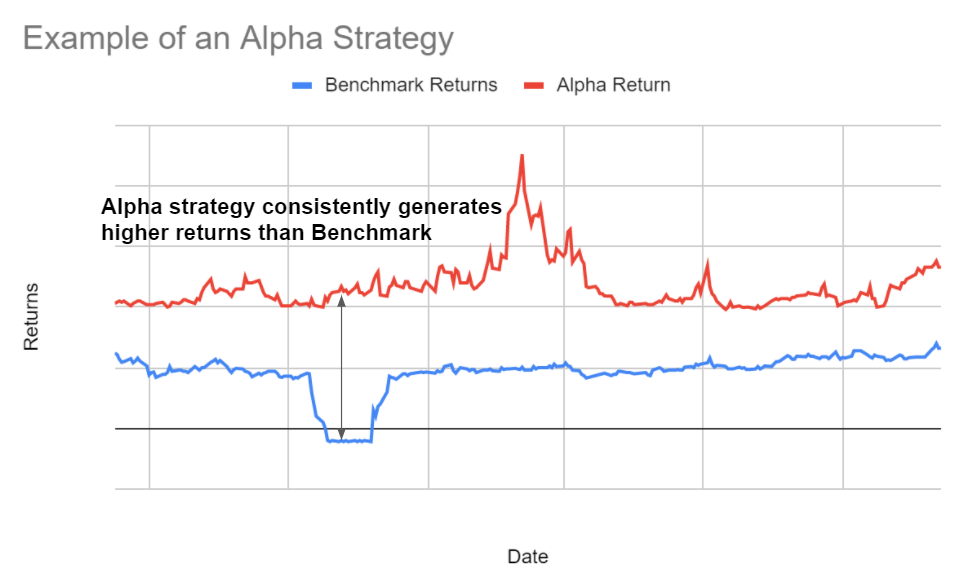

Alpha (α) is a term used in investing to describe an investment strategy’s ability to beat the market, or its “edge.” Alpha is thus also often referred to as “excess return” or “abnormal rate of return,” which refers to the idea that markets are efficient, and so it is not easy to systematically earn returns that exceed the broad market as a whole.

What Alpha is not

The notion of Alpha returns is commonly misunderstood. To begin with there was never really an official definition and also changes in traders and investors expectations of returns over time played a part in Alpha being misunderstood.

This part of the article attempts to make it crystal clear what the definition of Alpha really means. To cement this, we shall make it abundantly clear what it is not.

#1 – Alpha does not only mean positive returns

Just because a strategy is able to generate consistent positive returns does not necessarily mean it is an Alpha strategy. The definition of Alpha is excess returns to the market.

Hence Alpha should always be viewed relative to the market benchmark (for example S&P 500). If it is consistently positive but cannot beat the S&P 500 benchmark, it cannot be considered Alpha.

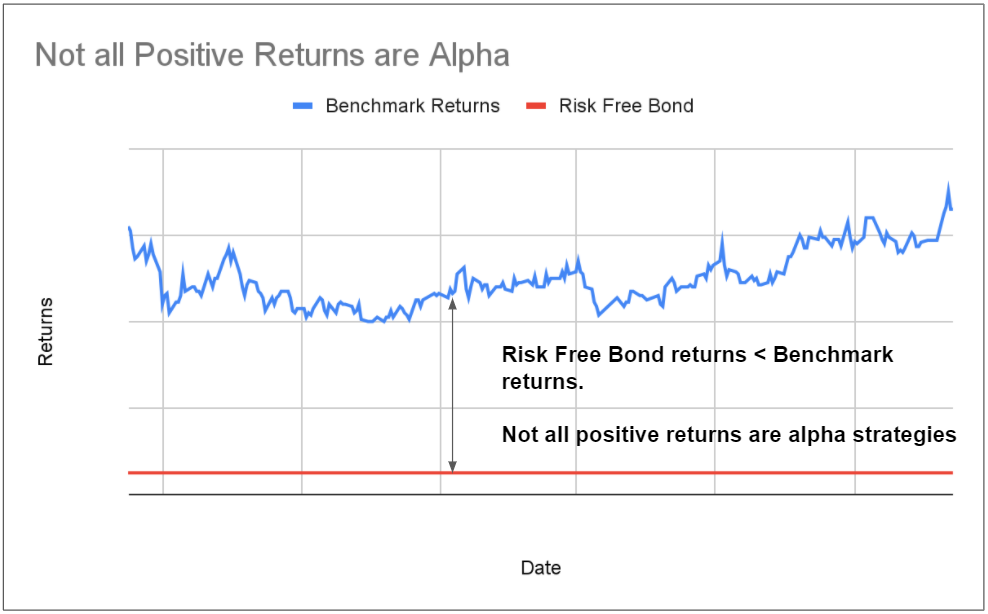

A very good example is the comparison between a risk free bond versus S&P 500.

A risk free asset is consistently able to generate investors a positive return. However, that return is very low in exchange for eliminating uncertainty. Correspondingly, a more uncertain and volatile equities benchmark provides higher returns in exchange for volatility.

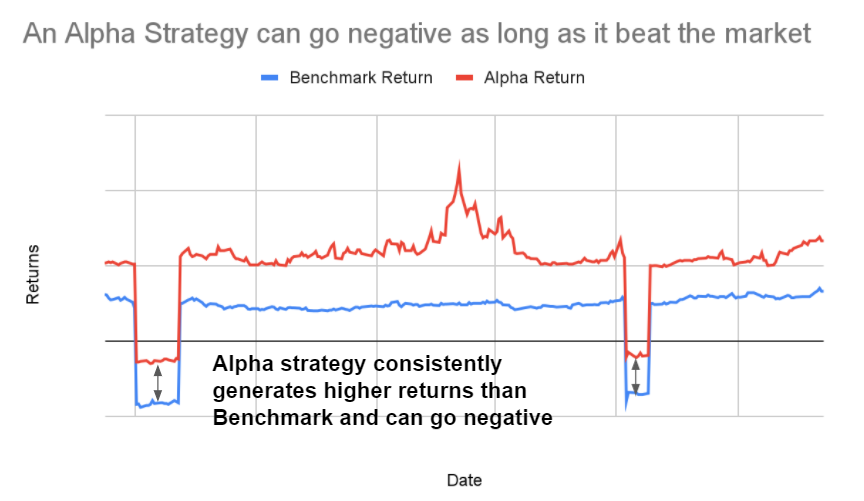

#2 – Alpha does not mean the Strategy cannot be negative

Similarly, a strategy can also at times generate negative returns but yet still be an alpha strategy as long as during the period of negative returns, it is less negative than the benchmark.

Remember the concept of Alpha is always relative to the benchmark in question.

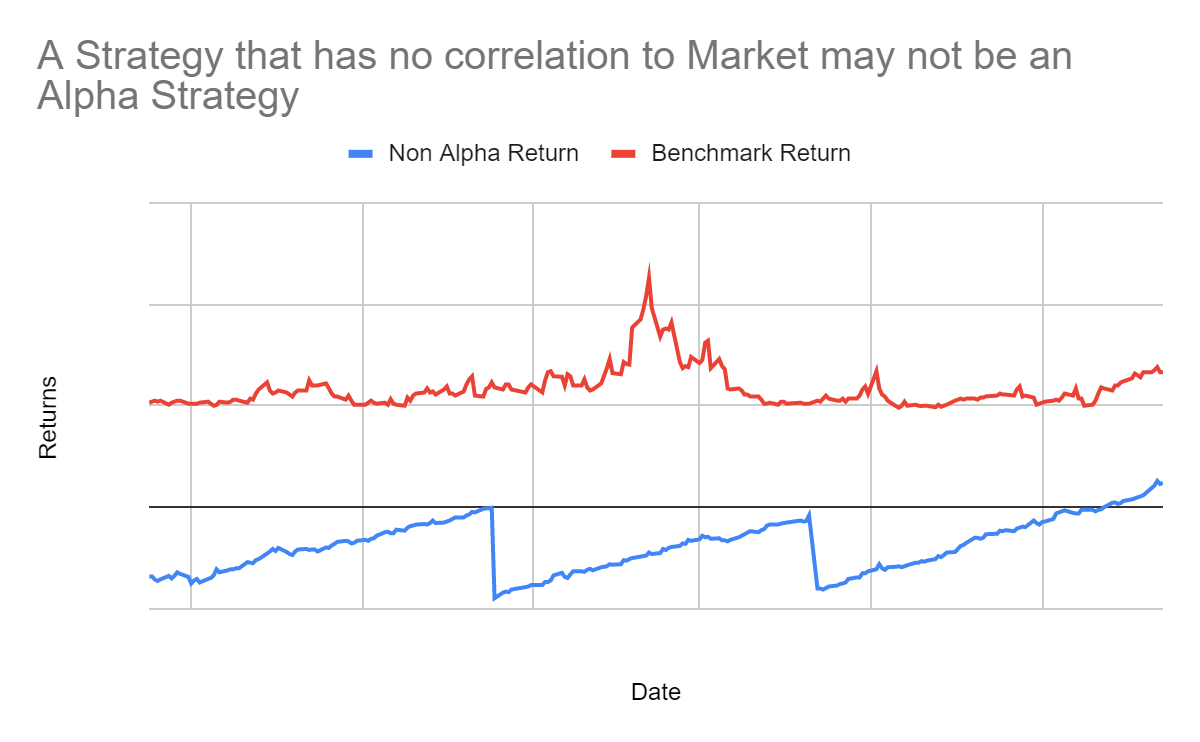

#3 – Alpha does not mean low correlation to the Market Benchmark

This scenario has perhaps confused the most number of investors and traders. Many think that just because Alpha means excess returns to benchmark, it therefore also implies there is no correlation between the two.

For a strategy to be Alpha it must therefore behave differently to the market in order for it to generate above market returns. While that is true, it doesn’t imply that any strategy that has no correlation to the market is an Alpha strategy! What about those that consistently lose money?

When Alpha is Grey

While the above examples clearly illustrate what Alpha is not, the unfortunate thing is it is not always so straight forward. There are 3 key reasons that contribute to this murkiness.

First, as much as we would like to own a strategy that is able to beat market returns 100% of the time, such strategies most likely do not exist.

Second, the official definition of Alpha does not explicitly provide prescriptive and reasonable time and percentage measures to assess what is Alpha and what is not. For example, if a strategy is able to beat the market 70% of the time, is it Alpha? What about 90%, 60% or 50%?

Third, to complicate it further, what does time even mean – do we have to break it down into seconds, minutes, hours, days, weeks, months, or years? Perhaps I can be cheeky and say my strategy is alpha because for 5 hours last trading day session it managed to beat the S&P 500 daily performance?

How is Alpha commonly applied?

It is probably safe to say that in the professional trading and investing community, many will endorse strategies as Alpha if they are able to beat market returns from an annual basis.

Perhaps there might be some sense to this application as it means the strategy is given a year’s worth of time to provide itself, and it is able to consistently outperform the market by year end, it is worthy of the Alpha badge. In summary, Alpha is commonly assessed on an annual returns basis.

Many even take this further, by assessing if the strategy is able to consistently beat the market, over the passage of time year in and year out. Such strategies are rare and highly sought after, because it is truly hard to beat market returns over the long term.

What to look out for in Alpha Strategies?

There are many other performance metrics (volatility, max drawdowns, average returns on investment, win rates etc) to pay attention to when assessing strategies.

Since we are on the topic of Alpha returns, perhaps the most important thing to look out for is the longevity of the strategy’s ‘Alphaness’.

The longer the strategy is able to beat the market, the better the Alpha credibility. More often than not it is preferred to look in terms of years.

In general, proceed cautiously when you see or hear such marketing and sales pitches for supposedly successful trading strategies:

- I made 200% returns during the Covid recession despite the S&P 500 experiencing a 38% drawdown

- Or, my market beating proprietary trading strategy made a consistent 60% returns in the past 3 months

The reason why these strategies should be assessed further is because they offer no insight into the long term Alphaness of these strategies, other than their short term market beating capabilities (even if they were true).

As traders and investors, what everyone is looking for is long term capital growth and consistent profits. If a trading strategy cannot generate market-beating returns in the long haul, and if you are looking for one that has long term alpha then such a strategy should be evaluated carefully.

1 https://www.investopedia.com/terms/a/alpha.asp