The U.S. stock market experienced significant losses as investor sentiment weakened amid ongoing concerns in major sectors, including Industrials, Technology, and Consumer Services. The Dow Jones Industrial Average fell by 1.69%, reaching a one-month low, while the S&P 500 lost 1.70%, and the NASDAQ Composite suffered a 2.20% decline. This marked a negative shift for U.S. equities, which had previously been buoyed by optimism around advancements in artificial intelligence (AI).

Source: The Atlanta Journal-Constitution

Commodity Prices Dip as U.S. Dollar Strengthen

In commodities, crude oil futures fell by 3.12%, while gold futures saw a modest 0.19% decline. The U.S. Dollar strengthened slightly, with the USD/JPY pair dropping by 0.36%, while the EUR/USD remained relatively stable.

Source: The Economic Times Business

AI Market Faces Volatility as Investors Weigh Long-Term Growth

Concerns in Industrials, Technology, and Consumer Services weighed heavily on markets, with investors questioning whether AI-driven innovations could deliver immediate economic benefits. The CBOE Volatility Index (VIX) surged 16.28%, indicating heightened market uncertainty.

In response to the shifting dynamics in AI, Nvidia’s CEO, Jensen Huang, addressed the market’s initial negative reaction to the DeepSeek AI model. He emphasized that DeepSeek’s advanced reasoning capabilities would, in fact, drive a greater demand for computing power, challenging the previous assumption that AI would require less computational capacity. Huang’s remarks helped restore some confidence in the sector, despite the short-term volatility.

Source: La Noticia Digital

Looking ahead, while the AI sector faces some short-term volatility, industry leaders like Huang are optimistic that technological advancements will lead to long-term growth, particularly in computing infrastructure. As such, both markets face a complex mix of challenges, but opportunities for growth remain on the horizon, driven by technological and market dynamics.

Housing Market Struggles as High Mortgage Rates Deter Buyers

Alongside the volatility in the stock market, the housing market also faced challenges. Sales of existing homes fell by 4.9% in January 2025, marking an extension of the slump that had plagued the housing market throughout 2024. High home prices and mortgage rates, which have been a persistent drag on housing affordability, continued to suppress sales activity. The National Association of Realtors (NAR) reported that the seasonally adjusted annual rate of home sales stood at 4.08 million in January, lower than the 4.20 million predicted by economists.

For many potential buyers, rising mortgage rates and elevated home prices have led to reduced affordability, particularly for first-time buyers. As a result, many homeowners have opted to stay put rather than sell, choosing to retain their low mortgage rates. Despite a slight increase in inventory, which typically signals a potential recovery, the rising costs of mortgage payments, home insurance, and property taxes are expected to keep many buyers on the sidelines.

Source: WSJ

Looking ahead, the spring housing market remains uncertain. While real estate professionals hope for a seasonal boost, mortgage rates above 7% and affordability concerns continue to weigh on buyers. Without a drop in interest rates or home prices, a significant market recovery may take longer than anticipated.

Watchout

UnitedHealth Stock Drops 7% as DOJ Probes Medicare Billing Practices

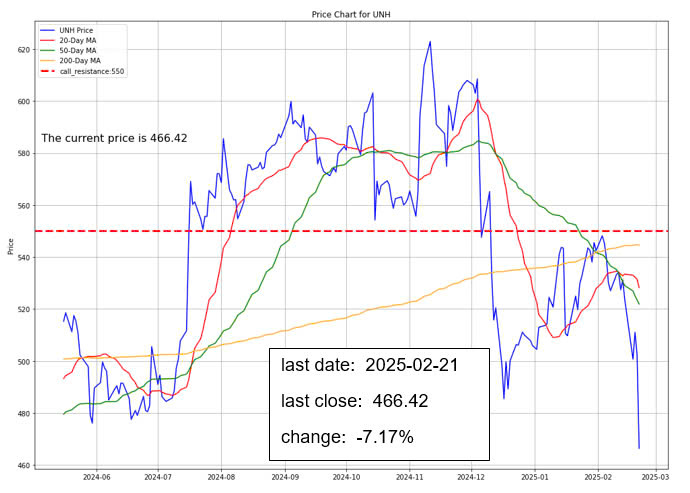

The stock fell by 7.17% on February 21, 2025. The main reason for this decline was a report stating that the U.S. Department of Justice (DOJ) launched an investigation into the company’s Medicare billing practices, particularly focused on whether UnitedHealth manipulated diagnoses to receive higher Medicare payments. This development stirred concerns about potential legal and financial implications, causing the stock to drop.

Additionally, UnitedHealth has faced scrutiny from the Office of Inspector General for issues related to health risk assessments and chart reviews, further adding to the negative sentiment surrounding the company. This news contributed to a broader decline in health insurance stocks as well, including those of Humana, Elevance Health, and CVS Health.

Option Smile Chart for UNH

- Our in-house system assigns a bullish index score of 0.403 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The implied volatility of the put options are higher than the implied volatility of the call options. That is the indication that the traders’ fear for a fall in the stock price outweigh the expectation for the stock price to rise.

- The volume near the current stock price is displaying that more traders are betting their money for the price to fall than rise. However it is interesting to note that at the strike price 500, considerable amount of call options are being placed for the price to reach and surpass that level.

- Looking at the open interest chart, there is no support level that may slow the slide if the sentiment worsen. For the resistance level, there is a major resistance at 550 level.

Investment Opportunity & Risk

Moderna (NYSE: MRNA)

Concerns about coronavirus news emerging from China likely influenced the market on Friday. While the broader session was down, with the S&P 500 falling by 1.7%, Moderna (MRNA) saw a notable rise, gaining more than 5%. At the same time, some travel-related stocks faced declines. These movements were likely driven by reports from outlets such as the South China Morning Post and Daily Mail, which covered a team of Chinese researchers identifying a bat coronavirus that could potentially spread from animals to humans. However, former FDA Commissioner Scott Gottlieb, speaking on CNBC, downplayed the risk, noting that such findings are routine and that the link to an imminent threat was weak.

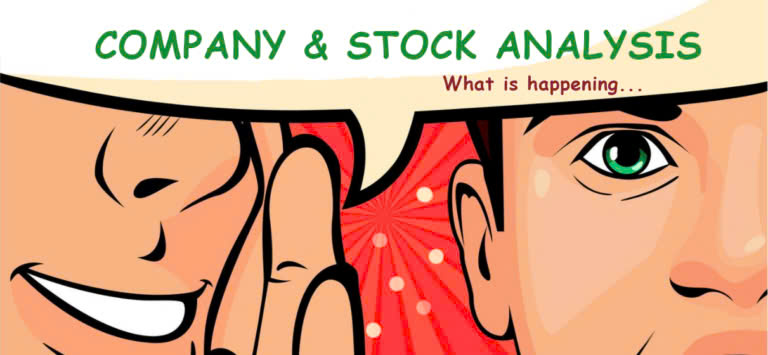

Option Smile Chart for MRNA

- Our in-house system assigns a bullish index score of 0.888 on a scale where 0 represents completely bearish and 1 represents completely bullish.

- Near the current stock price level (ATM), The implied volatility of the call options are averagely slightly higher than the implied volatility of the put options. That roughly indicates that the traders’ sentiment for a price rise or a price fall is about even.

- The volume near the current stock price is displaying that more traders are betting their money for the price to rise than fall. It is interesting to note that at the strike price 40, considerable amount of call options are being placed for the price to reach and surpass that level.

- Looking at the open interest chart, there is no support level that may slow the slide if the sentiment worsen. For the resistance level, there is a major resistance at 40 level.

CONCLUSION

- Major U.S. indexes fell, with losses across key sectors.

- MRNA stock rose following reports of a new coronavirus strain.

- Housing Market Struggles: High mortgage rates and affordability challenges dampened sales.

- Short-Term Volatility: Economic uncertainty continues to drive market fluctuations.

- Long-Term Growth Potential: AI infrastructure remains a key sector for future expansion.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.