INTRODUCTION

For starters, Renaissance Technologies is renowned as the world’s largest quantitative hedge fund, and Two Sigma Advisers is reported to manage US$60 Billion worth of assets through deployment of various technological methods, including artificial intelligence, machine learning, and distributed computing, for their hedge fund trading strategies.

According to a recent Bloomberg article “Renaissance, Two Sigma See Losses as Quant Giants Navigate Chaos”, two key powerhouse quantitative hedge funds, Renaissance and Two Sigma are experiencing losses as volatile markets this year are tripping up their proprietary quantitative models.

And apparently, they are not alone. The hedge fund industry as a whole is awakening to a new trading environment with very different dynamics from before. This is very surprising, as the hedge fund industry attracts top talents to navigate the challenging financial markets.Their whole purpose is dedicated to finding the extra edge in generating returns that the average trader cannot. Furthermore, Renaissance and Two Sigma are the crème de la crème of the hedge fund industry.

So why is this happening?

TAKEAWAY

- It is very surprising indeed the post Covid-19 financial markets have shaken the hedge fund industry at large.

- Not all quantitative trading strategies are created equal, and it must be highlighted that being a ‘Hedge Fund’ strategy does not mean it is not prone to sustaining losses, as is the current situation.

- Quantitative strategies rely on historical data to make trading decisions in current market conditions.

- Current market conditions are significantly different from historical situations.

- Volatility in current markets is unprecedented, which makes it extremely difficult for most quantitative strategies to outperform.

- By tracking the most renowned hedge fund strategies (Renaissance and Two Sigma), as well as the average hedge funds industry, it appears the tricky 2020 market conditions have caught these strategies out, resulting in significant losses.

- Algomerchant’s Trident is able to avoid similar losses

Based on the Bloomberg article, the following observation has been made with regard to how the trading environment has changed post Covid-19, by Adam Taback (Chief Investment Officer of Wells Fargo Private Wealth Management):

“Quants rely on data from time periods that have no reflection of today’s environment. When you have volatility in markets, it makes it extremely difficult for them to catch anything because they get whipsawed back and forth.”

How did Renaissance Technologies Perform?

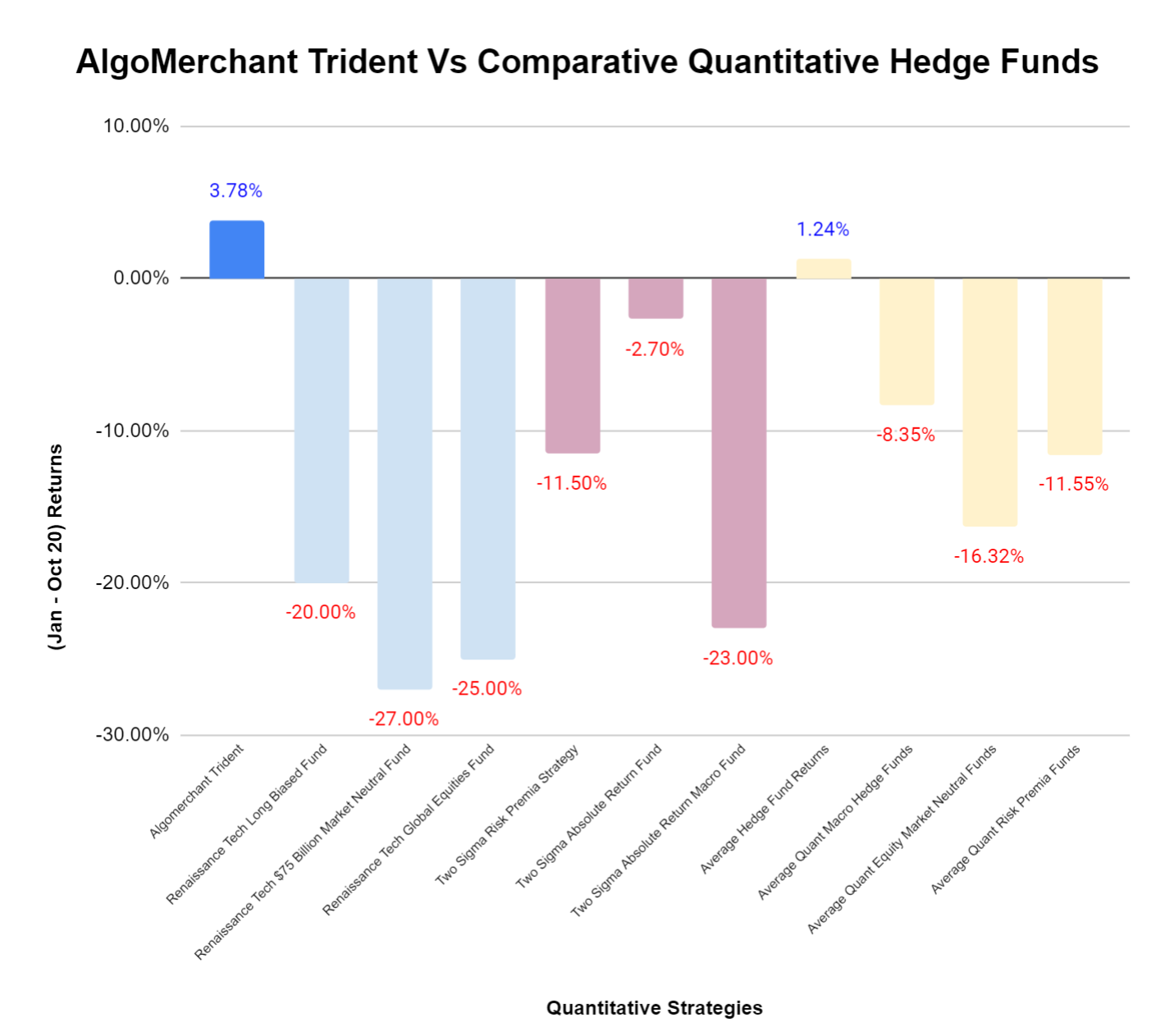

Based on the Bloomberg article, the performance of 3 separate Renaissance funds were provided from beginning 2020 to end October:

Long Biased Fund: -20%

$75 Billion Market Neutral Fund: -27%

Global Equities Fund: -25%

The following reasons were provided by Renaissance’s founder Jim Simons:

“Losses are due to being under-hedged during March’s collapse and then over-hedged in the rebound from April through June. That happened because models that had “overcompensated” for the original trouble.”

“It is not surprising that our funds, which depend on models that are trained on historical data, should perform abnormally (either for the better or for the worse) in a year that is anything but normal by historical standards,” Renaissance told clients in a September letter seen by Bloomberg.

How did Two Sigma Perform?

Based on the Bloomberg article, the performance of 3 separate Two Sigma funds were provided from beginning 2020 to end October:

Risk Premia Strategy: -11.5%

Absolute Return Fund: -2.7%

Absolute Return Macro Fund: -23%

How did the Average Quantitative Hedge Fund Perform?

According to Aurum Funds, which tracks 4,000 over hedge funds performance representing assets in excess of $2.9 trillions, show the following performance for the average hedge fund year to date (end October 2020):

Average Hedge Fund returns: +1.24%

Average Quant Macro Hedge Funds: -8.35%

Average Quant Equity Market Neutral Funds: -16.32%

Average Quant Risk Premia Funds: -11.55%%

Algomerchant's Trident Performance In Comparison

Comparatively, our AlgoMerchant Trident strategy performed much better compared to her equivalent competitors’ strategies. Year to date, ending October 2020, Trident managed a +3.78% positive return. Her competitors had results ranging between -27% to +1.24%!

This exceeds the average quantitative hedge funds results as tracked by Aurum Funds, as well as the Renaissance and Two Sigma funds.

Conclusion

Algomerchant’s Trident is able to avoid similar losses for 2 key reasons:

- Trident is designed to be highly intelligent. When it detects abnormal market risks it lowers trading frequencies compared to competitors’ strategies. Entered trades become very selective due to the priority shift towards risk focus more than rewards.

- Trident is designed to exploit high reward/loss ratio opportunities. This ensures that when trades are executed by Trident, it is confident of the win rate as well as each trade’s return on investment (ROI).