The U.S. economy and stock market are currently navigating through a complex landscape influenced by both domestic and international factors. On the domestic front, consumer confidence plunges, highlighted by a notable drop in the Conference Board’s consumer sentiment index. This reflects growing concerns about the economy, with consumers’ economic outlook worsening and the expectations index nearing recessionary levels, signaling anxiety over income stability and job market conditions.

Source: Bloomberg

Fed Debate on Rate Cuts Intensifies as Inflation Hits Housing, Markets Rally

Inflation remains persistent, sparking a division within the Federal Reserve over how aggressively to cut interest rates in 2025. While some Fed officials favor a cautious approach to prevent economic disruption, others advocate for quicker rate cuts to stimulate growth amid ongoing inflationary pressures. Additionally, rising insurance premiums and property taxes are putting further strain on homeowners, making housing even less affordable as these costs now surpass many mortgage payments. Consumer confidence plunges as these financial challenges escalate, adding to concerns about the economic outlook.

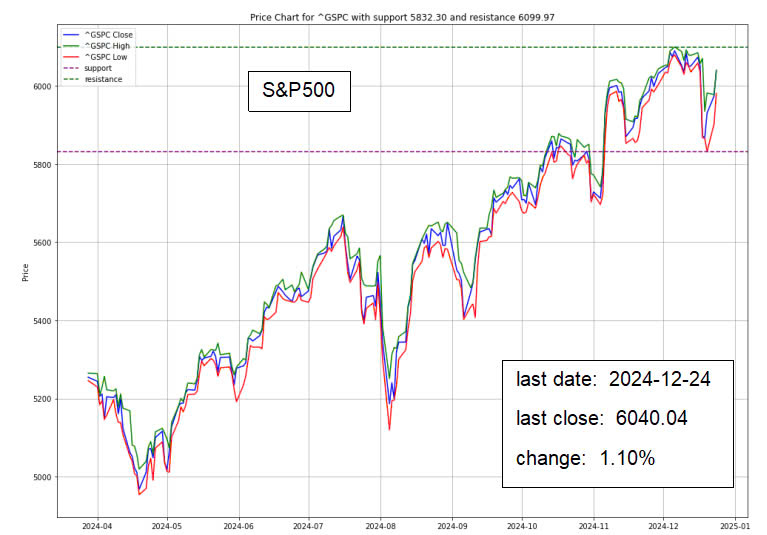

The stock market, however, has seen gains, driven in part by sectors like Consumer Goods, Consumer Services, and Financials. Major companies such as Walmart, Amazon, and Goldman Sachs have posted solid performance. Despite the domestic challenges, investor sentiment remains buoyed by certain tech stocks, including Nvidia and Broadcom, reflecting ongoing enthusiasm for AI and semiconductor industries.

GLOBAL IMPACT

The Rising AI Competition Between the U.S. and China

Internationally, the growing competition in the AI sector poses significant risks and opportunities. Chinese companies, despite facing restrictions on advanced semiconductor technology, are rapidly catching up to U.S. leaders like OpenAI. Startups such as DeepSeek and Moonshot AI are making strides in developing AI models that rival their American counterparts, often using workarounds to mitigate the impact of U.S. export controls. Furthermore, China’s Semiconductor Manufacturing International Corporation (SMIC) is benefiting from increased demand for localized chips, capitalizing on both AI development and the push for technological self-sufficiency.

Source: Asia Times

Internationally, the growing competition in the AI sector poses significant risks and opportunities. Chinese companies, despite facing restrictions on advanced semiconductor technology, are rapidly catching up to U.S. leaders like OpenAI. Startups such as DeepSeek and Moonshot AI are making strides in developing AI models that rival their American counterparts, often using workarounds to mitigate the impact of U.S. export controls. Furthermore, China’s Semiconductor Manufacturing International Corporation (SMIC) is benefiting from increased demand for localized chips, capitalizing on both AI development and the push for technological self-sufficiency.

Investment Opportunity & Risk

These are some stocks to consider, despite the challenges today, including consumer confidence plunges

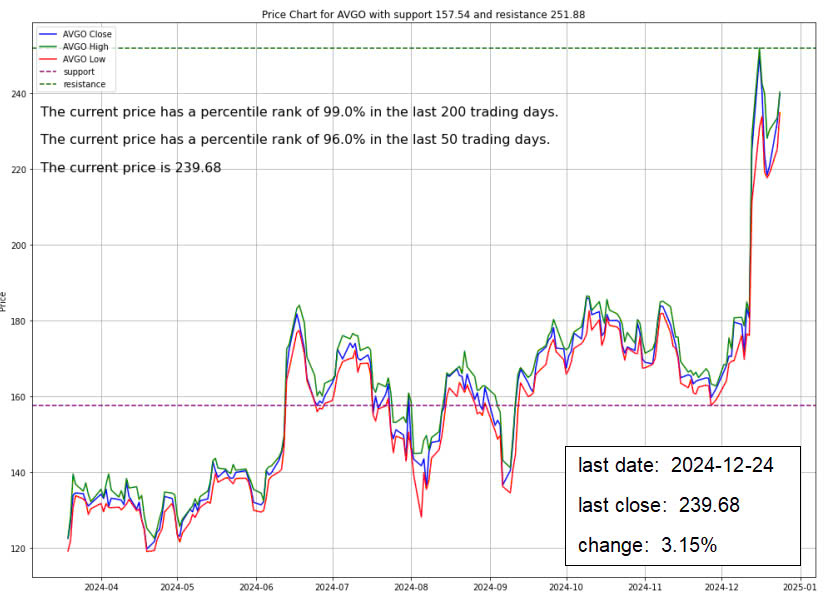

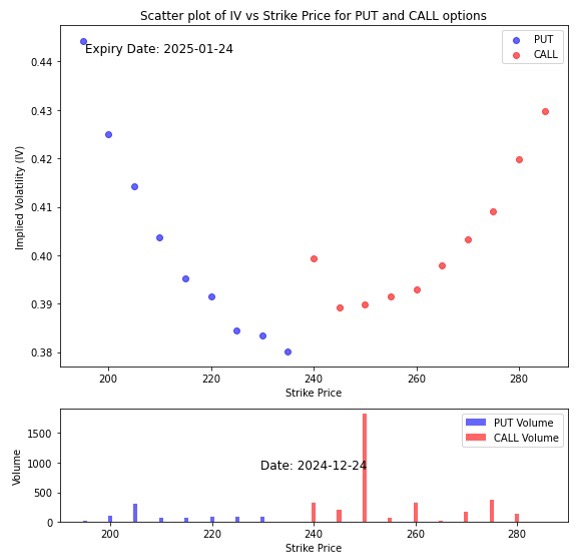

Broadcom (AVGO)

Broadcom has had a volatile year but is heading toward its best year on record, driven by investor enthusiasm. The California-based tech company, known for its application-specific integrated circuits (ASICs) used in artificial intelligence, also produces enterprise software and security solutions. Recently, UBS analyst Timothy Arcuri raised his price target for the stock to $270 from $220, while Morgan Stanley analyst Joseph Moore included Broadcom in his list of top ideas for 2025. Shares rose 3.2% to $239.68, more than doubling in price this year. Despite early volatility, including a dip in March, the stock hit a record high in June after strong earnings and a 10-for-1 stock split. Broadcom joined the $1 trillion market cap club in December and announced an 11% dividend increase, reinforcing investor confidence.

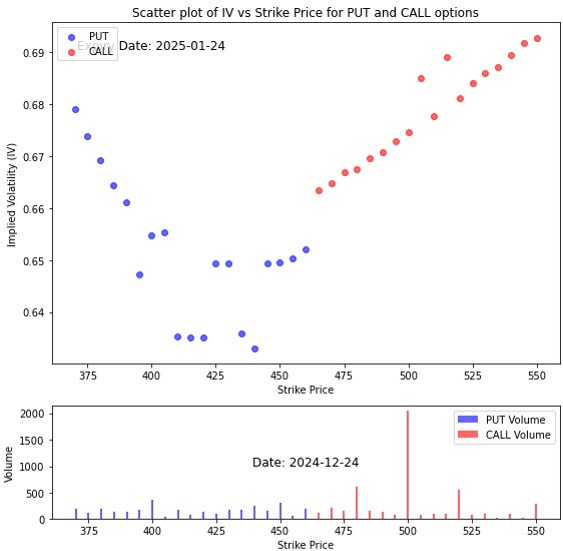

- As to the last situation shown by the volume of the option and the elevated implied volatility of the call option close the ATM, the signs are showing that the price will climb to 250.

- The steep rise of the put implied volatilities as the strikes get lower and the presence of considerable well spread open interest around 200, this shows that the fear of a correction is quite significant.

- If the price drop significantly, the open interest chart shows that the price will find the support level at 205.

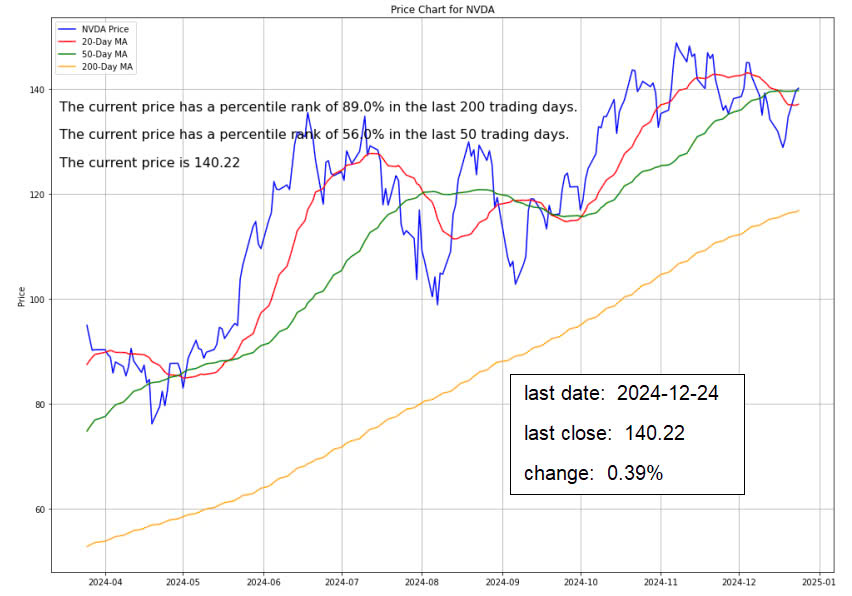

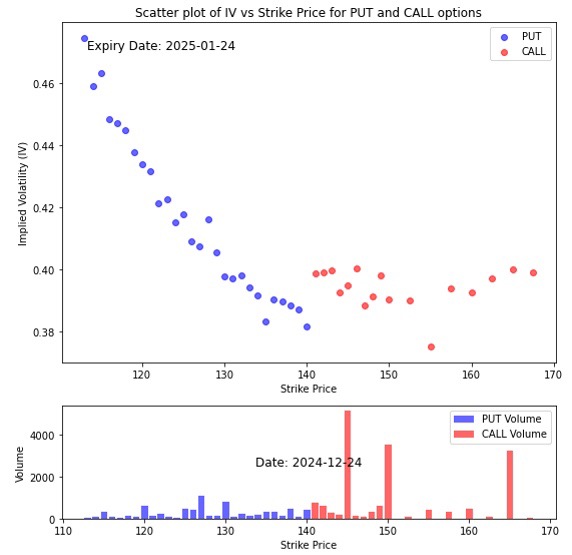

Nvidia (NVDA)

Nvidia stock rose 1.1% to $141.16 on Tuesday, extending a four-day rally as investors position themselves ahead of CEO Jensen Huang’s major speech in early January. The chip sector, benefiting from a “Santa Claus” rally, sees increased bets on artificial intelligence driving demand in 2025. Nvidia shares have rebounded from lows under $130 as investors assess the company’s progress in ramping up sales of its Blackwell AI chips. Meanwhile, other chip makers like Advanced Micro Devices and Broadcom also saw gains, up 1% and 1.8%, respectively.

- The heavy activity at the 140 and 150 strike prices, both in terms of volume and open interest, suggests these levels are key points of focus. The stock price may move toward or consolidate around this range in the near future. The presence of high implied volatility at these levels also points to potential for greater price movement as the expiry date nears. Thus, it’s likely the stock will experience some volatility, but with a higher probability of gravitating towards the 140-150 strike price range based on the observed activity.

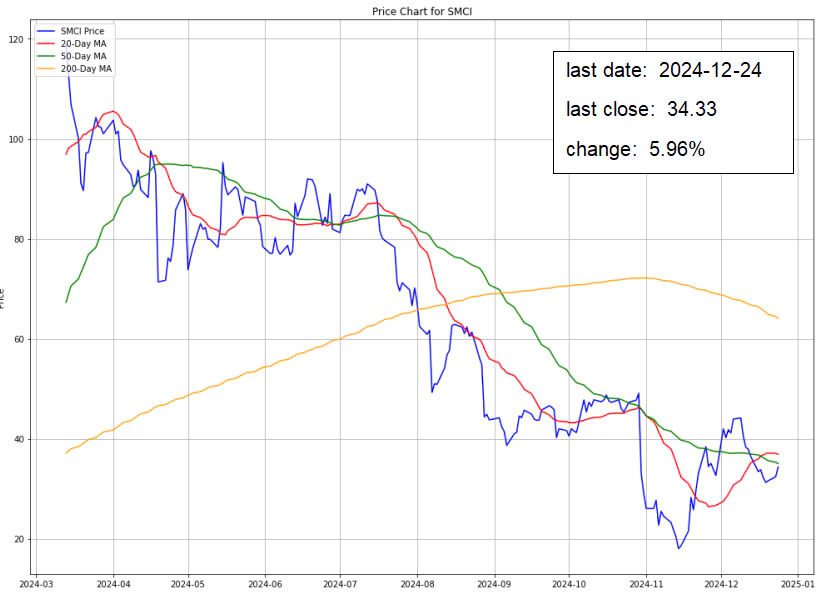

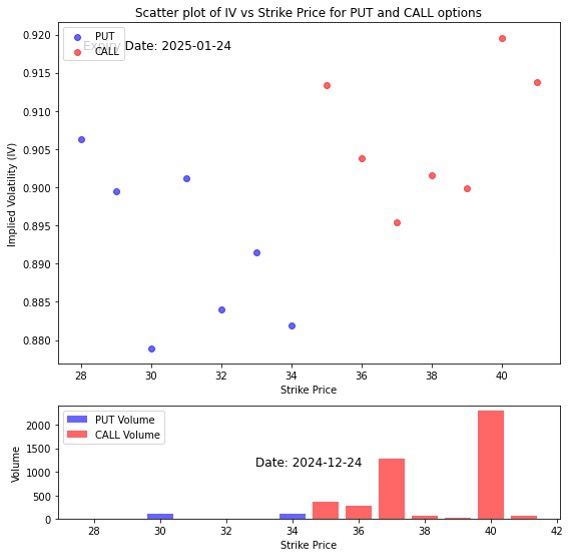

Super Micro Computer (SMCI)

Super Micro Computer rose 6% to $34.33, following a 2.6% increase in shares on Monday. After a volatile 2024, the stock has fluctuated between $18 and $119 since the beginning of the year. The company, which has postponed filing its most recent financial reports, was granted an extension until February 25 earlier this month, allowing it to avert the immediate risk of being delisted from the Nasdaq.

The high activity at the 37 and 40 strike prices, especially for CALL options, suggests that investors are positioning for potential upward movement. The stock price is likely to experience upward pressure, possibly approaching or consolidating around the 37-40 range, given the strong interest at these levels. The presence of higher implied volatility further suggests that the stock may experience notable movement as the expiry date nears.

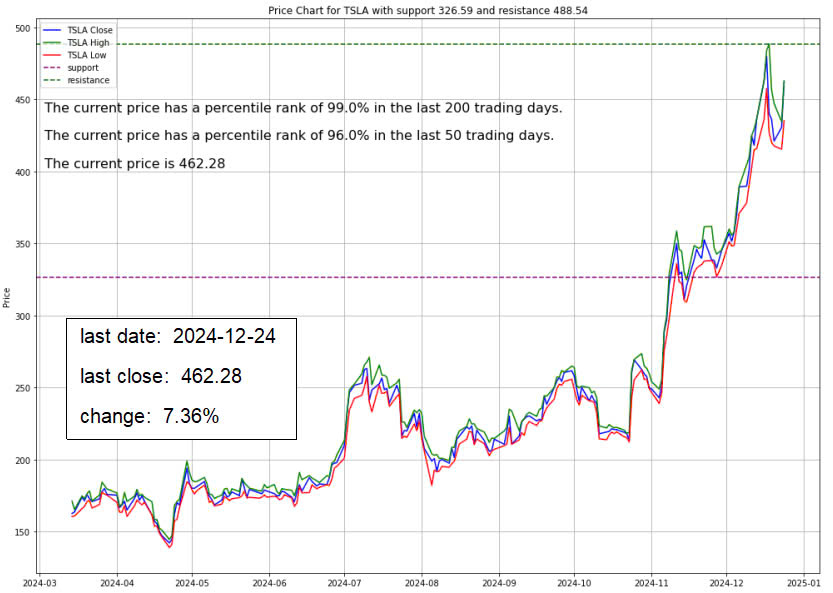

Tesla (TSLA)

Tesla surged 7.4% to $462.28, becoming the top performer in the S&P 500, with an impressive 86% increase year-to-date. The stock rose 2.3% on Monday, despite news of Honda and Nissan’s merger plans, which would form the world’s third-largest automaker by annual sales. This development comes as the automotive industry faces growing competition from China’s rising car exports and electric-vehicle companies like Tesla.

- Given the significant activity around the 500 strike price, both in terms of volume and open interest, it is likely that the stock price could trend toward this level as the expiry date approaches. The increased implied volatility at higher strike prices further supports the expectation of possible upward movement. Therefore, the stock may experience upward momentum, with the 500 strike price serving as a key resistance or target level.

CONCLUSION

- Consumer confidence plunges could be a sign of an impending recession.

- The U.S. economy faces many challenges like rising inflation, weakened consumer confidence, and growing housing costs.

- Despite these issues, the stock market is experiencing a concerning rally, driven by tech, consumer goods, financials, and AI-related industries.

- U.S.-China competition in AI and semiconductors is shaping global economic trends and influencing stock performance.

- Strategic investment in high-growth sectors like AI and semiconductors shows promise, but caution is advised.

- Monitoring domestic and international developments is key for making informed investment decisions.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.