Stocks End Higher as Fed’s Powell Signals Strong Economy

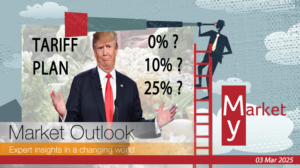

Stocks rebounded Friday despite the S&P 500’s worst week since September, driven by gains in Telecoms, Utilities, and Oil & Gas. However, trade uncertainties and rising tariffs keep market risks in focus