The S&P 500 ended largely flat on Wednesday, trimming early losses as optimism surrounding easing U.S.-China trade tensions countered a surprise economic contraction. At the close of trading, the Dow Jones Industrial Average rose by 141 points, or 0.4%, while the S&P 500 edged down by 0.01%, and the NASDAQ Composite slipped 0.1%. April has been a volatile month on Wall Street, with the major indices working to recover from steep losses triggered by the U.S. tariff announcement at the start of the month. The S&P 500 briefly entered bear market territory but has since narrowed its monthly losses.

Stocks Slipped on Weak Earnings while Microsoft and Meta Drew Attention

Notable corporate earnings reports revealed mixed results. Starbucks saw its stock drop nearly 6% after global comparable sales declined for the fifth consecutive quarter, signaling struggles with its turnaround strategy. Caterpillar also faced a dip in first quarter profits due to softer demand driven by economic uncertainty. Norwegian Cruise Line’s disappointing earnings and lowered guidance led to a more than 7% drop in its stock. Similarly, Super Micro Computer slumped by 11.5% after cutting revenue and profit projections due to delayed customer spending. Snap Inc. saw a significant 12.5% drop following its earnings report, which revealed better-than-expected revenue but no guidance for future quarters, citing macroeconomic uncertainties.

Source: UC Today

This earnings week is crucial for market sentiment, with a third of S&P 500 firms reporting results. Investors were particularly focused on earnings reports from Microsoft and Meta Platforms, two of the “Magnificent Seven” mega-cap tech companies. These firms have been central to market growth in recent years, although they have underperformed in 2025. Apple and Amazon are also scheduled to report later this week, with expectations high for their earnings.

Q1 Shrinkage Signals New Challenges For the U.S. Economy

In an unexpected turn, the U.S. economy contracted by 0.3% on an annualized basis in the first quarter of 2025, marking the first economic shrinkage since 2022 and a sharp reversal from the 2.4% growth recorded in Q4 2024. Economists had expected slight growth of 0.2%. The contraction was primarily driven by a 41.3% surge in imports—the largest in five years—as businesses and consumers rushed to stockpile goods ahead of anticipated tariffs. As a result, net exports subtracted a record 4.83 percentage points from GDP.

Consumer spending, a key driver of growth, rose by just 1.8%, its slowest pace since mid-2023. Federal government spending also declined during the quarter. Nevertheless, underlying demand remained relatively solid, with private sector investment continuing to increase despite the economic headwinds.

Source: Oxford Economics

With trade disruptions weighing heavily on the economy and inflation still a concern, the Federal Reserve faces a complex balancing act between curbing inflation and supporting employment. As policy uncertainty lingers, market watchers and policymakers alike will be closely monitoring upcoming data to gauge the resilience of the U.S. recovery.

Job Growth Slows and Sentiment Falls Amid Rising Uncertainty

Additional signs of strain emerged from the labor market and consumer confidence indicators. Private payrolls grew by only 62,000 in April, a steep decline from the 147,000 jobs added in March and well below expectations. The March JOLTS report showed job openings fell to 7.192 million, down from 7.48 million in February, reflecting a cooling in labor demand.

Source: Euro News

Meanwhile, consumer confidence dropped to its lowest level since May 2020, signaling growing concerns about economic stability. The ongoing trade conflict and tariff-related uncertainties have contributed to this weakening sentiment and are posing increasing challenges for both businesses and households.

Nvidia Faces Global Hit from U.S. AI Export Curbs

Nvidia’s concerns about the Trump administration extend far beyond China, with the recent “AI-diffusion” rules being one of the most significant obstacles. These restrictions, which limit the sale of AI chips to several countries, including allies like Israel, Switzerland, India, and Saudi Arabia, pose a serious threat to Nvidia’s growth. While the company has already faced a ban on its chips for the Chinese market, these new rules would further restrict Nvidia’s global market, especially given that a significant portion of its sales comes from countries affected by these curbs. The rules aim to prevent China from bypassing U.S. export controls by acquiring AI chips through other nations.

Source: Tech Monitors

Despite this, competitors like Huawei are already preparing to challenge Nvidia’s dominance. Although Nvidia has a strong financial position in the short term, the long-term effects of these restrictions could open the door for rivals in South Korea, Japan, and Europe, potentially shifting the global AI chip market away from U.S. companies. With the potential revenue hit of up to 10% of sales, Nvidia’s ability to navigate these challenges will be crucial in maintaining its market position. The company’s efforts to combat these regulations have included direct engagement with U.S. leaders, but the outcome remains uncertain.

International Issues

US-China Trade Talks Spark Optimism as Tariff Relief and Deal Near Finalization

In a positive development, the U.S. reportedly reached out to China to discuss tariff-related matters, reigniting hopes of a resolution to the trade conflict. These discussions were confirmed by sources linked to state-run Chinese media. President Trump’s administration also made moves to ease the impacts of tariffs on the auto industry, signing two executive orders offering tax relief and tariff relief on materials. This comes ahead of a significant tariff increase on auto parts.

Source: Financial Times

In addition, Commerce Secretary Howard Lutnick indicated that the U.S. was close to finalizing a major trade deal, further fueling optimism.

Wells Fargo Slashes Retail Earnings Estimates Amid Tariff, Recession Fears

Wells Fargo analyst Ike Boruchow has lowered his earnings estimates for several retail stocks by up to 25% for 2026, adjusting to the current economic uncertainty shaped by tariffs and potential recession fears. His revised forecasts reflect the broader macroeconomic impact, suggesting that tariffs imposed by the White House—such as a 145% tariff on Chinese goods—could increase operating costs, disrupt supply chains, and dampen consumer sentiment, putting additional pressure on the retail sector. Boruchow forecasts significant headwinds for consumer discretionary companies as the economy potentially heads into a downturn, with retail stocks facing a 46% compression in valuation multiples during past down cycles.

Source: Indian Express

Despite these challenges, Boruchow identified winners and losers, upgrading stocks like Levi-Strauss, Kontoor Brands, Ralph Lauren, and Tapestry, which have low exposure to China and strong margins. Meanwhile, stocks with higher exposure to tariffs, including Nike and Gap, were downgraded, with Boruchow also cutting ratings for Capri Holdings and Victoria’s Secret due to their vulnerable positions in the current economic environment.

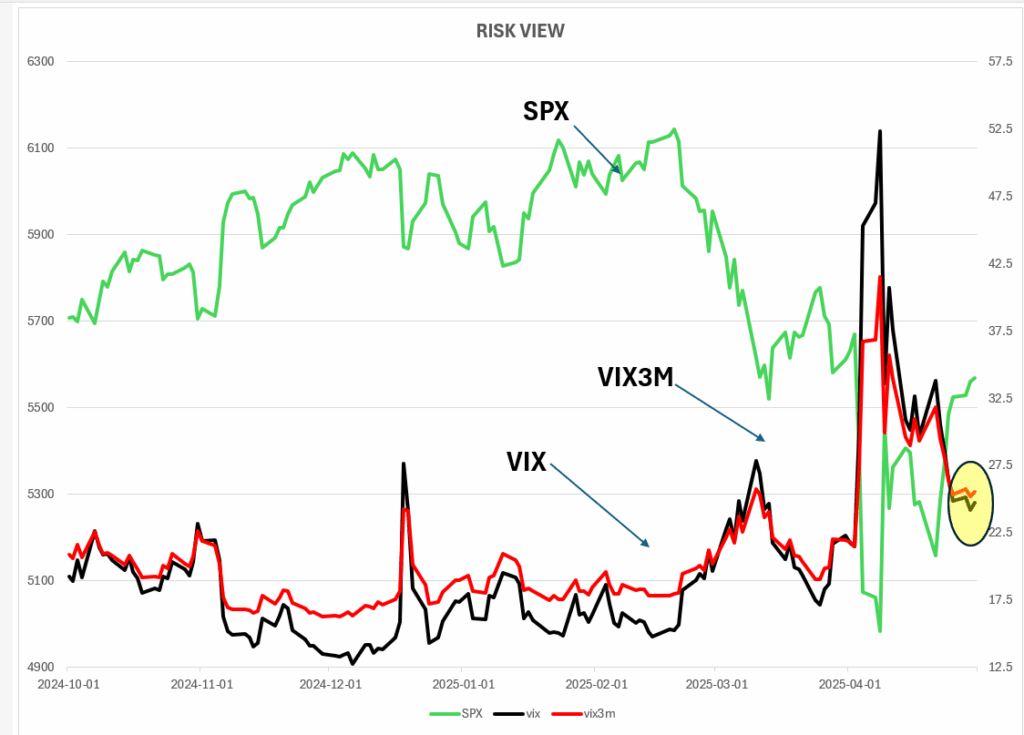

Market Risk

When the 2 lines in the yellow region stop going up and keep the gap steady, it may be time to start accumulating the stocks which you are aiming for.

CONCLUSION

- April 2025 brought economic turbulence, with a surprise GDP contraction, trade policy volatility, and uneven corporate earnings pressuring markets.

- The S&P 500 and NASDAQ struggled, though optimism over potential U.S.-China trade progress offered some relief.

- GDP fell in Q1, driven by surging imports and weakening consumer sentiment, highlighting the toll of tariffs and global trade tensions.

- Retail and tech sectors face hurdles, including export restrictions and earnings downgrades, while private sector investment shows resilience.

- The Federal Reserve’s balancing act between inflation control and economic growth remains pivotal.

- Investors are advised to focus on low-tariff-exposed companies with strong margins, and closely track trade talks and earnings results.

- A strategic, patient investment approach may uncover opportunities amid the ongoing uncertainty.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.