The stock market has shown resilience, with stock market highs as the S&P 500 and Nasdaq recently reached record levels. Positive economic indicators, such as higher-than-expected payroll numbers and rising consumer sentiment, have buoyed investor confidence. However, market gains were tempered by mixed signals from the Federal Reserve. Fed officials expressed cautious hawkishness, suggesting a slower pace of rate cuts to balance cooling inflation and economic growth.

Despite these gains, concerns remain regarding the potential for growth stock pullbacks in early 2025, as rising Treasury yields and a strong dollar could pressure valuations. The Federal Reserve’s anticipated rate cut is a major catalyst for the market, but investors are also bracing for the impact of a robust US fiscal policy agenda, particularly under the second Trump administration, which may weigh on multinational corporations due to potential tariffs, trade tensions, and cooling inflation.

A Glimpse of US Tech Stocks

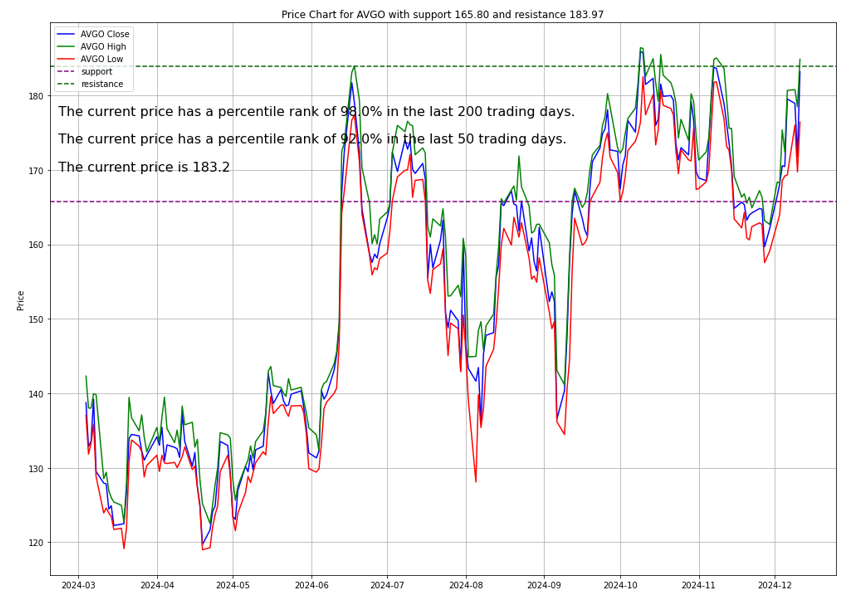

Nvidia, a standout in the semiconductor and AI sectors, has benefitted from the ongoing AI boom. The company continues to grow its presence in China, despite political tensions, focusing on AI-driven cars. This strategic hiring is part of Nvidia’s broader efforts to align itself with China’s technological ambitions, although it remains vulnerable to potential regulatory crackdowns.

In the software sector, Oracle (ORCL) has also seen strong growth, particularly in its Infrastructure-as-a-Service (IaaS) segment, which grew by 52%. However, its high net debt remains a point of caution for investors. Meanwhile, Adobe (ADBE), with its Firefly AI tools, is gaining traction in the creative software space. This, along with its strong operational performance, has led analysts to maintain a positive outlook on the stock. Broadcom (AVGO) also saw significant gains due to its collaboration with Apple on AI server chips, further emphasizing the growth potential within the tech sector.

GLOBAL IMPACT

US-China Tensions and Economic Pressures Reshape Global Markets

International issues continue to shape market dynamics, with the ongoing US-China trade tensions taking center stage. Nvidia finds itself at the forefront of this geopolitical friction, as China’s recent antitrust probe into the company underscores the heightened scrutiny of US tech firms operating in China. This move not only reflects the broader strain in US-China relations but also signals potential risks for US companies in critical sectors like semiconductors and AI. Some analysts interpret this as a negotiating tactic by China, but the long-term implications for US firms remain a pressing concern, particularly as China’s own advancements in technology threaten the market share of US players.

Source: CNBC

Meanwhile, the global economic backdrop adds another layer of complexity. The US economy continues to grapple with persistent inflationary pressures, although cooling inflation is beginning to ease some concerns. The Federal Reserve’s future decisions on interest rate cuts will play a pivotal role in shaping market behavior. As these geopolitical and economic factors intertwine, they create a volatile environment for businesses and investors navigating an increasingly uncertain global landscape, with cooling inflation playing a key role in shaping expectations.

Meanwhile, the global economic backdrop adds another layer of complexity. The US economy continues to grapple with persistent inflationary pressures, although cooling inflation is beginning to ease some concerns. The Federal Reserve’s future decisions on interest rate cuts will play a pivotal role in shaping market behavior. As these geopolitical and economic factors intertwine, they create a volatile environment for businesses and investors navigating an increasingly uncertain global landscape, with cooling inflation playing a key role in shaping expectations.

Investment Opportunity & Risk

Cooling US Inflation Boosts S&P 500 as Nasdaq Surpasses 20,000 – Key Stock Opportunities to Watch

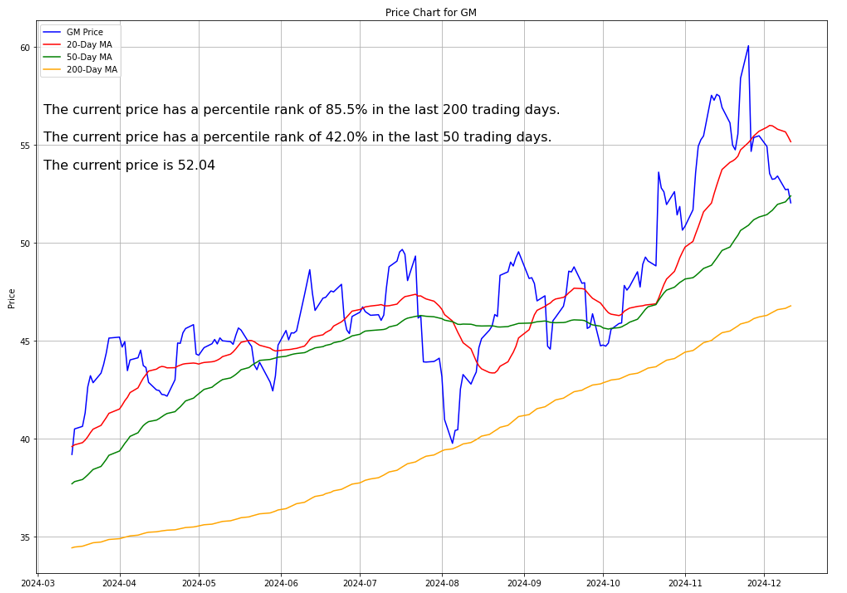

General Motors (GM)

Recently, General Motors decided to exit its Cruise robotaxi business, a move that has been viewed as a necessary step in light of the high costs associated with the project. Despite this setback, GM remains one of the top performers in the auto sector, up 45% for the year. The company is now focusing on its core business of gasoline-powered vehicles.

Prediction: Based on the pattern of high implied volatility for PUT options and strong CALL volume at higher strike prices, the stock may experience some downside risk in the very short term. However, if the stock price approaches the higher strike prices (around 55 to 60), there could be a bullish reversal, driven by the volume in CALL options.

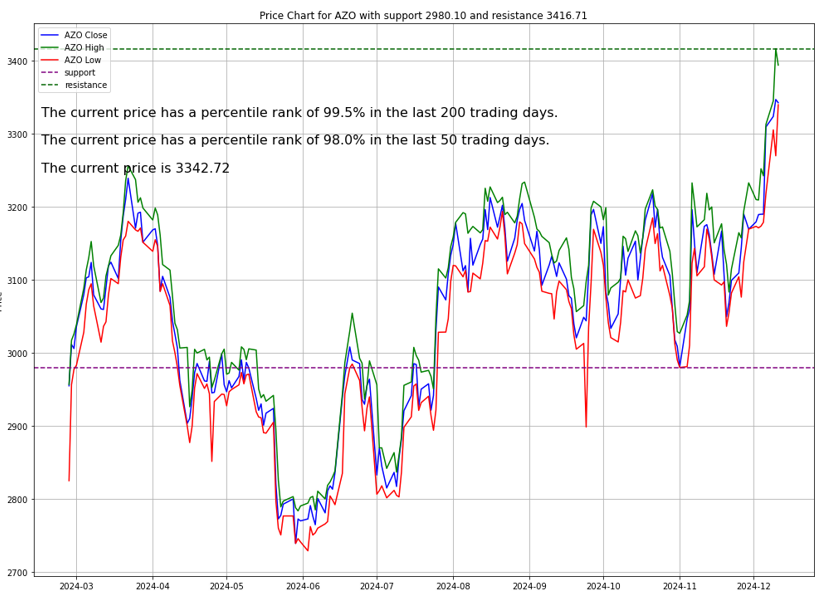

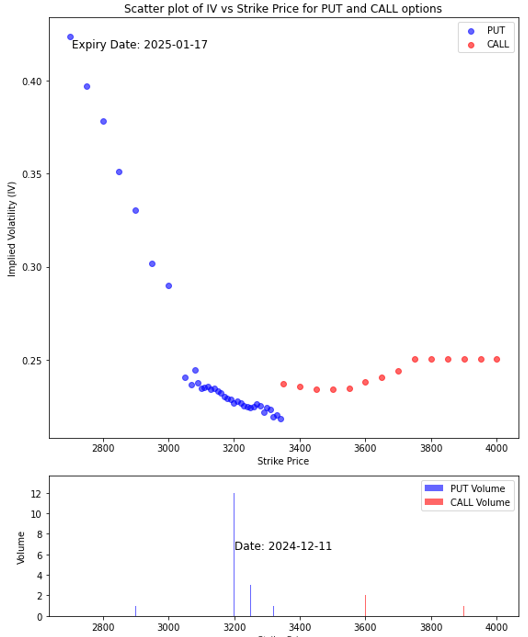

AutoZone (AZO)

AutoZone has reported mixed performance, with weaker-than-expected demand from professional mechanics affecting same-store sales growth. Nevertheless, Citi has reiterated a Buy rating for the stock, citing strong margins and a solid market position.

- Bearish Sentiment: The higher implied volatility for PUT options at lower strike prices suggests that there is cautiousness in the market, and some investors are hedging against potential downside movement. This implies that there is a degree of bearish sentiment or at least uncertainty in the short term.

- Support at 3200: The significant volume at the 3200 strike price for PUT options suggests that this level could act as a key support zone. If the stock price approaches this level, we could see further hedging or risk aversion, potentially leading to a short-term pullback.

Limited Bullish Sentiment: The lack of significant volume and lower implied volatility for CALL options at higher strike prices indicates that there isn’t much expectation of strong upside movement in the near future.

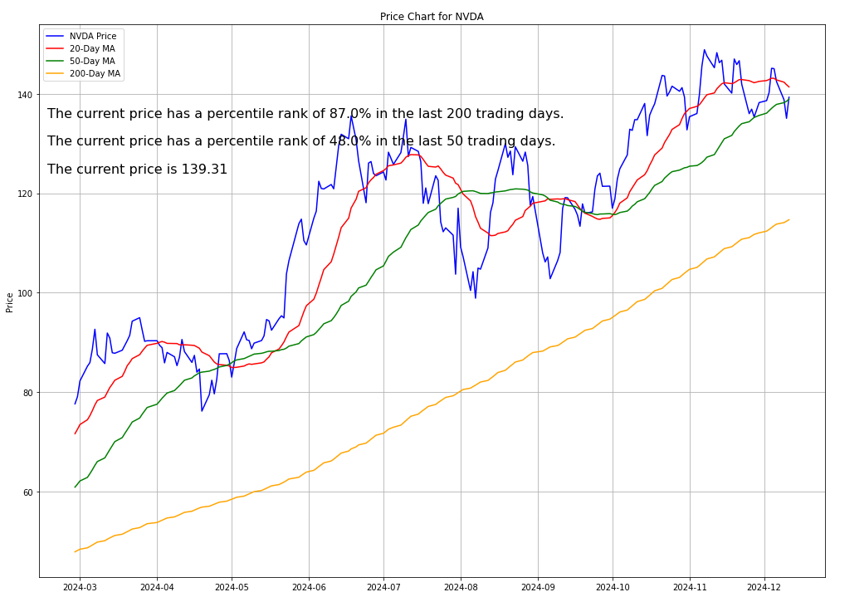

Nvidia (NVDA)

Nvidia continues to lead the AI and semiconductor sectors, with its strategic moves in China furthering its dominance in AI-driven car technology. The company remains under scrutiny from Chinese regulators but continues to show robust growth in its core AI business.

The stock appears to have a mixed outlook in the short term. There is cautiousness reflected in the higher implied volatility for PUT options, indicating downside risk, while the significant volume of CALL options at the 150 strike price suggests the potential for a short-term rally if the stock moves toward this level. The stock could experience some downward pressure in the immediate future, but if it approaches the 150 strike price, it may see upward momentum.

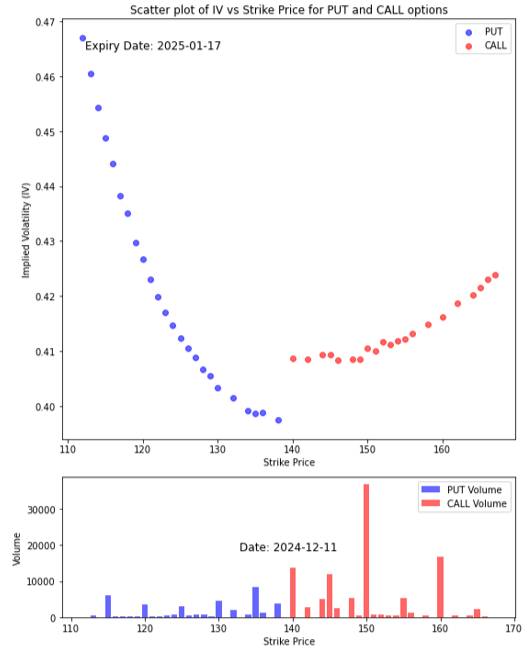

Broadcom (AVGO)

Broadcom has seen a significant increase in its stock price following reports that Apple is working with the company to develop a server chip designed for artificial intelligence. This partnership highlights the growing demand for AI-related hardware.

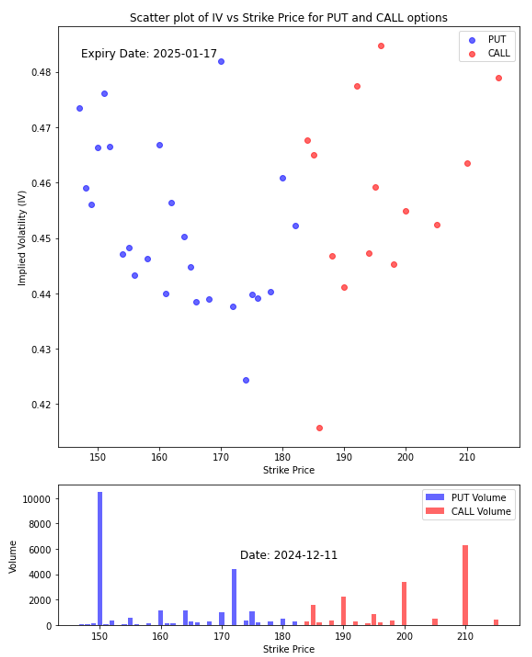

In the short term, the stock appears to have some downside risk, particularly around the 150–160 strike prices, due to the higher implied volatility and volume spikes in PUT options. However, if the stock approaches the higher strike prices (around 190–210), we could see upward momentum driven by the strong volume and implied volatility for CALL options at those levels. The stock may experience a period of volatility, with potential for a bullish reversal if it breaks past the 190–210 strike price range.

CONCLUSION

- The US stock market continues to exhibit strength, driven by optimism surrounding a potential rate cut and ongoing growth in key sectors like technology, aided by cooling inflation.

- However, there are underlying concerns, particularly regarding potential geopolitical risks, especially in the context of US-China trade tensions.

- The performance of major tech companies such as Nvidia, Oracle, Broadcom, and Adobe demonstrates the continued bullish outlook for AI and cloud computing, despite some concerns over regulatory scrutiny and market uncertainty.

- Meanwhile, GM and AutoZone reflect the mixed outlook in the broader market, where companies face both challenges and opportunities depending on sector-specific dynamics.

- In the short term, investors should be mindful of the potential for volatility, especially as geopolitical tensions and fiscal policies may create headwinds for growth.

- Still, the overall sentiment remains cautiously optimistic, particularly for companies with strong positions in AI and cloud technologies.

- The key levels for stocks like GM and AutoZone will depend on how they manage ongoing challenges, while stocks like Nvidia and Adobe are expected to maintain strong momentum, barring any significant regulatory shifts.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.